Friday, May 31, 2024

Thursday, May 30, 2024

Tuesday, May 28, 2024

Friday, May 24, 2024

Bazzini Signs Sweet Deal at 860 Nestle Way Breinigsville, PA

By Melannie Skinner CoStar Research

The A. L. Bazzini Co., commonly known as Bazzini, is a manufacturer and distributor of nut, dried fruit and chocolate confections based in Allentown, Pennsylvania. The snack firm signed a long-term lease for just under 130,000 square feet of warehouse space at 860 Nestle Way in Breinigsville, Pennsylvania, to expand its operations.

Founded in New York City in 1886, Bazzini is one of the oldest nut companies in the U.S. It has long supplied major event venues in New York with its nuts, such as Madison Square Garden and Yankee Stadium, as well as distributed its products through grocery and convenience stores. The firm has had a major presence in Allentown since 2011 when relocated its nut-roasting operations there. That same year it acquired Barton's Candy Co., a chocolatier and candy maker founded in 1940.

The firm's new space is within the 607,320-square-foot Lehigh Valley West Building Park owned by Prologis and located within one of the Lehigh Valley’s Foreign Trade Zones, enabling importers to achieve greater supply chain efficiencies and cost savings. Bazzini is expected to take occupancy this summer.

Monday, May 20, 2024

Philadelphia Leads the Keystone State in Industrial Construction

By Brenda Nguyen Costar Analytics

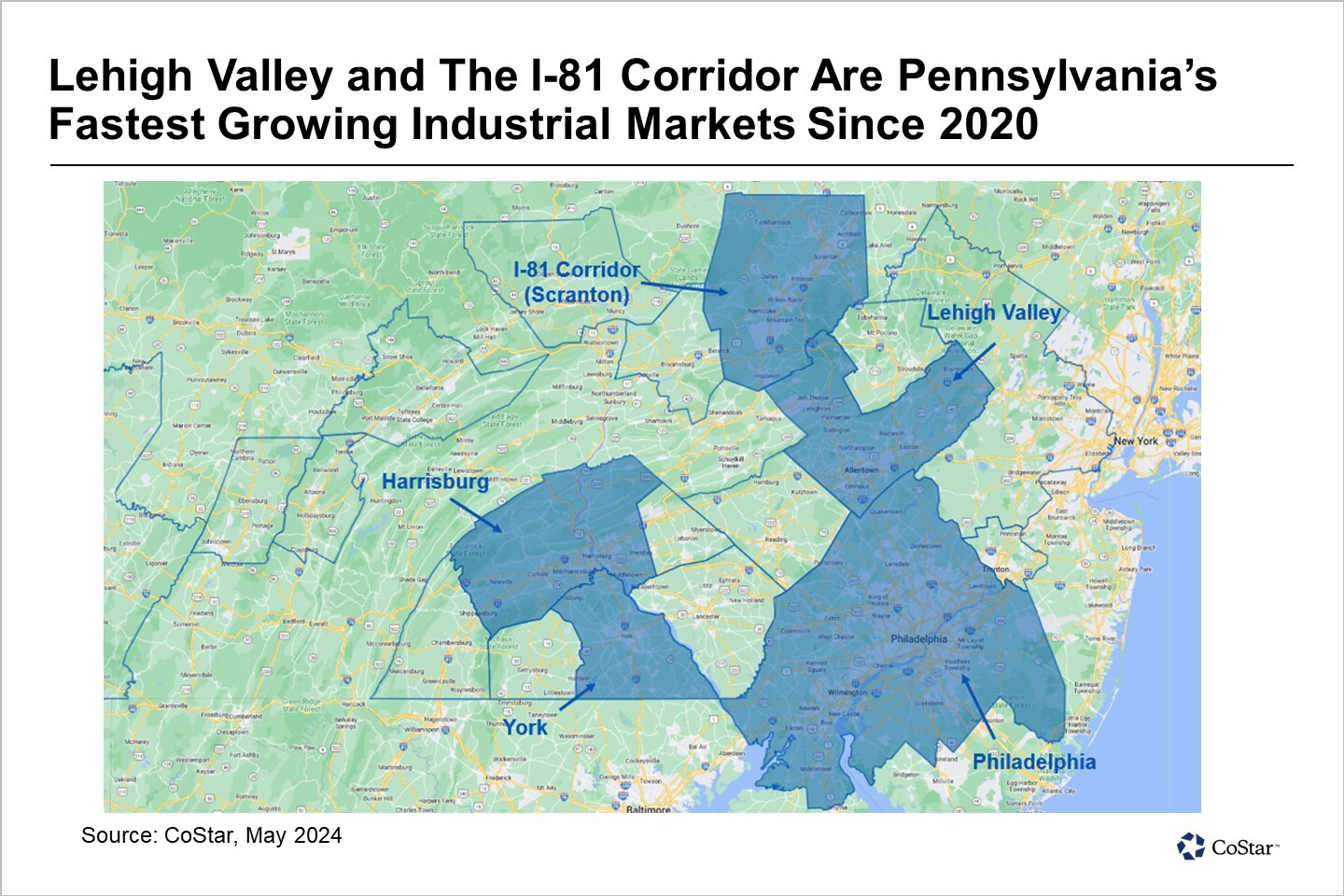

Demand has flooded Pennsylvania's top industrial markets in recent years, prompting a wave of new development. Last year's record number of completions capped more than 110 million square feet of new industrial space added over the past four years in Philadelphia and the nearby areas of Lehigh Valley, the I-81 Corridor, Harrisburg and York.

As the ninth largest U.S. industrial market, the Philadelphia region experienced the most significant addition of industrial inventory, gaining more than 250 new buildings measuring 63 million square feet.

Taking the 14.2 million square feet of industrial demolitions into account and Philadelphia's net gain in inventory since the first quarter of 2020 totals 48.8 million square feet, an 8.5% increase. Half of this new industrial space is concentrated in the southern New Jersey counties of Burlington, Gloucester, Camden and Salem, where supply-driven vacancy has been increasing.

