Friday, July 31, 2020

Thursday, July 30, 2020

Philly chooses developers for big Navy Yard expansion that includes housing

by Jacob Adelman Philadelphia Inquirer

Ensemble Real Estate Investments of Long Beach, Calif., and Philadelphia-based Mosaic Development Partners have been selected to lead a major redevelopment push at the South Philadelphia Navy Yard that will include millions more square feet of labs and offices, and — for the first time — an around-the-clock residential population at the former military base.

The Philadelphia Industrial Development Corp., which manages the Navy Yard on the city’s behalf, said in a release Wednesday that Ensemble and Mosaic were chosen for the 109-acre redevelopment project because they “demonstrated an understanding of PIDC’s mission and shared a strategic vision for the Navy Yard to drive business growth and job creation for Philadelphia.”

The project is expected to draw $2.6 billion in new private investment, PIDC said.

Ensemble developed the Navy Yard’s Marriott hotel and later acquired several other buildings there from the tract’s previous main developer, Liberty Property Trust, making it the largest private property owner at the former base. Mosaic’s projects have included the Eastern Lofts apartments in Brewerytown.

The team was selected from a shortlist that included developers such as Houston-based Hines, Washington’s Hoffman & Associates, and Trammell Crow Co., a subsidiary of Dallas-based commercial real estate company CBRE. Gilbane Development Co., the Rhode Island-based developer that was recently picked by Amtrak to help revamp 30th Street Station, also had been under consideration.

“The Navy Yard has fulfilled its initial promise of becoming a thriving center for business, innovation, investment, talent, and jobs,” Mayor Jim Kenney said in the statement. “The exciting new partnership with Ensemble/Mosaic will not only build on this track record but will also bring new ideas and energy to the Navy Yard while ensuring that equity and inclusion are at the forefront.”

Wednesday, July 29, 2020

Nestlé Purina PetCare Expands Operations in Mechanicsburg, Adding 94 Jobs

Nestlé Purina PetCare will expand its operations in Cumberland County, hiring 94 employees and adding new processing and packaging lines to its Hampden Township location.

“Purina has had a significant presence in Pennsylvania for more than 20 years, making pet food known worldwide."

Purina, which currently employs 320 people in Mechanicsburg, also has pet food operations in Allentown and employs nearly 800 people in Pennsylvania.

“Pet owners have trusted Purina for more than 90 years, and demand for our pet food is strong and continues to grow,” said John Bear, Purina vice president of Manufacturing. “Purina is proud to make high-quality foods for dogs and cats at our Mechanicsburg factory with a continued commitment to safety and environmental sustainability. This expansion reflects an investment in our local operations, and we look forward to continuing to deliver innovative and highly nutritious foods for pets.”

Purina has committed to investing more than $167 million into the project and creating 94 new jobs within the next three years. The company received a proposal from the Department of Community and Economic Development (DCED) for $282,000 in Job Creation Tax Credits (JCTC), to be distributed upon the creation of the new jobs, and $188,000 in funding for workforce development training. The project was coordinated by the Governor’s Action Team, an experienced group of economic development professionals who report directly to the governor and work with businesses that are considering locating or expanding in Pennsylvania.

Purina is the largest dry dog and cat food maker in the United States. The Mechanicsburg factory produces many of the company’s flagship brands, including Purina ONE, Purina Pro Plan, Fancy Feast, Dog Chow and Cat Chow.

“For nearly 25 years, Purina has provided premium jobs for residents of Mechanicsburg and surrounding communities,” said Mike O’Brien, Purina Mechanicsburg factory manager. “We’re proud to be making great foods that pets love while expanding the operations and providing even more jobs for the region.”

“Purina has had a long history in Cumberland County as a valued employer, and the Cumberland Area Economic Development Corporation is proud to partner with them on this project as they continue to provide vital jobs to our local community through this expansion,” said Laura Potthoff, CAEDC director of Business and Workforce Development.

Facebook Says Added Office Space Reflects Tight LA Market

Facebook has signed a lease for more space at a 4-year-old office complex in Los Angeles' Playa Vista neighborhood, a sign that technology companies are still scooping up real estate in competitive areas even as the pandemic prompts businesses to let more employees work from home permanently.

The Menlo Park, California-based social media company is boosting its space by about 23%. It's taking an additional 85,000 square feet at developer Tishman Speyer's The Brickyard, a luxury, two-building complex spanning more than 425,000 square feet in the heart of an area dubbed Silicon Beach because of its concentration of tech and media firms such as search engine provider Google and software maker Microsoft.

It comes as most of Facebook's employees are working remotely because of the coronavirus pandemic, including those who normally are in the office at The Brickyard. In May, Facebook CEO Mark Zuckerberg said that roughly half of its 48,000-strong workforce would transition to a work-from-home model on a permanent basis over the next five to 10 years.

