By Brenda Nguyen Costar

Reacting to a combination of higher borrowing and construction costs, as well as cooling demand for warehouse space, Philadelphia’s industrial landscape is showing the first signs of slowing development after three years of heightened construction levels.

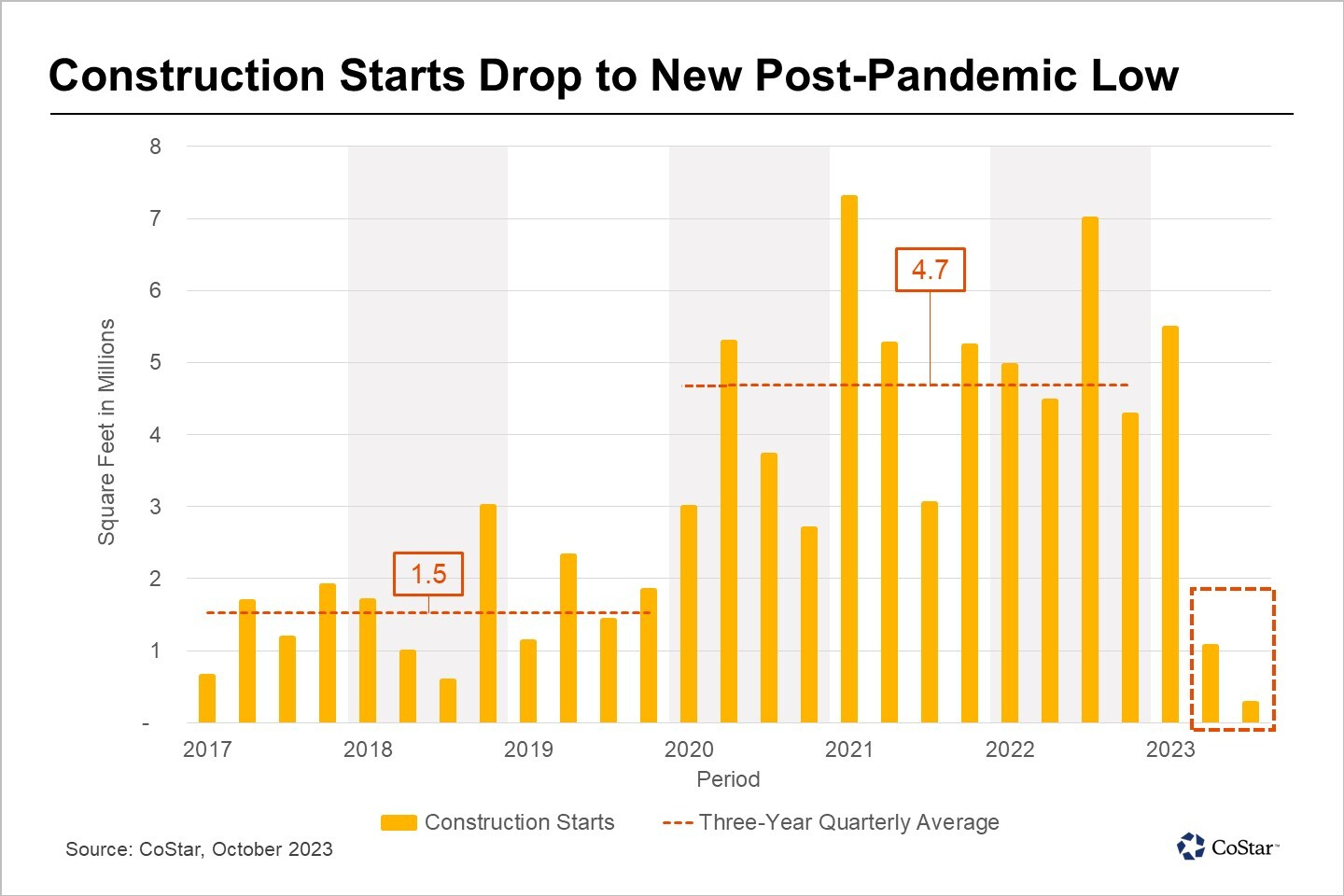

During the past two quarters, the Philadelphia industrial sector averaged only 665,000 square feet in construction starts, a small fraction of the 4.7 million square feet of quarterly construction starts seen between 2020 and 2022. For context, quarterly construction starts between 2017 and 2019 averaged a modest 1.5 million square feet.

While the industrial sector has been a standout performer, demonstrating resilience even amid concerns over elevated interest rates and recessionary pressures, the recent near halt in construction starts and a pullback in leasing demand confirms developers are finally easing on their bullishness.

The effects of the area's recent construction surge are clearly visible in the region's availability rate, which jumped to 9.5% in late 2023, from 6.6% in mid-2022. Some sections of the region, including Burlington County in New Jersey, saw the average industrial availability rate surge as high as 16.5%. Recently completed projects have faced heightened competition in securing tenants, leading to a buildup of industrial inventory that has lingered on the market longer than originally anticipated.

These factors, coupled with a slowdown in leasing momentum, have prompted developers to reevaluate their strategies. Subsequently, construction completions are now outpacing deliveries, with projects under construction shrinking from 27 million square feet in the first quarter to 17 million square feet in the fourth quarter, a 35% decline.

The pullback in construction starts is expected to offer developers and owners some breathing room as they seek to lease still-vacant buildings, but another ramp-up of construction is likely should interest rates begin to decline and the economy remains resilient in 2024.

There are more than 220 industrial development projects encompassing some 65 million square feet that are already in the proposal stage across the Philadelphia region. And while not all of them will be approved, nearly 40% of the proposed industrial development is concentrated in Southern New Jersey.

Given the already elevated availability levels, developers are encouraged to exercise caution when considering new projects, as competition in the market remains fierce.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.