Local investment firm Morgan Properties acquired the 504-unit Marchwood Apartments in Exton, Pennsylvania, from BET Investments for $82 million, or about $163,000 per unit.

The garden-style community at 105 Coach Lane comprises a mix of one-, two- and three-bedroom units ranging from 810 to 1,300 square feet in 40, two-story buildings. Built in 1973, the 95% occupied property spans 43.6 acres less than 30 miles from Philadelphia International Airport.

Morgan Properties President Jonathan Morgan said in a statement, "We are bullish on the suburban Philadelphia market. We look for Class B properties with a value-add component and saw this as a nice opportunity to further expand our suburban Philadelphia assets."

He also mentioned that they had a pre-existing relationship with the seller, making for a smooth transaction.

In March, Morgan Properties acquired a 10-property multifamily portfolio from Lonestar known as the Home Properties Portfolio for $890.5 million. Seven of the communities were located in Pennsylvania while the other three were in Northern Virginia. The firm owns and operates more than 167 multifamily apartment communities and over 51,000 units across the Mid-Atlantic, Nashville and Northeastern United States, according to its website.

www.omegare.com

Friday, June 28, 2019

The Galman Group Buys Studio Green, Park Place Complexes for $40.96 Million

Local investment firm The Galman Group purchased the 338-unit Studio Green and the 276-unit Park Place multifamily complexes in Newark, Delaware, from Houston-based Campus Living Villages for $40.96 million, or about $67,000 per unit.

The Studio Green student housing community at 91 Thorn Lane will be converted to apartment units named Thorn Flats. Built in 1965, the property comprises a mix of studio to four-bedroom units ranging from 484 to 1,507 square feet in 59, three-story buildings.

The garden-style Park Place complex at 650 Lehigh Road features a mix of one- and two-bedroom units ranging from 601 to 1,033 square feet in 23, three-story buildings. The Class B property spans 5.2 acres and was built in 1965.

www.omegare.com

The Studio Green student housing community at 91 Thorn Lane will be converted to apartment units named Thorn Flats. Built in 1965, the property comprises a mix of studio to four-bedroom units ranging from 484 to 1,507 square feet in 59, three-story buildings.

The garden-style Park Place complex at 650 Lehigh Road features a mix of one- and two-bedroom units ranging from 601 to 1,033 square feet in 23, three-story buildings. The Class B property spans 5.2 acres and was built in 1965.

www.omegare.com

Thursday, June 27, 2019

Innovative Hospitality Management Buys Hotel Near Hersheypark

Local investment firm Innovative Hospitality Management purchased the 110-room Hampton Inn & Suites in Hershey, Pennsylvania, from New York-based The Blackstone Group.

The three-story hotel at 749 E. Chocolate Ave. was built in 1999. The Class B property spans 2.2 acres less than a mile from Hersheypark.

Ketan Patel and Kevin Hanley with HREC Investment Advisors represented the seller, which originally purchased the property as part of a portfolio in December 2013, CoStar data shows.

Greg Porter at HREC Capital Markets Group led purchase financing. The non-recourse acquisition loan was sized to 72.6% of the purchase price plus budgeted PIP cost and 71.5% of the property’s post-PIP value and has a 10-year fixed rate of 4.35% and 30-year amortization.

www.omegare.com

The three-story hotel at 749 E. Chocolate Ave. was built in 1999. The Class B property spans 2.2 acres less than a mile from Hersheypark.

Ketan Patel and Kevin Hanley with HREC Investment Advisors represented the seller, which originally purchased the property as part of a portfolio in December 2013, CoStar data shows.

Greg Porter at HREC Capital Markets Group led purchase financing. The non-recourse acquisition loan was sized to 72.6% of the purchase price plus budgeted PIP cost and 71.5% of the property’s post-PIP value and has a 10-year fixed rate of 4.35% and 30-year amortization.

www.omegare.com

W.P. Carey Shows Appetite for Industrial Properties with Latest Deals

New York real estate investment trust W.P. Carey announced it paid $53 million for a variety of industrial buildings around the country in a sign that industrial properties are prime investment targets.

Sales of industrial buildings remain strong, though a bit off from a record selling last half of 2018, which was driven by big investors merging and acquiring one another. The report noted that “strong price appreciation has mirrored rent growth.”

Two of the properties W.P. Carey recently bought house operations for a company that basically provides the products that turn warehouses into distribution centers. It paid $10 million for a building in Westerville, Ohio, and another in North Wales, Pennsylvania, that are leased to Integrated Warehouse Solutions. The Forth Worth-based company is a roll up of three companies -- Bluff Manufacturing, Nordock and Wesco Industrial Products.

All of the deals involve the owners selling the properties and leasing them back. They include triple-net leases in which the tenant pays for more of the property’s operating expenses. The deal with IWS came with a 20-year lease.

W.P. Carey’s largest latest deal, $24 million, included eight production buildings in the United States and in Mexico from “a leading global manufacturer of electrical wire harnesses, control boxes and other value-added components for a diverse customer base.”

The buildings make up a “significant portion” of the undisclosed company’s North American manufacturing operations. W.P. Carey also has 20-year leases on those buildings.

Its third deal cost the REIT $19 million to acquire a 301,000-square-foot building in Statesville, North Carolina, leased to Front Sport Group, a company that owns athletic apparel brands Badger Sport and Alleson Athletic.

Earlier this year, W.P. Carey bought a fully leased food production plant in an undisclosed location for $44.7 million. It also paid $38 million for a distribution center leased to Memphis-based Orgill, a wholesale supplier to independent hardware stores, at 4925 Tablers Station Road in Inwood, West Virginia.

www.omegare.com

Sales of industrial buildings remain strong, though a bit off from a record selling last half of 2018, which was driven by big investors merging and acquiring one another. The report noted that “strong price appreciation has mirrored rent growth.”

Two of the properties W.P. Carey recently bought house operations for a company that basically provides the products that turn warehouses into distribution centers. It paid $10 million for a building in Westerville, Ohio, and another in North Wales, Pennsylvania, that are leased to Integrated Warehouse Solutions. The Forth Worth-based company is a roll up of three companies -- Bluff Manufacturing, Nordock and Wesco Industrial Products.

All of the deals involve the owners selling the properties and leasing them back. They include triple-net leases in which the tenant pays for more of the property’s operating expenses. The deal with IWS came with a 20-year lease.

W.P. Carey’s largest latest deal, $24 million, included eight production buildings in the United States and in Mexico from “a leading global manufacturer of electrical wire harnesses, control boxes and other value-added components for a diverse customer base.”

The buildings make up a “significant portion” of the undisclosed company’s North American manufacturing operations. W.P. Carey also has 20-year leases on those buildings.

Its third deal cost the REIT $19 million to acquire a 301,000-square-foot building in Statesville, North Carolina, leased to Front Sport Group, a company that owns athletic apparel brands Badger Sport and Alleson Athletic.

Earlier this year, W.P. Carey bought a fully leased food production plant in an undisclosed location for $44.7 million. It also paid $38 million for a distribution center leased to Memphis-based Orgill, a wholesale supplier to independent hardware stores, at 4925 Tablers Station Road in Inwood, West Virginia.

www.omegare.com

Here's Where US Apartments Are Heading

by Lou Hirsh Costar

Apartment developers are experimenting with new and niche styles, amenities and features to keep project pipelines flowing and new buildings filled with renters, almost a decade into a national economic expansion that propelled the U.S. multifamily market to new heights.

Some developers are doubling down on luxury amenities in large floor plans, while others are emulating the so-called sharing economy with "micro" units built around shared living spaces. Some seek to create quiet getaways, and some meld their projects into larger mixed-use entertainment districts, increasingly tied to professional sports venues, or put them closer to public transit.

Based on input from CoStar analysts nationwide, and in no particular order, here are five apartment projects showing how developers are aiming to serve diverse customer priorities, while dealing with rising costs and other factors challenging their ability to get affordable new housing built.

Dwell at 2nd Street, Philadelphia (Developer: Klein Company)

Developer Klein Co. is betting on the prefab movement to help control costs at its newest project, a 320-unit complex (shown above) in Philadelphia’s emerging Olde Kensington neighborhood. Most of its apartments will be built from modular units prefabricated off-site, according to the developer.

Business consulting firm McKinsey & Co. reports that modular construction in the United States has accelerated project completion timeliness by 20 to 50%, while reducing construction costs by 20% or more. The practice is still relatively uncommon in the apartment industry but could soon show up more often in some markets.

