Friday, August 30, 2019

Commercial Project Transformation of the Year

By Ingrid Tunberg Globest.com

In our pre-event coverage of GlobeSt.com’s ADAPT awards, we took a closer look at adaptive reuse projects across the country. The winner of the commercial project transformation of the year is Piazza Pod Park in Philadelphia. We will be honoring the project at our awards ceremony in Baltimore on September 16th.

Originally sited as a vacant parking lot in an industrial area devoid of steady foot traffic, the development of Pizza Pod Park has transformed the Northern Liberties neighborhood of Philadelphia into a widely-desirable, residential area.

Upon identifying the need for a community epicenter and recognizing the underutilized space of The Piazza, the Post Brothers acquired the property from Kushner Companies in 2018 and began construction that same year. The development project spans across nearly 125,000 square feet, featuring retail and commercial space, a public area and a 500-unit apartment community. Looking to bring life back to the area and promote community connections, the firm plans to cultivate a thriving social neighborhood scene with dining, fitness and entertainment options. Located at Germantown Avenue and Second Street, the formerly Schmidt’s Commons is being repositioned to revitalize The Piazza, shifting attractions and physically moving the community hub to hold events in the expansion of Piazza Pod Park.

Recognizing that the success of the development is dependent on the success of the communal space, the firm employed a dynamic programming strategy to intentionally appeal to everyone in the neighborhood; acquiring renown, established Philadelphia eateries, fresh, family-oriented attractions, as well as quaint, local businesses, all new to the neighborhood.

For the extension of the adjacent courtyard and retail offerings of The Piazza, Piazza Pod Park secured demographically-specific vendors to occupy 14 repurposed shipping containers in the aforementioned, unused parking lot to serve as the main focus of the project. The innovative retailer collective will feature pop-up shops from local vendors, offering fitness, wellness, food and beverage services, showcasing the property’s potential. Vendors of the park include: Essen Bakery, Lil Sum Sum, Tiki Tacos, New Liberty Distillery, Empanada Box, Fit Academy, Tildie’s Toy Box and more.

The park will also exhibit public art installations, seating for 300 people, 200 parking spaces and a two-level enclosed, climate-controlled dining pod and roof deck.

The Post Brothers development team overcame challenges in reimagining the area’s neglected residences as well. The development team has begun renovating the apartment complex with new finishes, planning to construct a new pool and fitness center within the property’s courtyard.

Rent in the area has already increased by 10% since the acquisition of The Piazza, due to hands-on management and rebranding campaigns. Upon renovations and retail repositioning, The Piazza alone is currently valued at $275 million, with numbers expecting to grow following the summer 2019 launch, while the park thrives as a centerpiece of the community.

www.omegare.com

In our pre-event coverage of GlobeSt.com’s ADAPT awards, we took a closer look at adaptive reuse projects across the country. The winner of the commercial project transformation of the year is Piazza Pod Park in Philadelphia. We will be honoring the project at our awards ceremony in Baltimore on September 16th.

Originally sited as a vacant parking lot in an industrial area devoid of steady foot traffic, the development of Pizza Pod Park has transformed the Northern Liberties neighborhood of Philadelphia into a widely-desirable, residential area.

Upon identifying the need for a community epicenter and recognizing the underutilized space of The Piazza, the Post Brothers acquired the property from Kushner Companies in 2018 and began construction that same year. The development project spans across nearly 125,000 square feet, featuring retail and commercial space, a public area and a 500-unit apartment community. Looking to bring life back to the area and promote community connections, the firm plans to cultivate a thriving social neighborhood scene with dining, fitness and entertainment options. Located at Germantown Avenue and Second Street, the formerly Schmidt’s Commons is being repositioned to revitalize The Piazza, shifting attractions and physically moving the community hub to hold events in the expansion of Piazza Pod Park.

Recognizing that the success of the development is dependent on the success of the communal space, the firm employed a dynamic programming strategy to intentionally appeal to everyone in the neighborhood; acquiring renown, established Philadelphia eateries, fresh, family-oriented attractions, as well as quaint, local businesses, all new to the neighborhood.

For the extension of the adjacent courtyard and retail offerings of The Piazza, Piazza Pod Park secured demographically-specific vendors to occupy 14 repurposed shipping containers in the aforementioned, unused parking lot to serve as the main focus of the project. The innovative retailer collective will feature pop-up shops from local vendors, offering fitness, wellness, food and beverage services, showcasing the property’s potential. Vendors of the park include: Essen Bakery, Lil Sum Sum, Tiki Tacos, New Liberty Distillery, Empanada Box, Fit Academy, Tildie’s Toy Box and more.

The park will also exhibit public art installations, seating for 300 people, 200 parking spaces and a two-level enclosed, climate-controlled dining pod and roof deck.

The Post Brothers development team overcame challenges in reimagining the area’s neglected residences as well. The development team has begun renovating the apartment complex with new finishes, planning to construct a new pool and fitness center within the property’s courtyard.

Rent in the area has already increased by 10% since the acquisition of The Piazza, due to hands-on management and rebranding campaigns. Upon renovations and retail repositioning, The Piazza alone is currently valued at $275 million, with numbers expecting to grow following the summer 2019 launch, while the park thrives as a centerpiece of the community.

www.omegare.com

Wednesday, August 28, 2019

Investors Line Up for New Opportunity Zone Hotel Projects

Investors are flocking to hotels, a property type in high demand across the United States and in the federal Opportunity Zone program that offers tax benefits.

Hotel sales in the program were up 51% last year over 2017, according to CoStar data. That’s in part because the federally designated areas enable investors to reap tax advantages from the real estate as well as investing in the hotel business.

Now investors are stepping up to buy new hotels nearing completion in Opportunity Zones. These include projects begun last year that were largely spurred by the program. Tax breaks are available on newly constructed properties as long as the money is invested before the property has been previously placed in service.

Overall hotel occupancy rates remain high as U.S. tourism surges, another draw for investors. New York and Chicago both reached records last year for numbers of visitors.

Virtua Partners of Scottsdale, Arizona, agreed last week to buy a 126-room Courtyard by Marriott under construction in downtown Winston-Salem, North Carolina, for an undisclosed price.

The Courtyard by Marriott deal is significant because it is among the first hospitality projects in the country to be built as an Opportunity Zone development, of which there is a growing number. CoStar data shows 120 hotel projects totaling more than 16,000 rooms now under construction or completed this year in the more than 8,000 designated Opportunity Zones across the country.

The Opportunities Zone program, enacted under the Tax Cuts and Jobs Act of 2017, is designed to stimulate the economies of overlooked, low-income communities through long-term investment from private capital. Investors can receive capital gains tax deferments or tax forgiveness for investments in real estate or companies within the zones.

"There is an incredible amount of upside for this project," Quinn Palomino, chief executive of Virtua, said in announcing the Courtyard by Marriott agreement. "Whether it be to the Winston-Salem community, the people who will be employed through construction and full-time hospitality jobs, or the investors who chose to finance this project."

Dedicated Fund

Virtua created a qualified opportunity fund as a one-off vehicle for investing in the Courtyard by Marriott. It raised $7.8 million in equity for the project.

The property’s internal rate of return is projected to be 18%, the official said.

Courtyard by Marriott is one of Virtua's favorite flags for Opportunity Zone investing. The company has three more such projects in its pipeline.

Virtua has about 100 Opportunity Zone projects overall, including hospitality, multifamily and single-family rental subdivisions.

Atlanta-based Hotel Equities will manage the Courtyard by Marriott when it opens in the first quarter of 2020.

Hotel Equities and Virtua joined forces last year to expand upon their current hospitality portfolio through new development and acquisition opportunities. Hotel Equities is providing development services for the Courtyard by Marriott through the construction process and plans to see it through completion.

Other firms are also developing hotels in Opportunity Zones.

In Atlanta, Peachtree Hotel Group, one of the nation's fastest-growing hotel investment and management firms, is targeting several Opportunity Zone developments. Projects range from an urban, dual-branded hotel in Atlanta to multiple ground-up hotels in the designated areas across the country.

Global alternative asset manager EJF Capital is developing a Marriott Moxy hotel in the Uptown neighborhood of Oakland, California.

"This is exactly the type of investment the Opportunity Zone program is intended to generate," said Neal Wilson, EJF's co-founder and chief operating officer, in a statement earlier this year. "This is the right time to invest in Oakland, a dynamic, expanding city that welcomes growth capital."

www.omegare.com

Hotel sales in the program were up 51% last year over 2017, according to CoStar data. That’s in part because the federally designated areas enable investors to reap tax advantages from the real estate as well as investing in the hotel business.

Now investors are stepping up to buy new hotels nearing completion in Opportunity Zones. These include projects begun last year that were largely spurred by the program. Tax breaks are available on newly constructed properties as long as the money is invested before the property has been previously placed in service.

Overall hotel occupancy rates remain high as U.S. tourism surges, another draw for investors. New York and Chicago both reached records last year for numbers of visitors.

Virtua Partners of Scottsdale, Arizona, agreed last week to buy a 126-room Courtyard by Marriott under construction in downtown Winston-Salem, North Carolina, for an undisclosed price.

The Courtyard by Marriott deal is significant because it is among the first hospitality projects in the country to be built as an Opportunity Zone development, of which there is a growing number. CoStar data shows 120 hotel projects totaling more than 16,000 rooms now under construction or completed this year in the more than 8,000 designated Opportunity Zones across the country.

The Opportunities Zone program, enacted under the Tax Cuts and Jobs Act of 2017, is designed to stimulate the economies of overlooked, low-income communities through long-term investment from private capital. Investors can receive capital gains tax deferments or tax forgiveness for investments in real estate or companies within the zones.

"There is an incredible amount of upside for this project," Quinn Palomino, chief executive of Virtua, said in announcing the Courtyard by Marriott agreement. "Whether it be to the Winston-Salem community, the people who will be employed through construction and full-time hospitality jobs, or the investors who chose to finance this project."

Dedicated Fund

Virtua created a qualified opportunity fund as a one-off vehicle for investing in the Courtyard by Marriott. It raised $7.8 million in equity for the project.