The Philadelphia metropolitan area has attracted the heaviest regional demand for industrial space from retailers, manufacturers and third-party logistics companies seeking to locate near major ports, airports and dense population centers along the Northeast U.S. corridor. Additionally, average rents for industrial space are about 30% lower than in Northern New Jersey, making Philadelphia a cost-effective alternative for occupiers.

Further north, the industrial hub of Lehigh Valley has followed a similar development trend, adding a net gain of 26 million square feet of industrial space across 74 buildings with very little space demolitions. This resulted in an impressive 18.6% increase in the region's industrial inventory, making it the fastest-growing industrial market in Pennsylvania.

Lehigh Valley's proximity to New York and Philadelphia has positioned it to capture spillover industrial demand from these costlier port markets. In recent years, the region attracted some of the country's largest industrial leases, which exceeded one million square feet at times. These headline leases have grabbed the attention of developers hoping to capitalize on the high demand.

As the availability of suitable land grows more limited in the mountainous region of Lehigh Valley, industrial development has shifted to the neighboring I-81 Corridor or Scranton. This inland region offers even deeper rent discounts to its port neighbors.

Over the past four years, the I-81 Corridor gained 17.2 million square feet across 47 buildings, a 17% increase in inventory, to become the second fastest-growing industrial market in Pennsylvania.

Meanwhile, Harrisburg gained 9.9 million square feet across 21 buildings, and York gained 9 million square feet across 30 buildings. Modest construction and continued demand have resulted in a very tight industrial market in Harrisburg and York, which have among the lowest industrial vacancy rates in the country.

Industrial development activity is expected to decelerate due to elevated interest rates and an accumulation of unleased inventory in some markets. Construction starts in these five Pennsylvania industrial areas have already decreased by 50% compared to the previous year, setting the stage for a quieter yet still active period of industrial completions through 2025.

Friday, May 17, 2024

$40 million marina, entertainment complex planned for Northeast Philadelphia

By Emma Dooling – Reporter, Philadelphia Business Journal

A new marina and entertainment complex is being planned along the Delaware River in Northeast Philadelphia.

