Tuesday, October 31, 2023

More Flight to Quality: LevLane relocates and downsizes Center City offices

By Paul Schwedelson – Reporter, Philadelphia Business Journal

LevLane has relocated its Center City headquarters to One Logan Square, departing its longtime home in the Wanamaker building as the troubled office property continues to lose tenants.

After almost two decades at the historic Wanamaker, LevLane joins the growing number of businesses downsizing their space and moving to more attractive office properties following the shift to hybrid and remote work arrangements.

The advertising agency moved into its new offices at One Logan this month after departing the Wanamaker over the summer, reducing its space from 13,914 square feet to 7,373 square feet on a nine-year lease. The firm had been at the Wanamaker since 2004.

The departure is yet another blow to the more than half-vacant Wanamaker, which was placed in receivership in September as debtholders pursue foreclosure on the 1300 Market St. property.

While the price per square foot is higher at Brandywine Realty Trust-owned One Logan, LevLane Chief Creative Officer Bruce Lev said the company's total cost for its new offices is about the same as it was at the Wanamaker. He believes the move into higher-quality space will help entice workers to return to the office.

The firm requires senior leaders to be in the office two to three days a week. LevLane President Josh Lev said the company will likely determine staff-wide office attendance policies in the coming months, but it won’t require in-office work five days a week.

“The need for that much space just wasn’t as severe as it was when we were five days a week,” Josh Lev said. “Being hybrid and being financially cautious in the current situation of the economy, we felt the perfect fit would be to take half the space. … We didn’t really need the old-school office space.”

With less space, LevLane designed its new office in One Logan, which sits along the Benjamin Franklin Parkway at 130 N. 18th St., to focus on collaboration with a coffee bar and barstools, conference rooms for video calls and seating areas that resemble living rooms.

Full story: https://tinyurl.com/3s78kz3f

Monday, October 30, 2023

Friday, October 27, 2023

Thursday, October 26, 2023

Tuesday, October 24, 2023

$270B in CRE capital is on the sidelines. How much of that sum could go into distressed real estate?

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

It's still mostly a waiting game for commercial loans and properties showing signs of distress — so what'll it take for more of those deals to trade?

At the end of the third quarter, an estimated $270.6 billion targeting North American real estate was sitting on the sidelines, according to Preqin Ltd. Of that, more than $100 billion was opportunistic capital, which typically targets properties requiring an aggressive repositioning and lease-up strategy, and also includes new development.

It comes at a time when the broader commercial real estate industry is watching what'll happen to an estimated $1.9 trillion in commercial real estate loans set to mature in the next four years. In particular, the office market is being closely observed as companies depart big blocks of space in older buildings in favor of consolidating into smaller offices in higher-quality buildings.

In September, the overall commercial-mortgage backed securities delinquency rate was 4.39%, an increase from 4.25% the month prior, according to Trepp LLC. The office delinquency rate also continued a monthly ascent (it has grown every month since December 2022), hitting 5.58% in September.

What will it take for distressed properties to trade?

While more distress is expected, it hasn't fully emerged yet, as lenders work with borrowers on short-term extensions and modify and restructure loans when possible.

The $100 billion or so earmarked for opportunistic real estate appears to be waiting to capitalize on emerging distressed situations across asset classes, said Aaron Jodka, director of U.S. capital markets research at Colliers International Inc. (Nasdaq: CIGI).

"We have to wait for some of these properties' debt to mature and a decision to be made," Jodka said. "A lot of investors are waiting for their hands to be forced: If they can wait out their existing financing, they’re going to do that. At the point that they need to refinance or they have an occupancy loss that doesn’t allow them to cover their debt service, that’s when those events will take place."

Pricing also has been cited as a major barrier for distressed and non-distressed buildings alike to trade. Commercial real estate investment volume was down by 60% year-over-year in the second quarter, according to CBRE Group Inc. (NYSE: CBRE).