The property’s internal rate of return is projected to be 18%, the official said.

Courtyard by Marriott is one of Virtua's favorite flags for Opportunity Zone investing. The company has three more such projects in its pipeline.

Virtua has about 100 Opportunity Zone projects overall, including hospitality, multifamily and single-family rental subdivisions.

Atlanta-based Hotel Equities will manage the Courtyard by Marriott when it opens in the first quarter of 2020.

Hotel Equities and Virtua joined forces last year to expand upon their current hospitality portfolio through new development and acquisition opportunities. Hotel Equities is providing development services for the Courtyard by Marriott through the construction process and plans to see it through completion.

Other firms are also developing hotels in Opportunity Zones.

In Atlanta, Peachtree Hotel Group, one of the nation's fastest-growing hotel investment and management firms, is targeting several Opportunity Zone developments. Projects range from an urban, dual-branded hotel in Atlanta to multiple ground-up hotels in the designated areas across the country.

Global alternative asset manager EJF Capital is developing a Marriott Moxy hotel in the Uptown neighborhood of Oakland, California.

"This is exactly the type of investment the Opportunity Zone program is intended to generate," said Neal Wilson, EJF's co-founder and chief operating officer, in a statement earlier this year. "This is the right time to invest in Oakland, a dynamic, expanding city that welcomes growth capital."

www.omegare.com

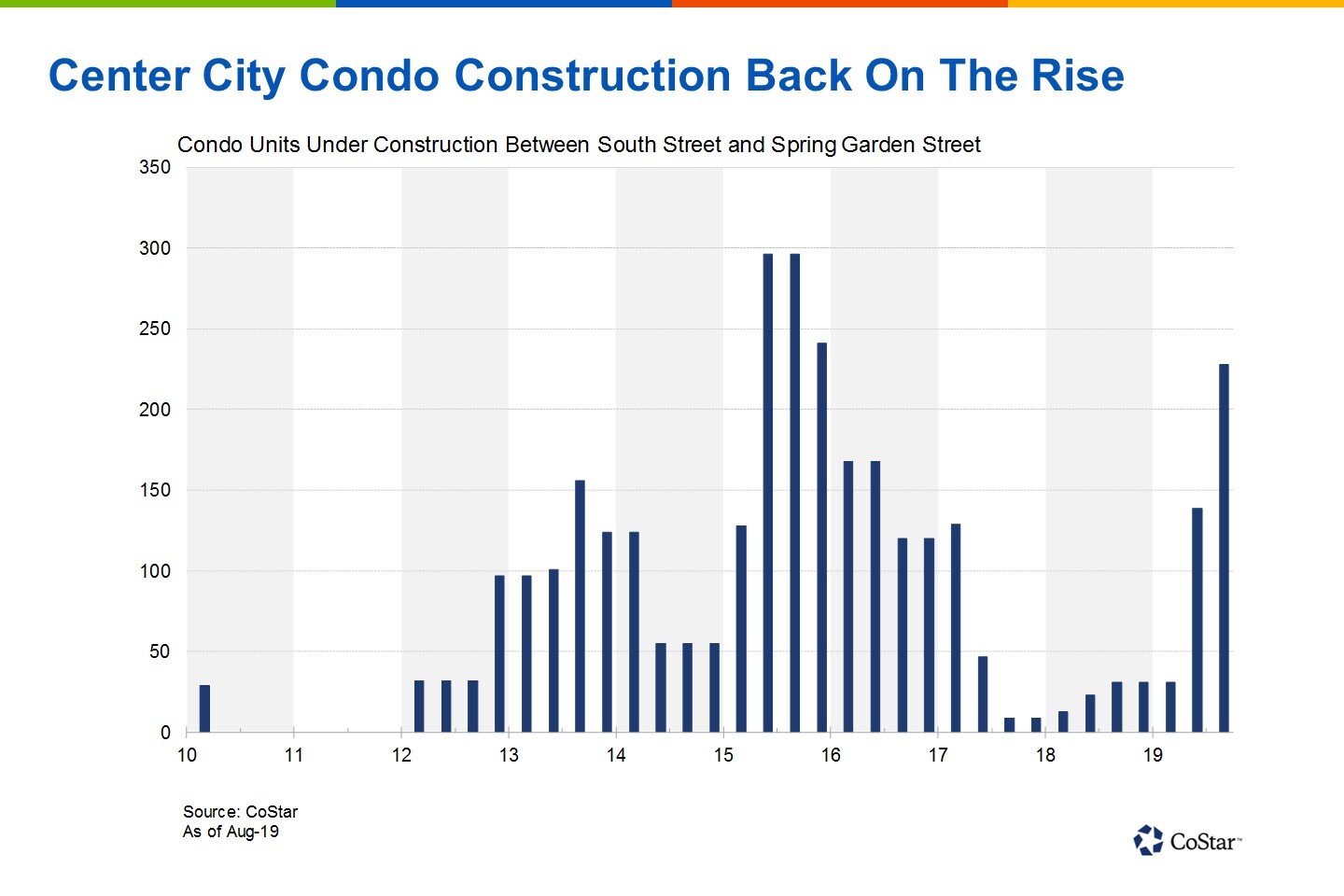

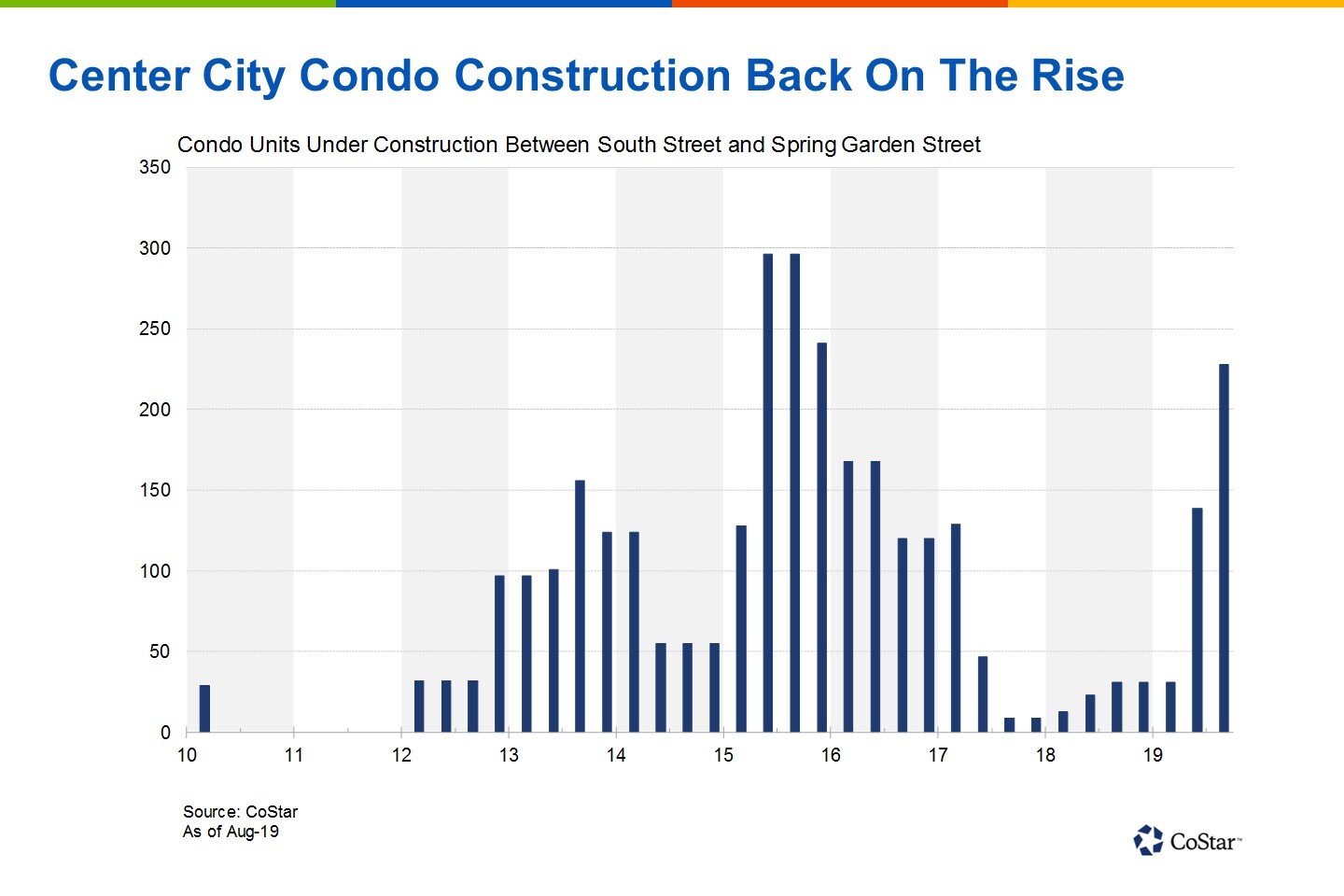

Luxury Condo Construction Ramps Up in Philadelphia's Center City

Luxury homebuilder Toll Brothers completed its acquisition of a four-story retail and office property at 704 Sansom St. on Jewelers' Row in Philadelphia earlier this month for just over $1.1 million.

The deal is a part of an assemblage of parcels along the 700 block of Sansom Street that will pave the way for Toll Brothers to break ground on its 85-unit Toll Washington Square. The condo development has already completed the Civic Design Review process, secured necessary zoning changes and could begin construction before the end of this year.

Progress on Toll Washington Square comes as groundbreakings for ultra-high-end condo projects are beginning to heat up around Center City. Since the beginning of the summer of 2019, three condo developments have broken ground, including Bock Development’s 2100 Hamilton, Dranoff Properties’ Arthaus and Southern Land Company’s The Laurel, which will build a mix of 189 apartments and 60 condo units on its upper floors.

Condo construction is back on the rise, as only one condo project with more than 25 units has delivered in Center City in the last 24 months. The 38-unit 500 Walnut completed during the summer of 2017, but its penthouse sold more than a year earlier, for $17.85 million, or just over $2,000 per square foot.

