Tuesday, January 31, 2023

Monday, January 30, 2023

D2 Capital Advisors explores conversion of Collegeville office building after refinancing

By Paul Schwedelson – Reporter, Philadelphia Business Journal

Owner D2 Capital Advisors is exploring new uses for 1000 Campus Drive, a four-story office building in Collegeville.

With uncertainty facing the office market, D2 Capital Advisors is keeping all options open for its vacant four-story, 81,400-square-foot office building in Collegeville.

D2 recently arranged an $8.5 million refinancing of the property, giving the company flexibility for a potential conversion of the building.

David Frankel, D2's chief operating officer, said the simplest option would be to continue with office space, but the building has sat vacant for the past two years. The property could be converted for life sciences, residential, self storage or other uses.

“We’re talking to different groups that have interest in it,” Frankel said. “We’re exploring what those options are.”

D2 Capital Advisors bought the building at 1000 Campus Drive in 2017 for $13.3 million. The building was fully leased at the time to Iron Mountain, a Boston-based information management company that had occupied the space since 1999. In late 2020, Iron Mountain (NYSE: IRM) struck a deal with D2 to leave the building despite having several years left on the lease. Iron Mountain moved to Royersford, consolidating its operations and leaving the building empty.

D2, headquartered in East Norriton, initially marketed the building to tenants and prospective buyers, but the effects of the Covid-19 pandemic and resulting rise of remote work eroded demand for office space dramatically.

Frankel and D2 Capital Advisors Vice President Jack Cortese secured refinancing of the property through TriState Capital Bank. Besides refinancing acquisition debt, the loan will be used to pay for improvements to the building. Cortese said securing the loan gives D2 an advantage over competitors that may be marketing conversion opportunities because the money is already in place rather than needing to line it up later on.

Full story: https://tinyurl.com/yck8kw7r

Investment firm acquires 8 PJW Restaurant Group properties, including 6 P.J. Whelihan’s locations, for $34.78M

Emma Dooling Reporter - Philadelphia Business Journal

P.J. Whelihan's Pub and Restaurant at 396 S. Lenola Road in Maple Shade, N.J.

A Princeton real estate investment firm has acquired at least eight properties housing P.J. Whelihan’s restaurants and other concepts from the hospitality group behind the popular eatery for a total of $34.78 million, according to New Jersey and Pennsylvania property records.

Essential Properties Realty Trust (NYSE: EPRT) bought the properties over the last four months of 2022. Each location is a single-tenant, standalone building, the kind of property that the investment firm typically looks to acquire and manage.

PJW Restaurant Group is the entity behind P.J. Whelihan’s Pub and Restaurant and five other concepts: The Pour House, The ChopHouse, ChopHouse Grille, Central Taco and Tequila, and Treno Pizza Bar. The South Jersey hospitality group was founded in 1983 by Bob and Donna Platzer and is based in Westmont. It employs more than 1,800 people.

In December 2021, New York City investment firm Garnett Station Partners acquired PJW Restaurant Group for an undisclosed amount. The firm’s portfolio includes similar concepts, with equity investments in Fat Tuesday and Primanti Bros. Restaurant and Bar, and credit investments in Checkers and Out West Restaurant Group Inc., an affiliate of Outback Steakhouse.

Dan Gagnier, a spokesperson for Garnett Station Partners and PJW Restaurant Group, said the sale of the real estate does not include the businesses themselves and will not impact restaurant operations.

Essential Properties did not respond to a request for comment.

Property records from New Jersey and Lehigh County, Pennsylvania, show that Essential Properties purchased the P.J. Whelihan’s locations at 425 Hurffville-Cross Keys Road in Washington Township, New Jersey, for $6.5 million; 4595 Broadway in Allentown for $2.6 million; and 1658 Hausman Road in Allentown for $1.32 million in September.

In November, Essential Properties purchased two more P.J. Whelihan’s locations in Maple Shade and Medford, New Jersey, for $6.15 million and $4.51 million, respectively. The firm also acquired the brand's Cherry Hill outpost at 1854 Route 70 E. for $5.15 million, although the date of the sale is unknown.

Full story: https://tinyurl.com/yckn5fhp

Thursday, January 26, 2023

Wednesday, January 25, 2023

Tuesday, January 24, 2023

Brandywine lists five-building Plymouth Meeting Executive Campus for sale

Paul Schwedelson Reporter - Philadelphia Business Journal

The office building at 630 W. Germantown Pike in Plymouth Meeting is one of five buildings in the Plymouth Meeting Executive Campus that's up for sale.