Aaron Jackson, the loan enforcement team leader of law firm Polsinelli PC's financial services litigation practice group, said there are buyers in the market with the ability now to purchase buildings, even ones facing financial issues, low vacancy and that need a significant capital infusion.

But, he added, a lot of buyers don't feel prices have bottomed out. There also are a lot of commercial real estate loans that, by today's standards, have low interest rates, meaning more buyers are interested in assuming existing debt.

Jodka said there's evidence of bridge capital being deployed, even for things like construction loans that will come due during the time of development, to help offset the rapid rise of interest rates since they were underwritten.

Still, there's been an increase in fund redemption requests this year, particularly in the private REIT space, said Chad Littell, national director of capital market analytics at CoStar Group Inc. (Nasdaq: CSGP). It's also taking twice as long to raise money in a commercial real estate fund as it did 18 months ago, he said, prompting questions about how much so-called dry powder will be available as loan distress and delinquencies rise.

While office real estate is expected to see the most potential distress and opportunistic buying, the hospitality sector is another one to watch closely, both Jodka and Jackson said.

Hotel real estate is usually financed with floating-rate debt, Jodka said, so there's naturally more refinancing risk there. Plus, the hospitality sector was hit hard during the Covid-19 pandemic, and any Paycheck Protection Program money owners received during that time went to keeping the lights on. In many cases, that further deferred maintenance that will soon need to be addressed, he said.

The lodging CMBS delinquency rate was 5.27% in September, according to Trepp LLC. That's actually a slight decline from recent months, and lower than both retail and office delinquency rates last month.

Full story: https://tinyurl.com/2p8ckmy3

Monday, October 23, 2023

Industrial Construction Starts in Philadelphia Stage Precipitous Drop-Off

By Brenda Nguyen Costar

Reacting to a combination of higher borrowing and construction costs, as well as cooling demand for warehouse space, Philadelphia’s industrial landscape is showing the first signs of slowing development after three years of heightened construction levels.

