By Adrian Ponsen

CoStar Market Analytics

Philadelphia commercial real estate pros are always quick to tout the stability of their region’s healthcare-driven economy, and its vastly more affordable cost of living compared to other large U.S. cities.

The coronavirus and its economic shock are proving that for Philadelphia’s apartment market at least, these benefits are far more than empty talking points.

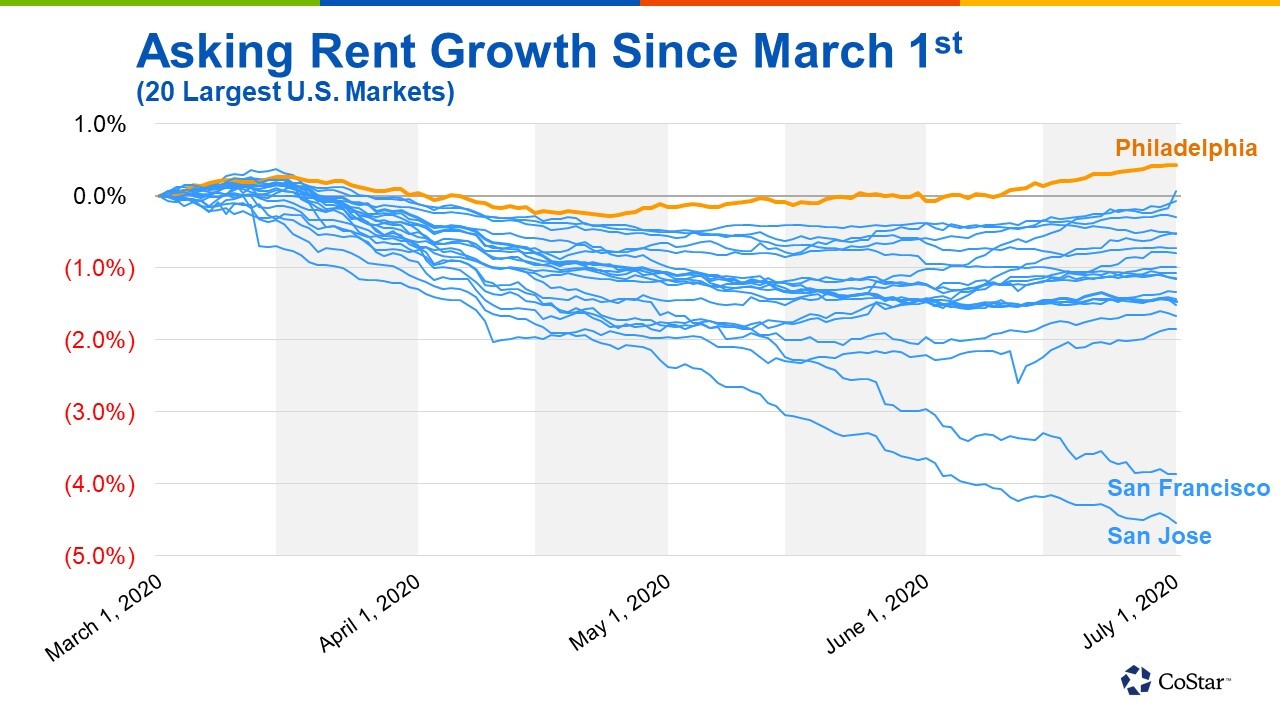

Through its range of apartment search platforms, CoStar’s rent series is fed by tens of thousands of daily updates to rent listings per market. Its data shows that among the nation’s largest 20 markets, Philadelphia’s apartment rents have held up best since the coronavirus began to grip in the U.S. in March.

Philadelphia’s outperformance is particularly notable given that Pennsylvania was the second state in the U.S. to order nonessential businesses closed and has been among the slowest to fully reopen.