The new lease was signed as other tech giants let staff work off site: On Monday, for instance, Google said it would allow workers to stay home through summer 2021 after announcing it would be pulling back on plans to grow its real estate and data center footprint.

The Facebook move is a sign that companies with a large office workforce won't stop signing office leases even if they are establishing permanent work-from-home policies. Many office space agreements run for multiple years that can easily transcend a one- or two-year disruption as a result of the pandemic, and growing companies need to plan for space based on potential workforce expansion.

Facebook was the sole tenant at the property's six-story, 122,000-square-foot structure at 12126 W. Waterfront Drive, according to CoStar data. Up to now, it also was the dominant tenant at its twin, a 297,000-square-foot building at 12105 W. Waterfront Drive where it leased about 140,000 square feet, that data shows. The new lease allows it to expand at the 12105 building. The company now accounts for about 83% of the total area at the property.

In an email to CoStar News, Facebook spokesman Tracy Clayton said the new lease was a hedge of sorts.

"Given the competitive real estate market in the region we are always on the lookout for opportunities to accommodate our growth," Clayton wrote. "The recent Brickyard lease was a natural expansion at an address we already call home."

Though Playa Vista's vacancy rate for office space is relatively high, according to CoStar analytics, top-shelf property there is still highly sought after and rents continue to be among the highest in the Los Angeles region.

Facebook also has about 49,000 square feet at another nearby property, an office complex at 12777 W. Jefferson Blvd. That, combined with its enhanced presence at The Brickyard, would bring its total office footprint in the Los Angeles area to just under 400,000 square feet in all from roughly 325,000 square feet, according to CoStar data.

"Facebook clearly thinks it will still need a sizable footprint in L.A. post pandemic despite publicly saying workers will be able to work remotely in perpetuity," said Ryan Patap, CoStar's director of market analytics for the Los Angeles region. "Facebook must think they will need the extra space over the long term, and some workers will want to return to offices. Working from home isn’t for everybody."

In May, Zuckerberg clarified in an interview with The Verge that his statement was more of a prediction than a hard and fast policy, and that it would largely be driven by existing employees' own preferences and Facebook's desire to untether its recruiting and hiring efforts from the areas where it currently has the largest presence: the San Francisco Bay, Silicon Valley, Seattle, New York and other regions where the cost of living is high.

"We ran these surveys and asked people what they want to do. Twenty percent of our existing employees said that they were extremely or very interested in working remotely full time," Zuckerberg said in May. "And another 20 percent on top of that said that they were somewhat interested. So I think what’s basically going to happen is that, because it’s going to take a while to get everyone back into the office, you have like 40 percent of employees already who were fairly willing to work remotely."

In any case, it will be some time before Facebook's full staff returns, physically, to its L.A. locations. Clayton said the company's employees will be working from home for the remainder of the year.

The landlord, New York City-based real estate firm Tishman Speyer, did not respond to a request from CoStar for a comment.

Monday, July 27, 2020

College Turns to Atlantic City Hotel for Student Housing in Pandemic

by Linda Moss Costar News

To get a sense of how the pandemic is changing student housing, look no further than Atlantic City, New Jersey, America's second-biggest gambling hot spot.

Stockton University is planning to house some of its students in a hotel in the biggest U.S. gaming center outside Las Vegas this fall to comply with social-distancing mandates stemming from the coronavirus pandemic.

The move is an example of how property owners nationwide are seeing their prospects improve amid higher demand from universities for more housing.

The school, based in Galloway, New Jersey, said it's finalizing an agreement with the Showboat Atlantic City at 801 Boardwalk to use up to 400 rooms at the hospitality property for students during the coming fall and spring 2021 semesters. The university at one time owned the hotel when it first attempted to open a campus at the seaside gaming mecca.

“Stockton promises to provide housing to all students who request it,” the school's executive director of residential life, Steven Radwanski, said in a statement. “This agreement ensures that we will have sufficient housing based on current demand.”

The deal with Showboat will allow Stockton, which now operates a satellite campus in Atlantic City, to have additional housing available as the university implements state COVID-19 guidelines, which reduce the number of students permitted in existing on-campus student housing.

Stockton is the former owner of the 23-story Showboat. The university purchased the hotel for $18 million from Caesars in December 2014 with plans to develop it into a residential campus. But land-use restrictions placed on the property at different times by owners derailed those efforts, leading Stockton to sell the 1.73 million-square-foot facility, which includes two hotel towers, parking lots and garage, for $23 million in June 2016.

The influx of students will be a boost for the Showboat amid the COVID-19 outbreak. Hotels across the United States have taken a revenue hit because of the pandemic, with temporary closings and people not traveling. In the case of Atlantic City, its casinos only recently began to reopen with social-distancing measures in place.

Under the deal, Showboat will provide up to 300 single rooms and 100 double rooms for Stockton students. In addition, the hotel will also provide at least 250 dedicated parking spaces and students will get complimentary memberships to the fitness facility on site, as well as access to an entertainment lounge with billiards and pingpong tables, the rooftop pool deck and a business-study lounge. Students will also have access to meals on site, and rooms will have a microwave and minifridge.