Developers remain more focused on apartment development, and condos still only represent about one-fifth of Center City’s total multifamily units currently under construction. However, with stock and bond prices near record highs, purchasing power is as strong as it’s ever been among Philadelphia’s wealthiest residents. Low mortgage rates and booming asset values are supporting demand for newly built Center City condos. Meanwhile, by choosing to build for-sale housing, developers are increasingly jumping at the chance to differentiate residential projects from a crowded field of recently completed high-end rental units.

www.omegare.com

The deal is a part of an assemblage of parcels along the 700 block of Sansom Street that will pave the way for Toll Brothers to break ground on its 85-unit Toll Washington Square. The condo development has already completed the Civic Design Review process, secured necessary zoning changes and could begin construction before the end of this year.

Progress on Toll Washington Square comes as groundbreakings for ultra-high-end condo projects are beginning to heat up around Center City. Since the beginning of the summer of 2019, three condo developments have broken ground, including Bock Development’s 2100 Hamilton, Dranoff Properties’ Arthaus and Southern Land Company’s The Laurel, which will build a mix of 189 apartments and 60 condo units on its upper floors.

Condo construction is back on the rise, as only one condo project with more than 25 units has delivered in Center City in the last 24 months. The 38-unit 500 Walnut completed during the summer of 2017, but its penthouse sold more than a year earlier, for $17.85 million, or just over $2,000 per square foot.

Developers remain more focused on apartment development, and condos still only represent about one-fifth of Center City’s total multifamily units currently under construction. However, with stock and bond prices near record highs, purchasing power is as strong as it’s ever been among Philadelphia’s wealthiest residents. Low mortgage rates and booming asset values are supporting demand for newly built Center City condos. Meanwhile, by choosing to build for-sale housing, developers are increasingly jumping at the chance to differentiate residential projects from a crowded field of recently completed high-end rental units.

www.omegare.com

New owner for Four Falls office complex

Natalie Kostelni Reporter Philadelphia Business Journal

Keystone Property Group has acquired Four Falls Corporate Center, a two-building office complex in West Conshohocken for an estimated $50 million.

Keystone purchased the complex, which includes 100 and 200 Four Falls Corporate Center, in a joint venture with Arden Group, which bought the building in 2014 for $44.3 million and continues to have an ownership stake in the property.

The buy fits in with Keystone’s portfolio. The real estate company has its headquarters in Conshohocken and is developing Sora West, a $325 million mixed-use development that will be the new headquarters for AmerisourceBergen. It also focuses on buying value-add real estate that needs either leasing or cosmetic work.

“It was a good opportunity and we like the location and area,” said Rich Gottlieb, president at Keystone, in an interview. “We felt that we could lease it and make it very successful.”

The company plans to invest “multi-million” dollars in the building to “transform it into a best-in-class trophy office building,” Keystone said in a statement. Gottlieb declined to divulge how much it expects to spend repositioning the complex or confirm the sale price, though sources familiar with the transaction indicated it was around $50 million.

Full Story: https://tinyurl.com/y3ouxthu

www.omegare.com

Keystone Property Group has acquired Four Falls Corporate Center, a two-building office complex in West Conshohocken for an estimated $50 million.

Keystone purchased the complex, which includes 100 and 200 Four Falls Corporate Center, in a joint venture with Arden Group, which bought the building in 2014 for $44.3 million and continues to have an ownership stake in the property.

The buy fits in with Keystone’s portfolio. The real estate company has its headquarters in Conshohocken and is developing Sora West, a $325 million mixed-use development that will be the new headquarters for AmerisourceBergen. It also focuses on buying value-add real estate that needs either leasing or cosmetic work.

“It was a good opportunity and we like the location and area,” said Rich Gottlieb, president at Keystone, in an interview. “We felt that we could lease it and make it very successful.”

The company plans to invest “multi-million” dollars in the building to “transform it into a best-in-class trophy office building,” Keystone said in a statement. Gottlieb declined to divulge how much it expects to spend repositioning the complex or confirm the sale price, though sources familiar with the transaction indicated it was around $50 million.

Full Story: https://tinyurl.com/y3ouxthu

www.omegare.com

Tuesday, August 27, 2019

Rubenstein Partners Adds 14 PA Office Buildings to Portfolio

by John Jordan Globest.com

Rubenstein Partners, L.P. of Philadelphia has acquired 1.1 million square feet of office space within 14 buildings in the Chesterbrook Corporate Center here.

The Class A office space in the King of Prussia submarket includes: 1300 Morris Dr., 1325 Morris Dr., 1400 Morris Dr., 851 Duportail Rd., 955 Chesterbrook Blvd., 965 Chesterbrook Blvd., 725 Chesterbrook Blvd., 735 Chesterbrook Blvd., 600 Lee Rd., 601 Lee Rd., 620 Lee Rd., 640 Lee Rd., 690 Lee Rd., and 701 Lee Rd.

No financial terms of the transaction were disclosed. The Philadelphia Business Journal previously reported that Rubenstein and seller Pitcairn Properties had the Chesterbrook Corporate Center under contract for $148.5 million in May.

“Chesterbrook is an exceptional office campus that we’re pleased to add to our portfolio. Additionally, this acquisition further increases our presence in the Philly market, which is particularly important to us as an investment firm based in the region,” says Lou Merlini of Rubenstein Partners.

He adds that the firm’s planned capital improvement program at the property “will completely reimagine Chesterbrook, taking advantage of the beautiful park-like setting while providing an amenity package that we expect to be unparalleled in a Philadelphia suburban office portfolio. We are very excited for the opportunity to restore Chesterbrook to the pre-eminent office destination in the market.”

The 140-acre Chesterbrook Corporate Center, situated off Route 202, is currently more than 80% occupied.

Rubenstein boasts an already substantial presence in the Philadelphia market. Among its holdings include Makefield Crossing (formerly known as the Lower Makefield Corporate Center) in Bucks County and the Wanamaker Building in Center City.

www.omegare.com

Rubenstein Partners, L.P. of Philadelphia has acquired 1.1 million square feet of office space within 14 buildings in the Chesterbrook Corporate Center here.

The Class A office space in the King of Prussia submarket includes: 1300 Morris Dr., 1325 Morris Dr., 1400 Morris Dr., 851 Duportail Rd., 955 Chesterbrook Blvd., 965 Chesterbrook Blvd., 725 Chesterbrook Blvd., 735 Chesterbrook Blvd., 600 Lee Rd., 601 Lee Rd., 620 Lee Rd., 640 Lee Rd., 690 Lee Rd., and 701 Lee Rd.

No financial terms of the transaction were disclosed. The Philadelphia Business Journal previously reported that Rubenstein and seller Pitcairn Properties had the Chesterbrook Corporate Center under contract for $148.5 million in May.

“Chesterbrook is an exceptional office campus that we’re pleased to add to our portfolio. Additionally, this acquisition further increases our presence in the Philly market, which is particularly important to us as an investment firm based in the region,” says Lou Merlini of Rubenstein Partners.

He adds that the firm’s planned capital improvement program at the property “will completely reimagine Chesterbrook, taking advantage of the beautiful park-like setting while providing an amenity package that we expect to be unparalleled in a Philadelphia suburban office portfolio. We are very excited for the opportunity to restore Chesterbrook to the pre-eminent office destination in the market.”

The 140-acre Chesterbrook Corporate Center, situated off Route 202, is currently more than 80% occupied.

Rubenstein boasts an already substantial presence in the Philadelphia market. Among its holdings include Makefield Crossing (formerly known as the Lower Makefield Corporate Center) in Bucks County and the Wanamaker Building in Center City.

www.omegare.com

Friday, August 23, 2019

Planet Fitness to Open at Moorestown Mall in Spring 2020

by John Jordan Globest.com

PREIT reports today it has signed Planet Fitness to a more than 23,000-square-foot lease at its Moorestown Mall here, continuing the health and fitness tenancy growth within the Philadelphia-based REIT’s portfolio.

The fitness facility is slated to open in the spring of next year. The deal marks the latest expansion of square footage dedicated to health and wellness tenancy at the PREIT’s properties.

“Gym-goers today are focused on the fitness journey—they’re not just going to the gym, but buying attire that suits their athletic style and seeking healthier eating alternatives,” says Joseph F. Coradino, CEO of PREIT. “We want to provide local consumers with more reasons to choose the mall as their go-to destination for activities that suit their lifestyle. With the addition of Planet Fitness, we’re continuing to add health and wellness tenants supporting the all-encompassing experience offered by our properties as consumer interests expand well beyond soft goods.”

Since 2008, fitness center leasing in malls has tripled on a square footage basis. PREIT says it has recognized the growing demand in this segment and has strengthened its portfolio to include a variety of health-oriented concepts, most recently incorporating Onelife Fitness at the Valley Mall, Peloton at the Cherry Hill Mall and Edge Fitness opening this fall at the Plymouth Meeting Mall.

Moorestown Mall recently enhanced its tenant mix to include new restaurants to complement a productive Harvest Seasonal Grill, YardHouse and Regal Cinema, rounding out a dining and entertainment component as well as a blend of new-to-market off price venues offering branded merchandise at a discount in the former Macy’s location, including HomeSense, Sierra and Five Below with Michaels Arts and Crafts joining the tenant roster in 2020.

At Moorestown Mall, results have been strong, PREIT reports. Rent generated in the former Macy’s store is 19 times the prior revenue. Traffic has improved by 5.7% through June 30, 2019 compared to the first six months of 2018.

www.omegare.com

PREIT reports today it has signed Planet Fitness to a more than 23,000-square-foot lease at its Moorestown Mall here, continuing the health and fitness tenancy growth within the Philadelphia-based REIT’s portfolio.

The fitness facility is slated to open in the spring of next year. The deal marks the latest expansion of square footage dedicated to health and wellness tenancy at the PREIT’s properties.