"Philadelphia has some of the highest construction costs of any major U.S. market, and the modular approach is being used to expedite construction time and lower development costs," said Adrian Ponsen, a Philadelphia-based director of analytics for CoStar Group. "You’ll see more projects like these as developers look for innovative ways to maintain their returns in the face of rising construction costs over the long term."

Little has been announced about amenities at the site, which is scheduled to be completed in early 2020.

CitySpaces 500 Kirkham, Oakland, California (Developer: Panoramic Interests)

Higher-density, transit-friendly projects have steadily gained traction in major cities. CitySpaces takes the trend further. Tiny units help to create this massive 1,032-unit "micro-pad" apartment community on three acres in Oakland, California, by Panoramic Interests. The developer’s website notes that its trademarked MicroPad concept is a 160-square-foot, self-contained dwelling with a private bathroom and kitchenette.

The project, which is currently in entitlement phases, is designed to include three buildings made of steel modular units constructed off-site and assembled in place. Plans call for 59 parking spaces to be devoted to car-share services like Zipcar, and the development is adjacent to West Oakland BART station.

Units are stacked to create buildings up to 12 stories tall.

City Club Apartments, Minneapolis (Developer: City Club Apartments LLC)

City Club Apartments in Minneapolis provide an opportunity for residents to stay on the property and grow their accommodations as their financial or life situations change over time, offering a mini-pad for single residents and larger units for growing families.

Set for completion next month, the project is expected to bring the micro-unit concept to a downtown setting, targeting recent college graduates and other young renters. The site comprises 307 units, with about half of those measuring 407 square feet or less. The smallest units are around 360 square feet.

Notably, the complex is designed to have 100 units with one and two bedrooms to accommodate tenants who might eventually want to move beyond the base-sized unit to more roomy accommodations, said Michael Roessle, director of market analytics CoStar Group in Minneapolis.

The project is designed to have 24-hour amenities including a fitness center, conference and business center, and concierge services, outdoor pool, indoor and outdoor theaters and on-site restaurant.

There will be no parking, as many young renters in the urban core don’t own a car and prefer biking and ride-sharing to get to work at several large nearby employers.

Ten Thousand, Los Angeles (Developer: Crescent Heights)

From robot butlers to dog spas, the ultimate in luxury amenities are showcased at this Los Angeles apartment high-rise, which could influence other nearby developers to compete more lavishly for the same high-spending customers.

Opened in 2017 and a potential tone-setter for future surrounding projects, this 40-story tower has drawn national media attention as an example of ultra-high luxury, in a city that has no shortage of conspicuously posh housing arrangements. Located on the border of L.A.’s Century City and the city of Beverly Hills, it has two-bedroom units going for between $10,000 and $30,000 per month, with some penthouses going for double that higher-end figure.

Other developers with similar clientele could be looking to keep up with high-touch services that have included on-site space for botox treatments. The developer’s website points to features including a dog spa, a cold-storage package delivery facility for perishable items and a robot butler named Charley that delivers mini-bar items to residents.

Twelve Cowboys Way, Frisco, Texas (Developer: Columbus Realty Partners)

Renters can live, work and play all on the same property in this Texas development, with "play" in this instance referencing the growing trend of professional sports teams entering the commercial development arena to interact with fans well beyond game times.

Among the latest examples of teams getting into the field of apartment and mixed-use development near their facilities, this 17-story luxury tower is scheduled to open in 2020 next to the suburban headquarters of the National Football League’s Dallas Cowboys.

The project is spearheaded by a group that includes the Cowboys’ Hall-of-Fame former quarterback Roger Staubach, former Cowboys player Robert Shaw and current Cowboys owner Jerry Jones. With rents expected to begin at $2,700 per month, it’s been billed as the first luxury development catering to those Cowboys football diehards, with amenities including exclusive access to certain team facilities.

www.omegare.com

Apartment developers are experimenting with new and niche styles, amenities and features to keep project pipelines flowing and new buildings filled with renters, almost a decade into a national economic expansion that propelled the U.S. multifamily market to new heights.

Some developers are doubling down on luxury amenities in large floor plans, while others are emulating the so-called sharing economy with "micro" units built around shared living spaces. Some seek to create quiet getaways, and some meld their projects into larger mixed-use entertainment districts, increasingly tied to professional sports venues, or put them closer to public transit.

Based on input from CoStar analysts nationwide, and in no particular order, here are five apartment projects showing how developers are aiming to serve diverse customer priorities, while dealing with rising costs and other factors challenging their ability to get affordable new housing built.

Dwell at 2nd Street, Philadelphia (Developer: Klein Company)

Developer Klein Co. is betting on the prefab movement to help control costs at its newest project, a 320-unit complex (shown above) in Philadelphia’s emerging Olde Kensington neighborhood. Most of its apartments will be built from modular units prefabricated off-site, according to the developer.

Business consulting firm McKinsey & Co. reports that modular construction in the United States has accelerated project completion timeliness by 20 to 50%, while reducing construction costs by 20% or more. The practice is still relatively uncommon in the apartment industry but could soon show up more often in some markets.

"Philadelphia has some of the highest construction costs of any major U.S. market, and the modular approach is being used to expedite construction time and lower development costs," said Adrian Ponsen, a Philadelphia-based director of analytics for CoStar Group. "You’ll see more projects like these as developers look for innovative ways to maintain their returns in the face of rising construction costs over the long term."

Little has been announced about amenities at the site, which is scheduled to be completed in early 2020.

CitySpaces 500 Kirkham, Oakland, California (Developer: Panoramic Interests)

Higher-density, transit-friendly projects have steadily gained traction in major cities. CitySpaces takes the trend further. Tiny units help to create this massive 1,032-unit "micro-pad" apartment community on three acres in Oakland, California, by Panoramic Interests. The developer’s website notes that its trademarked MicroPad concept is a 160-square-foot, self-contained dwelling with a private bathroom and kitchenette.

The project, which is currently in entitlement phases, is designed to include three buildings made of steel modular units constructed off-site and assembled in place. Plans call for 59 parking spaces to be devoted to car-share services like Zipcar, and the development is adjacent to West Oakland BART station.

Units are stacked to create buildings up to 12 stories tall.

City Club Apartments, Minneapolis (Developer: City Club Apartments LLC)

City Club Apartments in Minneapolis provide an opportunity for residents to stay on the property and grow their accommodations as their financial or life situations change over time, offering a mini-pad for single residents and larger units for growing families.

Set for completion next month, the project is expected to bring the micro-unit concept to a downtown setting, targeting recent college graduates and other young renters. The site comprises 307 units, with about half of those measuring 407 square feet or less. The smallest units are around 360 square feet.

Notably, the complex is designed to have 100 units with one and two bedrooms to accommodate tenants who might eventually want to move beyond the base-sized unit to more roomy accommodations, said Michael Roessle, director of market analytics CoStar Group in Minneapolis.

The project is designed to have 24-hour amenities including a fitness center, conference and business center, and concierge services, outdoor pool, indoor and outdoor theaters and on-site restaurant.

There will be no parking, as many young renters in the urban core don’t own a car and prefer biking and ride-sharing to get to work at several large nearby employers.

Ten Thousand, Los Angeles (Developer: Crescent Heights)

From robot butlers to dog spas, the ultimate in luxury amenities are showcased at this Los Angeles apartment high-rise, which could influence other nearby developers to compete more lavishly for the same high-spending customers.

Opened in 2017 and a potential tone-setter for future surrounding projects, this 40-story tower has drawn national media attention as an example of ultra-high luxury, in a city that has no shortage of conspicuously posh housing arrangements. Located on the border of L.A.’s Century City and the city of Beverly Hills, it has two-bedroom units going for between $10,000 and $30,000 per month, with some penthouses going for double that higher-end figure.

Other developers with similar clientele could be looking to keep up with high-touch services that have included on-site space for botox treatments. The developer’s website points to features including a dog spa, a cold-storage package delivery facility for perishable items and a robot butler named Charley that delivers mini-bar items to residents.

Twelve Cowboys Way, Frisco, Texas (Developer: Columbus Realty Partners)

Renters can live, work and play all on the same property in this Texas development, with "play" in this instance referencing the growing trend of professional sports teams entering the commercial development arena to interact with fans well beyond game times.

