Friday, April 28, 2023

Thursday, April 27, 2023

Wednesday, April 26, 2023

Monday, April 24, 2023

Friday, April 21, 2023

Wednesday, April 19, 2023

Tuesday, April 18, 2023

Retailers Ink Pair of Deals at Warwick Square Shopping Center

By Javon Roach CoStar Research

Warwick Square, a neighborhood center jointly owned by First Washington Realty of Bethesda, Maryland, and Jacksonville, Florida-based Regency Centers, recently strengthened the tenant lineup at the retail center located at 2395 York Road in Jamison, Pennsylvania, north of Philadelphia.

Grocery Outlet Bargain Market, an "extreme-value" grocery retailer, continued its East Coast expansion by signing a new lease for a 25,191-square-foot store in Warwick Square. The publicly-traded grocery franchise is based in California and operates as a network of independently operated stores. Grocery Outlet reports it has more than 440 stores in California, Washington, Oregon, Pennsylvania, Idaho, Nevada, Maryland and New Jersey on its website.

Fitness franchise Planet Fitness also signed a lease for 25,289 square feet to renew and expand its space in the retail center.

Monday, April 17, 2023

Morgan Stanley Extends Office Lease in Downtown Philadelphia

By James Hendricks Costar

Global financial services firm Morgan Stanley renewed the lease for its office space in downtown Philadelphia's One Liberty Place.

The lease covers Morgan Stanley's 31,000-square-foot space on the 42nd floor at 1650 Market St., a 61-story office tower owned by Chicago-based Metropolis Investment Holdings Inc.

Thursday, April 13, 2023

Philadelphia Office Market Sees Slowdown in Leasing Recovery

After a period of noteworthy leasing recovery since mid-2021, the Philadelphia office market has hit another setback.

Business decisions, and subsequently leasing momentum, have given way to inflationary measures and economic uncertainty in recent months. The past two quarters have recorded the lowest leasing levels since the height of the pandemic.

After recovering to 80% of pre-pandemic levels in 2021, the annual leasing volume fell to 70% recovery levels in 2022 due to a weak fourth quarter.

This year is already off to a rocky start, and given current economic headwinds, performance is unlikely to keep up with the recent leasing recovery for the remainder of 2023.

While this presents another obstacle in an already uphill battle for the office market, it’s important to note lease transactions have not disappeared altogether. Although occurring in lower volumes overall, significant leases are still being signed, particularly for high-end four- and five-star buildings, build-to-suit office towers and dedicated life science spaces.

Of course, Philadelphia is not the only office market to face this challenge caused by macroeconomic headwinds. Markets across the country, including New York, Boston and Charlotte, North Carolina, have also experienced a pullback toward pandemic-level lows. Some markets hit levels that were even lower than their pandemic low, such as Washington D.C., Atlanta and Baltimore.

Wednesday, April 12, 2023

PREIT seeking approval for a scaled-back apartment community at the Plymouth Meeting Mall

By Kevin Tierney MTTC

PREIT Is seeking zoning relief through a special exception to allow a 300-unit apartment community at the Plymouth Meeting Mall. A previous proposal, which was denied zoning relief and is currently on appeal with the Commonwealth Court, sought to construct a 502-unit apartment building.

Both proposals were for the portion of the mall property that contains a vacant office building on the Whole Foods side of the property. This building was once utilized by IKEA.

The previous proposal was for an 11-story building, while the new proposal is for a four or five-story building.

Full story: https://tinyurl.com/47cy94a7

Tuesday, April 11, 2023

Monday, April 10, 2023

Thursday, April 6, 2023

Former Sikorsky helicopter plant in Coatesville acquired by storied aviation firm

Ryan Mulligan Reporter - Philadelphia Business Journal

An aerial view of former Sikorsky plant Coatesville.

A Delaware County aviation company has purchased Chester County's shuttered Sikorsky helicopter plant, in a deal that aims to restore Coatesville's standing as a hub for aircraft development.

Essington-based Piasecki Aircraft Corp. purchased the 28-acre facility for $10.5 million with plans to expand its company and use it as a base for research, development and innovation. Lockheed Martin (NYSE: LMT), the parent company of Sikorsky, closed the plant in March 2022 after the prospect was discussed and planned for years but was spared in 2019 following pressure from local lawmakers and President Donald Trump. At one point, the facility employed over 1,000 workers.

The deal is symbolic given Piasecki's long history in rotorcraft innovation, and one that at points intertwines with Sikorsky's. Philadelphia native and University of Pennsylvania alum Frank Piasecki designed the second successful helicopter to fly in the U.S. in 1943. The first was Igor Sikorsky's VS-300 which flew in 1939, four years before Piasecki's.

The vacant Coatesville plant at 110 E. Stewart Huston Drive caught the eye of developers and other real estate investors, but Lockheed Martin and local government officials wanted the facility to stay in line with its intended use, said Gary Smith the CEO of the Chester County Economic Development Council, which helped coordinate the deal.