The rooms will be located on floors that will be occupied only by students, and students will also have exclusive use of one full elevator bank to secure access to the floors, according to Stockton. The school will have staff living on site, and Showboat will provide space at its front desk for university personnel.

The per-semester rates for the rooms will be $4,500 for a single and $3,800 for a double, which is competitive with similar on-campus housing, according to the university.

“Students can now room at the Showboat and enjoy all the amenities of the hotel and its boardwalk location, while living at a treasured icon of local history," Brandon Dixon, president of Tower Investments, which owns the Showboat, said in a statement. "Having the students here will also bring a new exciting energy to the north side of the boardwalk.”

Stockton requested proposals for off-campus housing in Atlantic City based on the number of students who have applied to live in campus housing, according to Radwanski. Freshmen will be housed only in on-campus housing. Typically, about a third of Stockton’s almost 10,000 undergraduate students live in campus housing in Galloway and Atlantic City.

After its plans for the Showboat facility fell though, the university developed and opened an Atlantic City campus on another part of the boardwalk in fall 2018 with an academic building, a 543-bed residential complex and a parking garage.

Friday, July 24, 2020

Thursday, July 23, 2020

Penn Logistics Portfolio Sells in Fairless Hills, Pennsylvania

Penn Logistics, a four building, 240,358 SF, industrial portfolio traded in Fairless Hills, Pennsylvania (“Property”) for $18.0 million.

The buildings were constructed between 1968 and 1970. They feature 24’ clear ceiling heights, ample loading capacity with full dock packages for the 42 dock positions. The Property is strategically located along US Routes 1 and 13 with close proximity to I-295 and I-95, the principal North/South highways in eastern Pennsylvania and New Jersey. The Property was 100% leased to four tenants at closing.

“We are extremely pleased we were able to execute this transaction given the current environment. The pricing achieved supports the strength of the overall industrial market, specifically in Lower Bucks as Tenant demand has not decreased in this submarket, especially for functional and well located last mile assets."

Pennsylvania’s Budget Issues Loom Large Over Commercial Real Estate

Pennsylvania’s economic woes might just be getting started according to an ominous report filed by its Independent Fiscal Office in early July.

June's tax revenue collections were just $2.67 billion, $545 million short of what the office estimated a year ago. That’s not at all surprising given the shutdown, and the auditing agency projects the coronavirus will probably cost Pennsylvania anywhere from $2.7 billion to $3.9 billion in taxable revenue.

This could affect commercial real estate in myriad ways, the most immediate of which may be a near-term tax increase to fund essential services such as education.

The school system soaks up more than 30% of the state’s budget, and a substantial chunk of the funding comes from property taxes. Elected officials across the state have been open about a property tax increase and recent actions make it clear they were not playing around. Earlier this week, Scranton’s school system recommended a 16% hike to fund local schools through 2021, and multiple school districts in Berks County, Erie and Allentown have also proposed tax increases as well.

Higher property taxes will probably reduce property values and could limit both investment and development. Save for logistics spaces, there’s already minimal development, investment, leasing, or rent growth in markets like Scranton, Reading, York and Harrisburg; and even less in smaller towns like Johnstown, Schuylkill, Beaver City and Carbondale.

Increased taxes could also discourage businesses and individuals from relocating into a market while providing incentive for them to look elsewhere. Residents moving away is a serious problem throughout Pennsylvania, and the latest census data shows that 42 of the state’s 67 counties have lost residents since 2010.

A declining population has an enormous impact on nearly every facet of commercial real estate, and financial distress would probably amplify the problem. The state’s secondary markets are particularly exposed to this risk. A recently released study from the University of Pittsburgh’s Center for Metropolitan Studies indicates that in the southwestern Pennsylvania region alone, 20% of municipalities could become insolvent in 2021.

Tax increases are never popular, but many residents believe these cities have been mismanaged for decades. A 16% tax hike in Scranton to fund schools will probably prove deeply unpopular, as its very public corruption issues appear directly tied into the school system. Its last mayor, Bill Courtright, is awaiting sentencing on federal charges and while in prison he can trade stories with the former mayors of Allentown, Reading and Bloomsburg.

There’s already ample evidence that a large swath of the business community is losing faith in the state’s handling of the shutdown, and local politics are becoming increasingly contentious. Though Democratic Governor Tom Wolf’s approval rating with the public at large remains relatively high, he faced an open rebellion in mid-May, when Republican officials from six counties made it public that they would be ending their lockdown with or without his approval.

Wolf condemned these upstart county officials and business owners as "cowards," and last week, announced that the state would be withholding federal relief funding from Lebanon County. Republicans, who dominate the state legislature, passed a resolution in second quarter directing Wolf to end his emergency declaration, which would reduce the restrictions placed on many businesses. Wolf declined, and an amendment to the state's constitution stripping the governor of his powers as well as a motion to impeach him was introduced shortly afterwards.