Among the latest examples of teams getting into the field of apartment and mixed-use development near their facilities, this 17-story luxury tower is scheduled to open in 2020 next to the suburban headquarters of the National Football League’s Dallas Cowboys.

The project is spearheaded by a group that includes the Cowboys’ Hall-of-Fame former quarterback Roger Staubach, former Cowboys player Robert Shaw and current Cowboys owner Jerry Jones. With rents expected to begin at $2,700 per month, it’s been billed as the first luxury development catering to those Cowboys football diehards, with amenities including exclusive access to certain team facilities.

www.omegare.com

DePaul Healthcare Sells Senior Living Properties in New Jersey, Philadelphia

A New Jersey chain of senior assisted living facilities has sold three of its properties, one in the Garden State and two in Philadelphia, according to the broker on the deal.

DePaul Healthcare of Sewell, New Jersey, sold the portfolio to Paramount Health Resources, based in McMurray, Pennsylvania, for an undisclosed sum, according to CoStar data.

The three facilities inlcuded in the sale are:

The DePaul family, built and owned the communities for decades. At the time of the sale, the three facilities were operating at break-even, but Paramount plans to implement better marketing and services while "simultaneously creating staffing efficiencies, all of which will increase earnings," according to IPA.

Paramount – which owns and operates senior living facilities in New York, New Jersey, Pennsylvania and Maryland – completed the financing and closed the deal with the assistance of Lazmor Capital and Ziegler Investment Banking.

www.omegare.com

DePaul Healthcare of Sewell, New Jersey, sold the portfolio to Paramount Health Resources, based in McMurray, Pennsylvania, for an undisclosed sum, according to CoStar data.

The three facilities inlcuded in the sale are:

- Absecon Pavilion, which has 162 beds at 1020 Pitney Road in Absecon, New Jersey;

- Angela Jane Pavilion, a 49-bed home at 8410 Roosevelt Blvd. in Philadelphia;

- River’s Edge Nursing and Rehabilitation Center, which has 120 beds at 9501 State Road in Philadelphia.

The DePaul family, built and owned the communities for decades. At the time of the sale, the three facilities were operating at break-even, but Paramount plans to implement better marketing and services while "simultaneously creating staffing efficiencies, all of which will increase earnings," according to IPA.

Paramount – which owns and operates senior living facilities in New York, New Jersey, Pennsylvania and Maryland – completed the financing and closed the deal with the assistance of Lazmor Capital and Ziegler Investment Banking.

www.omegare.com

Metrix-Penwood JV Begins Construction on New Distribution Facility in Lawrenceville

by John Jordan Globest.com

A joint venture of Princeton, NJ Metrix Real Estate Services, LLC and Penwood Real Estate Investment Management, LLC of West Hartford, CT has acquired a 31-acre site here and started construction on a more than 340,000-square-foot distribution facility here.

The joint venture between Metrix Real Estate Services, whose principal is Michael Nachamkin, and an institutional fund managed by Penwood Real Estate Investment Management recently closed on the purchase of 10 Princess Road in Lawrenceville.

Brokers-Simone Realty represented the seller, Capital Health Systems and Transwestern of New Jersey handled negotiations for the purchaser. No financial terms of the transaction were disclosed.

The partnership has since commenced construction on the speculative 10 Princess Logistics development, a 340,400-square-foot distribution facility with 40’ clear ceiling heights, cross loading, trailer storage and abundant parking. The project is scheduled to be completed in the spring of 2020.

“Our development team is very excited about the opportunity to build a state- of- the- art warehouse in Central New Jersey with a great institutional partner,” says Nachamkin, principal of Metrix.

He adds, “We anticipate strong interest in the project from a variety of potential tenants who are planning their expansion or opening up a new location. 10 Princess Logistics Center is located at the Princeton Pike/ I-295 interchange and services Southern, Central and Northern New Jersey as well as the Philadelphia region.”

www.omegare.com

A joint venture of Princeton, NJ Metrix Real Estate Services, LLC and Penwood Real Estate Investment Management, LLC of West Hartford, CT has acquired a 31-acre site here and started construction on a more than 340,000-square-foot distribution facility here.

The joint venture between Metrix Real Estate Services, whose principal is Michael Nachamkin, and an institutional fund managed by Penwood Real Estate Investment Management recently closed on the purchase of 10 Princess Road in Lawrenceville.

Brokers-Simone Realty represented the seller, Capital Health Systems and Transwestern of New Jersey handled negotiations for the purchaser. No financial terms of the transaction were disclosed.

The partnership has since commenced construction on the speculative 10 Princess Logistics development, a 340,400-square-foot distribution facility with 40’ clear ceiling heights, cross loading, trailer storage and abundant parking. The project is scheduled to be completed in the spring of 2020.

“Our development team is very excited about the opportunity to build a state- of- the- art warehouse in Central New Jersey with a great institutional partner,” says Nachamkin, principal of Metrix.

He adds, “We anticipate strong interest in the project from a variety of potential tenants who are planning their expansion or opening up a new location. 10 Princess Logistics Center is located at the Princeton Pike/ I-295 interchange and services Southern, Central and Northern New Jersey as well as the Philadelphia region.”

www.omegare.com

Wednesday, June 26, 2019

Endurance announces the signing of two leases totaling close to 300,000 SF at 2000 Bishops Gate

An affiliate of Endurance Real Estate Group, LLC (“Endurance”) and Thackeray Partners (“Thackeray”) is pleased to announce the signing of two leases with Maintenance Supply Headquarters (“MSH”) and Lean Supply Solutions (“LSS”) which brings the building to 100% occupancy.

“These two lease transactions raise the project’s occupancy to 100%. Achieving stabilization after completing our re-development of the building is a testament to tenant demand for functional, in-fill product in the Southern New Jersey market. We are excited Maintenance Supply chose to relocate their local operations to our facility and happy Lean Supply selected this location to support their expansion onto the East Coast.”

The 292,466 SF building was built in 1997 and renovated in 2018. It is equipped with an ESFR sprinkler system, LED lighting, 32’ clear height, 60’ concrete dock apron, 35 dock doors and 2 drive-in doors, and a 3-phase, 3,200 amp power system

www.omegare.com

“These two lease transactions raise the project’s occupancy to 100%. Achieving stabilization after completing our re-development of the building is a testament to tenant demand for functional, in-fill product in the Southern New Jersey market. We are excited Maintenance Supply chose to relocate their local operations to our facility and happy Lean Supply selected this location to support their expansion onto the East Coast.”

The 292,466 SF building was built in 1997 and renovated in 2018. It is equipped with an ESFR sprinkler system, LED lighting, 32’ clear height, 60’ concrete dock apron, 35 dock doors and 2 drive-in doors, and a 3-phase, 3,200 amp power system

www.omegare.com

Friday, June 21, 2019

E-Commerce Demand Pushes US Warehouse Construction to Record Levels

by John Jordan Globest.com

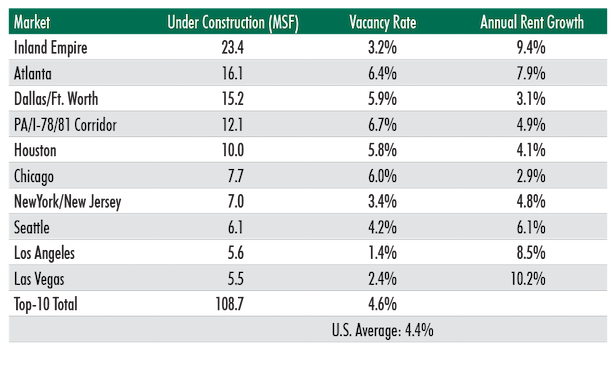

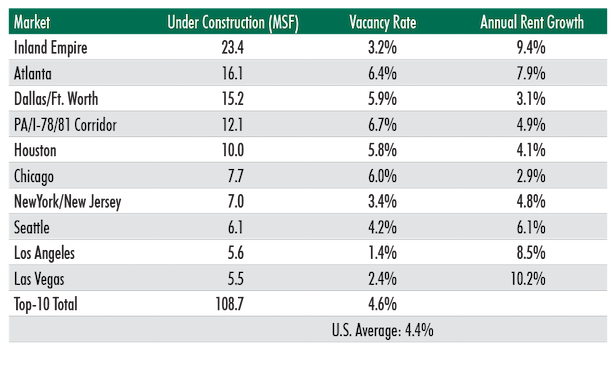

At the end of the first quarter of this year, warehouse construction in the United States reached an unprecedented 255 million square feet, driven in large part by e-commerce demand.

