New Jersey's soaring industrial market is in uncharted demand territory, making it difficult to predict when the leasing will cool, local executives say. And they point out that it comes as the state deals with a negative real estate issue, criticism of its programs to award tax breaks to get companies to do business in New Jersey.

The commentary on two of the hottest topics in the Garden State's commercial real estate industry came during a discussion at the annual meeting of the New Jersey chapter of NAIOP in Short Hills. The trade group hosted a panel on the real estate outlook for the coming year, with the logistics sector in the Garden State and its lapsed corporate tax credits on the agenda.

New Jersey, because of its proximity to New York City and area ports, as well as being centrally located in a densely populated region, has been a big beneficiary of the explosion of demand for warehouse and distribution space. That demand has been driven by the growing popularity of online shopping, spurred by e-commerce giant Amazon, as well as other companies and traditional brick-and-mortar retailers looking to offer quick delivery to demanding consumers.

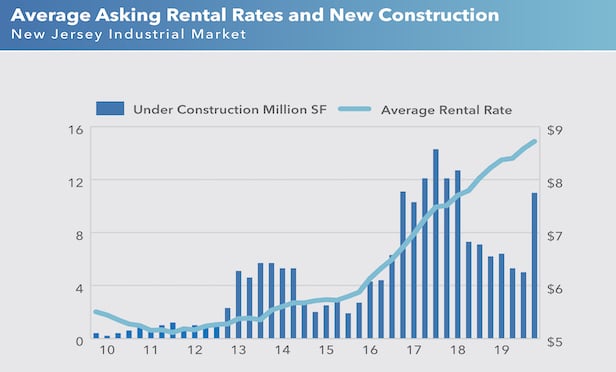

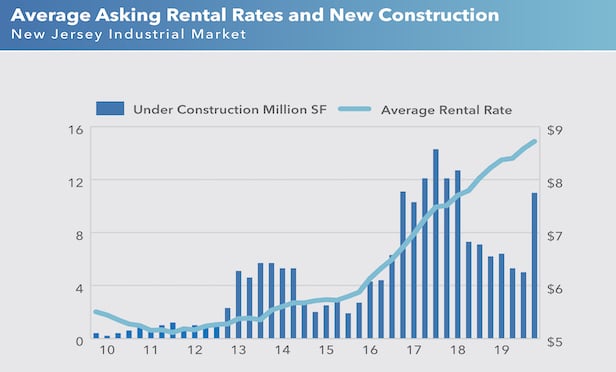

The phenomenon has resulted in record low vacancy rates and rising rents for industrial properties in New Jersey. But panelist Andrew Merin, a vice chairman at Cushman & Wakefield's office in East Rutherford, New Jersey, questioned how long the sector's hot streak can go on.

During his career Merin said he witnessed a run-up in the state's office market, "with phenomenal growth," and that he saw apartment properties "go off the charts" five years ago.

“However, in my 40-plus years I have never seen anything that rivals the velocity and the change that we’ve seen in the industrial market,” he said. “So we’re seeing things that are unprecedented ... I don’t know how long this is going to last because at some point all things peter out.”

Industrial Predictions

Industrial tenants could be leasing space "out in front of demand," which happened to the Jersey City, New Jersey, office market when it was at its height years ago, according to Merin. Large banks were inking 20-year leases for entire buildings on the waterfront, and ended up subleasing some of that space, he said.

“Now we’re seeing e-commerce people taking huge warehouses depending on the future, so it is unbelievable,” Merin said.

One of his fellow panelists raised the same question but predicted logistics will remain strong this year, with rents continuing to increase.

"The big question is is this the beginning of a trend that’s going to have a long runway to it, or does the market appear to be overheated?" said Ed Russo, president of Russo Development, based in Carlstadt, New Jersey.

The family-owned firm specializes in warehouse and distribution facilities, particularly in Northern New Jersey's Meadowlands area. Russo Development and Forsgate Industrial Partners of Teterboro, New Jersey, are developing Kinsgland Meadowlands, more than 3 million square feet of industrial buildings, on speculation, with no signed tenants yet.

Russo remains bullish on the industrial sector, predicting that rents for distribution sites could hit an "unprecedented" $20 a square foot.

Tax Break Fallout

New Jersey's commercial real estate industry has vocally supported the passage of new tax incentive programs for the state as quickly as possible, joining other business groups in saying the tax breaks are critical to attract and retain companies.

The former programs were administered by the New Jersey Economic Development Authority, which has come under fire and investigation for allegedly awarding incentives to companies that didn't deserve them. The old programs expired June 30 last year, and New Jersey Gov. Phil Murphy refused to extend them. He wants to overhaul the tax breaks, but hasn't been able to reach a consensus with state legislators on changes. The criticism over the incentives has made front-page headlines.

Panelist Christopher Paladino, president of New Brunswick Development Corp., said he expects the state will have new tax incentive programs by the spring. But New Jersey will have its work cut out for it in terms of rehabilitating its reputation in corporate America, in places like New York or Philadelphia or Chicago with companies that may be weighing relocating to or expanding in the Garden State, according to Paladino.

“There’s been so much damage done to New Jersey’s reputation," he said.

Nonetheless, while incentives are important to businesses, he said he'd "never had a CFO or a COO or a head of human resources say to me at the first meeting, ‘What are the incentives?’ ”

Catering to Workforce

Employers are more concerned about having access to an educated workforce, or forging relationships with institutions of higher learning like Rutgers University and Princeton University, according to Paladino.

Higher rents are part of the price that companies are willing to pay to draw employees, according to Merin. He cited the recent announcement that Big Four accounting firm Deloitte was relocating one of its offices in suburban Parsippany, New Jersey, to the more urban Morristown, New Jersey. Morristown boasts a train station and a lively downtown scene with many restaurants, bars and stores.

Deloitte could have stayed in Parsippany and continued to pay about $30 a square foot in rent, but instead it is opting to pay $55 a square foot to move to Morristown, according to Merin.

"That huge differential in the rent meant nothing" because Deloitte is striving to attract and retain quality employees, he said.

www.omegare.com

Thursday, January 30, 2020

Wednesday, January 29, 2020

Tuesday, January 28, 2020

Fisher Phillips Relocates from Radnor to Philadelphia

by John Jordan Globest.com

National workplace law firm Fisher Phillips is relocating its Philadelphia area office from Radnor, PA to 21,000 square feet of space at Two Logan Square in Center City here.

The law firm has signed a lease for space on the 12th floor of the 35-story tower building and expects to take occupancy in April. The firm’s current Philadelphia area office is located at 150 N. Radnor Chester Road in Radnor, PA.

Chris Stief, managing partner Fisher Phillips’ Philadelphia office, says, “The move will provide us a space at the core of Philadelphia’s business and legal markets and positions us to attract even more talent at all levels, including partners, associates and staff. Our goal was to find a space that uniquely positions us for our next decade of growth in Philadelphia.”

He adds that the move will increase its presence in Philadelphia by approximately 6,000 square feet. Fisher Phillips established its presence in Philadelphia with the opening of its office in Radnor in 2007. The firm’s Philadelphia area office has grown from six to 23 attorneys and is home to national leadership of Fisher Phillips’ Employment Defense Litigation Practice Group, Employee Defection and Trade Secrets Practice Group, International Employment Practice Group, the Data Security and Workplace Privacy team, the firm’s E-Discovery Committee and the firm’s Government Relations subsidiary, FP Advocacy.

Fisher Phillips recently announced the opening of two new offices in Nashville and Detroit, and the intent to further expand its Los Angeles presence with an office in the San Fernando Valley. In 2019, the firm opened a Pittsburgh office, bringing on a team of three workplace safety partners.