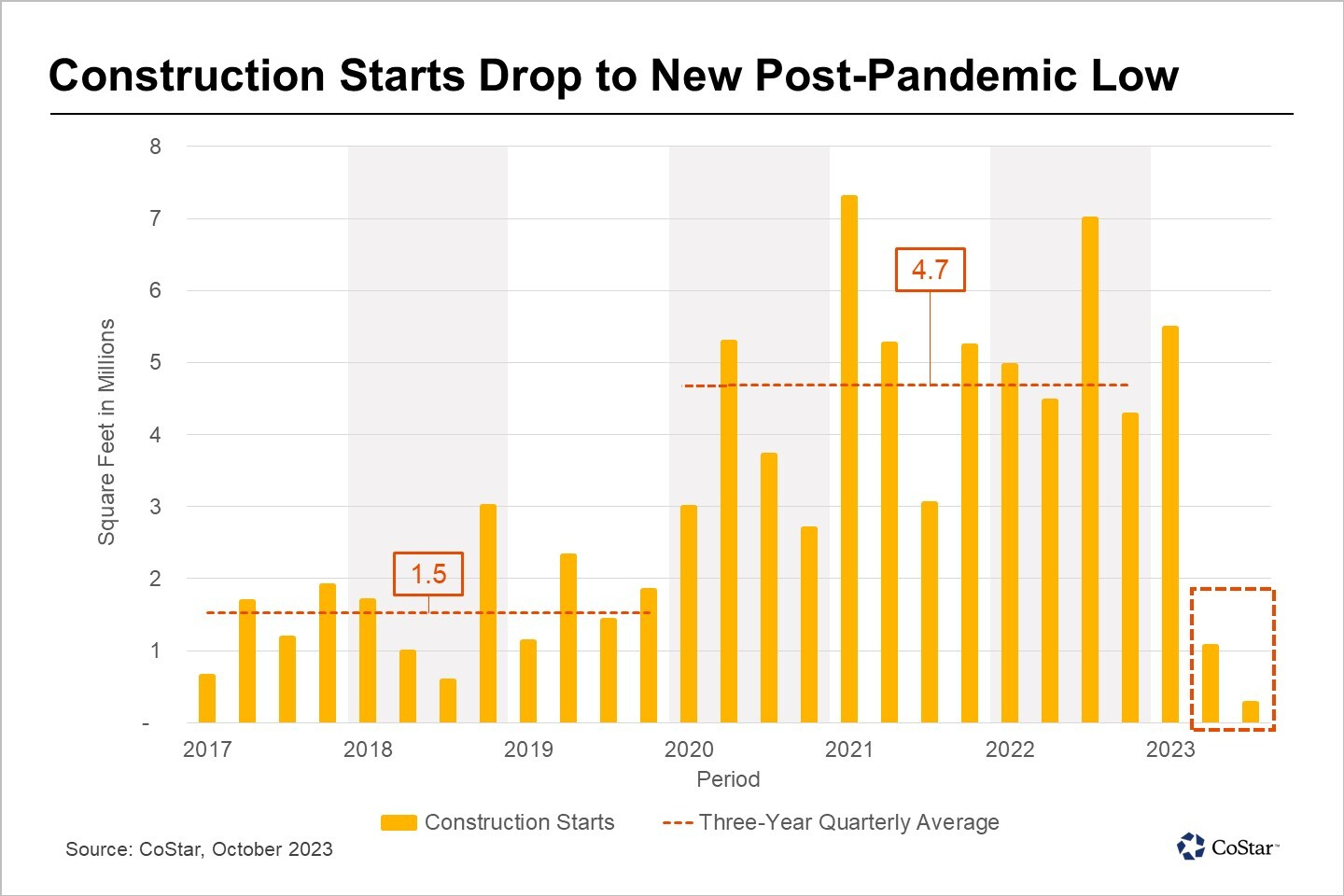

During the past two quarters, the Philadelphia industrial sector averaged only 665,000 square feet in construction starts, a small fraction of the 4.7 million square feet of quarterly construction starts seen between 2020 and 2022. For context, quarterly construction starts between 2017 and 2019 averaged a modest 1.5 million square feet.

While the industrial sector has been a standout performer, demonstrating resilience even amid concerns over elevated interest rates and recessionary pressures, the recent near halt in construction starts and a pullback in leasing demand confirms developers are finally easing on their bullishness.

The effects of the area's recent construction surge are clearly visible in the region's availability rate, which jumped to 9.5% in late 2023, from 6.6% in mid-2022. Some sections of the region, including Burlington County in New Jersey, saw the average industrial availability rate surge as high as 16.5%. Recently completed projects have faced heightened competition in securing tenants, leading to a buildup of industrial inventory that has lingered on the market longer than originally anticipated.

These factors, coupled with a slowdown in leasing momentum, have prompted developers to reevaluate their strategies. Subsequently, construction completions are now outpacing deliveries, with projects under construction shrinking from 27 million square feet in the first quarter to 17 million square feet in the fourth quarter, a 35% decline.

The pullback in construction starts is expected to offer developers and owners some breathing room as they seek to lease still-vacant buildings, but another ramp-up of construction is likely should interest rates begin to decline and the economy remains resilient in 2024.

There are more than 220 industrial development projects encompassing some 65 million square feet that are already in the proposal stage across the Philadelphia region. And while not all of them will be approved, nearly 40% of the proposed industrial development is concentrated in Southern New Jersey.

Given the already elevated availability levels, developers are encouraged to exercise caution when considering new projects, as competition in the market remains fierce.

Friday, October 20, 2023

Wednesday, October 18, 2023

Why some cities are likely to see taller warehouse projects — and the role Amazon is playing

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

After proliferating largely in other parts of the world, multistory warehouses are beginning to rise in the United States.

Nationally, there were 62.8 million square feet of warehouses with three or more stories in the U.S., as of August, with another 11.9 million square feet underway and 23 million in planning stages.