There is little chance Wolf will be removed from office, but none of this discord bodes well for the future because the unprecedented financial challenges the coronavirus created will require extraordinary cooperation across the political spectrum to resolve.

Whatever solution the state reaches will have major effects on the Pennsylvania commercial real estate market for some time.

Wednesday, July 22, 2020

Tuesday, July 21, 2020

Monday, July 20, 2020

Wednesday, July 15, 2020

Harrisburg Multifamily Holds Strong Through Second Quarter

Harrisburg multifamily held up well through the most tumultuous quarter in commercial real estate history.

By the end of June, vacancies remained near their pre-pandemic record lows. This is, thanks in large part, to minimal construction.

Fewer than 200 units were underway at the time of the shutdown, and most of those were in a single expansion to the Oakwood Mills in Mechanicsburg. The three-star project is adding close to 180 units, which are expected to deliver in late 2020.

Such minimal expansion makes sense in a slow-growth market like Harrisburg, and with few other projects underway, it seems unlikely that a significant softening will show up through the third quarter.

But there are some clouds on the horizon. Harrisburg contains plenty of workforce housing, and blue-collar workers. These projects could be in trouble as the retail industry is already being transformed by the virus, particularly if manufacturing takes a sustained hit.

The market also has an abnormally high percentage of industrial tenants exposed to risk. While both local and regional players remain confident that Harrisburg logistics will quickly recover, nearly 2.5% of its industrial space is occupied by at-risk tenants, who were struggling financially before the coronavirus hit.

Being the state’s capital typically provides the market with a base-level of insulation from economic disruption, however, Pennsylvania’s looming budget crises is already causing heavy cuts to state employment. Close to 2,000 employees have been laid off, and an additional 14,000 remain furloughed.

Additionally, the boosted unemployment benefits are set to be reduced at the end of July. The extra $600 a month from the feds could be offsetting the financial pinch many blue-collar workers are experiencing, which could drag down the market’s otherwise impressive levels of rent growth.

Local voices in the apartment industry seem confident, however. They cite the deep shipping market and high levels of state employment, as well as the ongoing population growth in Cumberland County. This could limit the fallout, though sales will likely be limited for some time.

Investment was nearly non-existent through the second quarter, with only a handful of small projects trading between private buyers. This could change if occupancies remain strong, however; and regional investors believe that the workforce housing market-which Harrisburg has a deep pool of- remain a solid buy.

“We don’t believe the coronavirus will have a long-term impact on multifamily demand” said Jerome Meyers, head of the Meyers Group. His boutique firm invests in workforce housing investment and development, and says markets like Harrisburg, with a deep concentration of blue-collar workers should remain a strong market.

“These are projects for cops, firefighters and warehouse workers,” he said. “The people who make the world go around. They aren’t going anywhere and will still need a place to live.”

Former B&G Foods Chairman Sells New Jersey Industrial Property to Brookfield

The former chairman of consumer-products giant B&G Foods sold one of the firm's factories in North Jersey for $14.3 million to Brookfield Property Group, in a deal that symbolizes a family's waning ties to the company they founded in the late 19th century.

Leonard Polaner, who retired from B&G Foods roughly a decade ago and resides in West Orange, New Jersey, told CoStar on Monday that he had divested the 120,000-square-foot manufacturing facility at 426 Eagle Rock Ave. in Roseland. His family founded the namesake company Polaner, which makes fruit preserves, in the late 1800s in Newark, New Jersey, and he himself was instrumental in the creation of the B&G Foods conglomerate.

Brookfield Property Group, part of global real estate firm Brookfield Property Partners, purchased the property at a price that translates to $120 a square foot, according to CoStar, which cited public documents. The building is a Class B industrial manufacturing property completed in 1950.

Polaner, 89, said none of his family members are involved in B&G Foods now so it made sense to sell the Roseland property. During his tenure at B&G Foods, in addition to chairman, Polaner also held the titles of president and CEO.

Polaner is a key figure in the formation of B&G Foods, which is the tenant at the 8-acre Roseland site. Headquartered in Parsippany, New Jersey, B&G Foods owns more than 50 brands, including not only Polaner but Back to Nature, Bear Creek, Cream of Wheat, Green Giant, Ortega and Mrs. Dash. The firm, which posted $1.66 billion in net sales in fiscal year 2019, manufactures, sells and distributes foods across the United States, Canada and Puerto Rico.

Leonard Polaner said Max and Lena Polaner, his grandfather and grandmother, started their fruit-preserve operation as a side business to their fresh fruit and vegetable market in Newark in the late 1890s. In 1986, under Leonard's leadership, Polaner introduced Polaner All Fruit, which was sweetened naturally with fruit and fruit juice. That fruit spread was marketed with a “Don't Dare Call It Jelly!" TV advertising campaign.