Dana and Ron Russikoff, the founders of Rodan Enterprises LLC, plan to develop a full-service marina with restaurants and a yacht club at 5190 Princeton Ave. near the Tacony and Mayfair neighborhoods. The duo recently acquired the 6-acre parcel that will house the project, called One River Marina, for $1.15 million, Dana Russikoff told the Business Journal.

The Russikoffs are well-versed in the boating world, having founded SureShade, a company that makes retractable sunshade systems for boats throughout North America and Europe. Indiana-based Lippert Components Inc., the maker of parts and accessories for recreational vehicles, acquired the Philadelphia business from the Russikoffs in late 2019.

Russikoff said the development, which is years in the making, will be a place for the local community to enjoy as well as a "world-class destination" for boaters located between two other waterfront destinations along the river: Penn's Landing to the south and Bristol Wharf to the north.

“This project checks every box for what is surely becoming a new age of 'nautical tourism' for the Delaware River – recreation, access and infrastructure development – for local residents and especially for boaters," Russikoff said in a statement.

Early estimates for One River Marina currently put the cost of the project between $30 million and $40 million.

One River Marina, located just north of the Tacony-Palmyra Bridge, is in the early stages of planning and will be completed in phases. The first phase of the project consists of the construction of a new bulkhead, docks, slips, fuel and boat storage. That portion is expected to be complete by the spring of 2026 in time for celebrations of the nation's 250th anniversary in Philadelphia, a series of events expected to draw a significant amount of tourists to the region.

Full Story: https://tinyurl.com/ybw7v66b

New York firm pays $90M for Phoenixville apartment complex

By Paul Schwedelson – Reporter, Philadelphia Business Journal

An entity tied to New York financial services firm Cantor Fitzgerald paid $90.3 million to acquire a large Phoenixville apartment complex, marking the company's latest investment in the Philadelphia region.

Cantor Fitzgerald bought the 349-unit Riverworks complex from Pantzer Properties, according to Chester County property records. The development sits on 30 acres that had been part of the shuttered Phoenix Steel Co. and is located on the north side of French Creek.

Located at 45 N. Main St., the Riverworks complex is within walking distance of Phoenixville's restaurant and retail area and has access to the Schuylkill River Trail.

Fort Washington-based homebuilder Toll Brothers developed the six-building complex for $66.5 million in 2016 and sold it to Pantzer Properties for $77.8 million in 2019. The project is one of the largest developments in Phoenixville.

Riverworks includes an 11,000-square-foot clubhouse, a pool and a climbing wall.

The apartment property is managed by Harbor Group Management, a real estate investor with more than 58,000 apartments in its portfolio, according to the company. A spokesperson for Harbor Group declined to comment when asked if it is a co-investor with Cantor Fitzgerald on Riverworks, but the companies previously partnered on the acquisition of a 229-unit apartment community in Westchester County, New York, in November.

Full story: https://tinyurl.com/s9sa3k9e

Thursday, May 16, 2024

Signs of More Office Demand Raise Optimism for Recovery

By Katie Burke CoStar News

Brandywine Realty Trust CEO Jerry Sweeney doesn't consider himself an optimist when it comes to the end of the national office market's "frustratingly slow" slog. But even the head of one of the largest U.S. real estate investment trusts sees early signs of what he said could be a turnaround — or at least a clearer picture of where the market may be headed.

A steady pickup in leasing, a burst of steeply discounted sales, and hints from large institutional investors have combined in recent months to provide an improved outlook that commercial real estate stakeholders such as Sweeney say they haven't had since the COVID-19 pandemic's outbreak more than four years ago. There's little debate the market faces unprecedented challenges, but some developers, investors and landlords are edging forward.

"There are a lot of stress factors impacting our business, so sure, from that standpoint it isn't as rosy as we'd like," Sweeney told CoStar News. "But now we figure out our relative positioning in all of it, what opportunities that presents and how we can be aggressive in taking advantage of them."