Notably, 74% of that pipeline and existing inventory is occupied by Amazon.com Inc. (Nasdaq: AMZN), the dominant player in industrial real estate, despite its pullback since the height of the Covid-19 pandemic.

But the cost to develop multistory warehouses continues to be higher than a more traditional industrial box, one reason why taller warehouses are likely to remain a fairly niche part of the market and concentrate in the nation's densest cities.

"We do think it’s going to continue to be a trend, and something we're going to see, and more are planned in many of these (denser) markets because there continues to be a need for occupier clients."

They recently examined multistory warehouses in the U.S., as the nation is in its fifth year of building multilevel logistics facilities. The first U.S. multistory warehouse opened in 2018 in Seattle.

Today, notable multistory warehouse projects include several in New York, where urban-logistics projects under construction and in planning would add 9.4 million square feet of additional last-mile logistics space.

Those include the 385,510-square-foot Red Hook Logistics Center in Brooklyn and the Borden Complex, which totals 680,000 square feet, in Long Island City.

The multistory warehouses being built in the U.S. today are past the point of "version 1.0" of five years ago, which tended to be larger projects, including some 1 million square feet or larger.

"People are looking at smaller parcels and then designing there, which is cool, because it gives occupier clients a little bit more variety," she continued.

At the Red Hook project, for example, there's an ability to subdivide the space by floor, so tenants that need 40,000 square feet or 80,000 square feet of industrial space in a dense urban market could lease space there, Lanne said.

Most of the urban multistory warehouse tenant demand is coming from groups needing last-mile delivery space, although, she said, there's also a lot of interest from food-and-beverage groups in occupying that kind of space.

Still, while the multistory warehouse trend has gained traction in the five years it's been in the United States, it's not likely to become a mainstream part of the industrial market.

For one, these facilities are more expensive to build — and may require specific, costlier infrastructure like underground parking, Lanne said. There are also zoning constraints to getting a multistory warehouse project approved, not unlike more traditional single-story industrial facilities.

Full story: https://tinyurl.com/yv5wxtrr

How talent, funding and flexible workspace options are turning Philadelphia into one of America’s fastest-rising life sciences cities

By Jeff DeVuono – executive vice president and regional managing director, Brandywine Realty Trust, The Business Journals

With a growing number of startups and established companies wanting a presence in Philly, the city has buzz. Here’s what’s behind it.

Over the last several years, no life sciences market in America has had greater momentum than Philadelphia. As the birthplace of cell and gene therapy, the city is not only producing breakout companies — including Spark Therapeutics (owned by Roche) and Tmunity Therapeutics (recently acquired by Kite) — it’s also become a place where both new and established cell and gene therapy companies are eager to have a presence. What’s more, Philadelphia has been at the forefront of other recent life sciences breakthroughs, including Nobel Prize-winning advances in mRNA technology that led directly to the development of Pfizer’s and Moderna’s COVID-19 vaccines.

With such success stories, it’s little wonder that the city has been rising rapidly in rankings of life sciences clusters. In recent reports, Philadelphia finished ahead of markets such as New York and the Research Triangle in the Raleigh-Durham area in North Carolina while closing the gap on longtime leader Boston in several key categories. For new and established life sciences companies, Philadelphia is now an essential part of the conversation.

Depth of talent in Philadelphia

What’s driving all this vitality? At the top of the list is talent. The work done by cell and gene therapy pioneers Carl June, co-founder of Tmunity, and Katherine High, co-founder of Spark and former president of therapeutics at AskBio, is attracting other highly regarded researchers and spurring even greater innovation. As of 2022, Philadelphia-based cell and gene therapy scientists had been granted more than 300 patents, and they were leading more than 130 clinical trials for new cell and gene therapies, according to research from the economics firm Econsult Solutions Inc. Overall, Philadelphia has one of the highest concentrations of life sciences researchers in the country, with its numbers rising nearly 20% between 2017 and 2022.