In 1996, New York investors, led by the firm Bruckman, Rosser, Sherrill & Co. and aided by Polaner, formed B&G Foods to acquire Bloch & Guggenheimer and Burns & Ricker, according to a company history posted on B&G Foods' website.

Monday, July 13, 2020

Lehigh Valley Warehouses and Logistics Not Terribly Affected by Coronavirus Through the Second Quarter

The coronavirus caused some minor disruption to Pennsylvania's Lehigh Valley logistics market through the second quarter, but fallout from the pandemic was largely limited to investment activity.

Roughly 60 deals closed through 2020’s tumultuous first two quarters, but only a handful finalized from April through June. With one exception, these were small properties trading between local buyers.

Given the uncertainty, its understandable why investment remains mostly muted through the third quarter; However, a June acquisition of the five-star, 475,000-square-foot LogistiCenter 33 could indicate investor confidence slowly coming back. The $62.5 million deal was easily the largest of the quarter and involved Black Creek Industrial. The Denver-based REIT acquired the asset for roughly $130 per square foot, comparing quite favorably to the market average near $85 per square foot.

Nearly everyone involved in the logistics industry remains bullish about its future, and it’s not hard to see why. The pandemic has forced the nation to rapidly adapt to online shopping, and e-commerce levels surged through the second quarter. According to Adobe’s Digital Economy Index, e-commerce growth has accelerated about five years in the past three months. Total online spending for May, at $82.5 billion, is up 77% from that same time in 2019.

Lehigh Valley is uniquely situated to take advantage of this trend. The market is at the intersection of I-79 and I-476, which allows distributors direct access to all the northeast’s major cities as well as other prominent shipping nodes like Nashville and Columbus.

Consequently, more than 10 million square feet was underway at the time of the shutdown, and builders still managed to deliver roughly 1 million square feet through the second quarter. The most notable of these new properties was at 7378 Airport Road, a 450,000-square-foot distribution center near the international airport in Bath.

The airport area has seen a flurry of construction and leasing activity in recent years. Within a five-mile radius, there’s close to 2.3 million square feet of logistics space underway, and it was here that the biggest lease of the second quarter finalized, when Geodis signed for a million square feet in April.

This type of sustained demand has given owners the confidence to continue building in the midst of a world-altering pandemic, and close to 2.3 million square feet broke ground between April and June.

While vacancies understandably softened somewhat through the second quarter, this is largely the result of incoming supply and a handful of moveouts. Because of the primacy of location in shipping, Lehigh attracts some of the biggest names in logistics, and it had a relatively low level of at-risk tenants when the coronavirus arrived. This should insulate owners of existing supply in the coming months, as millions of square feet in spec space arrives.

CoStar data shows less than half of this space was pre-leased at the end of second quarter, and an excess of supply might drag on rents. However, growth over the past several years has been otherwise healthy, and year over year changes remained positive through the second quarter. At the end of June, the average space in Lehigh was leasing for close to $6.20 per square foot, a year-over-year change of nearly 5%.

Lehigh will remain a market worth monitoring through the third quarter. New space arriving during so much uncertainty will test demand like never before and the speed of lease-up will likely impact both rents and investment volume.

Friday, July 10, 2020

Thursday, July 9, 2020

As US Rent Collections Soften, Concerns Grow for Apartment Owners

By John Doherty CoStar News

Apartment landlords, as well as their tenants, are now feeling the heat as the coronavirus pandemic drags on.

Industry executives say worries for landlords are mounting. Demand for higher-end rentals is falling with a half-million new units set to hit the market. And rent collection is down at Class B and C properties just as the federal unemployment benefits that kept many of those renters afloat are set to expire at the end of the month.

Payments have been halted on hundreds of Fannie Mae and Freddie Mac loans to apartment landlords — a wait-and-see limbo often followed by default. The concerns were laid out in a webinar Wednesday hosted by the National Multifamily Housing Council.

“Those are harbingers,” said Jeff Adler, chief operating officer of Yardi, one the five big rent-collection software companies that contribute to NMHC’s rent-tracker survey. “There is a recession going on. There have been job losses. There has been demand destruction.”

Declining rent collections and falling revenue because of waived fees and concessions are putting owners on edge. The suspension of late payment and credit card fees has become standard while new tenants are offered free rent.

NMHC reported Wednesday that 77.4% of renters nationwide made a full or a partial payment for this month’s rent through Monday. That’s down from the collections of 80.8% during the first week of June, and down from the 79.7% rate the first week of July last year.

Margette Hepfner is the chief operating officer of Dallas-based Lincoln Property Company, which owns or manages about 200,000 apartments in the country, second only to Greystar. On the webinar, she expressed concern that some of the biggest coastal markets, New York City and Southern California for instance, were showing the lowest collection rates.

“New York City was an early lagger,” she said. But collection rates were better in June than May, before new problems. “But [for Lincoln] New York in July had the lowest payment rate in the country.”