Across the United States, commercial property leasing has fallen nearly 15% from its annual average in the years leading up to the pandemic. Arrested sales volume that afflicted various office markets for the past several years is beginning to settle into what some real estate professionals say could be a post-pandemic reality. Companies such as Kroger, UPS, Amazon and IBM have formalized return-to-office policies and are now more willing to commit to longer-term lease deals.

Smaller investors, lured by record-low prices and the chance to acquire properties previously out of reach, have closed a flurry of deals since the start of 2024 to help reset valuation expectations. And, while interest rates remain elevated, real estate professionals say the shock from the string of increases ended last year has since worn off, making it easier to map out a strategy for the year ahead with a bit more certainty.

"We've seen the worst from a capital markets perspective, and while we might not be at the bottom just yet, we're close to it," said Kevin Shannon, Newmark's co-head of U.S. capital markets, told CoStar News. "Rates went up so fast that you didn't know how high was high or what your cost of capital was, and that's scary. People have a better understanding now, and while the impacts from the pandemic means the healing process will take longer, there are more signs of certainty and we can at least now see the bottom and rebuild from there."

Even Blackstone, the world’s largest commercial property owner, called 2023 a cyclical bottom for commercial real estate and acknowledged the hard-hit sector may present some opportunities for the firm to dive back in after cutting its U.S. office exposure to just 1% of its global real estate portfolio.

The New York-based private equity giant is now looking to buy “super-high-quality” office buildings at depressed prices, Jonathan Gray, Blackstone’s president and chief operating officer, said at New York University Schack Institute of Real Estate’s recent annual REIT symposium.

To be clear, investment volume across the national office market is still at a low not seen since the likes of the Great Recession or the dot-com bust. But in the challenging sales landscape, Phil Mobley, CoStar Group's national director of market analytics, said a silver lining is that this cycle's investment activity appears to at least be near bottom.

Sales volume has plummeted by more than 55% over the past year to $35 billion, according to CoStar data, a nearly 15-year low. Yet, on a quarterly basis, sales activity held steady throughout 2023 and even ticked up in the early months of 2024 as significant discounts pushed an expanding group of investors to take advantage of more deals.

Leasing Gains Traction

For Brandywine's Sweeney, uncharacteristic optimism has emerged as tenant demand for office space recovers from its pandemic-era hibernation.

The Philadelphia-based real estate investment trust, overseer of a portfolio spanning more than 22 million square feet across Pennsylvania, Texas and the Washington, D.C.-area, reported tenant tour activity in the first few months of this year jumped nearly 50% compared to its previous quarterly average. More than half the deals the developer has signed at the start of the year are attributable to companies looking to "move up the quality curve," Sweeney said, trading spaces in older buildings for offices in newer ones.

Other developers and landlords, especially those with portfolios concentrated with properties on the higher end of the quality spectrum, are also reporting an uptick in tours and leases that, in some cases, echo activity seen before the pandemic. Boston Properties, one of the nation’s largest office landlords, reported its weighted average lease term had climbed to more than 11.5 years in the first quarter, the highest since COVID-19 disrupted the office market in 2020.

In New York, a market Newmark's Shannon said is the furthest along in its recovery from the pandemic, about 250 tenants are looking to sign on for roughly 22 million square feet of office space, according to data from the brokerage Raise. About 45% of that demand is being driven by companies in the financial services or legal industries, while about 17% of that is fueled by those in technology.

Vornado Realty Trust and SL Green Realty, Manhattan’s largest office landlord, both said on first-quarter earnings calls they have started to see a pickup in interest from the tech industry in New York after a quiet period.

And in Silicon Valley — an area dominated by tech giants that were quick to offload significant chunks of office space — more than 80 tenants are hunting for a total of more than 4.2 million square feet, according to Raise data. More than 3.1 million square feet of that is for space exceeding 100,000 square feet, signaling that a growing pool of tenants are once again willing to commit to large spaces after several years of dramatically shrinking their real estate portfolios.

The turnaround in leasing follows several years of companies trying to figure out where and how employees want to work — and how much space they actually need to accommodate those shifts.

That is now beginning to settle, Gensler co-chair Diane Hoskins told CoStar News, meaning companies are now more willing to invest in high-quality spaces to try to make their offices destinations worthy of a commute, not a daily obligation.