That injection of talent is bolstered by several other factors that are important to growing life sciences companies. The pharmaceutical industry — including such titans as Merck, Johnson & Johnson, and GSK — has long had a major presence in the Greater Philadelphia region, providing a deep talent pool of experienced leaders for startups and existing companies. The region is also strong at the other end of the career spectrum: new graduates. Greater Philadelphia is home to four R1 research universities, and its 93 colleges and universities have been producing an increasing number of people ready for careers in science. According to Colliers, the region now ranks ahead of San Francisco, San Diego and Raleigh-Durham when it comes to producing next-generation talent.

Philadelphia’s arrow is also pointing up when it comes to biomanufacturing capacity. At the forefront of the phenomenon is Spark, whose headquarters is located within Schuylkill Yards, the development created by Brandywine Realty Trust and Drexel University in University City. Spark’s groundbreaking gene therapy treatment, Luxturna — used for a rare form of genetic blindness — was approved by the FDA in 2017, and the company (which is developing gene therapy treatments for other diseases, including hemophilia A and B and several central nervous system disorders) is now building a 500,000-square-foot manufacturing facility in University City, adjacent to its headquarters. The decision by Spark’s owner, Roche, to place the new facility there, just a short walk from the University of Pennsylvania, Drexel, Children’s Hospital of Philadelphia and other leading research institutions, is further enriching the life sciences ecosystem in University City and cementing the neighborhood as one of the world’s leading gene and cell therapy hubs. Meanwhile, manufacturing capacity is expanding quickly throughout the entire Greater Philadelphia region, with additional facilities opening everywhere from the Philadelphia Navy Yard to King Prussia.

An influx of funding for life sciences

Not surprisingly, all the recent advances and activity in Philadelphia have caught the attention of funders. The most significant statistic: Since 2018, Philadelphia is the number-one market in the country when it comes to NIH funding for cell and gene therapy, outpacing Boston, New York, Seattle and Los Angeles. When it comes to NIH grants more broadly, Philadelphia pulled in more than a billion dollars in support from the NIH in 2022 for thousands of projects, including work from Penn researchers on the design of universal vaccines against highly mutating viruses, bacteria and cancer, as well as work at the Wistar Institute that explores immunotherapy approaches to early-stage melanoma. And the awards are going to a mix of institutions: the region’s 10 most awarded organizations have seen annual funding grow by 4.2% on average, while smaller, emerging institutions are seeing 12.3% annual growth.*

Thanks to that kind of validation, as well as the continuing breakthroughs being produced in the lab, private investors are also seeing the city’s extraordinary potential. In 2022, venture capitalists poured $1.7 billion into Philadelphia life sciences firms, a nearly 400% increase over 2020. And despite the cooling of the overall venture capital market in the second half of 2022 and first quarter of 2023, opportunities for young companies remain robust.

The inflow of money reflects the confidence both public and private funders feel in work originating in Philadelphia, and with good reason: Penn, whose groundbreaking research led to the development of mRNA technology, now receives more than $1 billion annually from mRNA licensing agreements.

Full story: https://tinyurl.com/5n86xpkc

Tuesday, October 17, 2023

Monday, October 16, 2023

Site Centers Sells Grocery-Anchored Retail Center in Boothwyn, PA

By Taylor Collins CoStar Research

Larkin’s Corner, a 225,214-square-foot, grocery-anchored retail center located in Boothwyn, Pennsylvania, was purchased by a New York-based investment firm acting as Post Avenue Partners for $26 million or about $115.45 per square foot.

The community shopping center consists of a main building and three outparcels on a 22-acre site built in 1994. Key tenants include Walmart, Acme Grocery, Anytime Fitness, a newly re-located McDonald’s with a drive-thru, TD Bank and Dollar Tree. Located between Philadelphia and Wilmington, Delaware, the center was 99% fully leased at the time of sale.