The new 4,000-square-foot Nashville office is located at 3310 West End Ave. Fisher Phillips signed the lease in November and the firm began occupying the space in late December.

Earlier this month, the law firm had joined forces with The Murray Law Group, a boutique labor, employment, and immigration firm located in metropolitan Detroit. The combined firm is now located at 31780 Telegraph Road, Bingham Farms, MI and became the firm’s 36th office location.

www.omegare.com

National workplace law firm Fisher Phillips is relocating its Philadelphia area office from Radnor, PA to 21,000 square feet of space at Two Logan Square in Center City here.

The law firm has signed a lease for space on the 12th floor of the 35-story tower building and expects to take occupancy in April. The firm’s current Philadelphia area office is located at 150 N. Radnor Chester Road in Radnor, PA.

Chris Stief, managing partner Fisher Phillips’ Philadelphia office, says, “The move will provide us a space at the core of Philadelphia’s business and legal markets and positions us to attract even more talent at all levels, including partners, associates and staff. Our goal was to find a space that uniquely positions us for our next decade of growth in Philadelphia.”

He adds that the move will increase its presence in Philadelphia by approximately 6,000 square feet. Fisher Phillips established its presence in Philadelphia with the opening of its office in Radnor in 2007. The firm’s Philadelphia area office has grown from six to 23 attorneys and is home to national leadership of Fisher Phillips’ Employment Defense Litigation Practice Group, Employee Defection and Trade Secrets Practice Group, International Employment Practice Group, the Data Security and Workplace Privacy team, the firm’s E-Discovery Committee and the firm’s Government Relations subsidiary, FP Advocacy.

Fisher Phillips recently announced the opening of two new offices in Nashville and Detroit, and the intent to further expand its Los Angeles presence with an office in the San Fernando Valley. In 2019, the firm opened a Pittsburgh office, bringing on a team of three workplace safety partners.

The new 4,000-square-foot Nashville office is located at 3310 West End Ave. Fisher Phillips signed the lease in November and the firm began occupying the space in late December.

Earlier this month, the law firm had joined forces with The Murray Law Group, a boutique labor, employment, and immigration firm located in metropolitan Detroit. The combined firm is now located at 31780 Telegraph Road, Bingham Farms, MI and became the firm’s 36th office location.

www.omegare.com

Philadelphia Based Alterra Bets on Outside Storage Properties as a New Investment Strategy

As demand for industrial real estate spreads beyond warehouses into outside storage for trucks and heavy equipment, Alterra Property Group is lining up major investors to amass a portfolio of these low-cost utilitarian properties.

Alterra, based in Philadelphia, and institutional investors advised by J.P. Morgan Asset Management formed a $300 million joint venture to buy properties they're calling industrial outside storage, or IOS for short. Alterra considers these sites to be untapped assets within the broader traditional industrial property sector. It comes as investments in other types of industrial real estate, including self-storage, data centers and biotech labs, have been increasing in recent years.

The Alterra-led group seeks to add another category by acquiring properties leased to tenants needing two to 50 acres for outside storage and who only require a small building – about 20,000 square feet or so. Such properties sell in a range from a few hundred thousand to a few million dollars, far less than the typical institutional investor target that can reach into the tens of millions of dollars or more.

Ownership of such properties is highly fragmented. Most landlords are local and private, with outside storage tenants ranging in activity from truck parking, port-related container storage, equipment rental, building materials and petrochemical delivery. But one thing they have in common: There's a finite supply, which means their value may be poised to increase.

"The U.S. economy is based on something being manufactured in one place and consumed in a different place. Those goods make several stops between the plant and the point of consumption," Leo Addimando, founder and managing partner at Alterra, told CoStar. It is those stops in between on which Alterra is focusing.

Private owners and owner/users have made up about $7.6 billion of the five-year total of $10.1 billion in property purchases matching Alterra's criteria, according to CoStar data. Such sales averaged about $1.8 billion a year from 2015 to 2018 but jumped to $2.6 billion last year.

Such properties are critical for supporting the growth of online shopping and new construction. For warehouses to be useful, shipping containers, semitrailers and rail cars are needed to move goods around. For new buildings to be built, materials and equipment need be shipped to construction sites.

"All of that has its own support real estate needs," Addimando said, "and so we're buying those yards. At the end of the day, we're basically buying the growth of the economy."

The goal of the joint venture is to build a portfolio valued at several hundred million dollars, centered on single-tenant leases, and that capitalizes on the shrinking supply of outside storage sites in growing markets.

Growth Areas

Users of such locations have specific location requirements, according to Addimando. They want to be in the path of growth.

"In a lot of cases, they are getting priced out of places where they naturally need to be to access their customers," Addimando said. "If you're the landlord, you're really in a win-win situation. You feel good because if they leave it empty, it's just worth a lot more money as something else."

Finding yield beyond the traditional property segments is growing, according to Alterra and J.P. Morgan. Property types outside the four traditional sectors of office, multifamily, retail and industrial distribution centers now account for about 40% of the publicly traded real estate investment trust market.

Publicly traded REITs such as Terreno Realty, Rexford Industrial Realty and National Retail Properties acquire and own such properties but not as a primary focus. Such holdings make up 10% or less of their holdings.

And publicly traded REITs have acquired only about $309 million of properties in the past five years with criteria similar to what Alterra is targeting, according to CoStar data. But their activity is growing. They acquired nearly $130 million of similar properties last year, up from $37 million in 2018.

Other institutional and private equity funds too have acquired such properties but as a smaller part of their portfolios. Their five-year total came to about $433 million, according to CoStar data. Their 2019 volume of $155 million doubled their average annual volume of the previous four years.

"If you think back 10 years, single-family homes were not an institutional asset class," Addimando said. "Go back 20 years, mobile homes were not an institutional asset. If you go back 30 years, self-storage was not an institutional asset class. We strongly believe this is the next new category of real estate to become less fragmented and more institutionally owned."

Since forming the joint venture, the group has already acquired four properties. The latest was a $4.2 million purchase of 3800 N. Powerline Road in Pompano Beach, Florida. Maxim Crane Works sold and leased back the 3.37-acre property with a 14,000-square-foot building.

www.omegare.com

Alterra, based in Philadelphia, and institutional investors advised by J.P. Morgan Asset Management formed a $300 million joint venture to buy properties they're calling industrial outside storage, or IOS for short. Alterra considers these sites to be untapped assets within the broader traditional industrial property sector. It comes as investments in other types of industrial real estate, including self-storage, data centers and biotech labs, have been increasing in recent years.

The Alterra-led group seeks to add another category by acquiring properties leased to tenants needing two to 50 acres for outside storage and who only require a small building – about 20,000 square feet or so. Such properties sell in a range from a few hundred thousand to a few million dollars, far less than the typical institutional investor target that can reach into the tens of millions of dollars or more.

Ownership of such properties is highly fragmented. Most landlords are local and private, with outside storage tenants ranging in activity from truck parking, port-related container storage, equipment rental, building materials and petrochemical delivery. But one thing they have in common: There's a finite supply, which means their value may be poised to increase.

"The U.S. economy is based on something being manufactured in one place and consumed in a different place. Those goods make several stops between the plant and the point of consumption," Leo Addimando, founder and managing partner at Alterra, told CoStar. It is those stops in between on which Alterra is focusing.

Private owners and owner/users have made up about $7.6 billion of the five-year total of $10.1 billion in property purchases matching Alterra's criteria, according to CoStar data. Such sales averaged about $1.8 billion a year from 2015 to 2018 but jumped to $2.6 billion last year.