"There is more certainty and clarity about the value of workspaces," the architecture firm executive said. "We're heading toward an equilibrium where tenants are still looking for value but are also willing to invest in premier buildings that are helping to make it easier getting employees to want to come back to an office. A lot of dynamics have changed, and companies have far more confidence in decision-making now."

Some tenants are committing to office space for the long term, even if it is for less than what they previously occupied. Tenants collectively signed on for about 395 million square feet last year, according to CoStar data, about 13% below the annual average reported in the years leading up to the pandemic's 2020 outbreak. What's more, those deals are about 16% smaller on average than those signed between 2015 and 2019, exacerbating the vacancy challenges and the available space across the country's largest office markets.

Hunting for a Deal

After years of tabling some deals or sticking to the sidelines, a growing pool of private buyers, owner-users, local firms and smaller asset managers are scooping up properties at a fraction of their previously traded prices, helping to provide some clarity as to where valuations are ultimately expecting to settle.

Large institutional firms such as Blackstone, Clarion Partners and Brookfield are still selling properties at discounted prices and have yet to return to the market as buyers. However, Shannon said more are now talking about jumping back in compared to this time last year.

"Institutions typically come in after the market has clearly bottomed," he said. "They're more conservative than other buyer types, but last year almost none of them were looking at office and this year, they're discussing it. That's not to say they're buying yet, but there's progress in the fact that they're looking again."

A joint venture between New York Life Real Estate Investors and investment firm Bridgeton, for example, earlier this month closed a $22 million deal to acquire 410 Townsend St., a 78,000-square-foot office building in San Francisco's tech-concentrated SoMa area that has a long history of housing early-stage startups. The building last sold in 2019 when seller Clarion paid nearly $86 million, and this deal underscores the growing eagerness among investors in getting in on the ground floor of cities' post-pandemic recoveries — and fear in missing out on a major deal.

"This is the start of the recovery for the San Francisco real estate market," Albert Pura, New York Life Real Estate Investors' senior director of transactions, said in a statement. The Townsend Street building offers the joint venture “the opportunity to acquire a best-in-class” building at a significant discount, a sentiment echoed among other buyers behind deals that have recently closed in top-tier markets such as San Francisco, Boston, Chicago, Los Angeles, New York and Washington, D.C.

There is still plenty of uncertainty stemming from issues such as sticky inflation and ongoing job cuts, all of which could derail what some office stakeholders say they hope are early signs of a market rebound.

Cyrus Sanandaji, the co-president and CEO of real estate investment firm Presidio Bay Ventures, said any sense of optimism in the broader office market will also need to be broken down on a market-by-market level given each region's specific set of both challenge and opportunities.

"I wouldn't paint the entire U.S. office market with a broad stroke [since] there's so much nuance that will impact the recovery of each market," he said. "However, in general, the increasing pushback against remote work in most creative and apprentice-based industries is very promising."

The firm last year was one of the first investors to close an office deal since the early days of the pandemic, acquiring the building at 60 Spear St. for about $41 million, or less than one-third of the property's previously sold price tag.

Presidio Bay, continuing to focus on opportunistic deals downtown, is now in the early stages of putting together plans to invest another roughly $4 million to overhaul the Spear Street property into an "office resort," building in hospitality minded amenities such as a rooftop bar and restaurant, sauna rooms, cold and warm-water plunges, saltwater floating pools, and spaces for both coworking and events.

The CEO said he's mindful of the challenges that still face the city and its record amount of available office space, but the chance to position the firm and its portfolio at the forefront of what he said is "a true urban renaissance" is worth the financial risk.

"In San Francisco specifically, we’re seeing the entire ecosystem, from investors to entrepreneurs, embrace the return to office and recognize how much you gain" from being back in a physical space, he said. "This is what’s driving so many to start searching for office space and signing new leases. We need a lot more of it, but when it turns back on, it’ll ramp up very quickly and beyond what most people are anticipating.”