"We didn’t want land speculators and developers to buy it," Smith said. "It's a beautiful building and is state-of-the-art for this particular use." Smith added that Lockheed Martin "didn't take the highest offer on the building but long-term they got the best match and we tip our hats to them."

Steve Zohrabian, the chief operating officer of Piasecki Aircraft Corp., said the 68-year-old company's "vision for growth" is to initially use the facility for research and development. It could add other programs like aircraft production down the line and expand hiring. Piasecki Aircraft will gradually migrate select programs from its Essington base to Coatesville. The company is currently in the process of fitting out and restructuring the plant, Zohrabian said. Still, Piasecki Aircraft plans to take full advantage of the "220,000 square feet of Class A aerospace facility," Zohrabian said.

The company will maintain its presence in Essington off Route 291 along the Delaware River.

The former Sikorsky plant was the production site for its S-92 and S-76 helicopters. Sikorsky bought the plant in 2014 for $17.9 million, according to property records, and the company was acquired a year later by Lockheed Martin for nearly $9 billion.

Roughly 240 employees lost their jobs when the plant shut down last year.

Smith said the facility has the capacity to house hundreds of jobs. Both Zohrabian and Smith said the site could attract other companies to the area to partner with and supplement Piasecki Aircraft's work in Coatesville. The facility sits adjacent to the Chester County Airport, representing another asset for Piasecki Aircraft to partner with. Smith envisions Coatesville as being a hotspot for helicopter development.

"Piasecki does a lot of innovative work, we’ll be kind of a universal think tank and innovator for rotorcraft innovation and bring in more companies around them that would be compatible and complimentary," Smith said.

Full story: https://tinyurl.com/enudjfsk

Buccini/Pollin buys Conshohocken's One Tower Bridge for $59M

Paul Schwedelson Reporter - Philadelphia Business Journal

One Tower Bridge in Conshohocken was constructed in 1989.

Buccini/Pollin Group Inc. has bought One Tower Bridge, a 15-story office building in Conshohocken for $59 million.

Wilmington-based Buccini/Pollin plans to invest $9 million into the 271,678-square-foot property by renovating the garage, plaza, common area restroom and corridor, lobby and façade.

The sale closed on Friday. Oliver Tyrone Pulver and its partner, an institutionally managed firm.

The building sits at 100 Front St. along the Schuylkill River and was built in 1989 by Oliver Tyrone Pulver Corp. It was the first of the Tower Bridge cluster of buildings and helped spark the Conshohocken office submarket. Seven Tower Bridge was completed in 2021.

One Tower Bridge is 92% leased with tenants including Morgan Stanley and other financial services and investment management companies. The building has retained 65% of the tenants that leased space when it was built.

“This investment is right down our strike zone,” said Chris Buccini, who is co-President of Buccini/Pollin. “We’ve always been hyper focused on the Greater Philly region, number one. We’ve been in Conshohocken for 18 years now. We still own Quaker Park and we’ve always had great success in that market. We love that submarket.”

Buccini/Pollin Group has specialized in Class A and best-in-class assets, said Buccini, noting there’s more demand now for high-end office space than there was before the Covid-19 pandemic.

In 2022, Class A deals accounted for more than three-and-a half times as much space leased than Class B.

Buccini/Pollin manages 7 million square feet of commercial office space. It bought Quaker Park in Conshohocken in 2005 and manages Swedesford Park in Wayne. One Tower Bridge is the first office building Buccini/Pollin has bought since the start of the pandemic. Buccini called it “an iconic building” and the planned $9 million renovations are to “give it a refresh. We don’t want to change it.” Buccini/Pollin Group typically owns properties for well more than 10 years, Buccini said, so the upgrades are meant to have a long-lasting impact.

One Tower Bridge was put up for sale in 2020 and at one point was under contract to sell to Brandywine Realty Trust for nearly $100 million, according to industry sources.

Buccini/Pollin Group’s core office market spans throughout the mid-Atlantic region and south to Nashville and west to Pittsburgh. Buccini said the company would consider buying more office properties if it fit the top-tier criteria it typically looks for.

“If you’re trying to get people back into the office or trying to retain and attract talent, the workspace has become much more important,” Buccini said.