NMHC tracks rent collection at about 11 million occupied apartments around the country. The industry advocacy group does not break down how many paying residents made only partial payments — but to date most big operators say it’s a small percentage.

Most of the landlords reporting their rent-collection data to NMHC are relatively large: professionally managed properties big enough to hire a company such as Entrata or ResMan to handle rent collections.

Smaller landlords — owners of properties with 50 units or fewer — seem to be suffering more, said Adler. Another wild card weighing on the apartment sector is the soon-expiring moratorium on evictions. Renters who have fallen behind in payments could soon be kicked out, but that would also mean a rise in vacancy, which could affect owners’ agreements with their lenders.

Hepfner, though, said that's not a pressing concern.

“We are not facing an eviction bomb,” she said.

Tuesday, July 7, 2020

Curaleaf Acquires New Jersey Cannabis Dispensary

By Linda Moss CoStar News

Curaleaf Holdings, a vertically integrated U.S. cannabis company, has picked up the business and state medical marijuana license of an alternative treatment center in New Jersey, where the industry is poised for potential growth.

The Wakefield, Massachusetts-based firm said Monday it completed its planned acquisition of Curaleaf NJ, a nonprofit that holds one of the original six medical cannabis licenses in the Garden State. Curaleaf Holdings, which previously provided management service for the New Jersey facilities at 640 Creek Road and 130 Harding Ave., both in Bellmawr, now owns 100% of the operation.

The Bellmawr properties are part of New Jersey's largest medical cannabis dispensary, which totals 51,000 square feet including space for cultivation and processing. Cannabis is a burgeoning business in the Garden State, and Curaleaf Holdings is planning an expansion. In November, voters across the state will decide if they want to legalize the sale of marijuana for adult recreational use.

In accordance with recently adopted state regulations, Curaleaf Holdings plans to open two additional New Jersey dispensary locations, as well as an additional cultivation and processing operation slated for a site in Winslow, which is expected to create hundreds of jobs, the company said in a statement.

Curaleaf NJ occupies a 13,500-square-foot dispensary building on Creek Road and a 23,600-square-foot industrial property on Harding Avenue in the borough of Bellmawr in Camden County, not far from Philadelphia.

Curaleaf Holdings acquired the Curaleaf NJ license and other assets in exchange for canceling loans that were used to fund the build-out of the previously managed nonprofit entity.

"Curaleaf is one of New Jersey's oldest and largest providers of cannabis," Curaleaf CEO Joseph Lusardi said in a statement. "The asset acquisition we announced today completes our vertical integration and conversion to a for-profit entity in the state, marking a major milestone for our New Jersey presence. With our strong growth and a cannabis adult-use ballot approval on the horizon, we are actively investing in the expansion of our market leading position to better serve the more than 9 million residents of the Garden State with the quality cannabis products they rely on."

Originally, New Jersey medical cannabis alternative treatment centers were required to be operated as nonprofits. Curaleaf Holdings' announcement comes in the wake of changes to New Jersey Department of Health regulations, which now permit such treatment centers to sell or transfer their license to a for-profit entity, with state approval.

In March 2018, under the direction of Gov. Phil Murphy, who campaigned on a platform that included cannabis legalization, the health department issued the Executive Order 6 Report, which immediately expanded the medical cannabis program in many ways.

For example, chronic pain and anxiety were added as as qualifying conditions for medical cannabis use; the monthly product limit was doubled; and current licensees were permitted to open satellite dispensaries. In December, the Legislature passed a bill to add an initiative to the November ballot this year that will allow voters to decide whether to legalize the sale of adult-use recreational cannabis.

Curaleaf Holdings operates in 18 states with 57 dispensaries, 15 cultivation sites and 24 processing sites, employing more than 2,200 people across the United States.

Partnership Finances $120M Loan for Philadelphia Mixed-Use Project

By Ingrid Tunberg Globest.com

Bank OZK and Fisher Brothers affiliate, Lionheart Strategic Management LLC have closed $120 million in financing to fund the ground-up construction of a mixed-use project in Philadelphia.

For the loan, Bank OZK provided $107.5 million as the senior secured lender, and Lionheart provided $12.5 in mezzanine financing.

The $179 million mixed-use project, located at 510 N. Broad St., will feature 410 multifamily units and retail space, which has been partially pre-leased to a national, investment-grade grocery chain.

The partnership’s local sponsor, Alterra Property Group previously developed Philadelphia multifamily properties at 4233 Chestnut St. and the LVL 4125 at 4125 Chestnut St. Alterra Property Group will employ similar, modular construction techniques at 510 N. Broad St.

Lionheart’s next credit vehicle will deploy the financing. The company is currently finalizing its capital raise.