The top 10 warehouse markets were ranked with the Inland Empire, CA leading the way with 23.4 million square feet in the ground and a 3.2% vacancy rate and 9.4% annual rent growth, followed by Atlanta at 16.1 million square feet under construction, a 6.4% vacancy rate and 7.9% annual rent growth and Dallas /Fort Worth, TX at number three at 15.2 million square feet being built, a 5.9% vacancy rate and 3.1%% annual growth.

The New York/NJ and Pennsylvania markets have very active warehouse markets with a combined more than 19 million square feet under construction.

The PA/78/81 Corridor came in at number four in the US with 12.1 million square feet in the ground, a 6.7% vacancy rate and 4.9% annual rent growth.

Ranked at number seven, New York/New Jersey market has 7 million square feet under construction, a 3.4% vacancy rate and 4.8% annual rent growth.

Coming in at number five in the US was Houston at 10 million square feet under construction, a 5.8% vacancy rate and 4.1% annual rent growth.

The City of Chicago came in at number six with 7.7 million square feet being built at the moment, with a 6.0% vacancy rate and 2.9% annual rent growth.

Rounding at the top 10 were: Seattle at 6.1 million square feet in the ground, a 4.2% vacancy rate and 6.1% annual rent growth; Los Angeles with 5.6 million square feet in the ground, a 1.4% vacancy rate and 8.5% rent growth and Las Vegas, which has 5.5 million square feet being built, a 2.4% vacancy rate and 10.2% annual rent growth.

The US average vacancy rate is 4.4%.

Of the 255 million square feet of warehouse space under construction, 70.2% of it is on spec. Since 2015, however, warehouse demand has outpaced new warehouse completions by 169 million square feet and rents have increased by 19.2%.

Five of the top-10 markets for speculative development have market conditions that justify adding more big-box warehouses: vacancy rates below or slightly above the national average (4.4%) and aggregate net asking rent growth of 7.8% annually.

The remaining five markets were well above the national vacancy average and their aggregate rent growth averaged 4.6% due to more available supply.

With demand not likely to diminish, speculative big-box developments in those five markets are expected to lease up shortly after completion. E-commerce, food & beverage, wholesaler and third-party logistics users, which have dominated pre-leasing activity, are the best candidates to occupy these new modern warehouse facilities, they add.

Commenting on the New York/New Jersey industrial markets, “In Northern New Jersey, e-commerce continues to create a huge demand for new distribution space. As online grocery sales continue to grow and given the state’s prime location to major consumer markets and local ports, we anticipate the warehouse vacancy rate to remain low, while rents steadily increase.”

www.omegare.com

At the end of the first quarter of this year, warehouse construction in the United States reached an unprecedented 255 million square feet, driven in large part by e-commerce demand.

The top 10 warehouse markets were ranked with the Inland Empire, CA leading the way with 23.4 million square feet in the ground and a 3.2% vacancy rate and 9.4% annual rent growth, followed by Atlanta at 16.1 million square feet under construction, a 6.4% vacancy rate and 7.9% annual rent growth and Dallas /Fort Worth, TX at number three at 15.2 million square feet being built, a 5.9% vacancy rate and 3.1%% annual growth.

The New York/NJ and Pennsylvania markets have very active warehouse markets with a combined more than 19 million square feet under construction.

The PA/78/81 Corridor came in at number four in the US with 12.1 million square feet in the ground, a 6.7% vacancy rate and 4.9% annual rent growth.

Ranked at number seven, New York/New Jersey market has 7 million square feet under construction, a 3.4% vacancy rate and 4.8% annual rent growth.

Coming in at number five in the US was Houston at 10 million square feet under construction, a 5.8% vacancy rate and 4.1% annual rent growth.

The City of Chicago came in at number six with 7.7 million square feet being built at the moment, with a 6.0% vacancy rate and 2.9% annual rent growth.

Rounding at the top 10 were: Seattle at 6.1 million square feet in the ground, a 4.2% vacancy rate and 6.1% annual rent growth; Los Angeles with 5.6 million square feet in the ground, a 1.4% vacancy rate and 8.5% rent growth and Las Vegas, which has 5.5 million square feet being built, a 2.4% vacancy rate and 10.2% annual rent growth.

The US average vacancy rate is 4.4%.

Of the 255 million square feet of warehouse space under construction, 70.2% of it is on spec. Since 2015, however, warehouse demand has outpaced new warehouse completions by 169 million square feet and rents have increased by 19.2%.

Five of the top-10 markets for speculative development have market conditions that justify adding more big-box warehouses: vacancy rates below or slightly above the national average (4.4%) and aggregate net asking rent growth of 7.8% annually.

The remaining five markets were well above the national vacancy average and their aggregate rent growth averaged 4.6% due to more available supply.

With demand not likely to diminish, speculative big-box developments in those five markets are expected to lease up shortly after completion. E-commerce, food & beverage, wholesaler and third-party logistics users, which have dominated pre-leasing activity, are the best candidates to occupy these new modern warehouse facilities, they add.

Commenting on the New York/New Jersey industrial markets, “In Northern New Jersey, e-commerce continues to create a huge demand for new distribution space. As online grocery sales continue to grow and given the state’s prime location to major consumer markets and local ports, we anticipate the warehouse vacancy rate to remain low, while rents steadily increase.”

www.omegare.com

Thursday, June 20, 2019

Tower Health, Drexel U. College of Medicine Break Ground on New Regional Campus

by John Jordan Globest.com

Construction has begun on a new four-year regional campus for the Drexel University College of Medicine at Tower Health here.

Drexel University College of Medicine at Tower Health, located on Parcel 9 of The Knitting Mills redevelopment, will feature state-of-the-art technology, as well as traditional classrooms, learning communities and lecture halls. The facility, located less than a mile from Reading Hospital, will include traditional and nontraditional instructional venues where students will advance their medical skills and education via simulated patient rooms, anatomy laboratories and simulation labs to promote interdisciplinary education with residents, physicians and nurses.

When fully operational, the campus will have capacity to educate and train 200 medical students. The new campus building will total 150,000 square feet, according to a report in Lehigh Valley Business.

Tower Health and Drexel University held a groundbreaking ceremony on June 17 for the new project. No development cost for the project was disclosed.

Clint Matthews, Tower Health President and CEO, said of the new campus initiative, “Tower Health is focused on taking care of all the communities we serve. Our collaboration with Drexel University further enhances our ongoing commitment to our academic mission by educating the physicians of tomorrow while also having a positive economic impact in Berks County.”

At the new building, students will have access to a fitness center with indoor and outdoor recreation space, Information Commons (Library), lounge areas, a game room and café.

Drexel University states that its medical students will benefit from the addition of a new regional campus in an area that is experiencing economic growth, while studying medicine at the largest hospital between Philadelphia and Pittsburgh. “Our relationship with Tower Health and this four-year regional campus creates an excellent destination for our medical students to build the emerging skills required by today’s physicians to meet the ever-growing needs within health care,” said Drexel University president John Fry.

Tower Health and Drexel University first announced plans to develop a regional campus near Reading Hospital in April 2018. Parcel 9 of The Knitting Mills was selected as the future home of Drexel University College of Medicine at Tower Health in October 2018. A 20-year academic agreement was signed between the two organizations in February 2019, and on May 29, 2019, 20, third-year medical students began their core clinical rotations at Reading Hospital.

With more than 12,000 team members, Tower Health consists of Reading Hospital in West Reading; Brandywine Hospital in Coatesville; Chestnut Hill Hospital in Philadelphia; Jennersville Hospital in West Grove; Phoenixville Hospital in Phoenixville and Pottstown Hospital in Pottstown. It also includes Reading Hospital Rehabilitation at Wyomissing; Reading Hospital School of Health Sciences in West Reading; home healthcare services provided by Tower Health at Home; and a network of 22 urgent care facilities across the Tower Health service area. Tower Health offers a connected network of 2,000 physicians, specialists and providers across 125 locations.

www.omegare.com

Construction has begun on a new four-year regional campus for the Drexel University College of Medicine at Tower Health here.