“Despite rising interest rates and the evolving capital markets landscape, we continue to see strong investor demand for retail assets. Strong retail fundamentals nationally combined with the availability of debt financing for retail assets have been the key drivers behind the strong investment sales activity in the retail sector."

"With near full occupancy, a waiting list for specific space at the property, significant rental growth and leasing spreads, the asset’s performance was at an all-time high and in ideal position for a sale."

Seller Site Centers Corp. is a publicly traded real estate investment trust based in Beechwood, Ohio, that has been divesting shopping centers lately.

Thursday, October 12, 2023

MRP Completes Work on Two-Building Infill Industrial Park

By Javon Roach CoStar Research

MRP Industrial, a privately held real estate company based in Baltimore, Maryland, that has built a large number of industrial facilities throughout the Northeast U.S., and its investment backer Clarion Partners, have wrapped up construction on their latest project at 1900 River Road, a two-building, in-fill redevelopment industrial park totaling 1,512,840 square feet.

The speculative project was completed with no preleasing commitments and is fully available.

The new industrial development occupies the site of the former GSA Eastern Distribution Center, a 1,050,266-square-foot warehouse that MRP and Clarion acquired from Stag Industrial in 2020 and subsequently demolished to make way for the two-building redevelopment.

Located in central New Jersey's Burlington County, the site offers access to the Pennsylvania and New Jersey Turnpike Connection at Exit 6A. Building 1 is an 845,280-square-foot cross-dock facility with full-building circulation, 600 auto stalls, 225 trailer stalls and 175 dock doors. Building 2 measures 667,560 square feet with 475 auto stalls, 95 trailer stalls, and 160 dock doors.

The project broke ground in October 2022 and the industrial park is surrounded by locations for several major corporate tenants such as Burlington, Performance Team and Trane to name a few.

A construction boom of industrial space across the Philadelphia region has posed lease-up challenges as supply continues to outpace demand for the fifth consecutive quarter, with Burlington County located at the epicenter of the new supply wave.

Wednesday, October 11, 2023

Industrial Property Sector Grapples With Slower Lease-Up as More Space Floods the Philadelphia Market

By Brenda Nguyen Costar

The recent construction boom of industrial space across the Philadelphia region has posed lease-up challenges as supply continues to outpace demand for the fifth consecutive quarter.

In the past year, greater Philadelphia's industrial real estate market has experienced an unprecedented surge in new inventory, with developers adding more than 20 million square feet of industrial space. Subsequently, the region's availability rate has expanded to 9.5% in the fourth quarter, a significant increase from the low of 6.6% observed in mid-2022.

A total of 1,055 industrial properties totaling 56 million square feet of space are available and searching for tenants. This increase in availability is a notable shift from the tighter market conditions seen in mid-2022 when approximately 40 million square feet of space were available for lease.

Southern New Jersey, in particular, has played a significant role in driving these headline numbers. The area, known for its robust industrial activity, has seen pronounced spikes in availability rates.

Two localities, Burlington County and Salem County, stand out. Burlington County's availability rate has surged to 16.5% in the fourth quarter, doubling its availability rate compared to two years ago. Meanwhile, Salem County's significantly smaller inventory is approaching a 30% availability rate. However, the smaller size of markets such as Salem County makes them more susceptible to significant fluctuations.

Burlington County's Pennsylvania neighbor, Bucks County, has also experienced substantial industrial construction levels. However, the availability rate remains relatively lower at 6.8% in the fourth quarter. Bucks County's construction activity is about half that of Burlington County's. Moreover, Bucks County's industrial inventory is only 45% the size of Burlington's. Its comparatively smaller selection of inventory has bolstered compressed vacancies at under 2.5% in recent quarters—among the lowest in the country.

Burlington County saw nearly 8.9 million square feet of completed industrial properties in the past year, intensifying lease-up competition in the market. Despite annual net absorption reaching 2.1 million square feet—the best performance by a locality in the region—demand has struggled to keep pace with the overwhelming supply pipeline.