Such properties are critical for supporting the growth of online shopping and new construction. For warehouses to be useful, shipping containers, semitrailers and rail cars are needed to move goods around. For new buildings to be built, materials and equipment need be shipped to construction sites.

"All of that has its own support real estate needs," Addimando said, "and so we're buying those yards. At the end of the day, we're basically buying the growth of the economy."

The goal of the joint venture is to build a portfolio valued at several hundred million dollars, centered on single-tenant leases, and that capitalizes on the shrinking supply of outside storage sites in growing markets.

Growth Areas

Users of such locations have specific location requirements, according to Addimando. They want to be in the path of growth.

"In a lot of cases, they are getting priced out of places where they naturally need to be to access their customers," Addimando said. "If you're the landlord, you're really in a win-win situation. You feel good because if they leave it empty, it's just worth a lot more money as something else."

Finding yield beyond the traditional property segments is growing, according to Alterra and J.P. Morgan. Property types outside the four traditional sectors of office, multifamily, retail and industrial distribution centers now account for about 40% of the publicly traded real estate investment trust market.

Publicly traded REITs such as Terreno Realty, Rexford Industrial Realty and National Retail Properties acquire and own such properties but not as a primary focus. Such holdings make up 10% or less of their holdings.

And publicly traded REITs have acquired only about $309 million of properties in the past five years with criteria similar to what Alterra is targeting, according to CoStar data. But their activity is growing. They acquired nearly $130 million of similar properties last year, up from $37 million in 2018.

Other institutional and private equity funds too have acquired such properties but as a smaller part of their portfolios. Their five-year total came to about $433 million, according to CoStar data. Their 2019 volume of $155 million doubled their average annual volume of the previous four years.

"If you think back 10 years, single-family homes were not an institutional asset class," Addimando said. "Go back 20 years, mobile homes were not an institutional asset. If you go back 30 years, self-storage was not an institutional asset class. We strongly believe this is the next new category of real estate to become less fragmented and more institutionally owned."

Since forming the joint venture, the group has already acquired four properties. The latest was a $4.2 million purchase of 3800 N. Powerline Road in Pompano Beach, Florida. Maxim Crane Works sold and leased back the 3.37-acre property with a 14,000-square-foot building.

www.omegare.com

Crunch Fitness Opens New Location in Philadelphia

Crunch Fitness, a fitness center chain headquartered in New York, is opening a new location in Philadelphia.

The gym has leased 30,619 square feet at Northeast Shopping Center. Located at 9165-9175 Roosevelt Blvd., the center spans 42.5 acres less than two miles from Northeast Philadelphia Airport.

Crunch Fitness currently has more than 300 gyms worldwide.

www.omegare.com

The gym has leased 30,619 square feet at Northeast Shopping Center. Located at 9165-9175 Roosevelt Blvd., the center spans 42.5 acres less than two miles from Northeast Philadelphia Airport.

Crunch Fitness currently has more than 300 gyms worldwide.

www.omegare.com

Monday, January 27, 2020

New Jersey Medical Device Maker Chooses New Headquarters

A medical device company is relocating its global headquarters to Marlton, New Jersey, from its current location in Mount Laurel in the Garden State.

Impulse Dynamics has signed a long-term lease for 21,000 square feet at 50 Lake Center, an 88,800-square-foot Class A office building in the greater Philadelphia metropolitan area, according to the broker on the transaction, Avison Young. The property is owned by Twenty Lake Management in New York City, according to CoStar data.

Impulse Dynamics is now based at the Gateway Business Park at 523 Fellowship Road in Mount Laurel. It plans to make the roughly 3-mile move in the second quarter this year.

The firm recently announced it had completed an $80.25 million Series D financing with new investors. The proceeds will mainly be used to facilitate the U.S. commercialization of the Optimizer Smart, a Food and Drug Administration-approved implantable device for treating chronic heart failure that's been proven to strengthen that vital organ and help it beat more forcibly.

The Marlton property, constructed in 2006, features ribbon glass construction, a two-story granite atrium, an expansive window line, scenic lake views, on-site walking/running trails, and ample parking. The four-story building is on a nearly 12-acre site that's on Route 73, just a mile north of the Route 70 intersection and 3 miles from the New Jersey Turnpike, according to Avison Young.

www.omegare.com

Impulse Dynamics has signed a long-term lease for 21,000 square feet at 50 Lake Center, an 88,800-square-foot Class A office building in the greater Philadelphia metropolitan area, according to the broker on the transaction, Avison Young. The property is owned by Twenty Lake Management in New York City, according to CoStar data.

Impulse Dynamics is now based at the Gateway Business Park at 523 Fellowship Road in Mount Laurel. It plans to make the roughly 3-mile move in the second quarter this year.

The firm recently announced it had completed an $80.25 million Series D financing with new investors. The proceeds will mainly be used to facilitate the U.S. commercialization of the Optimizer Smart, a Food and Drug Administration-approved implantable device for treating chronic heart failure that's been proven to strengthen that vital organ and help it beat more forcibly.

The Marlton property, constructed in 2006, features ribbon glass construction, a two-story granite atrium, an expansive window line, scenic lake views, on-site walking/running trails, and ample parking. The four-story building is on a nearly 12-acre site that's on Route 73, just a mile north of the Route 70 intersection and 3 miles from the New Jersey Turnpike, according to Avison Young.

www.omegare.com

New Industrial Supply Finally Outpaces Demand

By Erika Morphy Globest.com

Last year new supply in the industrial market finally surpassed demand and is expected to continue to do so for the next two years. However, industrial will remain a hotly-contested asset class by investors with North American absorption forecasted to be a healthy 459.9 million square feet through 2021 and a vacancy that will remain anchored around the 5% mark. Meanwhile, asking rents are expected to increase by 6.8% and reach a new nominal high of $6.95 per square foot by year-end 2021—up from $6.51 psf in 2019.

In addition, it adds that “Over the next several years, we expect underlying industrial market liquidity to continue to grow as investors seek to deploy record levels of capital with an increasingly favorable allocation directed towards industrial assets.”

Industrial Cooled Off In 2019

There were several factors that led to the tipping point for industrial supply-demand last year, in which new supply registered 336.3 million square feet compared to 262.1 million square feet, respectively. Last year also saw a rough start with weather-related construction delays causing a ripple effect throughout the rest of the year, thus slowing tenant occupancy. Also, a lack of quality vacant space continues to restrict net occupancy growth.

Additionally, at the start of 2019, some owner-occupiers were concerned that the market would slow after the banner year of 2018—concerns that likely caused some of the slowdown. Also, it notes, because 2018 was a record year for industrial absorption, absorption numbers for 2019 appeared low compared to the past few years.

The Years Ahead

Pressure to remain high on industrial occupancy and rent growth levels across North America, driven by a combination of strong consumer confidence, wage inflation, low unemployment, and an anticipated increase in e-commerce spending at multiple times the rate of overall spending.

It is also projected that new leasing activity will be driven in large part by traditional and online retailers as well as third-party logistics providers as consumers demand for goods at a grander and faster scale.

Some trends from 2019 and previous years will still remain in play, though. They also predicts that “some of the hottest and most talked about facilities types in the industrial world” will include cold-storage facilities, in-fill/last mile facilities, and multistory warehouses.

www.omegare.com

Last year new supply in the industrial market finally surpassed demand and is expected to continue to do so for the next two years. However, industrial will remain a hotly-contested asset class by investors with North American absorption forecasted to be a healthy 459.9 million square feet through 2021 and a vacancy that will remain anchored around the 5% mark. Meanwhile, asking rents are expected to increase by 6.8% and reach a new nominal high of $6.95 per square foot by year-end 2021—up from $6.51 psf in 2019.