Drexel University College of Medicine at Tower Health, located on Parcel 9 of The Knitting Mills redevelopment, will feature state-of-the-art technology, as well as traditional classrooms, learning communities and lecture halls. The facility, located less than a mile from Reading Hospital, will include traditional and nontraditional instructional venues where students will advance their medical skills and education via simulated patient rooms, anatomy laboratories and simulation labs to promote interdisciplinary education with residents, physicians and nurses.

When fully operational, the campus will have capacity to educate and train 200 medical students. The new campus building will total 150,000 square feet, according to a report in Lehigh Valley Business.

Tower Health and Drexel University held a groundbreaking ceremony on June 17 for the new project. No development cost for the project was disclosed.

Clint Matthews, Tower Health President and CEO, said of the new campus initiative, “Tower Health is focused on taking care of all the communities we serve. Our collaboration with Drexel University further enhances our ongoing commitment to our academic mission by educating the physicians of tomorrow while also having a positive economic impact in Berks County.”

At the new building, students will have access to a fitness center with indoor and outdoor recreation space, Information Commons (Library), lounge areas, a game room and café.

Drexel University states that its medical students will benefit from the addition of a new regional campus in an area that is experiencing economic growth, while studying medicine at the largest hospital between Philadelphia and Pittsburgh. “Our relationship with Tower Health and this four-year regional campus creates an excellent destination for our medical students to build the emerging skills required by today’s physicians to meet the ever-growing needs within health care,” said Drexel University president John Fry.

Tower Health and Drexel University first announced plans to develop a regional campus near Reading Hospital in April 2018. Parcel 9 of The Knitting Mills was selected as the future home of Drexel University College of Medicine at Tower Health in October 2018. A 20-year academic agreement was signed between the two organizations in February 2019, and on May 29, 2019, 20, third-year medical students began their core clinical rotations at Reading Hospital.

With more than 12,000 team members, Tower Health consists of Reading Hospital in West Reading; Brandywine Hospital in Coatesville; Chestnut Hill Hospital in Philadelphia; Jennersville Hospital in West Grove; Phoenixville Hospital in Phoenixville and Pottstown Hospital in Pottstown. It also includes Reading Hospital Rehabilitation at Wyomissing; Reading Hospital School of Health Sciences in West Reading; home healthcare services provided by Tower Health at Home; and a network of 22 urgent care facilities across the Tower Health service area. Tower Health offers a connected network of 2,000 physicians, specialists and providers across 125 locations.

www.omegare.com

Wednesday, June 19, 2019

WeWork to Open Fifth Location in Philadelphia

Shared office space provider WeWork has signed a 50,514-square-foot lease Class A office building in Philadelphia.

The eight-story building at 1100 Ludlow St. in Philadelphia’s East Market development totals 227,313 square feet. Built in 1920, the landlords recently tapped Morris Adjmi and BLT Architects to transform and improve the facade of the facility.

The modernized exterior features Adjmi’s signature grid design, and the "post-industrial style" emulated in the facade and interior is helping to create the dynamic urban neighborhood that will connect Midtown Village with the business district along Market Street. 1100 Ludlow is located in the heart of Philadelphia’s City Center with proximity to City Hall, Chinatown and public transportation.

WeWork’s lease includes the entire top two floors of the 4-Star building, which is the company's fifth location in the city. The coworking company is also located at 1000-1010 N Hancock St., 1430 Walnut St., 1601 Market St. and 1900 Market St.

www.omegare.com

The eight-story building at 1100 Ludlow St. in Philadelphia’s East Market development totals 227,313 square feet. Built in 1920, the landlords recently tapped Morris Adjmi and BLT Architects to transform and improve the facade of the facility.

The modernized exterior features Adjmi’s signature grid design, and the "post-industrial style" emulated in the facade and interior is helping to create the dynamic urban neighborhood that will connect Midtown Village with the business district along Market Street. 1100 Ludlow is located in the heart of Philadelphia’s City Center with proximity to City Hall, Chinatown and public transportation.

WeWork’s lease includes the entire top two floors of the 4-Star building, which is the company's fifth location in the city. The coworking company is also located at 1000-1010 N Hancock St., 1430 Walnut St., 1601 Market St. and 1900 Market St.

www.omegare.com

Tuesday, June 18, 2019

Ventas to Move Forward with $800M in New University-Based Research & Innovation Developments

by John Jordan Globest.com

Locally-based Ventas Inc. announced on Monday four new university-based research and innovation developments in partnership with Wexford Science & Technology, LLC of Baltimore valued at approximately $800 million.

The four Ventas-Wexford projects are located in Pittsburgh, Philadelphia and St. Louis and are part of Ventas’ near-term $1.5 billion R&I pipeline of expected new projects previously announced by Ventas.

The four projects include the development of a $280-million research, academic medicine and innovation hub anchored by University of Pittsburgh to house ground-breaking immunotherapy research in collaboration with the University of Pittsburgh Medical Center and co-located with UPMC’s Shadyside Hospital. The project totals 350,000 square feet and will house the Immune Transplant and Therapy Center.

The development is expected open in two phases, with the first and second phase expected to be completed in 2021. The full project is 70% pre-leased.

Ventas also reports two new projects in the City of Philadelphia. The first is a a new development that expands the Philadelphia uCity Square Knowledge Community associated with the University of Pennsylvania. Also in uCity Square, Vexel will develop a state of the art College of Nursing and Health Professionals for Drexel University. These two projects will total $400 million and 650,000 square feet.

Ventas expects the College of Nursing and Health Professions, Drexel University, to open in 2022. The firm anticipates that the Knowledge Community at uCity Square will open in early 2022. Ventas owns four buildings in the uCity sub-market that are nearly 100% leased.

The final project announced by Ventas calls for the expansion of the vibrant Cortex Innovation Community associated with Washington University in St. Louis. The $115-million, 320,000-square-foot development is located in the Cortex Innovation Community. The new development adds to Ventas’s Cortex R&I portfolio of four owned buildings totaling more than 700,000 square feet, which are nearly 100% occupied.

The projects are 40% pre-leased and are expected to generate more than a 7% cash yield, and over an 8% GAAP yield, upon stabilization.

Combined with a $77-million project announced in late February with Arizona State University, Ventas has now announced a total of $900 million in new projects that add approximately 1.5 million square feet to its portfolio.

“Ventas and Wexford are proud to partner with leading research universities, health systems, academic medical centers, life science companies and entrepreneurs in the creation of Knowledge Communities and innovation hubs. We are committed to collaborating with and supporting these world-class research institutions, pioneers in biomedical research, academic medicine leaders and innovators as they develop life-changing therapies, conduct groundbreaking scientific research, and train clinicians to improve the lives of millions of patients as the population rapidly ages,” says Debra A. Cafaro, Ventas chairman and CEO.

Ventas currently has relationships with more than 15 leading research universities in its R&I portfolio. Pro forma for announced developments, Ventas’s R&I portfolio will total nearly eight million square feet and is expected to generate approximately $230 million in annual net operating income upon stabilization of announced new developments.

www.omegare.com

Locally-based Ventas Inc. announced on Monday four new university-based research and innovation developments in partnership with Wexford Science & Technology, LLC of Baltimore valued at approximately $800 million.

The four Ventas-Wexford projects are located in Pittsburgh, Philadelphia and St. Louis and are part of Ventas’ near-term $1.5 billion R&I pipeline of expected new projects previously announced by Ventas.

The four projects include the development of a $280-million research, academic medicine and innovation hub anchored by University of Pittsburgh to house ground-breaking immunotherapy research in collaboration with the University of Pittsburgh Medical Center and co-located with UPMC’s Shadyside Hospital. The project totals 350,000 square feet and will house the Immune Transplant and Therapy Center.

The development is expected open in two phases, with the first and second phase expected to be completed in 2021. The full project is 70% pre-leased.

Ventas also reports two new projects in the City of Philadelphia. The first is a a new development that expands the Philadelphia uCity Square Knowledge Community associated with the University of Pennsylvania. Also in uCity Square, Vexel will develop a state of the art College of Nursing and Health Professionals for Drexel University. These two projects will total $400 million and 650,000 square feet.

Ventas expects the College of Nursing and Health Professions, Drexel University, to open in 2022. The firm anticipates that the Knowledge Community at uCity Square will open in early 2022. Ventas owns four buildings in the uCity sub-market that are nearly 100% leased.