Brandywine Realty Trust has listed its five-building Plymouth Meeting Executive Campus for sale with some in the industry estimating it could sell for more than $100 million.

The five office buildings total 521,288 square feet. Four of the buildings have four floors and the fifth stands at six floors.

The property could sell for over $200 per square foot, according to an industry source, a figure that would equate to more than $104.3 million.

Spanning 22 acres, the Plymouth Meeting Executive Campus was built between the mid-1980s and early 90s.

Philadelphia-based Brandywine (NYSE: BDN) bought four of the buildings in 2002 for $67.2 million, according to filings with the U.S. Securities and Exchange Commission. It bought the fifth, at 660 W. Germantown Pike, in 2012 for $9.1 million. That building has six floors rather than four.

The five buildings are:

600 W. Germantown Pike: 89,626 square feet;

610 W. Germantown Pike: 90,088 square feet;

620 W. Germantown Pike: 90,183 square feet;

630 W. Germantown Pike: 89,870 square feet; and,

660 W. Germantown Pike: 161,521 square feet

Full story: https://tinyurl.com/2r5ubejc

Monday, January 23, 2023

Thursday, January 19, 2023

Campbell Soup To Relocate Offices From NC & CT to NJ HQ

By Linda Moss CoStar News

Campbell Soup Co. plans to invest roughly $50 million in its Camden, New Jersey, headquarters as it consolidates and brings its snack-business operations in North Carolina and Connecticut to its corporate campus.

Campbell, based at 1 Camden Place, on Wednesday said it is looking to relocate 330 jobs from its snack offices in Charlotte and Norwalk and close those buildings. Then, over the next three years, the company aims to update and renovate its Camden site so it can accommodate the more than 1,600 employees who will end up being located at the campus. Local media reported that the Norwalk closing will be the shuttering of Pepperidge Farm's headquarters at 595 Westport Ave.

Campbell said it campus upgrade "will create a contemporary work environment that fosters connectivity and faster decision making" in a project that includes upgrading existing space and constructing new buildings, including a new research and development center and pilot plant. Capmbell is looking "to enhance work spaces, meeting and multi-purpose rooms, and communal spaces to support a wide variety of work styles," it said.

Those adaptable work spaces will be complemented amenities such as on-site day care, a cafe, a complimentary health-and-fitness center and other services, according to Campbell. Construction is expected to start in March.

The consolidation is a win for the Garden State and Gov. Phil Murphy. New Jersey saw an exodus of corporate headquarters and operations a few years back, and Murphy's administration has been trying to keep businesses in place or lure new ones with financial carrots such as a revamped state tax incentive program. Campbell's expansion is also a boost for Camden, a city plagued by crime, poverty and other urban issues.

“Campbell is an iconic New Jersey company, and I’m pleased with their commitment to invest and grow in our state,” Murphy said in a statement. “This plan will create jobs, stimulate economic development, and strengthen Campbell’s roots in Camden where their efforts have played an essential role in the continued transformation of the city.”

Consolidation, Cost Savings

The company said it expects to realize cost savings from consolidating the snack buildings beginning in fiscal year 2024 and to reach $10 million in annual cost savings by fiscal year 2026. The savings will be partially reinvested in the business and are included in the company’s plan to increase margins in the snacks division, according to Campbell.

No commercial roles are being eliminated due to the closing of the Charlotte and Norwalk office buildings, and Campbell said it will provide eligible employees with comprehensive relocation support.

Campbell has called Camden its home for more than 150 years, since 1869, according to President and CEO Mark Clouse.

“We remain committed to our two-division operating model and are confident that being together in one headquarters is the best way for us to continue building a culture that unlocks our full growth potential," he said in a statement. "This investment will ensure Campbell remains a great place to work and a compelling destination for top talent.”

Campbell has been evaluating plans to unify its snacks' headquarters following the acquisition of Snyder’s-Lance, a maker of salty snacks like pretzels, in 2018. At that time, Campbell merged Synder's-Lance with its Pepperidge Farm unit to create what it called "a unified snacking organization in the U.S. called Campbell Snacks." The division currently operates across multiple office locations, mainly split between Camden, Charlotte and Norwalk, according to Campbell. The Charlotte office building has 104,368 square feet, according to CoStar data.