“As a long-term investor, Lionheart is bullish on the broader US economy and is particularly focused on well-located, urban assets that are being developed by strong sponsors in dynamic markets with multiple foundational economic demand drivers. This transaction highlights our continued desire to pursue deals in the current environment,” said Winston Fisher, chairman of Lionheart. “It has been a pleasure to work alongside Bank OZK on another transaction and we look forward to building a strong partnership with local sponsor, Alterra Property Group.”

Monday, July 6, 2020

Philadelphia Apartment Rents Top US in Coronavirus Resilience

By Adrian Ponsen

CoStar Market Analytics

Philadelphia commercial real estate pros are always quick to tout the stability of their region’s healthcare-driven economy, and its vastly more affordable cost of living compared to other large U.S. cities.

The coronavirus and its economic shock are proving that for Philadelphia’s apartment market at least, these benefits are far more than empty talking points.

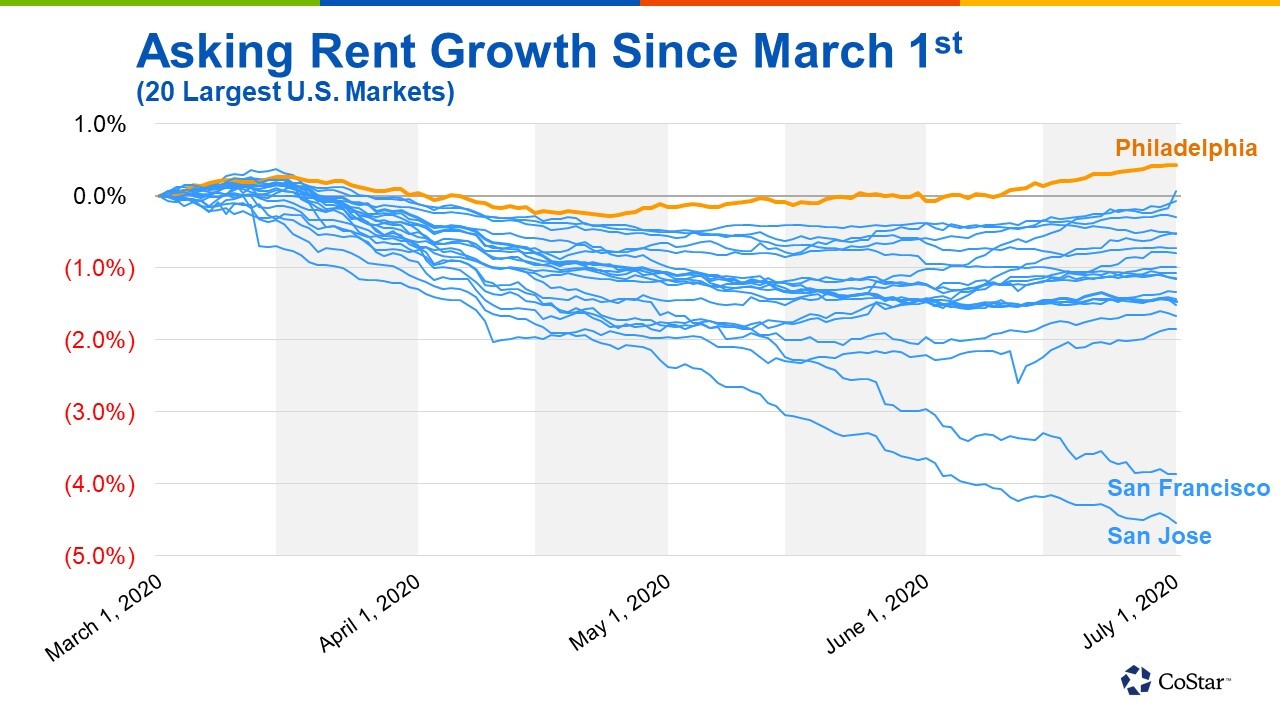

Through its range of apartment search platforms, CoStar’s rent series is fed by tens of thousands of daily updates to rent listings per market. Its data shows that among the nation’s largest 20 markets, Philadelphia’s apartment rents have held up best since the coronavirus began to grip in the U.S. in March.

Philadelphia’s outperformance is particularly notable given that Pennsylvania was the second state in the U.S. to order nonessential businesses closed and has been among the slowest to fully reopen.

Affordability appears to be key in determining rent resiliency in the face of the coronavirus. The markets that have endured the steepest drops in rents since the crisis took hold are those notorious for exorbitant cost of living including the San Francisco Bay Area, and Orange County California.

Outside of Philadelphia, rents are also holding up relatively well in smaller markets that are havens of affordability in otherwise prohibitively expensive regions, such as Sacramento, Baltimore and Inland Empire.