The final project announced by Ventas calls for the expansion of the vibrant Cortex Innovation Community associated with Washington University in St. Louis. The $115-million, 320,000-square-foot development is located in the Cortex Innovation Community. The new development adds to Ventas’s Cortex R&I portfolio of four owned buildings totaling more than 700,000 square feet, which are nearly 100% occupied.

The projects are 40% pre-leased and are expected to generate more than a 7% cash yield, and over an 8% GAAP yield, upon stabilization.

Combined with a $77-million project announced in late February with Arizona State University, Ventas has now announced a total of $900 million in new projects that add approximately 1.5 million square feet to its portfolio.

“Ventas and Wexford are proud to partner with leading research universities, health systems, academic medical centers, life science companies and entrepreneurs in the creation of Knowledge Communities and innovation hubs. We are committed to collaborating with and supporting these world-class research institutions, pioneers in biomedical research, academic medicine leaders and innovators as they develop life-changing therapies, conduct groundbreaking scientific research, and train clinicians to improve the lives of millions of patients as the population rapidly ages,” says Debra A. Cafaro, Ventas chairman and CEO.

Ventas currently has relationships with more than 15 leading research universities in its R&I portfolio. Pro forma for announced developments, Ventas’s R&I portfolio will total nearly eight million square feet and is expected to generate approximately $230 million in annual net operating income upon stabilization of announced new developments.

www.omegare.com

Monday, June 17, 2019

Chestnut Funds, Anchor Health Properties Sell Rittenhouse Square Facility

Chestnut Funds and Anchor Health Properties sold a Class B medical office building in the Rittenhouse Square submarket of Philadelphia to a private investor for an undisclosed price.

The 50,000-square-foot facility at 1740 South St. is adjacent to the Penn Medicine Rittenhouse campus, which comprises a 96-bed hospital, licensed through the Hospital of the University of Pennsylvania. Built in 1986 and renovated in 2010, the facility is 97% leased to a diverse mix of private physician groups.

"Philadelphia is home to one of the nation’s largest concentrations of healthcare and higher education institutions, including the adjacent UPenn Health System, the oldest health system in the country; and 9th top-ranked in 2018. Yet, relative to other U.S. cities, health systems own more of their outpatient real estate, leaving fewer ownership opportunities for medical office investors. This creates very strong demand for quality healthcare assets in and around Philadelphia when those opportunities sporadically arise," Appel said in a statement.

www.omegare.com

The 50,000-square-foot facility at 1740 South St. is adjacent to the Penn Medicine Rittenhouse campus, which comprises a 96-bed hospital, licensed through the Hospital of the University of Pennsylvania. Built in 1986 and renovated in 2010, the facility is 97% leased to a diverse mix of private physician groups.

"Philadelphia is home to one of the nation’s largest concentrations of healthcare and higher education institutions, including the adjacent UPenn Health System, the oldest health system in the country; and 9th top-ranked in 2018. Yet, relative to other U.S. cities, health systems own more of their outpatient real estate, leaving fewer ownership opportunities for medical office investors. This creates very strong demand for quality healthcare assets in and around Philadelphia when those opportunities sporadically arise," Appel said in a statement.

www.omegare.com

Friday, June 14, 2019

Dranoff Breaks Ground on $253M Tower Project in Downtown Philadelphia

by John Jordan Globest.com

Dranoff Properties broke ground earlier this week on its latest project, a 47-story condominium tower located at Broad and Spruce streets, across from the Kimmel Center for the Performing Arts.

The $253-million Arthaus condo tower will feature 108 units, more than 36,000 square feet of amenities, including a rooftop greenhouse, and more than 4,200 square feet of ground floor retail.

Designed by Philadelphia-native Eugene Kohn of Kohn Pedersen Fox Associates, is scheduled for initial occupancy in the fall of 2021.

“Arthaus is a no-compromise, single-purpose tower that punctuates the Philadelphia skyline with luxurious living and unmatched amenities,” said Carl Dranoff, CEO, Dranoff Properties. “We are bringing Philadelphia something it has never seen before—a greenhouse with extraordinary outdoor amenities—we’re giving our residents their own park in the sky.”

Dranoff Properties groundbreaking event on Tuesday featured a host of dignitaries, including: Ed Rendell, former Governor of Pennsylvania; Philadelphia Mayor Jim Kenney; Eugene Kohn, founder and chairman of Kohn Pedersen Fox Associates; Councilman Mark Squilla and others.

“Carl Dranoff has a track record of reshaping and rejuvenating neighborhoods and cities,” said Philadelphia Mayor Jim Kenney. “For decades he has pioneered areas like Old City, Fitler Square and the Avenue of the Arts and transformed them into highly desirable residential destinations. A prominent skyscraper like Arthaus furthers his deep commitment to Philadelphia and solidifies our position as a world-class city.”

The building’s design was inspired by the Bauhaus movement—a period of architecture that stressed form and function over excess and decoration, the developer notes. The Arthaus tower will offer high ceilings, floor-to-ceiling windows, wide-plank oak flooring and oversized balconies with panoramic views from each corner unit, Dranoff Properties states.

Building amenities will include a 75-foot indoor lap pool and state-of-the-art fitness center overlooking the Kimmel Center, a library, board room, club room, a dining salon, café with demonstration kitchen and kids’ playroom. In addition, Arthaus will offer a 24-hour concierge, valet services and a chauffeur-driven town car.

www.omegare.com

Dranoff Properties broke ground earlier this week on its latest project, a 47-story condominium tower located at Broad and Spruce streets, across from the Kimmel Center for the Performing Arts.

The $253-million Arthaus condo tower will feature 108 units, more than 36,000 square feet of amenities, including a rooftop greenhouse, and more than 4,200 square feet of ground floor retail.

Designed by Philadelphia-native Eugene Kohn of Kohn Pedersen Fox Associates, is scheduled for initial occupancy in the fall of 2021.

“Arthaus is a no-compromise, single-purpose tower that punctuates the Philadelphia skyline with luxurious living and unmatched amenities,” said Carl Dranoff, CEO, Dranoff Properties. “We are bringing Philadelphia something it has never seen before—a greenhouse with extraordinary outdoor amenities—we’re giving our residents their own park in the sky.”

Dranoff Properties groundbreaking event on Tuesday featured a host of dignitaries, including: Ed Rendell, former Governor of Pennsylvania; Philadelphia Mayor Jim Kenney; Eugene Kohn, founder and chairman of Kohn Pedersen Fox Associates; Councilman Mark Squilla and others.

“Carl Dranoff has a track record of reshaping and rejuvenating neighborhoods and cities,” said Philadelphia Mayor Jim Kenney. “For decades he has pioneered areas like Old City, Fitler Square and the Avenue of the Arts and transformed them into highly desirable residential destinations. A prominent skyscraper like Arthaus furthers his deep commitment to Philadelphia and solidifies our position as a world-class city.”

The building’s design was inspired by the Bauhaus movement—a period of architecture that stressed form and function over excess and decoration, the developer notes. The Arthaus tower will offer high ceilings, floor-to-ceiling windows, wide-plank oak flooring and oversized balconies with panoramic views from each corner unit, Dranoff Properties states.

Building amenities will include a 75-foot indoor lap pool and state-of-the-art fitness center overlooking the Kimmel Center, a library, board room, club room, a dining salon, café with demonstration kitchen and kids’ playroom. In addition, Arthaus will offer a 24-hour concierge, valet services and a chauffeur-driven town car.

www.omegare.com

Dermody Adds Logistics Property in Central New Jersey

by John Jordan Globest.com

Dermody Properties has acquired 150 Milford Road, a more than 600,000-square-foot logistics building, here.

The Reno, NV-based private equity real estate investment, development and management company plans to undertake building upgrades that will make a total of 615,000 square feet ready for occupancy in 2020. No financial details of the transaction were disclosed.

The building, located on 51.49 acres, was originally built in 1998 with a warehouse expansion added in 2003. The building features 28 trailer parking positions, 413 car parking stalls, 41 dock doors, two drive-in doors and a 36-foot clear height in the warehouse addition, making it well-suited for e-commerce operations, Dermody states.

“This new acquisition fits well with Dermody Properties’ strategy to procure logistics real estate in key markets across the nation,” says Douglas A. Kiersey, Jr., president of Dermody Properties. “The asset provides an opportunity for our customers to grow their logistics network in one of the tightest submarkets in the country.”