Notably, the largest industrial facility in the county, Box Park Logistics Center, a massive 1.2 million-square-foot distribution facility, was constructed on a speculative basis without a tenant in place and still awaits signing a tenant. Of the 16 industrial properties completed here in 2023, 10 single-tenant buildings are still seeking tenants.

As leasing activity has incrementally softened in the past year, it will likely take longer to lease up the available inventory than developers initially anticipated. However, there is hope for stabilization as developers have significantly pulled back construction starts in 2023. This pause in additional supply sets the stage for the market to stabilize and absorb the excess supply in due course.

Tuesday, October 10, 2023

Monday, October 9, 2023

Friday, October 6, 2023

Topgolf property in Northeast Philadelphia is up for sale

By Emma Dooling – Reporter, Philadelphia Business Journal

The Topgolf off Roosevelt Boulevard in Northeast Philadelphia has been listed for sale nearly 18 months after opening.

Located at 2140 Byberry Road off Roosevelt Boulevard, the 16.4-acre property and the 68,000-square-foot building are listed on online real estate platform Crexi as "unpriced." The property is currently owned by RealtyLink LLC.

Topgolf Philadelphia is located on part of a 27-acre site formerly home to a Nabisco and Mondelēz International factory. It was developed by Villanova real estate company Provco, which also constructed a Wawa, Chick-fil-A and Aldi on the old Nabisco land. RealtyLink also helped develop the property, Alleva said.

Topgolf's operations will not be impacted by any potential sale of the property.

Greenville, South Carolina-headquartered RealtyLink has another Topgolf property available for sale in Charleston, South Carolina, according to its website. Of the Topgolfs that have been up for sale over the past couple of years, Alleva, said the Philadelphia property may be the one located in the most densely populated metropolitan area.

Full story: https://tinyurl.com/y99feexk

Thursday, October 5, 2023

Industrial Realty Secures 400 Acres at Atlantic City Airport for Logistics Development

By Linda Moss CoStar News

Industrial Realty Group has secured a ground lease for roughly 400 acres at the Atlantic City International Airport where it plans to build a mixed-use logistics project in the southern part of the Garden State.

Based in Los Angeles and billing itself as one of the largest industrial real estate developers in the nation, Industrial Realty said it reached an agreement with the South Jersey Transportation Authority to lease the large parcel on the northwest corner of the airport, which is located in Egg Harbor Township, New Jersey. As part of the deal, Industrial Realty and the authority have agreed to work cooperatively on the new construction, the company said in a statement on Tuesday.

Industrial Realty is "planning to build a mixed-use, industrial development to potentially include air cargo, rail and over-the-road (tri-modal)," a company spokeswoman said in an email to CoStar News on Wednesday. Renderings of the development weren't available.

“IRG has a wealth of experience in the aviation segment of commercial development,” Stuart Lichter, the developer's president, said in a statement. “We have already discussed site opportunities with many job-creating tenants. We believe this momentum will continue to grow because of the property’s location and airport proximity.”

For several years now New Jersey has been a hotbed for warehouse development because of its central location within a highly populated area, situated between New York and Philadelphia, and its proximity to major airports and seaports. Meanwhile, the Atlantic City airport has been in the local news recently because of a controversial proposal by the Biden administration to use the site as a place to house immigrants.

Industrial Realty said it has also been working with the Atlantic County Economic Alliance on the agreement, and added that the project "could stimulate tens of millions of dollars in new private investment in the region."

In July last year, the South Jersey Transportation Authority authorized its executive director, Stephen Dougherty, to enter negotiations and execute an agreement for the development of the northwest quadrant of the airport. The lease is the culmination of efforts stemming from that authorization.

“We could not have found a better partner to make this project a reality,” Dougherty said in a statement.