In addition, it adds that “Over the next several years, we expect underlying industrial market liquidity to continue to grow as investors seek to deploy record levels of capital with an increasingly favorable allocation directed towards industrial assets.”

Industrial Cooled Off In 2019

There were several factors that led to the tipping point for industrial supply-demand last year, in which new supply registered 336.3 million square feet compared to 262.1 million square feet, respectively. Last year also saw a rough start with weather-related construction delays causing a ripple effect throughout the rest of the year, thus slowing tenant occupancy. Also, a lack of quality vacant space continues to restrict net occupancy growth.

Additionally, at the start of 2019, some owner-occupiers were concerned that the market would slow after the banner year of 2018—concerns that likely caused some of the slowdown. Also, it notes, because 2018 was a record year for industrial absorption, absorption numbers for 2019 appeared low compared to the past few years.

The Years Ahead

Pressure to remain high on industrial occupancy and rent growth levels across North America, driven by a combination of strong consumer confidence, wage inflation, low unemployment, and an anticipated increase in e-commerce spending at multiple times the rate of overall spending.

It is also projected that new leasing activity will be driven in large part by traditional and online retailers as well as third-party logistics providers as consumers demand for goods at a grander and faster scale.

Some trends from 2019 and previous years will still remain in play, though. They also predicts that “some of the hottest and most talked about facilities types in the industrial world” will include cold-storage facilities, in-fill/last mile facilities, and multistory warehouses.

www.omegare.com

NaReit Reports on Office, Multifamily, Urban Retail & Ground Leasing (Video)

Office

Apartments

Urban Retail

Land Leasing

www.omegare.com

Philadelphia, Southern NJ Commercial Real Estate Markets Ended 2019 on High Note

by John Jordan Globest.com

Philadelphia and Southern New Jersey office markets held steady in 2019, with strong leasing volume and low vacancy rates.

In the firm’s fourth quarter 2019 report on the Southern New Jersey and Southeastern Pennsylvania markets, although leasing activity was down overall, vacancy rates remained low and gross leasing absorption was positive, although trending lower when compared quarter-over-quarter.

The vacancy rate in Philadelphia’s office market rose slightly to 8.7%. The office vacancy rate is still near a 20-year low, and below that of comparable major cities.

The industrial sector in Philadelphia remains very strong. The fourth quarter vacancy rate stood at 5.4% at the end of the fourth quarter, while net absorption was at 5.4 million square feet. Rent growth of 4.8% has far exceeded the long-term average of 1.7%.

In terms of the markets the firm covers in Southern New Jersey (Burlington, Camden and Gloucester) that there were approximately 204,077 square feet of new office leases and renewals executed in the fourth quarter, which was down compared to the previous quarter. However, the sales market stayed active, with about 1.5 million square feet on the market or under agreement. Completed sales more than doubled from the previous quarter, at approximately 781,130 square feet trading hands.

New leasing activity accounted for approximately 65% of all deals for the three counties surveyed. Overall, gross leasing absorption for the fourth quarter was in the range 85,000 square feet, up about 20% over third quarter absorption levels.

“CRE performance was good by almost every measure as the year wound down. It seems like when one sector or part of the region underperforms, the rest of the market keeps moving in the right direction.”

Overall office vacancy in the market was approximately 12% at the end of the fourth quarter, which was up half a point from the previous quarter. This is still near a 20-year low.

The report notes that average rents for Class A and B product continued to show strong support in the range of $10.00-$15.00-per-square-foot triple net or $20.00-$25.00-per-square-foot gross for deals completed during the quarter. Those averages have hovered near this range for more than a year.

Office vacancy in Camden County rose to 12% for the quarter, due in part to the return of a few large blocks of space to the market.

Burlington County’s office vacancy also stood at 12%. Burlington’s vacancy rate also jumped earlier in the year due to several large blocks of space returning to the market.

www.omegare.com

Philadelphia and Southern New Jersey office markets held steady in 2019, with strong leasing volume and low vacancy rates.

In the firm’s fourth quarter 2019 report on the Southern New Jersey and Southeastern Pennsylvania markets, although leasing activity was down overall, vacancy rates remained low and gross leasing absorption was positive, although trending lower when compared quarter-over-quarter.

The vacancy rate in Philadelphia’s office market rose slightly to 8.7%. The office vacancy rate is still near a 20-year low, and below that of comparable major cities.

The industrial sector in Philadelphia remains very strong. The fourth quarter vacancy rate stood at 5.4% at the end of the fourth quarter, while net absorption was at 5.4 million square feet. Rent growth of 4.8% has far exceeded the long-term average of 1.7%.

In terms of the markets the firm covers in Southern New Jersey (Burlington, Camden and Gloucester) that there were approximately 204,077 square feet of new office leases and renewals executed in the fourth quarter, which was down compared to the previous quarter. However, the sales market stayed active, with about 1.5 million square feet on the market or under agreement. Completed sales more than doubled from the previous quarter, at approximately 781,130 square feet trading hands.

New leasing activity accounted for approximately 65% of all deals for the three counties surveyed. Overall, gross leasing absorption for the fourth quarter was in the range 85,000 square feet, up about 20% over third quarter absorption levels.

“CRE performance was good by almost every measure as the year wound down. It seems like when one sector or part of the region underperforms, the rest of the market keeps moving in the right direction.”

Overall office vacancy in the market was approximately 12% at the end of the fourth quarter, which was up half a point from the previous quarter. This is still near a 20-year low.

The report notes that average rents for Class A and B product continued to show strong support in the range of $10.00-$15.00-per-square-foot triple net or $20.00-$25.00-per-square-foot gross for deals completed during the quarter. Those averages have hovered near this range for more than a year.

Office vacancy in Camden County rose to 12% for the quarter, due in part to the return of a few large blocks of space to the market.

Burlington County’s office vacancy also stood at 12%. Burlington’s vacancy rate also jumped earlier in the year due to several large blocks of space returning to the market.

www.omegare.com

Friday, January 24, 2020

Thursday, January 23, 2020

Philadelphia Investor Buys Grocery-, Gym-Anchored Shopping Center for $18.3 Million

Philadelphia-based Gorman & Co. has purchased the grocery- and gym-anchored Larchmont Commons retail center in Mount Laurel, New Jersey, from RPC Real Estate and Merion Realty Partners’ asset management group for $18.25 million, or about $142 per square foot.

Financing was arranged of $12.9 million, 10-year, fixed-rate acquisition loan with an institutional capital source on behalf of the new owner.

The 128,172-square-foot center at 3105-3117 Route 38 is anchored by Aldi, Planet Fitness and Dollar Tree. Major tenants at the 88% leased property include Hair Cuttery, The UPS Store and Kumon Learning Center.

The center spans 24.7 acres less than 12 miles from the Philadelphia CBD.

"There has been a steady increase in investor demand for grocery-anchored product within the greater Philadelphia marketplace, resulting in correlating cap-rate compression since the start of 2019," Munley said in a statement. "With the steady flow of new capital we have witnessed entering the retail investment market, we anticipate that to continue into 2020."

For more than 30 years, the principals of Gorman & Co. and its predecessor companies have been engaged in the land acquisition and ground up development of more than 3 million square feet of office, retail, residential, self-storage and mixed-use properties throughout the region with an aggregate value of more than $400 million, according to its website.

www.omegare.com

Financing was arranged of $12.9 million, 10-year, fixed-rate acquisition loan with an institutional capital source on behalf of the new owner.

The 128,172-square-foot center at 3105-3117 Route 38 is anchored by Aldi, Planet Fitness and Dollar Tree. Major tenants at the 88% leased property include Hair Cuttery, The UPS Store and Kumon Learning Center.