“Gym-goers today are focused on the fitness journey—they’re not just going to the gym, but buying attire that suits their athletic style and seeking healthier eating alternatives,” says Joseph F. Coradino, CEO of PREIT. “We want to provide local consumers with more reasons to choose the mall as their go-to destination for activities that suit their lifestyle. With the addition of Planet Fitness, we’re continuing to add health and wellness tenants supporting the all-encompassing experience offered by our properties as consumer interests expand well beyond soft goods.”

Since 2008, fitness center leasing in malls has tripled on a square footage basis. PREIT says it has recognized the growing demand in this segment and has strengthened its portfolio to include a variety of health-oriented concepts, most recently incorporating Onelife Fitness at the Valley Mall, Peloton at the Cherry Hill Mall and Edge Fitness opening this fall at the Plymouth Meeting Mall.

Moorestown Mall recently enhanced its tenant mix to include new restaurants to complement a productive Harvest Seasonal Grill, YardHouse and Regal Cinema, rounding out a dining and entertainment component as well as a blend of new-to-market off price venues offering branded merchandise at a discount in the former Macy’s location, including HomeSense, Sierra and Five Below with Michaels Arts and Crafts joining the tenant roster in 2020.

At Moorestown Mall, results have been strong, PREIT reports. Rent generated in the former Macy’s store is 19 times the prior revenue. Traffic has improved by 5.7% through June 30, 2019 compared to the first six months of 2018.

www.omegare.com

Recent CRE Deals

By Natalie Kostelni – Reporter, Philadelphia Business Journal

4,183SF

CluePoints Inc., a company that helps with clinical trial oversight, signed a five-year deal on 4,183 square feet at 1000 Continental Drive in King of Prussia.

34,559SF

CompanyVoice, a call center, renewed its lease on 34,559 square feet at 930 Harvest Drive in Blue Bell. The company had 43,000 square feet but reduced the amount of space it needed to be more efficient. The company first moved into 14,471 square feet at the Harvest Drive building in June 2012 and has expanded over the years.

5,300SF

Villanova Insurance Partners signed a seven-year lease on 5,300 square feet at King of Prussia Business Center at 1004-1019 W. 8th Ave. in King of Prussia.

6,700SF

Janney Montgomery Scott leased 6,700 square feet at Rosetree 2 at 1400 N. Providence Road in Media and relocated from Rosetree 1 in the same office complex.

18,000SF

Tiger Optics, a manufacturer of devices that detect gas, leased 18,000 square feet at 261-283 Gibralter Road in Horsham for its headquarters and will be relocating from about 10,000 square feet at 250 Titus Ave. in Warrington.

www.omegare.com

4,183SF

CluePoints Inc., a company that helps with clinical trial oversight, signed a five-year deal on 4,183 square feet at 1000 Continental Drive in King of Prussia.

34,559SF

CompanyVoice, a call center, renewed its lease on 34,559 square feet at 930 Harvest Drive in Blue Bell. The company had 43,000 square feet but reduced the amount of space it needed to be more efficient. The company first moved into 14,471 square feet at the Harvest Drive building in June 2012 and has expanded over the years.

5,300SF

Villanova Insurance Partners signed a seven-year lease on 5,300 square feet at King of Prussia Business Center at 1004-1019 W. 8th Ave. in King of Prussia.

6,700SF

Janney Montgomery Scott leased 6,700 square feet at Rosetree 2 at 1400 N. Providence Road in Media and relocated from Rosetree 1 in the same office complex.

18,000SF

Tiger Optics, a manufacturer of devices that detect gas, leased 18,000 square feet at 261-283 Gibralter Road in Horsham for its headquarters and will be relocating from about 10,000 square feet at 250 Titus Ave. in Warrington.

www.omegare.com

Thursday, August 22, 2019

Wednesday, August 21, 2019

Endurance announces the sale of the King of Prussia Industrial Portfolio in King of Prussia, Pennsylvania

An affiliate of Endurance Real Estate Group, LLC (“Endurance”) and Thackeray Partners (“Thackeray”) is pleased to announce the disposition of the King of Prussia Industrial Portfolio, a five (5) building, 292,110 SF industrial/flex portfolio located in King of Prussia, Pennsylvania (“Property”)

The buildings were constructed in the 1960’s and 1970’s and feature Class B warehouse/distribution specifications including 22’ average clear ceiling heights, wet sprinkler systems and ample loading capacity with full dock packages. The portfolio is situated in the Montgomery County submarket of the Philadelphia MSA industrial market, offering users immediate proximity to I-276 and close proximity to I-76 and I-476. The portfolio was 95% leased at closing.

“Immediately after we acquired the 72% leased portfolio, we implemented our speculative capital improvement plan for the portfolio focusing on the large 60,000 SF vacancy at 780 Third Avenue. We started with the demolition of the second story office area at the building. We then focused our attention to the exterior of the building where improvements were made to the main entrance and parking areas of the building. Interior and exterior painting of the building was completed as well as various landscaping upgrades. Shortly after our renovation was complete, we secured a long term lease for the entire building with a national tenant to stabilize the portfolio”,

The buildings were constructed in the 1960’s and 1970’s and feature Class B warehouse/distribution specifications including 22’ average clear ceiling heights, wet sprinkler systems and ample loading capacity with full dock packages. The portfolio is situated in the Montgomery County submarket of the Philadelphia MSA industrial market, offering users immediate proximity to I-276 and close proximity to I-76 and I-476. The portfolio was 95% leased at closing.

“Immediately after we acquired the 72% leased portfolio, we implemented our speculative capital improvement plan for the portfolio focusing on the large 60,000 SF vacancy at 780 Third Avenue. We started with the demolition of the second story office area at the building. We then focused our attention to the exterior of the building where improvements were made to the main entrance and parking areas of the building. Interior and exterior painting of the building was completed as well as various landscaping upgrades. Shortly after our renovation was complete, we secured a long term lease for the entire building with a national tenant to stabilize the portfolio”,

Radial Leases Dermody Properties' LogistiCenter at 33

Multinational e-commerce company Radial, Inc. leased Dermody Properties' LogistiCenter at 33 distribution building at Forks Industrial Park in Easton, Pennsylvania.

The lease mark's Radial's first on-the-ground fulfillment presence in the state of Pennsylvania, where the company plans to provide nearly 100 management and hourly positions initially, as well as 700 hourly positions later this year to meet customer demand during the holidays.

The 475,800-square-foot, single-story facility at 4200 Braden Blvd. East was completed by the landlord in 2016. The high-tier property spans 31.3 acres near several national companies including Amazon, UPS, FedEx, Porsche, Mondelēz International, BMW and Walgreens.

LogistiCenter at 33 comprises 36-foot clear ceiling heights, 226 car parking spaces and 85 trailer parking spaces.

Dermody Properties East Region Partner Eugene Preston said in a statement, "The location of this property is ideal for Radial’s e-commerce, fulfillment and transportation operations, providing proximity to major East Coast markets and population centers."

Headquartered in Reno, Nevada, Dermody Properties has invested in more than 83 million square feet of industrial space since its launch in 1960, according to its website.

www.omegare.com

The lease mark's Radial's first on-the-ground fulfillment presence in the state of Pennsylvania, where the company plans to provide nearly 100 management and hourly positions initially, as well as 700 hourly positions later this year to meet customer demand during the holidays.

The 475,800-square-foot, single-story facility at 4200 Braden Blvd. East was completed by the landlord in 2016. The high-tier property spans 31.3 acres near several national companies including Amazon, UPS, FedEx, Porsche, Mondelēz International, BMW and Walgreens.

LogistiCenter at 33 comprises 36-foot clear ceiling heights, 226 car parking spaces and 85 trailer parking spaces.

Dermody Properties East Region Partner Eugene Preston said in a statement, "The location of this property is ideal for Radial’s e-commerce, fulfillment and transportation operations, providing proximity to major East Coast markets and population centers."

Headquartered in Reno, Nevada, Dermody Properties has invested in more than 83 million square feet of industrial space since its launch in 1960, according to its website.