The building is less than a mile away from the New Jersey Turnpike and Route 33 and is located within 45 miles of Newark Liberty International Airport, Port Newark and Port Elizabeth.

Eugene Preston, East Region partner for Dermody Properties, adds, “The building represents one of the largest blocks of available space in the Central New Jersey industrial market.”

Dermody has been active in the Pennsylvania/New Jersey industrial market of late. The deal for the East Windsor, NJ property comes less than a month after the firm broke ground on two buildings at a 557,820-square-foot complex located 80 miles from the Port of New York and New Jersey in Wind Gap, PA.

The firm’s LogistiCenter at Lehigh Valley East will be located at 450 East Moorestown Road in the Northampton County submarket. Construction of the first building is scheduled to be complete in the fourth quarter of 2019. The second building will be completed in early 2020.

Last month, Dermody Properties also announced that it recently broke ground on a 251,800-square-foot distribution center in the North Las Vegas submarket of southern Nevada. It will be located at 6565 Nascar St. on a 14-acre parcel and will be called LogistiCenter at Speedway. Dermody estimates that construction will be completed by first quarter of 2020.

www.omegare.com

Dermody Properties has acquired 150 Milford Road, a more than 600,000-square-foot logistics building, here.

The Reno, NV-based private equity real estate investment, development and management company plans to undertake building upgrades that will make a total of 615,000 square feet ready for occupancy in 2020. No financial details of the transaction were disclosed.

The building, located on 51.49 acres, was originally built in 1998 with a warehouse expansion added in 2003. The building features 28 trailer parking positions, 413 car parking stalls, 41 dock doors, two drive-in doors and a 36-foot clear height in the warehouse addition, making it well-suited for e-commerce operations, Dermody states.

“This new acquisition fits well with Dermody Properties’ strategy to procure logistics real estate in key markets across the nation,” says Douglas A. Kiersey, Jr., president of Dermody Properties. “The asset provides an opportunity for our customers to grow their logistics network in one of the tightest submarkets in the country.”

The building is less than a mile away from the New Jersey Turnpike and Route 33 and is located within 45 miles of Newark Liberty International Airport, Port Newark and Port Elizabeth.

Eugene Preston, East Region partner for Dermody Properties, adds, “The building represents one of the largest blocks of available space in the Central New Jersey industrial market.”

Dermody has been active in the Pennsylvania/New Jersey industrial market of late. The deal for the East Windsor, NJ property comes less than a month after the firm broke ground on two buildings at a 557,820-square-foot complex located 80 miles from the Port of New York and New Jersey in Wind Gap, PA.

The firm’s LogistiCenter at Lehigh Valley East will be located at 450 East Moorestown Road in the Northampton County submarket. Construction of the first building is scheduled to be complete in the fourth quarter of 2019. The second building will be completed in early 2020.

Last month, Dermody Properties also announced that it recently broke ground on a 251,800-square-foot distribution center in the North Las Vegas submarket of southern Nevada. It will be located at 6565 Nascar St. on a 14-acre parcel and will be called LogistiCenter at Speedway. Dermody estimates that construction will be completed by first quarter of 2020.

www.omegare.com

FCP Re-Enters Philadelphia With $118M Acquisition

by By Erika Morphy Globest.com

FCP has re-entered the Philadelphia market with the $117.9 million acquisition of a luxury high-rise apartment. The 286-unit property is called Edgewater and is located at 2323 Race St. in the Center City submarket. The sellers were institutional investors advised by J.P. Morgan Asset Management.

The purchase price includes excess land that can be developed, a stand-alone parking garage (in addition to parking beneath the building) and a revenue producing billboard along I-676.

The acquisition of Edgewater is FCP’s fourth Center City Philadelphia investment and its first deal in the city in a long time. Other investments, such as the adaptive re-use projects, The Arch and ICON 1616, both in the downtown market, have been exited.

The sale is indicative of the firm’s very active multifamily acquisition activity over the past 12 months with 4,766 units acquired throughout the US.

“Strong job growth, extraordinary walkability and the continued evolution of Center City into a complete live/work/play downtown make Philadelphia an attractive market,” said FCP Associate, Drew Schwartz in a prepared statement.

Schwartz said that FCP was able to close the transaction with all cash and didn’t obtain a loan.

www.omegare.com

FCP has re-entered the Philadelphia market with the $117.9 million acquisition of a luxury high-rise apartment. The 286-unit property is called Edgewater and is located at 2323 Race St. in the Center City submarket. The sellers were institutional investors advised by J.P. Morgan Asset Management.

The purchase price includes excess land that can be developed, a stand-alone parking garage (in addition to parking beneath the building) and a revenue producing billboard along I-676.

The acquisition of Edgewater is FCP’s fourth Center City Philadelphia investment and its first deal in the city in a long time. Other investments, such as the adaptive re-use projects, The Arch and ICON 1616, both in the downtown market, have been exited.

The sale is indicative of the firm’s very active multifamily acquisition activity over the past 12 months with 4,766 units acquired throughout the US.

“Strong job growth, extraordinary walkability and the continued evolution of Center City into a complete live/work/play downtown make Philadelphia an attractive market,” said FCP Associate, Drew Schwartz in a prepared statement.

Schwartz said that FCP was able to close the transaction with all cash and didn’t obtain a loan.

www.omegare.com

Hackensack Meridian Health to Build $714M Medical Pavilion

by John Jordan Globest.com

Officials with the Hackensack Meridian Health Hackensack University Medical Center unveiled plans on Thursday to build a new 530,000-square-foot state-of-the-art medical pavilion along Second Street here.

Construction on the $714-million project is expected to begin in 2022. The new pavilion that will total 438,000 square feet of usable space will feature nine floors of cutting-edge technology and a design to provide patients and families with world-class acute care, while enhancing comfort and privacy, Hackensack Meridian states.

“This large-scale, innovative project will truly transform the Hackensack University Medical Center campus, preparing us to effectively meet the growing needs of our patients and the communities we serve,” says Robert C. Garrett, FACHE, CEO of Hackensack Meridian Health. “As Bergen County’s first hospital and the largest provider of inpatient and outpatient services in the state, Hackensack University Medical Center has always been setting the standard for excellence in health care. This is a major investment to elevate our best-in-class health care services and modernize our facilities to ensure we are providing patients the world-class, cutting-edge care they deserve.”

Hackensack University Medical Center is the primary teaching site for the Hackensack Meridian School of Medicine at Seton Hall University. Hackensack University Medical Center’s renovation, expansion and modernization plans will ensure its campus will be able to accommodate the growing needs of the region and continue operating at the highest standards. The new pavilion, which spans Second Street, will become the largest building on campus.

Hackensack University Medical Center is prioritizing the enhancement of the patient experience and states that it will privatize and modernize all of its patient rooms over the next 10 years. The new pavilion is the first step in that process and will feature 24 new operating rooms, new and improved Intensive Care Unit beds, as well as three floors of private patient rooms. In addition, the building will include: a new Second Street entrance/visitor lobby, a visitor center, a new central sterile processing department, 24 operating rooms including an intraoperative MRI, 50 ICU beds, shell space for an additional 25 ICUs, 100 medical-surgical beds and a 50 bed Orthopedic Institute.

Gordon N. Litwin, Esq., chair, Hackensack Meridian Health Board of Trustees, says, “This new pavilion will provide an enhanced patient experience, while preserving the privacy, respect and dignity our patients and families deserve. Our patients are at the heart of the work we do, and we will continue to pursue groundbreaking initiatives that advance the network’s world-class, patient- and family-centered care well into the future.”

RSC Architects of Hackensack is the lead architect and is partnered with EYP Architects of Houston. Stantec Consulting is providing project management services/owner’s representative services for the overall project. The W.M. Blanchard and Turner Construction Company have created a joint venture to provide construction management services for the project.

Hackensack University Medical Center is the largest employer in Bergen County with more than 8,000 employees. It will continue to maintain 781 beds even after the new pavilion project is completed.