Full story: https://tinyurl.com/yszxsthn

Wednesday, April 5, 2023

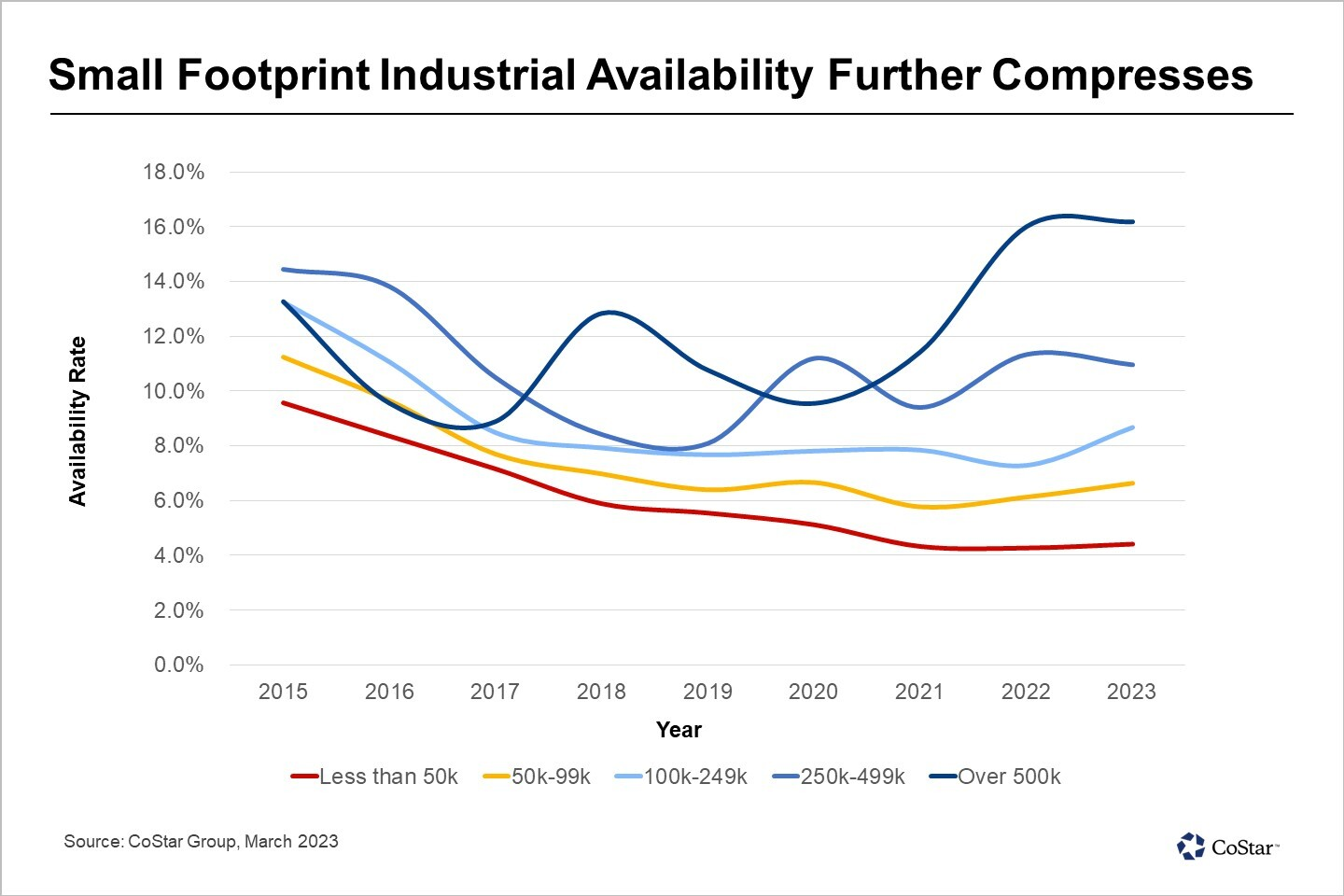

Philadelphia’s Small-Bay Industrial Market Underserved by Recent Construction

Tuesday, April 4, 2023

Monday, April 3, 2023

Post Brothers Execute Biggest Multifamily Sale Ever in Philadelphia Despite Challenging Economy

By Linda Moss CoStar News

Post Brothers scored Philadelphia's priciest multifamily sale ever last year, a record $357 million, despite a turbulent economy where rising interest rates put the brakes on many other deals.

The multifamily landlord and developer made history in the Philadelphia market with its November sale of Presidential City, a 1,015-unit high-rise complex that includes four, 12-story buildings at 3900 City Ave. It was purchased by KKR and Mack Real Estate Group. The deal's size, and the fact it was executed in a challenging environment for acquisitions, earned it a 2023 CoStar Impact Award as judged by real estate professionals familiar with the area.

Philadelphia-based Post Brothers had opted to refinance the property in 2019, and KKR assumed that fixed-rate loan, which made the purchase appealing in spite of the turmoil in the macroeconomy.

When the real estate firm first acquired the property from Gebroe-Hammer Associates in 2012 for $51 million, the deal was the largest market-rate multifamily trade by units in Philadelphia that year. Following a massive renovation of the Class A luxury property, the sale to KKR represents a value increase of 600%

About the project: Presidential City was alluring in part because of its renovations, which included the construction of a $7 million, 41,000-square-foot amenity center; multiple infinity pools; an office building and ground-floor retail space that is now occupied by a Panera Bread location.

Rising Capital LLC Sells Lafayette Parkway Self Storage in LaGrange, GA

Sold! Rising Capital LLC purchased Lafayette Parkway Self Storage in LaGrange, GA in June 2020. We raised debt and equity in the beginning of a Pandemic! (not recommended!) We originally had a 5 yr hold with expected investor IRRs of 30%. Due to numerous unsolicited offers, we took the property to market with Matthews Investment Services. We sold this property in 2.75 yrs and achieved an investor multiplier of 2.6X and IRR of 41%. If you have self storage projects for us to consider please send opportunities to jodonnell@risingcapitalllc.com (484) 354-2162