www.omegare.com

Tuesday, August 20, 2019

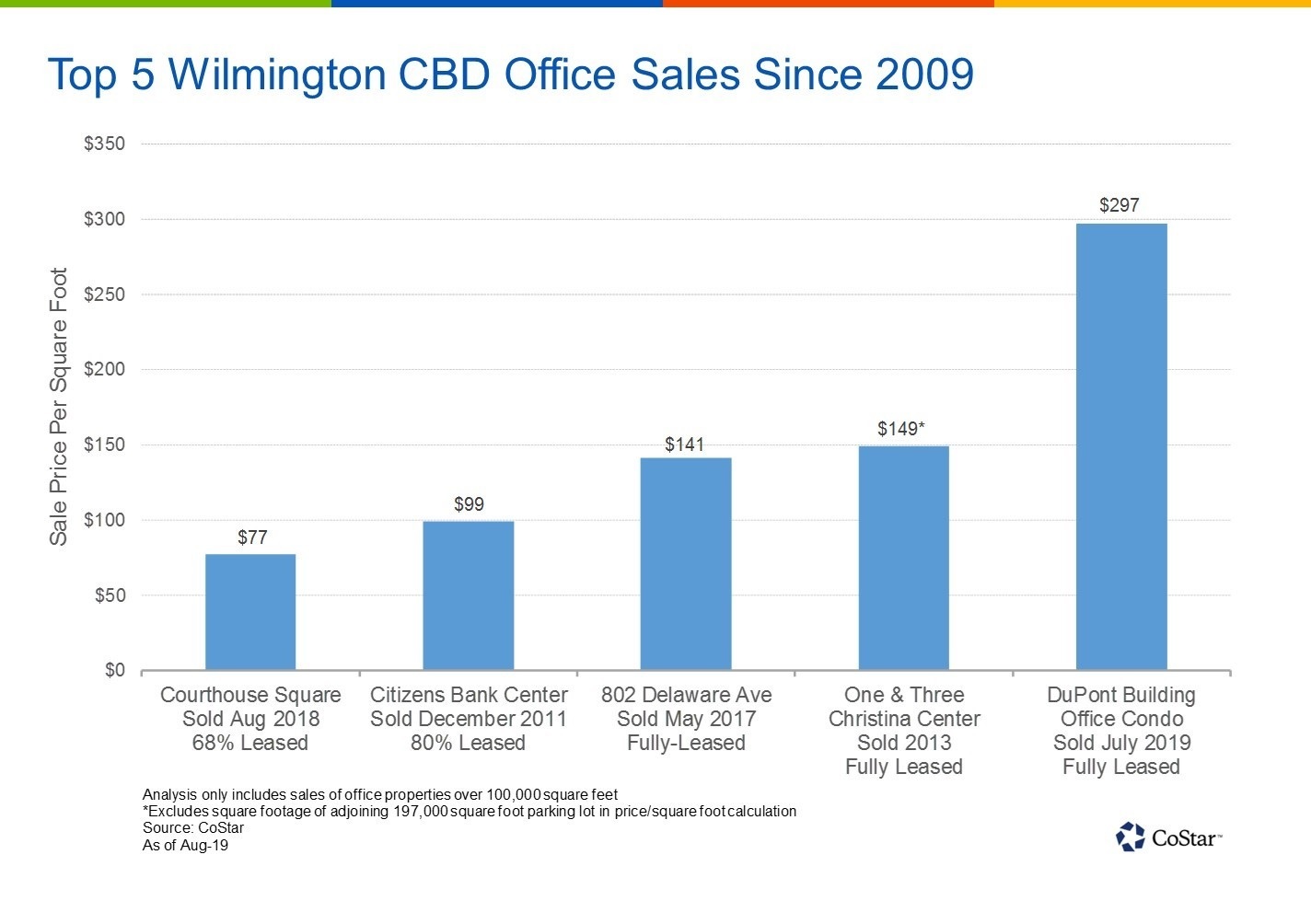

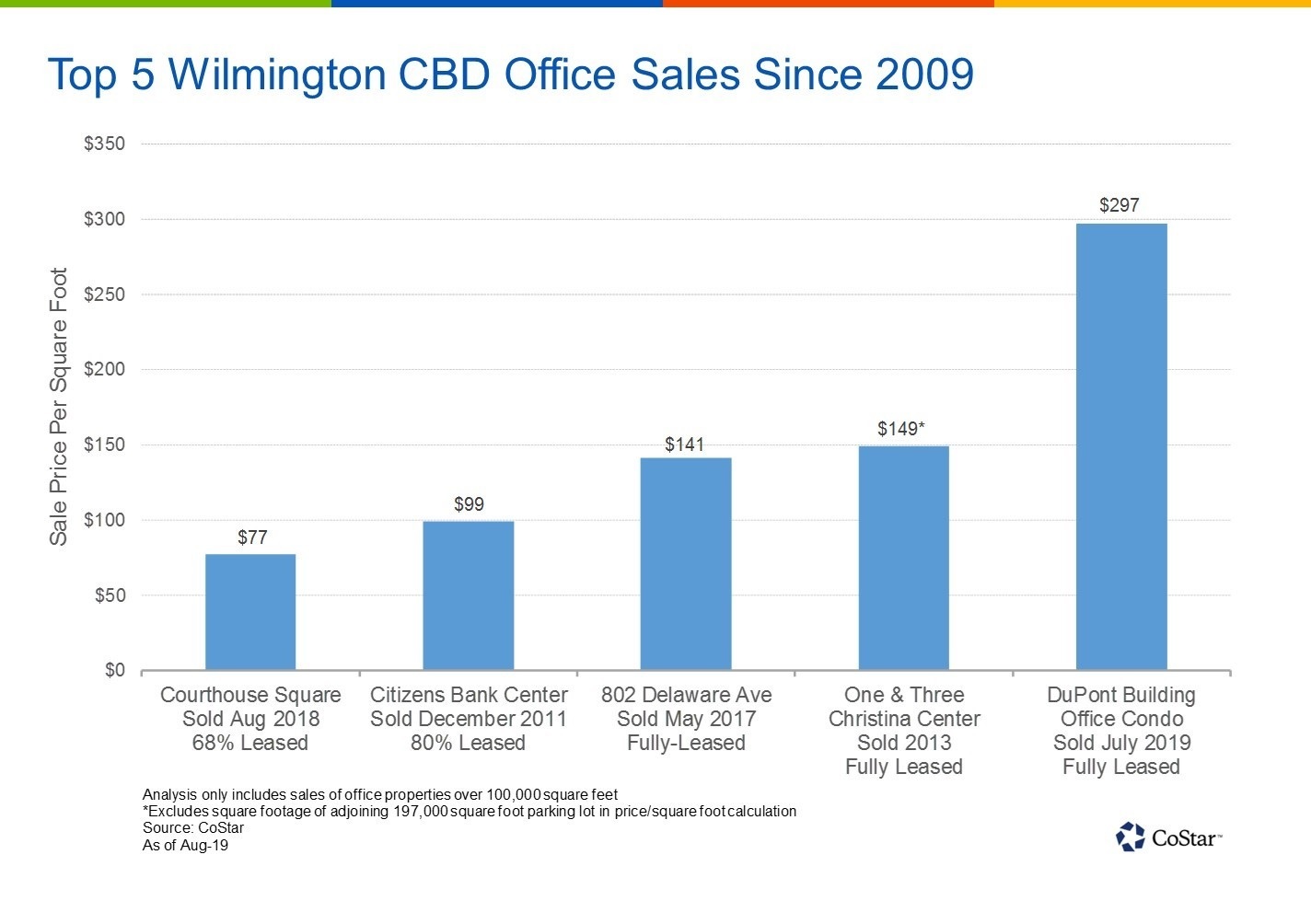

Delaware Sets Pricing Milestone for Downtown Wilmington Office Market

The sale of a 283,000-square-foot office condo in Wilmington, Delaware, made few headlines when it closed last month, largely because the deed was transferred on the Monday after Fourth of July weekend. But a quick look back at the $84 million sale of Chemour's headquarters at the historic DuPont Building reveals that the deal was a milestone for Downtown Wilmington’s office market in many ways.

Thanks in part to Chemours’ 15-year lease in place, this was by far the highest price per square foot on a major office sale that has ever closed in Wilmington’s Central Business District, a submarket that has been riddled with tenant move-outs and sales of high-vacancy properties over the past few years.

The office condo was jointly purchased by Connecticut’s Arch Street Capital Advisors and Kuwait-based private equity firm Soor Capital. The pair also jointly purchased a portfolio of Malvern office properties from Liberty Property Trust in 2018.

The Buccini/Pollin Group, the most active local developer revitalizing the submarket’s office and residential properties of late, first acquired the entire 950,000-square-foot DuPont Building at 1007 N Market St. in 2017, for a lean $32 million, or about $34 per square foot.

At the time of the 2017 sale, the 1908-built property straddled a number of uses. The luxury Hotel du Pont occupied more than 200,000 square feet, which it still does today. Meanwhile, the seller, chemical company Chemours, announced plans to downsize its office within the property to 283,000 square feet that would be renovated by the incoming owner.

After a 20-month long renovation, Chemours’ new office opened in the fall of 2018 and last month, Buccini/Pollin group capitalized on the award-winning project, selling Chemours’ office as a separate condo within the property for nearly $297 per square foot.

Other investors including Austin, Texas-based Capital Commercial Investments, and Louisville, Kentucky-based Real Capital Solutions, have acquired high-vacancy office properties in Downtown Wilmington in recent years.

Although the DuPont Building is unique for its historical and architectural attributes, the willingness of an international private equity fund to pay almost $300 per square foot for Chemours’ headquarters sends an encouraging signal to other recent value-add buyers, in terms of the level of investor interest their Downtown Wilmington properties could garnish if they are successfully released to long-term tenants.

The sale gives Buccini/Pollin Group a large cash infusion to continue with its plan to renovate a large portion of the property’s remaining empty office space into 180 luxury multifamily units that would share some amenities and services with Hotel du Pont.

Buccini/Pollin Group also opened a new foodhall on the ground floor of the property last spring, and the property’s reinvigoration is a sign of hope in a submarket that has proven challenging for plenty of other local office owners in recent years.

www.omegare.com

Thanks in part to Chemours’ 15-year lease in place, this was by far the highest price per square foot on a major office sale that has ever closed in Wilmington’s Central Business District, a submarket that has been riddled with tenant move-outs and sales of high-vacancy properties over the past few years.

The office condo was jointly purchased by Connecticut’s Arch Street Capital Advisors and Kuwait-based private equity firm Soor Capital. The pair also jointly purchased a portfolio of Malvern office properties from Liberty Property Trust in 2018.

The Buccini/Pollin Group, the most active local developer revitalizing the submarket’s office and residential properties of late, first acquired the entire 950,000-square-foot DuPont Building at 1007 N Market St. in 2017, for a lean $32 million, or about $34 per square foot.

At the time of the 2017 sale, the 1908-built property straddled a number of uses. The luxury Hotel du Pont occupied more than 200,000 square feet, which it still does today. Meanwhile, the seller, chemical company Chemours, announced plans to downsize its office within the property to 283,000 square feet that would be renovated by the incoming owner.

After a 20-month long renovation, Chemours’ new office opened in the fall of 2018 and last month, Buccini/Pollin group capitalized on the award-winning project, selling Chemours’ office as a separate condo within the property for nearly $297 per square foot.

Other investors including Austin, Texas-based Capital Commercial Investments, and Louisville, Kentucky-based Real Capital Solutions, have acquired high-vacancy office properties in Downtown Wilmington in recent years.

Although the DuPont Building is unique for its historical and architectural attributes, the willingness of an international private equity fund to pay almost $300 per square foot for Chemours’ headquarters sends an encouraging signal to other recent value-add buyers, in terms of the level of investor interest their Downtown Wilmington properties could garnish if they are successfully released to long-term tenants.

The sale gives Buccini/Pollin Group a large cash infusion to continue with its plan to renovate a large portion of the property’s remaining empty office space into 180 luxury multifamily units that would share some amenities and services with Hotel du Pont.