The center spans 24.7 acres less than 12 miles from the Philadelphia CBD.

"There has been a steady increase in investor demand for grocery-anchored product within the greater Philadelphia marketplace, resulting in correlating cap-rate compression since the start of 2019," Munley said in a statement. "With the steady flow of new capital we have witnessed entering the retail investment market, we anticipate that to continue into 2020."

For more than 30 years, the principals of Gorman & Co. and its predecessor companies have been engaged in the land acquisition and ground up development of more than 3 million square feet of office, retail, residential, self-storage and mixed-use properties throughout the region with an aggregate value of more than $400 million, according to its website.

www.omegare.com

Essex County Unveils Plans for New 150,000 Government Office Building

New Jersey’s Essex County is advancing plans to construct a 150,000-square-foot office building at its government complex in downtown Newark, the county seat.

The development is part of a series of updates and expansions that Essex County is making to its properties in New Jersey's largest city, which has also seen a surge in the private real estate development of both office and multifamily buildings.

The latest project is slated for what is now a jurors' parking lot on the south side of the Essex County Hall of Records center. The planned building, with its front entrance to face Martin Luther King Jr. Boulevard, is expected to house 11 courtrooms for tax court and space for the county clerk, board of elections, superintendent of elections, surrogate's office and board of taxation, according to a statement from Essex County Executive Joseph DiVincenzo Jr.

Plans for the new building also include cafeteria space large enough to accommodate the entire complex and would replace the current cafe on the Hall of Records' third floor. A pedestrian bridge would connect the new building to the records hall.

County officials outlined details of their plans for the development Wednesday at a news conference that New Jersey Gov. Phil Murphy attended. At the event, DiVincenzo said he's proposing to name the building the Essex County Dr. Martin Luther King Jr. Justice Building in honor of the legendary civil rights leader.

The county has awarded Comito and Associates a $2.3 million professional services contract to design the building. A resolution to award a publicly bid construction contract is on the agenda for an Essex County Board of Chosen Freeholders meeting on Feb. 26.

The county is funding the project, scheduled to be completed in the spring of 2021, through its capital budget. The Essex County Department of Public Works will monitor the construction.

"Many of the visitors who come to the Hall or Records to conduct business or search for records have a difficult time navigating our hallways and finding the offices they need," DiVincenzo said in a statement. "When the Superior Court was looking for modern space, we realized this was an opportunity to create a state-of-the-art building where we could consolidate our constitutional offices and create an atmosphere that was more user-friendly. Visitors already are taking time out of their busy schedules to come to the Hall of Records; we want to make it as easy as possible to get to the office they need."

The new King building is part of a multiphase county project to provide additional office space and modern facilities at the Hall of Records complex. Right now, a 900-car deck for employee parking is under construction on West Market Street, and the renovation of two office buildings at 320-321 University Ave. is underway. That location will serve as the new headquarters for the Essex County Division of Family Assistance and Benefits. Both projects are expected to be completed this year.

Essex County dedicated an 8-foot bronze statue of King and named a plaza after him in 2015. That original statue will be incorporated into the proposed building. In addition, a new 16-foot bronze statue of King will be commissioned and placed at the front entrance to the planned building on King Boulevard.

www.omegare.com

The development is part of a series of updates and expansions that Essex County is making to its properties in New Jersey's largest city, which has also seen a surge in the private real estate development of both office and multifamily buildings.

The latest project is slated for what is now a jurors' parking lot on the south side of the Essex County Hall of Records center. The planned building, with its front entrance to face Martin Luther King Jr. Boulevard, is expected to house 11 courtrooms for tax court and space for the county clerk, board of elections, superintendent of elections, surrogate's office and board of taxation, according to a statement from Essex County Executive Joseph DiVincenzo Jr.

Plans for the new building also include cafeteria space large enough to accommodate the entire complex and would replace the current cafe on the Hall of Records' third floor. A pedestrian bridge would connect the new building to the records hall.

County officials outlined details of their plans for the development Wednesday at a news conference that New Jersey Gov. Phil Murphy attended. At the event, DiVincenzo said he's proposing to name the building the Essex County Dr. Martin Luther King Jr. Justice Building in honor of the legendary civil rights leader.

The county has awarded Comito and Associates a $2.3 million professional services contract to design the building. A resolution to award a publicly bid construction contract is on the agenda for an Essex County Board of Chosen Freeholders meeting on Feb. 26.

The county is funding the project, scheduled to be completed in the spring of 2021, through its capital budget. The Essex County Department of Public Works will monitor the construction.

"Many of the visitors who come to the Hall or Records to conduct business or search for records have a difficult time navigating our hallways and finding the offices they need," DiVincenzo said in a statement. "When the Superior Court was looking for modern space, we realized this was an opportunity to create a state-of-the-art building where we could consolidate our constitutional offices and create an atmosphere that was more user-friendly. Visitors already are taking time out of their busy schedules to come to the Hall of Records; we want to make it as easy as possible to get to the office they need."

The new King building is part of a multiphase county project to provide additional office space and modern facilities at the Hall of Records complex. Right now, a 900-car deck for employee parking is under construction on West Market Street, and the renovation of two office buildings at 320-321 University Ave. is underway. That location will serve as the new headquarters for the Essex County Division of Family Assistance and Benefits. Both projects are expected to be completed this year.

Essex County dedicated an 8-foot bronze statue of King and named a plaza after him in 2015. That original statue will be incorporated into the proposed building. In addition, a new 16-foot bronze statue of King will be commissioned and placed at the front entrance to the planned building on King Boulevard.

www.omegare.com

Brian O’Neill to build cell and gene manufacturing facility in King of Prussia

by Katie Park, Philadelphia Inquirer

Brian O’Neill, the Main Line developer who founded the substance abuse treatment chain Recovery Centers of America, plans to develop a $1.1 billion cell and gene therapy manufacturing facility in King of Prussia.

The company, which O’Neill has named the Center for Breakthrough Medicines, is part of the Discovery Labs, a 1.6 million-square-foot, $500 million biotechnology, health-care, and life sciences office complex he is building in an industrial section of King of Prussia. The center will claim 680,000 square feet of the Discovery Labs.

The goal of the center, its management said Wednesday, is to pursue cures for diseases including cystic fibrosis, hemophilia A, and certain cancers by working with scientists, large pharmaceutical companies, and academic and governmental institutions.

Health-care investment management firm Deerfield Management of New York City co-founded the center with O’Neill.

“Today, brilliant scientists are advancing an unprecedented number of gene and cell therapy drug candidates," Alex Karnal, Deerfield’s partner and managing director and a Discovery Labs board member, said in a statement. “The real tragedy, however, is a scarcity of manufacturing know-how, which is complex and expensive.”

The Center for Breakthrough Medicines will address what it regards as a “shortfall” in cell and gene therapy manufacturing, the company said, as well as a scarcity of products approved by the U.S. Food and Drug Administration.

Discovery Labs is managed by Radnor-based MLP Ventures, formerly the O’Neill Properties Group. The complex has announced its plans to remake the 1 million-square-foot Upper Merion West facility formerly occupied by the pharmaceutical company GlaxoSmithKline and 640,000 square feet at the nearby office park Innovation Renaissance.

In 2018, MLP Ventures bought a portion of Innovation Renaissance from Wayne-based Liberty Property Trust for $77 million. Liberty, the company that built the Comcast Towers in Philadelphia, has since arranged to be acquired by San Francisco’s Prologis Inc. for $12.6 billion.

Major construction continues at the Discovery Labs, which plans suites for universal cell processing, viral vector production, and cell banking for the Center for Breakthrough Medicines. The company said it would hire around 2,000 employees over the next 2½ years.