Wednesday, May 15, 2024

Tuesday, May 14, 2024

Monday, May 13, 2024

Friday, May 10, 2024

Industrial vacancies are rising, but one heavyweight's activity could signal a reversal

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

The U.S. industrial market appears to have normalized after an unsustainable clip of growth during the pandemic and may find its post-pandemic bottom this year, as supply continues to outpace demand in many markets.

Amid that softening, Amazon.com Inc. (Nasdaq: AMZN), an informal "first mover" in the industry, is showing signs of restarting expansion of its industrial real estate holdings.

Industrywide, the first quarter of the year brought the sixth consecutive three-month period of declining net absorption, at 27.9 million square feet absorbed nationally. The vacancy rate also continued to rise, to 6.1%, thanks to lower tenant demand and the continued trend of higher-than-average construction deliveries.

Some market trackers put the national vacancy rate a little higher. By Savills' estimate, for example, it's at 6.7%. Some of the nation's top industrial markets are posting double-digit vacancy rates, including Savannah, Georgia, at 12.1%; Phoenix, at 11.8%; and Dallas-Fort Worth, at 10.8%.

And while Mark Russo, vice president of industrial research at Savills, said it's likely vacancy will continue to rise in the coming quarters, conditions may be setting the stage for a recovery in the broader sector medium term, especially heading into 2025.

A resurgence in demand from industries like e-commerce is among the indicators that gains could be ahead for the industrial market, and that's where Amazon's recent activity comes into play.

Amazon is among the nation's biggest users of warehouse space. So far this year, it's leased almost 15 million square feet nationally, according to Russo. That follows a period of slower growth from the company, and even efforts by Amazon a few years ago to put some of its space back on the market.

While one company's real estate decisions shouldn't be overemphasized, Amazon's activity continues to be a closely watched as a possible sign of where the broader market may be headed.

"It is interesting that they’re getting more active," Russo said.

By Savills' measurements, Amazon's active U.S. facilities are projected to grow by 43 million square feet this year, up from growth of less than 30 million square feet last year. In 2020 and 2021, when e-commerce sales skyrocketed, Amazon's active U.S. facilities grew by about 100 million square feet each of those years.

E-commerce more broadly will continue to see tailwinds, thanks to demographic changes and a need to address supply-chain "Whac-a-Mole" caused by events like the Baltimore bridge collapse earlier this spring and global conflicts, Russo said.

And while online sales have slowed since the height of the pandemic, e-commerce activity still accounted for 15.6% of total retail sales in Q1 2024 — up from 14.4% in Q2 2022, according to U.S. Department of Commerce data.

Full story: https://tinyurl.com/mr3wat77

Wednesday, May 8, 2024

Tuesday, May 7, 2024

Friday, May 3, 2024

Wednesday, May 1, 2024

Philadelphia sits among nation's elite life sciences hubs in new Colliers rankings

By John George – Senior Reporter, Philadelphia Business Journal

The Philadelphia region takes fourth place in a new ranking of the country's top life sciences hubs on the strength of its talent pipeline and recent real estate activity.

The analysis conducted by the commercial real estate services firm Colliers International focuses on a region's ability to support and sustain industry growth using factors such as venture capital funding, National Institutes of Health grants and biomedical degree completions. The study, which examined 18 markets, also takes into account each region's life sciences real estate market, specifically its office and lab space inventory along with the amount of space under construction and the space absorbed by companies over the past three years.

Boston holds the top score in the Colliers analysis, followed by the San Francisco Bay area and then San Diego. Philadelphia's fourth-place finish puts it ahead of New Jersey, New York City and Seattle. Rounding out the top 10 are Raleigh/Durham in the eighth spot, followed by suburban Maryland and Chicago.

Philadelphia's highest scores are in net property absorption, where the region ranks third, and in three categories where it ranks fourth: biomedical degree graduates with 3,758 in 2022; office and lab space inventory with 23.7 million square feet; and square footage under construction at 2.5 million square feet.

The local region's NIH grant funding of $1.4 billion and venture capital investments of $547 million rank sixth and seventh, respectively.

Full story: https://tinyurl.com/mnv7zm9k