Buccini/Pollin Group also opened a new foodhall on the ground floor of the property last spring, and the property’s reinvigoration is a sign of hope in a submarket that has proven challenging for plenty of other local office owners in recent years.

www.omegare.com

Monday, August 19, 2019

Friday, August 16, 2019

Hankin to build $100M senior living facility in Eagleview

By Natalie Kostelni – Reporter, Philadelphia Business Journal

Hankin Group is building a $100 million senior-living facility in Eagleview, which will be a first for the mixed-use community in Exton.

Called Eagleview Landing, the project will be developed in two phases have a total of 284 units. The first phase, totaling $35 million, is underway and will consist of 62 personal care units and 45 memory care units. The second phase will have independent-living units.

Though a new type of housing for Eagleview, the addition of assisted living fits with the developer’s desire to follow the principles of New Urbanism at the 800-acre community that has been a work in progress for three decades and incorporates a mix of uses with open space in a walkable environment. When it comes to housing, Eagleview has single-family, multifamily, age-restricted and as well as low income units. Eagleview Landing will round out the community’s offerings by providing another type of housing that accommodates different stages of life and different lifestyles.

“We try to provide every kind of housing here,” said Robert Hankin, CEO at Hankin Group. "One of the concepts that had guided us through the years is the idea that the whole is greater than the parts. We have tried to follow the concepts of New Urbanism and, in doing so, we have learned how to add a mix of uses where ever possible. So, while we can’t always bring every use into each project, we strive to build communities that are as walkable as possible and combine as many uses as supportable.”

Blue Harbor Senior Living, an Oregon operator of senior living facilities, will manage Eagleview Landing.

Full story: https://tinyurl.com/y49u5q69

www.omegare.com

Hankin Group is building a $100 million senior-living facility in Eagleview, which will be a first for the mixed-use community in Exton.

Called Eagleview Landing, the project will be developed in two phases have a total of 284 units. The first phase, totaling $35 million, is underway and will consist of 62 personal care units and 45 memory care units. The second phase will have independent-living units.

Though a new type of housing for Eagleview, the addition of assisted living fits with the developer’s desire to follow the principles of New Urbanism at the 800-acre community that has been a work in progress for three decades and incorporates a mix of uses with open space in a walkable environment. When it comes to housing, Eagleview has single-family, multifamily, age-restricted and as well as low income units. Eagleview Landing will round out the community’s offerings by providing another type of housing that accommodates different stages of life and different lifestyles.

“We try to provide every kind of housing here,” said Robert Hankin, CEO at Hankin Group. "One of the concepts that had guided us through the years is the idea that the whole is greater than the parts. We have tried to follow the concepts of New Urbanism and, in doing so, we have learned how to add a mix of uses where ever possible. So, while we can’t always bring every use into each project, we strive to build communities that are as walkable as possible and combine as many uses as supportable.”

Blue Harbor Senior Living, an Oregon operator of senior living facilities, will manage Eagleview Landing.

Full story: https://tinyurl.com/y49u5q69

www.omegare.com

Thursday, August 15, 2019

GIANT Food to Open Flagship Philly Store in Center City

by John Jordan Globest.com

A host of city and state dignitaries were on hand yesterday when GIANT Food Stores announced plans to develop a new two-level flagship Philadelphia store in Center City.

The 65,000-square-foot store will be located in the first of two towers under development at 60 North 23rd St. by PMC Property Group of Philadelphia.The store is expected to open by the fall of 2020 and create more than 200 new jobs for the city.

GIANT Food Stores president Nicholas Bertram was joined by Pennsylvania Department of Community and Economic Development Secretary Dennis Davin, Philadelphia Mayor Jim Kenney and PMC Property Group president Ron Caplan formally at a groundbreaking ceremony at the site of the new Riverwalk development project.

“Like the city of Philadelphia, GIANT continues to grow and innovate – becoming part of this new incredible Riverwalk project helps cement our commitment to Philadelphia,” said Bertram of GIANT Food Stores. “We’ve always been dedicated to bringing quality groceries to the people of our home state of Pennsylvania, but this new Philadelphia store—as well as our new GIANT Heirloom Markets throughout the city—represent the future of GIANT: fresh solutions for the way families live now.”

Located in the Logan Square neighborhood within walking distance to Center City, the new GIANT will be housed in Riverwalk’s Tower 1. High open ceilings will welcome customers into the first-floor glass lobby. Natural light and city views will enhance the shopping experience while an outdoor terrace will give customers a picturesque place to enjoy a glass of wine or beer and food. A dedicated onsite parking garage will be available exclusively to GIANT customers, company officials stated.

“GIANT has become an integral part of the Philadelphia region, both as a business serving our communities and as a tremendous partner to our area’s nonprofits. Not only has GIANT done a great deal to improve the health and wellbeing of Philadelphians over the years, its recent growth has also brought hundreds of high-quality jobs to our neighborhoods. The announcement of GIANT’S new flagship store is an exciting development for the city,” said Philadelphia Mayor Jim Kenney.

More than 600 varieties of fresh produce with local product being spotlighted will be available at the new store. Inspired by GIANT Heirloom Market, the store will also feature community vendor partnerships with passionate Philadelphia-area food purveyors tempting and captivating shoppers. The store will boast the largest plant-based department in the company.

“The features planned for the new Riverwalk GIANT speak directly to the needs and desires of our city demographic. We’re thrilled to offer our future residents and customers such an incredible and innovative amenity,” noted Ron Caplan, president of PMC Property Group.

Plans for the Riverwalk store highlight Philadelphia’s central role in the company’s recent growth strategy and is in addition to a $70 million investment GIANT announced in April 2018 to grow its store network across the Commonwealth by constructing six new stores, remodeling two locations and opening four new fuel stations through the end of this year. GIANT will soon open a new store in East Stroudsburg and has plans to open two more GIANT Heirloom Markets in the Philadelphia neighborhoods of Northern Liberties and Queen’s Village.

GIANT has 158 stores in the state of Pennsylvania and employs nearly 29,000 associates in the state. The Carlisle, PA-based retailer has a total of 181 stores, 132 pharmacies, 102 fuel stations and more than 106 online pickup hubs in Pennsylvania, Maryland, Virginia and West Virginia. The firm employs more than 32,000 associates.

www.omegare.com

A host of city and state dignitaries were on hand yesterday when GIANT Food Stores announced plans to develop a new two-level flagship Philadelphia store in Center City.

The 65,000-square-foot store will be located in the first of two towers under development at 60 North 23rd St. by PMC Property Group of Philadelphia.The store is expected to open by the fall of 2020 and create more than 200 new jobs for the city.

GIANT Food Stores president Nicholas Bertram was joined by Pennsylvania Department of Community and Economic Development Secretary Dennis Davin, Philadelphia Mayor Jim Kenney and PMC Property Group president Ron Caplan formally at a groundbreaking ceremony at the site of the new Riverwalk development project.

“Like the city of Philadelphia, GIANT continues to grow and innovate – becoming part of this new incredible Riverwalk project helps cement our commitment to Philadelphia,” said Bertram of GIANT Food Stores. “We’ve always been dedicated to bringing quality groceries to the people of our home state of Pennsylvania, but this new Philadelphia store—as well as our new GIANT Heirloom Markets throughout the city—represent the future of GIANT: fresh solutions for the way families live now.”

Located in the Logan Square neighborhood within walking distance to Center City, the new GIANT will be housed in Riverwalk’s Tower 1. High open ceilings will welcome customers into the first-floor glass lobby. Natural light and city views will enhance the shopping experience while an outdoor terrace will give customers a picturesque place to enjoy a glass of wine or beer and food. A dedicated onsite parking garage will be available exclusively to GIANT customers, company officials stated.

“GIANT has become an integral part of the Philadelphia region, both as a business serving our communities and as a tremendous partner to our area’s nonprofits. Not only has GIANT done a great deal to improve the health and wellbeing of Philadelphians over the years, its recent growth has also brought hundreds of high-quality jobs to our neighborhoods. The announcement of GIANT’S new flagship store is an exciting development for the city,” said Philadelphia Mayor Jim Kenney.

More than 600 varieties of fresh produce with local product being spotlighted will be available at the new store. Inspired by GIANT Heirloom Market, the store will also feature community vendor partnerships with passionate Philadelphia-area food purveyors tempting and captivating shoppers. The store will boast the largest plant-based department in the company.

“The features planned for the new Riverwalk GIANT speak directly to the needs and desires of our city demographic. We’re thrilled to offer our future residents and customers such an incredible and innovative amenity,” noted Ron Caplan, president of PMC Property Group.

Plans for the Riverwalk store highlight Philadelphia’s central role in the company’s recent growth strategy and is in addition to a $70 million investment GIANT announced in April 2018 to grow its store network across the Commonwealth by constructing six new stores, remodeling two locations and opening four new fuel stations through the end of this year. GIANT will soon open a new store in East Stroudsburg and has plans to open two more GIANT Heirloom Markets in the Philadelphia neighborhoods of Northern Liberties and Queen’s Village.

GIANT has 158 stores in the state of Pennsylvania and employs nearly 29,000 associates in the state. The Carlisle, PA-based retailer has a total of 181 stores, 132 pharmacies, 102 fuel stations and more than 106 online pickup hubs in Pennsylvania, Maryland, Virginia and West Virginia. The firm employs more than 32,000 associates.

www.omegare.com

Newly Built Mixed-Use Philly Property Secures Nearly $28M Refi Deal

by John Jordan Globest.com

The ownership of the recently built 1600 Callowhill St. mixed-use building here has secured $27.5 million in refinancing funding for the project.

The building owners are Ivy Realty of Montvale, NJ and DW Partners of New York City in procuring the refinancing loan from BBVA.

“This transaction was unique in that Ivy Realty in partnership with DW Partners delivered differentiated rental product in luxury loft units which leased quickly in the market and lenders who understood the growth in the sub market were eager to lend on the asset and Sponsorship."

Approximately 40% of the building’s units are leased to Sonder, a short-term rental start-up in nearly 30 cities that recently surpassed a valuation of more than $1 billion.