Hackensack Meridian Health comprises 17 hospitals from Bergen to Ocean counties, which includes three academic medical centers—Hackensack University Medical Center in Hackensack, Jersey Shore University Medical Center in Neptune, JFK Medical Center in Edison; two children’s hospitals: Joseph M. Sanzari Children’s Hospital in Hackensack, K. Hovnanian Children’s Hospital in Neptune; nine community hospitals: Ocean Medical Center in Brick, Riverview Medical Center in Red Bank, Mountainside Medical Center in Montclair, Palisades Medical Center in North Bergen, Raritan Bay Medical Center in Perth Amboy, Southern Ocean Medical Center in Manahawkin, Bayshore Medical Center in Holmdel, Raritan Bay Medical Center in Old Bridge, and Pascack Valley Medical Center in Westwood; a behavioral health hospital – Carrier Clinic in Belle Mead; and two rehabilitation hospitals – JFK Johnson Rehabilitation Institute in Edison and Shore Rehabilitation Institute in Brick.

The network has more than 500 patient care locations throughout New Jersey, which include ambulatory care centers, surgery centers, home health services, long-term care and assisted living communities, ambulance services, lifesaving air medical transportation, fitness and wellness centers, rehabilitation centers, urgent care centers and physician practice locations.

www.omegare.com

Officials with the Hackensack Meridian Health Hackensack University Medical Center unveiled plans on Thursday to build a new 530,000-square-foot state-of-the-art medical pavilion along Second Street here.

Construction on the $714-million project is expected to begin in 2022. The new pavilion that will total 438,000 square feet of usable space will feature nine floors of cutting-edge technology and a design to provide patients and families with world-class acute care, while enhancing comfort and privacy, Hackensack Meridian states.

“This large-scale, innovative project will truly transform the Hackensack University Medical Center campus, preparing us to effectively meet the growing needs of our patients and the communities we serve,” says Robert C. Garrett, FACHE, CEO of Hackensack Meridian Health. “As Bergen County’s first hospital and the largest provider of inpatient and outpatient services in the state, Hackensack University Medical Center has always been setting the standard for excellence in health care. This is a major investment to elevate our best-in-class health care services and modernize our facilities to ensure we are providing patients the world-class, cutting-edge care they deserve.”

Hackensack University Medical Center is the primary teaching site for the Hackensack Meridian School of Medicine at Seton Hall University. Hackensack University Medical Center’s renovation, expansion and modernization plans will ensure its campus will be able to accommodate the growing needs of the region and continue operating at the highest standards. The new pavilion, which spans Second Street, will become the largest building on campus.

Hackensack University Medical Center is prioritizing the enhancement of the patient experience and states that it will privatize and modernize all of its patient rooms over the next 10 years. The new pavilion is the first step in that process and will feature 24 new operating rooms, new and improved Intensive Care Unit beds, as well as three floors of private patient rooms. In addition, the building will include: a new Second Street entrance/visitor lobby, a visitor center, a new central sterile processing department, 24 operating rooms including an intraoperative MRI, 50 ICU beds, shell space for an additional 25 ICUs, 100 medical-surgical beds and a 50 bed Orthopedic Institute.

Gordon N. Litwin, Esq., chair, Hackensack Meridian Health Board of Trustees, says, “This new pavilion will provide an enhanced patient experience, while preserving the privacy, respect and dignity our patients and families deserve. Our patients are at the heart of the work we do, and we will continue to pursue groundbreaking initiatives that advance the network’s world-class, patient- and family-centered care well into the future.”

RSC Architects of Hackensack is the lead architect and is partnered with EYP Architects of Houston. Stantec Consulting is providing project management services/owner’s representative services for the overall project. The W.M. Blanchard and Turner Construction Company have created a joint venture to provide construction management services for the project.

Hackensack University Medical Center is the largest employer in Bergen County with more than 8,000 employees. It will continue to maintain 781 beds even after the new pavilion project is completed.

Hackensack Meridian Health comprises 17 hospitals from Bergen to Ocean counties, which includes three academic medical centers—Hackensack University Medical Center in Hackensack, Jersey Shore University Medical Center in Neptune, JFK Medical Center in Edison; two children’s hospitals: Joseph M. Sanzari Children’s Hospital in Hackensack, K. Hovnanian Children’s Hospital in Neptune; nine community hospitals: Ocean Medical Center in Brick, Riverview Medical Center in Red Bank, Mountainside Medical Center in Montclair, Palisades Medical Center in North Bergen, Raritan Bay Medical Center in Perth Amboy, Southern Ocean Medical Center in Manahawkin, Bayshore Medical Center in Holmdel, Raritan Bay Medical Center in Old Bridge, and Pascack Valley Medical Center in Westwood; a behavioral health hospital – Carrier Clinic in Belle Mead; and two rehabilitation hospitals – JFK Johnson Rehabilitation Institute in Edison and Shore Rehabilitation Institute in Brick.

The network has more than 500 patient care locations throughout New Jersey, which include ambulatory care centers, surgery centers, home health services, long-term care and assisted living communities, ambulance services, lifesaving air medical transportation, fitness and wellness centers, rehabilitation centers, urgent care centers and physician practice locations.

www.omegare.com

Thursday, June 13, 2019

Alliance Partners Secures Financing for SoNo Project

Alliance Partners secured permanent financing for the leasehold interest in the SoNo building, a 186,000-square-foot, mixed-use property in Philadelphia.

The redeveloped project at 456 N. 5th St. is fully leased to three tenants including Yards Brewing Company, 70,000 square feet; City of Philadelphia's Archives Department, 68,000 square feet; and Target, 48,000 square feet.

"We are pleased to work with our client, Alliance Partners, on the refinancing of their SoNo development. The combination of an exceptional redevelopment, high-quality tenancy and strong sponsorship allowed for easy execution of this financing assignment."

Since inception in 2009, Alliance, the East Coast operating platform of The Shidler Group, has acquired, developed and redeveloped more than $1 billion of commercial properties with acquisition prices ranging from $5 million to $125 million, according to its website.

www.omegare.com

The redeveloped project at 456 N. 5th St. is fully leased to three tenants including Yards Brewing Company, 70,000 square feet; City of Philadelphia's Archives Department, 68,000 square feet; and Target, 48,000 square feet.

"We are pleased to work with our client, Alliance Partners, on the refinancing of their SoNo development. The combination of an exceptional redevelopment, high-quality tenancy and strong sponsorship allowed for easy execution of this financing assignment."

Since inception in 2009, Alliance, the East Coast operating platform of The Shidler Group, has acquired, developed and redeveloped more than $1 billion of commercial properties with acquisition prices ranging from $5 million to $125 million, according to its website.

www.omegare.com

Rutgers Begins Construction on Adult Autism Services' Facility in New Brunswick

by John Jordan Globeest.com

Rutgers University has announced the start of construction on its new Rutgers Center for Adult Autism Services building here.

A groundbreaking ceremony was held for the $9.5-million project on Monday. The university notes that the building, when completed next year, will be the first of its kind at a higher education institution in the United States. The new building will allow the center to more than double its capacity from 12 to 30 participants. The center, located on the Douglass Campus of Rutgers University-New Brunswick, is being financed by philanthropic funds.

“This center will have a lasting impact on the lives of adults with autism in New Jersey and across the country,” Rutgers President Robert L. Barchi said at the groundbreaking event.

The Rutgers Center for Adult Autism Services was founded in 2016 and serves adults with autism by providing meaningful, paid employment and integration into the Rutgers community. The new facility will include vocational and life skills teaching areas, high-tech meeting rooms and amenities intended to provide a welcoming environment for program participants and other members of the surrounding community, including Rutgers students, faculty and staff, the university states.

Mel Karmazin, the former CEO of Sirius XM Radio, was a key leader in fundraising for the project along with his daughter Dina Karmazin Elkins, executive director of the Mel Karmazin Foundation. Dina Karmazin’s son, Hunter, was diagnosed with autism at age two, and the Karmazin Foundation has been active in autism causes.

“What would be a better place to house a center that would create jobs for adults on the spectrum than a college campus?” Mel Karmazin said at the groundbreaking.

Christopher Manente, executive director of the center, says, “The RCAAS exists to stand for those adults on the spectrum who are not always able to stand up for themselves, and whenever possible it also exists to amplify the voices of those who can.”

He adds, “Today, I call on all of you to stand with us in opposition to the lack of awareness and the general indifference that the rest of the world continues to show in response to the crisis impacting adults with autism and their families. Today, I ask that all of you help us change the world.

Autism and autism spectrum disorder are among the fastest-growing developmental disabilities in the United States. Rutgers-New Brunswick’s Graduate School of Applied and Professional Psychology created the center to address the well-documented shortage of quality services that help adults with autism lead meaningful and productive lives, and to conduct research that can inform the development of other programs for adults with autism.