It is marketing itself as “the world’s largest and most advanced single solution cell and gene therapy contract development and manufacturing organization. Period."

www.omegare.com

Brian O’Neill, the Main Line developer who founded the substance abuse treatment chain Recovery Centers of America, plans to develop a $1.1 billion cell and gene therapy manufacturing facility in King of Prussia.

The company, which O’Neill has named the Center for Breakthrough Medicines, is part of the Discovery Labs, a 1.6 million-square-foot, $500 million biotechnology, health-care, and life sciences office complex he is building in an industrial section of King of Prussia. The center will claim 680,000 square feet of the Discovery Labs.

The goal of the center, its management said Wednesday, is to pursue cures for diseases including cystic fibrosis, hemophilia A, and certain cancers by working with scientists, large pharmaceutical companies, and academic and governmental institutions.

Health-care investment management firm Deerfield Management of New York City co-founded the center with O’Neill.

“Today, brilliant scientists are advancing an unprecedented number of gene and cell therapy drug candidates," Alex Karnal, Deerfield’s partner and managing director and a Discovery Labs board member, said in a statement. “The real tragedy, however, is a scarcity of manufacturing know-how, which is complex and expensive.”

The Center for Breakthrough Medicines will address what it regards as a “shortfall” in cell and gene therapy manufacturing, the company said, as well as a scarcity of products approved by the U.S. Food and Drug Administration.

Discovery Labs is managed by Radnor-based MLP Ventures, formerly the O’Neill Properties Group. The complex has announced its plans to remake the 1 million-square-foot Upper Merion West facility formerly occupied by the pharmaceutical company GlaxoSmithKline and 640,000 square feet at the nearby office park Innovation Renaissance.

In 2018, MLP Ventures bought a portion of Innovation Renaissance from Wayne-based Liberty Property Trust for $77 million. Liberty, the company that built the Comcast Towers in Philadelphia, has since arranged to be acquired by San Francisco’s Prologis Inc. for $12.6 billion.

Major construction continues at the Discovery Labs, which plans suites for universal cell processing, viral vector production, and cell banking for the Center for Breakthrough Medicines. The company said it would hire around 2,000 employees over the next 2½ years.

It is marketing itself as “the world’s largest and most advanced single solution cell and gene therapy contract development and manufacturing organization. Period."

www.omegare.com

Chicago Developer Buys Former Philadelphia Refinery in Bankruptcy Auction

Hilco Redevelopment Partners is the winning bidder of one of the oldest and largest oil refineries on the East Coast. The purchase by Hilco, a company that specializes in redeveloping industrial sites, suggests the oil refinery may soon be transformed into a logistics hub.

Hilco, based in Chicago, plans to spend $240 million to buy the Philadelphia Energy Solutions refinery, according to filings revealed Wednesday with the U.S. Bankruptcy Court for the District of Delaware. The 150-year-old refinery sits in south Philadelphia and has been closed since a fire and explosion last year. Shortly after the fire, Philadelphia Energy Solutions filed for Chapter 11 bankruptcy protection.

The refinery sale still requires approval from the U.S. Bankruptcy Court as well as creditors, according to the filings.

The property is on 1,300 acres along the Schuylkill River, providing waterway infrastructure.

Hilco has a track record of redeveloping industrial sites into logistics-focused projects. Hilco bought a former Baltimore steel mill for $72 million several years ago and transformed it into Tradepoint Atlantic, a 3,300-acre shipping and logistics industrial development with tenants such as Amazon and Home Depot, according to CoStar data.

In Chicago, Hilco is redeveloping the former Crawford Station — one of the city’s oldest power stations — into a 1 million-square-foot logistics center. The project, called Exchange 55, is expected to be completed this year.

Meanwhile, the Philadelphia Energy Solutions refinery was the largest refinery on the East Coast and processed roughly 335,000 barrels of oil per day at maximum capacity.

Demand for refined petroleum is expected to dwindle in the coming years because of increased fuel efficiency and wider use of electric and hybrid vehicles, according to a market report from IHS Markit, an industry consulting firm. The East Coast is expected to have the steepest decline in demand because of higher operating costs and competition from alternative energy, according to IHS Markit.

IHS Markit cites uncertainties related to the refinery site such as environmental conditions and being an urban location close to residential communities. About 219,700 people lived within 3 miles of the refinery site in 2017, according to the consulting firm.

www.omegare.com

Hilco, based in Chicago, plans to spend $240 million to buy the Philadelphia Energy Solutions refinery, according to filings revealed Wednesday with the U.S. Bankruptcy Court for the District of Delaware. The 150-year-old refinery sits in south Philadelphia and has been closed since a fire and explosion last year. Shortly after the fire, Philadelphia Energy Solutions filed for Chapter 11 bankruptcy protection.

The refinery sale still requires approval from the U.S. Bankruptcy Court as well as creditors, according to the filings.

The property is on 1,300 acres along the Schuylkill River, providing waterway infrastructure.

Hilco has a track record of redeveloping industrial sites into logistics-focused projects. Hilco bought a former Baltimore steel mill for $72 million several years ago and transformed it into Tradepoint Atlantic, a 3,300-acre shipping and logistics industrial development with tenants such as Amazon and Home Depot, according to CoStar data.

In Chicago, Hilco is redeveloping the former Crawford Station — one of the city’s oldest power stations — into a 1 million-square-foot logistics center. The project, called Exchange 55, is expected to be completed this year.

Meanwhile, the Philadelphia Energy Solutions refinery was the largest refinery on the East Coast and processed roughly 335,000 barrels of oil per day at maximum capacity.

Demand for refined petroleum is expected to dwindle in the coming years because of increased fuel efficiency and wider use of electric and hybrid vehicles, according to a market report from IHS Markit, an industry consulting firm. The East Coast is expected to have the steepest decline in demand because of higher operating costs and competition from alternative energy, according to IHS Markit.

IHS Markit cites uncertainties related to the refinery site such as environmental conditions and being an urban location close to residential communities. About 219,700 people lived within 3 miles of the refinery site in 2017, according to the consulting firm.

www.omegare.com

NJ Industrial Market Ends Decade with Record Vacancies, Rents

by John Jordan Globest.com

The industrial market in the state of New Jersey set new records at the end of 2019 for low vacancy and high rents.

In its fourth quarter 2019 industrial market report for New Jersey, showed the big box bubble is showing no sign of bursting as new construction continues to lease up quickly.

New Jersey’s industrial market finished the year at a record-low vacancy rate of 3.5%. The decade also ended with 18 consecutive quarters of increased rents and 16 consecutive quarters of record-high rents, closing 2019 at $8.73-per-square-foot.

Last year, new development in the Garden State slowed down with 4.7 million square feet being built, the lowest amount recorded since 2016. During 2019, 5.4 million square feet of industrial space was absorbed, the lowest level since 2012, due to limited supply.

“The scarcity of available land, especially in northern New Jersey, has slowed development in the past couple of years, and most new construction has been leased up quickly. Following exhaustive searches, challenges with rezoning and environmental factors, developers have replenished the construction pipeline heading into 2020.”

At the close of 2019, nearly 11 million square feet was under construction in core New Jersey markets, including more than 1 million square feet in the pipeline for five of the 25 submarkets.

Rents continued to rise, albeit at a slower pace, increasing by 6.1% from a year ago. Led by Exit 8A and the Hudson Waterfront submarkets, 17 of the 25 submarkets included reported higher rents than a year ago, with nine increasing by more than 10% year over year. New construction is commanding double-digit rents, with some approaching the mid-teens.