Investing in Camden Campus

Campbell said it determined that investing in Camden and unifying most of the company’s office-based employees in one location "provides the greatest benefits for the business and will provide the snacks division with significantly improved facilities, resources and services than those that exist in Charlotte or Norwalk.

Employees in Charlotte and Norwalk will relocate to Camden in phases starting in mid-2023. For employees who choose not to relocate, Campbell will provide job placement support and severance-benefits commensurate with level and years of service.

The snacks building closings will not impact Campbell’s other operations in Connecticut and North Carolina. In Connecticut, Campbell will continue to operate its Pepperidge Farm bakery in Bloomfield. Opened in 2002, the bakery employs nearly 400 people, is actively hiring and has plans to expand this year.

In North Carolina, in Charlotte Campbell will remain a manufacturing and distribution center, with about 1,400 employees in the Pineville area. Combined with the company’s Maxton manufacturing site, Campbell employs roughly 2,500 people in the state.

“We have a long history in Connecticut and North Carolina and will continue to have key operations in both states,” Clouse said. “The decision to close these offices was difficult but it is the right thing to do for our business and culture. Unifying the company in one headquarters increases connectivity, collaboration and provides enhanced career opportunities for our team.”

Campbell has been at its current spot in Camden since 1957, when the corporate headquarters was moved roughly one mile from its original manufacturing plant. The company last completed a major expansion and renovation of its campus in 2010 at a cost of roughly $132 million. At that time, Campbell also purchased vacant buildings and parcels surrounding its headquarters, which spurred the redevelopment of Camden’s Gateway District and the location of other major businesses to the city, including Subaru of America.

Wednesday, January 18, 2023

Tuesday, January 17, 2023

Major Student Housing Developer Plans Second Project Near Drexel University in Philadelphia

By Richard Lawson CoStar News

One of the nation’s largest student housing developers and investors plans to build its second project near two Philadelphia universities.

Landmark Properties announced Thursday that a new 363-unit tower called The Mark will rise 34 stories within a few blocks of the University of Pennsylvania, an Ivy League school, and Drexel University.

The project also includes 55,938 square feet of existing historic office space next to the tower. Renderings provided by the developer appear to show the tower rising next to The Ralston House, a building constructed in the 1880s as a home for indigent, elderly women, according to documents on file with the city of Philadelphia. The University of Pennsylvania currently uses The Ralston House as office space.

The Athens, Georgia-based firm is well underway on construction of The Standard at Philadelphia, a 280-unit property a short distance from The Mark. The Standard is scheduled to open this fall with The Mark following in 2026.

Last year was a record year for Landmark. It did $4.7 billion in transactions to bring assets under management to $10.4 billion, the most in the company’s 20-year history. The firm also struck two deals with the Abu Dhabi Investment Authority, a sovereign wealth fund that invests on the Middle Eastern country's behalf, totaling $3 billion to buy properties and build new ones. Landmark closed out the year teaming up with Canadian investor Manulife Investment Management to build student housing, starting with a development near the University of Connecticut.