The proposed industrial development could also help Atlantic County move toward its goal of diversifying and strengthening the economy in the region, moving beyond gambling and tourism, according to local officials. Industrial development has been a key component of regional master planning and the Atlantic City airport for a decade, officials said.

“This agreement is conducive with our efforts to explore the development of an air-cargo-maintenance-and-repair facility that could result in hundreds of short-term

construction jobs and many more long-term jobs,” Atlantic County Executive Dennis Levinson said in a statement.

Industrial Realty's forte is the conversion and privatization of federal properties. The company owns and serves as the master developer of three closed military bases, a former NASA manufacturing facility and a closed Veterans Affairs site.

Wednesday, October 4, 2023

Monday, October 2, 2023

Core5 Industrial, Arbok Partners Plan One of New Jersey’s Biggest Warehouses

By Linda Moss CoStar News

Core5 Industrial Partners and Arbok Partners have acquired a site in South Jersey where they plan to build a 1.75 million-square-foot warehouse, which would be one of the largest in the Garden State, as developers continue to see a demand for logistics space.

Core5, based in Atlanta, and Arbok, headquartered in Jersey City, New Jersey, have closed on the purchase of a 156-acre site, a farm, at 1087 Route 40 in Carneys Point, New Jersey. That's where the developers plan to construct the first building of what is planned to be a complex of five distribution facilities totaling nearly 4 million square feet.

The project will be the first one for Core5 in New Jersey, Doug Armbruster, a senior vice president and managing director at the real estate firm, told CoStar News on Friday.

Carneys Point, which is near both Delaware and Philadelphia in the southwestern part of New Jersey, has become a hub for industrial development. E-commerce giant Amazon, for example, has a 1.25 million-square-foot fulfillment center not far from the Core5-Arbok property. The area is a good location for distribution centers because it's not only near Philadelphia but it's just few hours away from both New York and Washington, D.C., with the airport and seaport in Newark, New Jersey, just 100 miles away on the New Jersey Turnpike, according to Armbruster. Carneys Point is also on the Interstate 95 corridor, he said.

New Jersey remains a favorite site for industrial development even though demand for such space has slowed down a bit in the wake of the pandemic. The Garden State benefits from its location in a highly populated region near major transit hubs. Because the northern part of the state is highly developed, real estate firms have been going farther south to find open land to build.

"Sites are fewer and fewer between," Armbruster said.

Vying for Biggest-Warehouse Title

In some cases that's caused friction — and court battles — with residents who complain of alleged "warehouse sprawl," while development proponents argue that the fast-growing logistics industry shouldn't be throttled.

The first building planned for the Core5 Kelly Logistics Park at Carneys Point, at 1.75 million square feet, would be one of the biggest individual industrial buildings in New Jersey. It's probably the largest in terms of "pure-play warehouse," without manufacturing, according to Mateusz Wnek, associate director of market analytics for CoStar Group, said in an email. It all depends on how one defines industrial.

A Bristol Myers Squibb site at 1 Squibb Drive in New Brunswick is 1.8 million square feet. While that property is technically industrial, it is also a manufacturing site for pharmaceuticals, Wnek said.

An industrial property at 1 Passaic St. in Wood-Ridge, New Jersey, is 2.3 million square feet, but it also does manufacturing, according to Wnek.

Then there are three industrial properties that rank right behind Core5's first building in size, each at 1.5 million square feet, according to CoStar data. They are 107 Trumbull St., Elizabeth; 629 Grove St., Jersey City; and 995 Taylors Lane, Cinnaminson.

Kelly Logistics Park would ultimately have 3.8 million square feet across five buildings, according to a marketing brochure. Those properties will range from 371,000 to the 1.75 million square feet.

The main large building will have 285 loading docks, four drive-in doors, parking for 516 trailer trucks and 1,450 cars. Company officials are still working through a timetable for development of the project, Armbruster said.

KBC Advisors is handling leasing for the building, according to Armbruster. It is being developed on a speculative basis, with no tenant lined up yet.