“Industrial real estate will remain the preferred asset class for investors and will also be the safest investment during periods of economic uncertainty. E-commerce was the catalyst for demand during the past decade, and recent reports of record-setting online shopping points to continued prosperity in the industrial market heading into 2020.”

E-commerce continues to have a positive impact on the industrial space as it has created “reverse logistics, or the need for separate facilities to handle returns directly by the originating retailer or third-party logistics providers.”

Key data points that clearly indicate the emerging influence e-commerce has on retail sales and the industrial real estate market.

E-commerce as a percentage of overall U.S. retail sales surpassed 11% for the first time in the third quarter of 2019. At the start of the decade, Amazon did not occupy any industrial properties in New Jersey. By the end of 2019, the company now occupies more than 12 million square feet in the state.

Cargo volume for the Port of New York and New Jersey continued to set records, the latest in November 2019, maintaining its position as the second-largest port in North America. By 2050, cargo at the port is expected to double.

Wednesday, January 22, 2020

Endurance announces the sale of 2000 Bishops Gate in Mount Laurel, New Jersey

An affiliate of Endurance Real Estate Group, LLC (“Endurance”) and Thackeray Partners (“Thackeray”) is pleased to announce the disposition of 2000 Bishops Gate, a 292,466 SF, Class A industrial warehouse, located in Mount Laurel, New Jersey (“Property”) for $32.2 million.

The building was constructed in 1988 and renovated in 2019. It features 32’ clear ceiling heights, an ESFR sprinkler system and ample loading capacity with full dock packages for its 35 dock positions. The Property is strategically located on NJ Route 38, a principal East/West highway in Burlington County, NJ and offers access to Exits 4 and 5 of the NJ Turnpike and Exit 40 of I-295. The Property was 100% leased to two tenants at closing.

“We are thrilled to see the transformation of this project through its stabilization to disposition," stated Albert J. Corr, Senior Vice President from Endurance. “We acquired the building in early 2017 knowing it would be vacant within a few months. We set forth on a full scale $5 million capital improvement plan to upgrade and modernize the Property to make it a very attractive option for prospective tenants. We demolished 75,000 sf of office areas in the building, replaced the roof, installed new LED lighting throughout the warehouse and added ten (10) additional dock doors to meet the demand of today’s industrial tenants,” concluded Corr. Benjamin Cohen, President of Endurance, added, “Our ongoing partnership with Thackeray includes 10 deals together in the greater Philly MSA, this transaction being a very successful one. Burlington County has seen a tremendous uptick in tenant demand and investor interest in the last few years and with our business plan completed we were able to capitalize on that growth.”

www.omegare.com

The building was constructed in 1988 and renovated in 2019. It features 32’ clear ceiling heights, an ESFR sprinkler system and ample loading capacity with full dock packages for its 35 dock positions. The Property is strategically located on NJ Route 38, a principal East/West highway in Burlington County, NJ and offers access to Exits 4 and 5 of the NJ Turnpike and Exit 40 of I-295. The Property was 100% leased to two tenants at closing.

“We are thrilled to see the transformation of this project through its stabilization to disposition," stated Albert J. Corr, Senior Vice President from Endurance. “We acquired the building in early 2017 knowing it would be vacant within a few months. We set forth on a full scale $5 million capital improvement plan to upgrade and modernize the Property to make it a very attractive option for prospective tenants. We demolished 75,000 sf of office areas in the building, replaced the roof, installed new LED lighting throughout the warehouse and added ten (10) additional dock doors to meet the demand of today’s industrial tenants,” concluded Corr. Benjamin Cohen, President of Endurance, added, “Our ongoing partnership with Thackeray includes 10 deals together in the greater Philly MSA, this transaction being a very successful one. Burlington County has seen a tremendous uptick in tenant demand and investor interest in the last few years and with our business plan completed we were able to capitalize on that growth.”

www.omegare.com

Parkway to Build New Office Tower in Philadelphia for Law Firm Morgan Lewis

by John Jordan Globest.com

Locally-based Parkway Corp. reports it will build a new 19-story office building in the Central Business District for law firm Morgan Lewis & Bockius.

Parkway reports that the law firm will occupy the entire 305,000-square-foot office building at 2222 Market St. The office building will be the first non-Comcast commercial office building constructed in the city’s CBD in more than 30 years.

“As Morgan Lewis continues its focus on exceptional client service, we believe that 2222 Market, with its cutting-edge design and technology, will increase collaboration among our lawyers and staff as well as add to our operational efficiencies,” says Sarah E. Bouchard, Morgan Lewis’ Philadelphia office managing partner. “We look forward to welcoming our clients, our lawyers, and our professional staff to our new office in Philadelphia.”

The tower is designed by architectural firm Gensler and will feature 10-foot high ceilings throughout with floor-to-ceiling glass, multiple outdoor terrace amenities, flexible workspace planning, fitness center, and conference center.

The building is designed to have a light carbon footprint and will be seeking LEED-CS Gold and Fitwell certifications.

Morgan Lewis & Bockius’ Philadelphia headquarters is currently located at 1701 Market St.

www.omegare.com

Locally-based Parkway Corp. reports it will build a new 19-story office building in the Central Business District for law firm Morgan Lewis & Bockius.

Parkway reports that the law firm will occupy the entire 305,000-square-foot office building at 2222 Market St. The office building will be the first non-Comcast commercial office building constructed in the city’s CBD in more than 30 years.

“As Morgan Lewis continues its focus on exceptional client service, we believe that 2222 Market, with its cutting-edge design and technology, will increase collaboration among our lawyers and staff as well as add to our operational efficiencies,” says Sarah E. Bouchard, Morgan Lewis’ Philadelphia office managing partner. “We look forward to welcoming our clients, our lawyers, and our professional staff to our new office in Philadelphia.”

The tower is designed by architectural firm Gensler and will feature 10-foot high ceilings throughout with floor-to-ceiling glass, multiple outdoor terrace amenities, flexible workspace planning, fitness center, and conference center.

The building is designed to have a light carbon footprint and will be seeking LEED-CS Gold and Fitwell certifications.

Morgan Lewis & Bockius’ Philadelphia headquarters is currently located at 1701 Market St.

www.omegare.com

Tuesday, January 21, 2020

Monday, January 20, 2020

Thursday, January 16, 2020

Newly Released Census Figures Show Surge in College Educated Renters in Philly

Just before the start of the new year, the U.S. census released a treasure trove of its most recent demographic data for 2018.

While the census’ data releases are lagged, the bureau still provides far and away the most granular insights available on changes in long-term demographic trends that shape commercial real estate markets across the U.S.

For Philadelphia’s commercial real estate community, one of the most important takeaways from the recent release was the continued surge in Philadelphia’s population of college-educated renters.

The year-end tally of overall renter households in Philadelphia County wasn’t particularly noteworthy. At 287,500, the figure was almost unchanged compared to 2013 levels.

But the slow-growing headline figure masks dramatic changes in the demographic makeup of Philadelphia’s renter population. With rents having risen for 10 years straight, low income renters are being priced out of Philadelphia at an alarming rate.

The number of renter households without a college degree declined by almost 20,000, or 13% over the past five years, more than 10 times the national rate of decline in this cohort. Conversely, the number of renter households with bachelor’s or graduate degrees jumped to 97,000 in 2018, an acceleration over the 5.4% annual growth the figure has averaged during the past five years.

In line with these shifts, Philadelphia’s share of renter households earning over $75,000 has now doubled from 10% in 2010 to 21% in 2018, with most of the gains accruing during the second half of the decade.

hy is Philly experiencing such rapid growth in high income renters? Increasing affordability barriers to homeownership (which will be covered in a future update) are keeping more high-income residents in the renter pool well into their 30s.