“The lease with Sonder for a portion of the units in the building further showcased the high-quality build and led to a competitive marketing process,” Alascio adds. “BBVA was able to put forth a custom financing package tailored to meet the needs and business plan of the sponsorship.”

1600 Callowhill Road is a brand-new multifamily building located between the City Center and Philadelphia’s Fairmount neighborhood. The property features a design that pays homage to the site’s historical past. Tenant amenities include a rooftop terrace, gym, lounge, parking, concierge, exposed brick and in-unit washers and dryers.

www.omegare.com

The ownership of the recently built 1600 Callowhill St. mixed-use building here has secured $27.5 million in refinancing funding for the project.

The building owners are Ivy Realty of Montvale, NJ and DW Partners of New York City in procuring the refinancing loan from BBVA.

“This transaction was unique in that Ivy Realty in partnership with DW Partners delivered differentiated rental product in luxury loft units which leased quickly in the market and lenders who understood the growth in the sub market were eager to lend on the asset and Sponsorship."

Approximately 40% of the building’s units are leased to Sonder, a short-term rental start-up in nearly 30 cities that recently surpassed a valuation of more than $1 billion.

“The lease with Sonder for a portion of the units in the building further showcased the high-quality build and led to a competitive marketing process,” Alascio adds. “BBVA was able to put forth a custom financing package tailored to meet the needs and business plan of the sponsorship.”

1600 Callowhill Road is a brand-new multifamily building located between the City Center and Philadelphia’s Fairmount neighborhood. The property features a design that pays homage to the site’s historical past. Tenant amenities include a rooftop terrace, gym, lounge, parking, concierge, exposed brick and in-unit washers and dryers.

www.omegare.com

Wednesday, August 14, 2019

Plymouth Meeting Ripe for More Apartments, but Development Sites Limited

One of the most popular strategies among Philadelphia apartment developers in recent years has been to deliver large, highly amenitized rental communities near centers of suburban office employment. This approach has been particularly successful in Philadelphia’s western suburbs, which are notorious for rush-hour traffic congestion along I-76.

By completing projects less than a 10-minute drive from existing office parks, developers have been able to offer apartment renters relief from bumper-to-bumper traffic. This benefit has been a key ingredient for success for projects such as MLP Ventures’ Royal Worthington, which is adjacent to Vanguard’s giant Malvern campus, and for the more than 1,600 market rate apartment units that have delivered within King of Prussia’s Village at Valley Forge master planned development since 2017.

But CoStar’s recent analysis of the ratio of occupied office space to existing apartment units in various Philadelphia suburbs suggests that Plymouth Meeting may be undersupplied in terms of apartment options relative to the size of its office stock.

Within a two-mile radius of Plymouth Meeting Mall, for every existing apartment unit there is more than 3,300 square feet of occupied office space.

That is more than three times the amount of occupied office space per apartment unit of surrounding suburban retail centers such as the Bala Cynwyd Shopping Center, Exton Square Mall and Neshaminy Mall. The figure suggests a large number of Plymouth Meeting office workers would jump at the chance to rent a high-end apartment and shorten their commutes.

When Parc at Plymouth Meeting delivered in 2015, the project was the township’s first market-rate apartment development to complete since the 1970s. The property reported over 95% occupancy last month and has raised one-bedroom asking rents by about 17% since it began preleasing five years ago.

But no other projects have completed or broken ground in Plymouth Meeting since Parc at Plymouth Meeting’s completion, as the lack of properly zoned, open land has limited developers’ options. Of the four land parcels over one acre currently listed for sale on CoStar, all are being advertised as having light industrial designations in place.

This lack of new development in an otherwise viable apartment submarket means landlords of existing properties should benefit from minimal competition over the next several quarters. Investors committed to bringing more high-end apartments to market in Plymouth Meeting may have to consider redeveloping some of the area’s older, underperforming office buildings, although few are currently being offered for sale.

www.omegare.com

By completing projects less than a 10-minute drive from existing office parks, developers have been able to offer apartment renters relief from bumper-to-bumper traffic. This benefit has been a key ingredient for success for projects such as MLP Ventures’ Royal Worthington, which is adjacent to Vanguard’s giant Malvern campus, and for the more than 1,600 market rate apartment units that have delivered within King of Prussia’s Village at Valley Forge master planned development since 2017.

But CoStar’s recent analysis of the ratio of occupied office space to existing apartment units in various Philadelphia suburbs suggests that Plymouth Meeting may be undersupplied in terms of apartment options relative to the size of its office stock.

Within a two-mile radius of Plymouth Meeting Mall, for every existing apartment unit there is more than 3,300 square feet of occupied office space.

That is more than three times the amount of occupied office space per apartment unit of surrounding suburban retail centers such as the Bala Cynwyd Shopping Center, Exton Square Mall and Neshaminy Mall. The figure suggests a large number of Plymouth Meeting office workers would jump at the chance to rent a high-end apartment and shorten their commutes.

When Parc at Plymouth Meeting delivered in 2015, the project was the township’s first market-rate apartment development to complete since the 1970s. The property reported over 95% occupancy last month and has raised one-bedroom asking rents by about 17% since it began preleasing five years ago.

But no other projects have completed or broken ground in Plymouth Meeting since Parc at Plymouth Meeting’s completion, as the lack of properly zoned, open land has limited developers’ options. Of the four land parcels over one acre currently listed for sale on CoStar, all are being advertised as having light industrial designations in place.

This lack of new development in an otherwise viable apartment submarket means landlords of existing properties should benefit from minimal competition over the next several quarters. Investors committed to bringing more high-end apartments to market in Plymouth Meeting may have to consider redeveloping some of the area’s older, underperforming office buildings, although few are currently being offered for sale.

www.omegare.com

Tuesday, August 13, 2019

Hampshire Companies Sells 33-Property Portfolio to Colony Industrial

by John Jordan Globest.com

Hampshire Companies of Morristown, NJ has sold a portfolio of 33 industrial buildings and development sites in the Garden State to Dallas-based Colony Industrial, which announced last week that it has put its multi-billion-dollar industrial portfolio on the market for sale.

The deal that includes 30 industrial buildings totaling more than 1.3 million square feet. Colony Industrial acquired the portfolio, which is situated on nearly 83-acres of land, for an undisclosed sale price. Also included in the transaction were three development sites located in Carteret and West Caldwell, NJ totaling 46-acres.

Colony Industrial is the industrial platform of Los Angeles-based Colony Capital. No financial details of the transaction were disclosed.

The acquired assets by Colony Industrial are located within the Northern New Jersey industrial market and are currently 99% occupied by a diverse tenant roster. The portfolio provides a continuous cash flow with value enhancement through contractual lease escalations and rollover of existing tenants to continually increasing market rental rates.

“This portfolio offered Colony Industrial the very rare opportunity to acquire a critical mass of high-quality industrial assets and a future development pipeline in a joint venture structure with Hampshire Real Estate Companies, one of the most respected developers in New Jersey. This deal was a win-win for both parties and we are proud of the outstanding results our team was able to deliver.”

Among the properties in the portfolio are 41 Slater Drive, Elmwood Park, 700 Blair Road, Carteret and 231-232 Main Street, Little Falls, NJ.

Colony Capital announced on Aug. 9th as part of its second quarter financial report that it has engaged advisors to market the company’s multi-billion-dollar industrial portfolio for sale, which may include the related management platform.

“There has been significant appreciation in the value of our industrial portfolio driven by favorable operating fundamentals and strong investor demand for light industrial assets. As a result, a sale of the industrial portfolio may yield a price higher than the value that may be ascribed by the market to the industrial portfolio as part of the company’s overall valuation,” the company states.

Colony Capital is seeking to complete a sale by the end of 2019.

As of June 30, 2019, the consolidated light industrial portfolio consisted of 446 light industrial buildings totaling 55.7 million rentable square feet across 26 major U.S. markets and was 92% leased. The company’s equity interest in the consolidated light industrial portfolio was approximately 34% as of June 30, 2019 and March 31, 2019. Total third-party capital commitments in the light industrial portfolio were approximately $1.7 billion compared to cumulative balance sheet contributions of $749 million as of June 30, 2019. The light industrial portfolio is composed of and primarily invests in light industrial properties in infill locations in major U.S. metropolitan markets generally targeting multi-tenanted warehouses less than 250,000 square feet.

As of June 30, 2019, the consolidated bulk industrial portfolio consisted of six bulk industrial buildings totaling 4.2 million rentable square feet across five major U.S. markets and was 67% leased. The company’s equity interest in the consolidated bulk industrial portfolio was approximately 51%, or $72 million, with the other 49% owned by third-party capital, which is managed by the company’s industrial operating platform.

Back in March of this year, Colony Industrial acquired a class A building in Mahwah, NJ, with 271,176 square feet, and two class A light industrial buildings in Las Vegas totaling 423,786 square feet.

In February, Colony Industrial closed on the sale of a light industrial portfolio to Nuveen Real Estate, a division of TIAA, for $136 million. The warehouse portfolio totals 2.3 million square feet and is situated in four markets including 18 buildings in Atlanta, five buildings in Dallas, five buildings in Houston and six buildings in PA/NJ.

www.omegare.com

Hampshire Companies of Morristown, NJ has sold a portfolio of 33 industrial buildings and development sites in the Garden State to Dallas-based Colony Industrial, which announced last week that it has put its multi-billion-dollar industrial portfolio on the market for sale.

The deal that includes 30 industrial buildings totaling more than 1.3 million square feet. Colony Industrial acquired the portfolio, which is situated on nearly 83-acres of land, for an undisclosed sale price. Also included in the transaction were three development sites located in Carteret and West Caldwell, NJ totaling 46-acres.

Colony Industrial is the industrial platform of Los Angeles-based Colony Capital. No financial details of the transaction were disclosed.

The acquired assets by Colony Industrial are located within the Northern New Jersey industrial market and are currently 99% occupied by a diverse tenant roster. The portfolio provides a continuous cash flow with value enhancement through contractual lease escalations and rollover of existing tenants to continually increasing market rental rates.