Monday, January 16, 2023

Friday, January 13, 2023

Wednesday, January 11, 2023

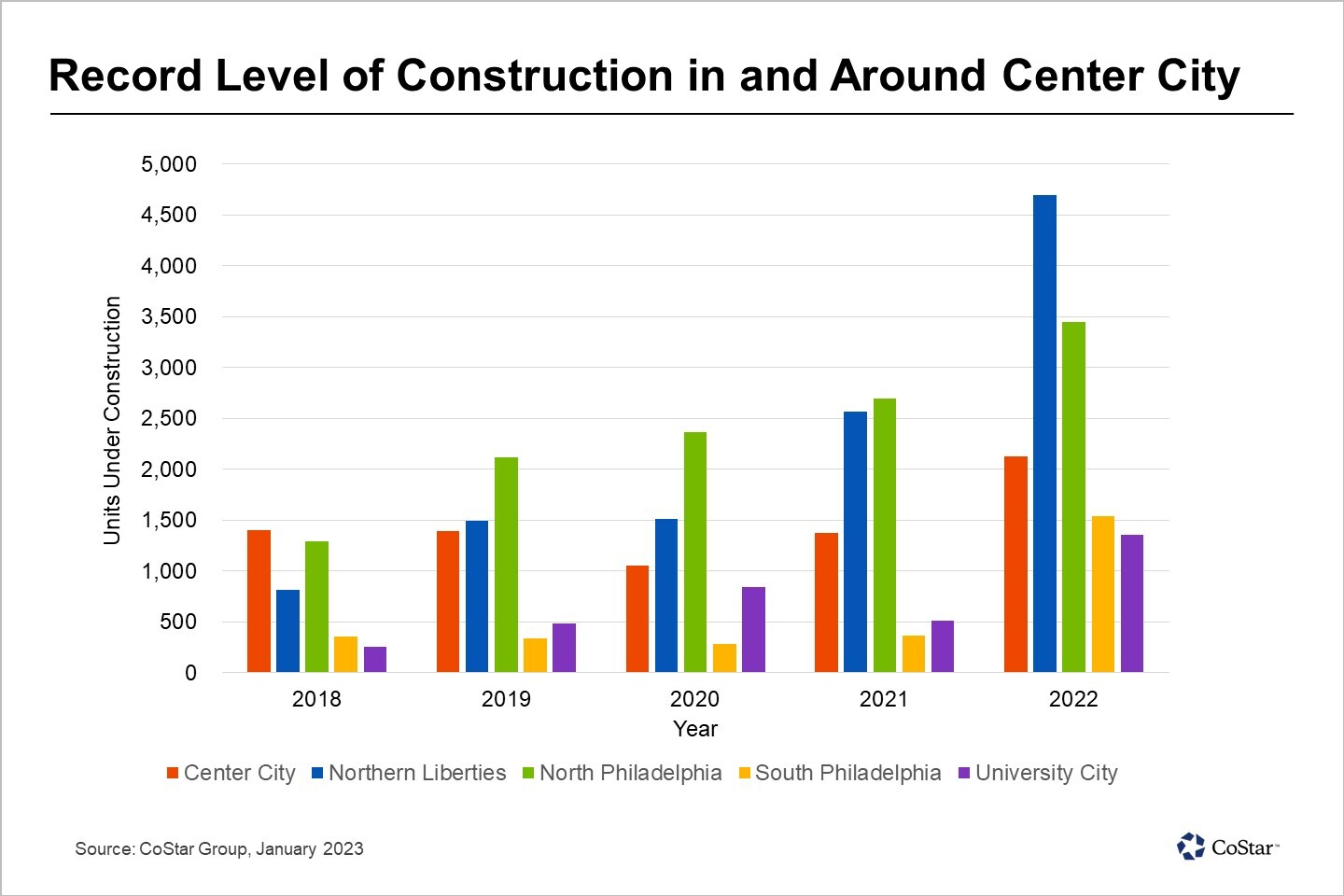

Apartment Owners Face Increased Lease-Up Competition As Apartment Development Ramps Up in and Around Center City Philadelphia

The record-breaking supply surge will temporarily outpace renter demand during this cycle. Subsequently, marketing efforts aimed at a more constrained renter pool have already ramped up in these neighborhoods, and lease-up competition will likely continue through mid-2024. If overall macro environment confidence improves near-term, the springtime may unlock pent-up renter demand. However, this supply wave will still moderately exceed even the highest demand levels seen throughout the golden period between late 2020 and early 2022. As vacancy trends upward alongside the wave of new additions, daily asking rent growth is expected to moderate, while concessions will become more widespread throughout 2023.

A review of Apartments.com listings indicates that concessions have returned in early 2023. Nearly half of the top properties in each area offer some form of concession, from a $500 move-in credit to a generous two months of free rent plus a $1,000 move-in credit for city, education and health professionals. Several stabilized properties with occupancy above 90% are even offering concessions.

As renters digest recent rent surges, landlords will need to re-evaluate what 2023 rental rates are competitive to lease up individual developments in a sea of high-end options for renters. Across three-star properties in these five areas, vacancy is 6.5%. Meanwhile, across four- and five-star properties, vacancy is already at 10% and is expected to increase in the near term with the large number of new deliveries. While rent differentials may fluctuate drastically across individual properties, the average market rent differential between three-star and four- and five-star properties is $445 per month for studio units, $540 per month for one-bedroom, and $860 per month for two-bedroom units in these five areas.

In 2023, four- and five-star multifamily owners will need to prepare for the heavy competition ahead, but there should be a reprieve by late 2024 from a significant slowdown in new large-scale supply entering the market. Until then, property owners should focus on renter retention as much as renter attraction to maintain a well-occupied, competitive development.