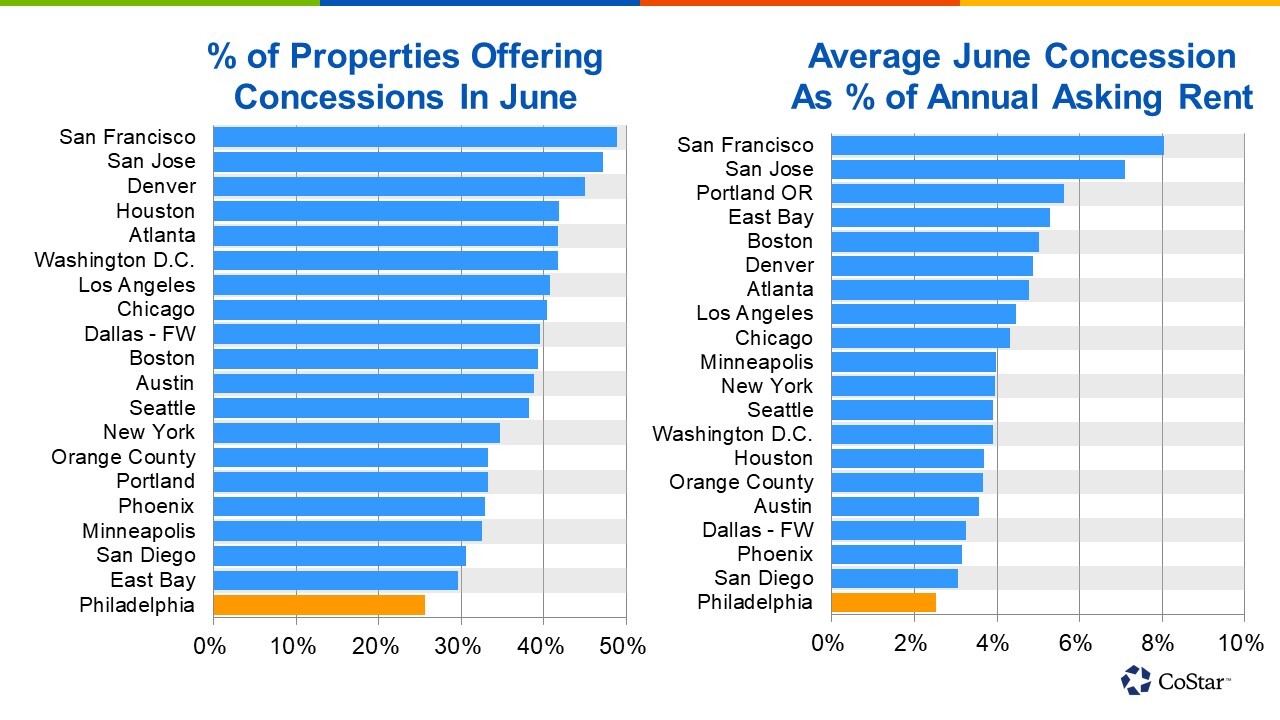

Affordability appears to be key in determining rent resiliency in the face of the coronavirus. The markets that have endured the steepest drops in rents since the crisis took hold are those notorious for exorbitant cost of living including the San Francisco Bay Area, and Orange County California.

Outside of Philadelphia, rents are also holding up relatively well in smaller markets that are havens of affordability in otherwise prohibitively expensive regions, such as Sacramento, Baltimore and Inland Empire.

Not only has Philadelphia maintained the most resilient asking rents in the face of the coronavirus, its landlords have also been doling out concessions at the lowest rates of any top 20 market in the U.S.

Philadelphia has its own set of long-term challenges including its slow growth economy, and there’s no guarantee the market will be a top performer in rent growth over the next several years as the U.S. economy recovers.

However, the coronavirus’ real-time stress test on markets across the country is clearly demonstrating just how compelling Philadelphia’s apartment sector is as a destination for investors looking for stable properties that can avoid sharp downsides in net operating income.

The current crisis is also revealing that in some of the country’s most expensive coastal markets, the foundations for sky-high living costs are far less solid than they appeared just a few months ago.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.