“This portfolio offered Colony Industrial the very rare opportunity to acquire a critical mass of high-quality industrial assets and a future development pipeline in a joint venture structure with Hampshire Real Estate Companies, one of the most respected developers in New Jersey. This deal was a win-win for both parties and we are proud of the outstanding results our team was able to deliver.”

Among the properties in the portfolio are 41 Slater Drive, Elmwood Park, 700 Blair Road, Carteret and 231-232 Main Street, Little Falls, NJ.

Colony Capital announced on Aug. 9th as part of its second quarter financial report that it has engaged advisors to market the company’s multi-billion-dollar industrial portfolio for sale, which may include the related management platform.

“There has been significant appreciation in the value of our industrial portfolio driven by favorable operating fundamentals and strong investor demand for light industrial assets. As a result, a sale of the industrial portfolio may yield a price higher than the value that may be ascribed by the market to the industrial portfolio as part of the company’s overall valuation,” the company states.

Colony Capital is seeking to complete a sale by the end of 2019.

As of June 30, 2019, the consolidated light industrial portfolio consisted of 446 light industrial buildings totaling 55.7 million rentable square feet across 26 major U.S. markets and was 92% leased. The company’s equity interest in the consolidated light industrial portfolio was approximately 34% as of June 30, 2019 and March 31, 2019. Total third-party capital commitments in the light industrial portfolio were approximately $1.7 billion compared to cumulative balance sheet contributions of $749 million as of June 30, 2019. The light industrial portfolio is composed of and primarily invests in light industrial properties in infill locations in major U.S. metropolitan markets generally targeting multi-tenanted warehouses less than 250,000 square feet.

As of June 30, 2019, the consolidated bulk industrial portfolio consisted of six bulk industrial buildings totaling 4.2 million rentable square feet across five major U.S. markets and was 67% leased. The company’s equity interest in the consolidated bulk industrial portfolio was approximately 51%, or $72 million, with the other 49% owned by third-party capital, which is managed by the company’s industrial operating platform.

Back in March of this year, Colony Industrial acquired a class A building in Mahwah, NJ, with 271,176 square feet, and two class A light industrial buildings in Las Vegas totaling 423,786 square feet.

In February, Colony Industrial closed on the sale of a light industrial portfolio to Nuveen Real Estate, a division of TIAA, for $136 million. The warehouse portfolio totals 2.3 million square feet and is situated in four markets including 18 buildings in Atlanta, five buildings in Dallas, five buildings in Houston and six buildings in PA/NJ.

www.omegare.com

Monday, August 12, 2019

Continental Cup Company to Establish Plant in Lehigh Valley

by John Jordan Globest.com

Continental Cup Company, a fledgling manufacturer of high-end graphic paper cups, will establish its first manufacturing operation in the City of Bethlehem in Northampton County.

State officials say the project will create 71 new full-tine jobs over the next three years. “I’m proud to welcome Continental Cup Company to Pennsylvania,” says Gov. Tom Wolf. “Manufacturing is thriving in the Lehigh Valley and the addition of this new facility helps to keep this momentum going.”

CCC will lease a 40,000-square-foot building in Lehigh Valley Industrial Park. The company has pledged to invest at least $9.5 million into the project. CCC is a startup paper cup manufacturing company that will service the theater industry, quick service restaurants, convenience stores and food service distribution companies.

“We are extremely excited for our very first operation in Northampton County and proud of our contribution to the local economy providing family-sustaining jobs that will have a positive impact on Bethlehem and surrounding communities,” says Rick Timone, president of CCC. “The support from the Governor’s Action Team was a key component to making this project a reality.”

CCC received a funding proposal from the Department of Community and Economic Development for a $155,000 Pennsylvania First grant, $142,000 in Job Creation Tax Credits to be to be distributed upon creation of the new jobs, and up to $31,950 in grants for workforce training and development.

The company can also to apply for a low-interest $400,000 loan from the Pennsylvania Industrial Development Authority to assist with equipment costs. The project was coordinated by the Governor’s Action Team, an experienced group of economic development professionals who report directly to the governor and work with businesses that are considering locating or expanding in Pennsylvania, with additional coordination through the Lehigh Valley Economic Development Corporation.

Don Cunningham, president and CEO of the Lehigh Valley Economic Development Corporation, says that Continental will join the nearly 700 manufacturers in the Lehigh Valley that account for $7.4 billion of the region’s $40 billion GDP.

www.omegare.com

Continental Cup Company, a fledgling manufacturer of high-end graphic paper cups, will establish its first manufacturing operation in the City of Bethlehem in Northampton County.

State officials say the project will create 71 new full-tine jobs over the next three years. “I’m proud to welcome Continental Cup Company to Pennsylvania,” says Gov. Tom Wolf. “Manufacturing is thriving in the Lehigh Valley and the addition of this new facility helps to keep this momentum going.”

CCC will lease a 40,000-square-foot building in Lehigh Valley Industrial Park. The company has pledged to invest at least $9.5 million into the project. CCC is a startup paper cup manufacturing company that will service the theater industry, quick service restaurants, convenience stores and food service distribution companies.

“We are extremely excited for our very first operation in Northampton County and proud of our contribution to the local economy providing family-sustaining jobs that will have a positive impact on Bethlehem and surrounding communities,” says Rick Timone, president of CCC. “The support from the Governor’s Action Team was a key component to making this project a reality.”

CCC received a funding proposal from the Department of Community and Economic Development for a $155,000 Pennsylvania First grant, $142,000 in Job Creation Tax Credits to be to be distributed upon creation of the new jobs, and up to $31,950 in grants for workforce training and development.

The company can also to apply for a low-interest $400,000 loan from the Pennsylvania Industrial Development Authority to assist with equipment costs. The project was coordinated by the Governor’s Action Team, an experienced group of economic development professionals who report directly to the governor and work with businesses that are considering locating or expanding in Pennsylvania, with additional coordination through the Lehigh Valley Economic Development Corporation.

Don Cunningham, president and CEO of the Lehigh Valley Economic Development Corporation, says that Continental will join the nearly 700 manufacturers in the Lehigh Valley that account for $7.4 billion of the region’s $40 billion GDP.

www.omegare.com

Two Philly-Area Apartment Properties Change Hands

by John Jordan Globest.com

The Royersford Gardens at 25 N. 5th St. in Royersford, PA in Montgomery County, and Maple Grove Apartments at 151 Maple Ave. in Dublin, PA traded in Bucks County.

The two apartment communities totaled 61 units. “Both properties traded at sub 6.5% T-12 cap rates and north of $110,000 per unit, which shows the strength of the multi-family market at this time. With historically low interest rates, values are at all-time highs.”

No further financial details of both transactions were released,

Royersford Gardens consists of 29 units located in a quaint residential neighborhood. Most units have a private balcony or patio. It was sold as a value-add opportunity due to the fact that only 31% of the apartments had been renovated by the previous owner.

Maple Grove Apartments consists of 32 two-bedroom units. Prior to sale, the property had been owned and managed by the same owner since the early 1980s. It was also presented as a value-add opportunity, due to the rent growth potential after renovations.

“The Suburban Philadelphia sub-market is extremely robust. This is the second deal this year in Dublin, Bucks County, PA that sold at another record price per unit.”

An increasing number of buyers from outside of the Philadelphia market have been investing in properties in Philadelphia and the surrounding suburbs over the past few years.

The buyer in the Royersford Gardens transaction was a group out of North Jersey that is new to the multi-family industry.”

www.omegare.com

The Royersford Gardens at 25 N. 5th St. in Royersford, PA in Montgomery County, and Maple Grove Apartments at 151 Maple Ave. in Dublin, PA traded in Bucks County.

The two apartment communities totaled 61 units. “Both properties traded at sub 6.5% T-12 cap rates and north of $110,000 per unit, which shows the strength of the multi-family market at this time. With historically low interest rates, values are at all-time highs.”

No further financial details of both transactions were released,

Royersford Gardens consists of 29 units located in a quaint residential neighborhood. Most units have a private balcony or patio. It was sold as a value-add opportunity due to the fact that only 31% of the apartments had been renovated by the previous owner.

Maple Grove Apartments consists of 32 two-bedroom units. Prior to sale, the property had been owned and managed by the same owner since the early 1980s. It was also presented as a value-add opportunity, due to the rent growth potential after renovations.

“The Suburban Philadelphia sub-market is extremely robust. This is the second deal this year in Dublin, Bucks County, PA that sold at another record price per unit.”

An increasing number of buyers from outside of the Philadelphia market have been investing in properties in Philadelphia and the surrounding suburbs over the past few years.

The buyer in the Royersford Gardens transaction was a group out of North Jersey that is new to the multi-family industry.”

www.omegare.com

Friday, August 9, 2019

Thursday, August 8, 2019

Keystone Signs Expansion Deals in Philly Area

Keystone Property Group reports it has signed lease expansion deals with four tenants at properties surrounding Philadelphia.

The largest transaction was with wireless site development firm Network Building & Consulting, LLC, which agreed to add 10,491 square feet to its space at Keystone’s VEVA, a 417 420,546 square-foot office campus in Blue Bell, PA. The firm now occupies a total of 25,037 square feet at the property. The firm has expanded on four separate occasions since moving into the complex in 2013 and is one of the largest tenants in the entire VEVA campus.

The second lease expansion for Keystsone was with Jefferson University Physicians, a Pennsylvania non-profit corporation, which will expand its current space at 225 City Ave. in Bala Cynwyd, PA by 6,790 square feet. Its new space totals 10,574 square feet—roughly three times its initial size.

Keystone also reports that Janney Montgomery Scott, a full-service financial services firm, relocated from Rosetree 1 to Rosetree 2 in Media, PA and expanded its footprint to 6,700 square-feet—an increase of approximately 20%—to provide for future growth and modernize its space.

The fourth lease expansion was with Affiliated Distributors, Inc., which added expansion space of about 2,500 square feet to its existing 28,000-square foot space at Valley Forge Office Center, in Wayne, PA in order to accommodate a recent acquisition.