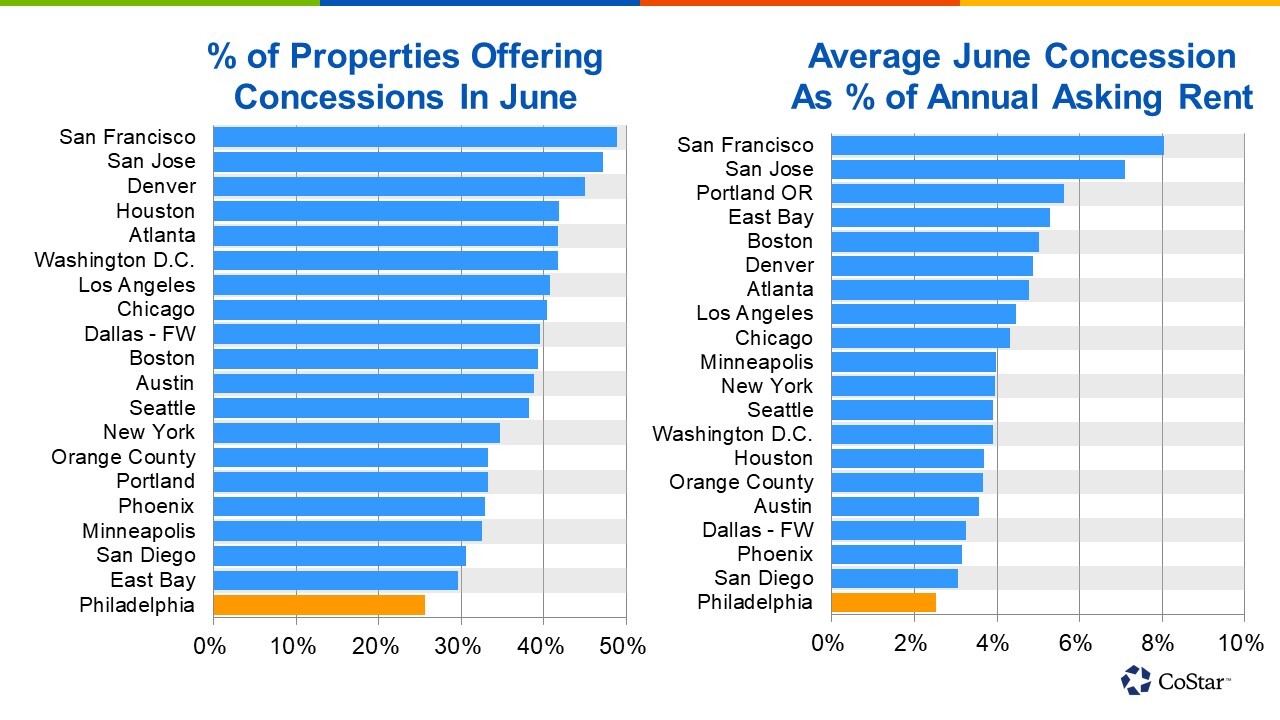

Not only has Philadelphia maintained the most resilient asking rents in the face of the coronavirus, its landlords have also been doling out concessions at the lowest rates of any top 20 market in the U.S.

Philadelphia has its own set of long-term challenges including its slow growth economy, and there’s no guarantee the market will be a top performer in rent growth over the next several years as the U.S. economy recovers.

However, the coronavirus’ real-time stress test on markets across the country is clearly demonstrating just how compelling Philadelphia’s apartment sector is as a destination for investors looking for stable properties that can avoid sharp downsides in net operating income.

The current crisis is also revealing that in some of the country’s most expensive coastal markets, the foundations for sky-high living costs are far less solid than they appeared just a few months ago.

Thursday, July 2, 2020

Piedmont Office Realty Trust Sells Landmark Office Tower for $360M

by Ingrid Tunberg Globest.com

Independence Blue Cross has acquired the landmark, 45-story, class A, office tower at 1901 Market Street in downtown Philadelphia from the Atlanta-based REIT, Piedmont Office Realty Trust, in a $360 million transaction.

The 800,000-square-foot tower has been exclusively leased to the health insurance company, serving as its headquarters, since the property’s completion in 1989. Piedmont Office Realty Trust has owned the asset since 2003.

Selling for $450 per square foot, the transaction represents the disposition of Piedmont Office Realty Trust’s sole Philadelphia asset. As a result of the sale, 96% of the REIT’s annualized lease revenue is now generated from its seven core markets, primarily from its Sunbelt locations.

Throughout the past eight years, the office tower has undergone more than $110 million in capital improvements, including various interior renovations, a new lobby, an outdoor plaza and new mechanical systems.

“The sale of 1901 Market Street concludes a successful recycling story for Piedmont, allowing us to dispose of a long-term, 100%-leased asset in a non-strategic market where we believe the value potential during our ownership has been realized and to fully reinvest the proceeds accretively into our recent purchase of Dallas Galleria Office Towers,” said Piedmont president and CEO, C. Brent Smith. “The transaction was structured as a 1031 exchange for tax purposes; therefore, no special distribution will be required despite the nine-digit gain on the sale of 1901 Market. Overall, this transaction represents a good strategic move for the purchaser and a phenomenal outcome for our stockholders.”

Subscribe to:

Posts (Atom)