However, even greater affordability challenges in nearby New York and Washington, D.C., are sending residents Philadelphia’s way. As housing costs have skyrocketed in those locations during recent years, the number of college educated migrants arriving in Philadelphia annually has grown by more than 50% since 2012.

This influx has been offset by Philadelphia’s continued losses in low- and middle-income renters. Census data suggests that in many cases, these renters are moving to some of the lowest-cost corners of the Philadelphia MSA, including Delaware County, Pennsylvania and New Castle County, Delaware, which both saw their tallies of non-college educated renters rise by more than 4,000 over the past five years. However, others continue to leave Philadelphia, seeking the mix of lower housing costs and better blue collar employment prospects offered in the southern U.S.

The overarching takeaway from 2018’s census release is that while Philadelphia’s renter population is growing more slowly than it was five years ago, it continues to gentrify at a rapid pace.

www.omegare.com

While the census’ data releases are lagged, the bureau still provides far and away the most granular insights available on changes in long-term demographic trends that shape commercial real estate markets across the U.S.

For Philadelphia’s commercial real estate community, one of the most important takeaways from the recent release was the continued surge in Philadelphia’s population of college-educated renters.

The year-end tally of overall renter households in Philadelphia County wasn’t particularly noteworthy. At 287,500, the figure was almost unchanged compared to 2013 levels.

But the slow-growing headline figure masks dramatic changes in the demographic makeup of Philadelphia’s renter population. With rents having risen for 10 years straight, low income renters are being priced out of Philadelphia at an alarming rate.

The number of renter households without a college degree declined by almost 20,000, or 13% over the past five years, more than 10 times the national rate of decline in this cohort. Conversely, the number of renter households with bachelor’s or graduate degrees jumped to 97,000 in 2018, an acceleration over the 5.4% annual growth the figure has averaged during the past five years.

In line with these shifts, Philadelphia’s share of renter households earning over $75,000 has now doubled from 10% in 2010 to 21% in 2018, with most of the gains accruing during the second half of the decade.

hy is Philly experiencing such rapid growth in high income renters? Increasing affordability barriers to homeownership (which will be covered in a future update) are keeping more high-income residents in the renter pool well into their 30s.

However, even greater affordability challenges in nearby New York and Washington, D.C., are sending residents Philadelphia’s way. As housing costs have skyrocketed in those locations during recent years, the number of college educated migrants arriving in Philadelphia annually has grown by more than 50% since 2012.

This influx has been offset by Philadelphia’s continued losses in low- and middle-income renters. Census data suggests that in many cases, these renters are moving to some of the lowest-cost corners of the Philadelphia MSA, including Delaware County, Pennsylvania and New Castle County, Delaware, which both saw their tallies of non-college educated renters rise by more than 4,000 over the past five years. However, others continue to leave Philadelphia, seeking the mix of lower housing costs and better blue collar employment prospects offered in the southern U.S.

The overarching takeaway from 2018’s census release is that while Philadelphia’s renter population is growing more slowly than it was five years ago, it continues to gentrify at a rapid pace.

www.omegare.com

Joint Venture Buys Whole Foods-Anchored Shopping Center Near Center City, Philadelphia

A joint venture between Charter Realty & Development Corp. and an open-end institutional fund sponsored by Inland Institutional Capital has purchased Baederwood Shoppes on the Fairway in Abington, Pennsylvania, for $43.3 million, or about $371 per square foot.

The 116,778-square-foot center at 1537-1659 Fairway Valley Road is anchored by Whole Foods. Tenants at the 94% leased center include Planet Fitness, Panera Bread, Le Papillon Hair Salon, Message Envy and Baederwood Pharmacy.

The property spans 10.4 acres less than 10 miles from Center City, Philadelphia

"Having sold three Whole Foods-anchored centers over the past year, it is evident that investors of Whole Foods-anchored shopping centers have an insatiable demand for the product. Baederwood attracted a wide array of strong interest from a diverse group of institutional, REIT and private investors."

According to its website, Inland Institutional Capital has facilitated the completion of transactions with a value in excess of $11.5 billion since 2005.

www.omegare.com

The 116,778-square-foot center at 1537-1659 Fairway Valley Road is anchored by Whole Foods. Tenants at the 94% leased center include Planet Fitness, Panera Bread, Le Papillon Hair Salon, Message Envy and Baederwood Pharmacy.

The property spans 10.4 acres less than 10 miles from Center City, Philadelphia

"Having sold three Whole Foods-anchored centers over the past year, it is evident that investors of Whole Foods-anchored shopping centers have an insatiable demand for the product. Baederwood attracted a wide array of strong interest from a diverse group of institutional, REIT and private investors."

According to its website, Inland Institutional Capital has facilitated the completion of transactions with a value in excess of $11.5 billion since 2005.

www.omegare.com

Tuesday, January 14, 2020

Pennmark Properties Sells Mount Laurel Office Center in Southern New Jersey

Pennmark Properties has sold the 83,216-square-foot Mount Laurel Office Center in Mount Laurel, New Jersey, for $11.05 million, or about $133 per square foot.

The buildings at 530, 532 and 534 Fellowship Road are fully leased to six tenants and is anchored by the various uses of the United States Government’s General Services Administration.

Built in 1984, the property has visibility from Route 73 and access to many of the area’s primary thoroughfares, including Routes 38 and 70, Interstate 295 and The New Jersey Turnpike.

www.omegare.com

The buildings at 530, 532 and 534 Fellowship Road are fully leased to six tenants and is anchored by the various uses of the United States Government’s General Services Administration.

Built in 1984, the property has visibility from Route 73 and access to many of the area’s primary thoroughfares, including Routes 38 and 70, Interstate 295 and The New Jersey Turnpike.

www.omegare.com

Cyprus Investment Firm Acquires Pennsylvania Shopping Center for $40M in Blue Bell

by John Jordan Globest.com

Medipower Overseas Co. of Cyprus has acquired the nearly fully-occupied Centre Square Commons shopping center here from Kinsley Properties for approximately $40 million.

The 88,598-square-foot grocery-anchored shopping center was 96% occupied at the time of the sale. The buyers were Medipower Overseas Co.,

Developed in 2017 as one of only a handful of new grocery-anchored shopping centers delivered in the past few years in the greater Philadelphia suburbs, Centre Square Commons is located on the corner of Route 202, and Route 73 in the heart of Blue Bell. The property is anchored by a 22,450-square-foot Aldi Supermarket.

“The pride of ownership on a generational asset, the success of the lease-up, fine aesthetics of first-class construction, and internet-proof tenancy created strong demand from national investors to own Centre Square Commons."

Centre Square Commons’ tenant roster includes a 10,816-square-foot Pennsylvania Fine Wine & Spirits Signature Premium Store, Starbucks, Zoe’s Kitchen, Anthony’s Coal Fired Pizza, Turning Point, Hand & Stone Massage, Lash Lounge, Jersey Mike’s, Barre 3 Yoga, Verizon and Vist Bank.

www.omegare.com

Medipower Overseas Co. of Cyprus has acquired the nearly fully-occupied Centre Square Commons shopping center here from Kinsley Properties for approximately $40 million.

The 88,598-square-foot grocery-anchored shopping center was 96% occupied at the time of the sale. The buyers were Medipower Overseas Co.,

Developed in 2017 as one of only a handful of new grocery-anchored shopping centers delivered in the past few years in the greater Philadelphia suburbs, Centre Square Commons is located on the corner of Route 202, and Route 73 in the heart of Blue Bell. The property is anchored by a 22,450-square-foot Aldi Supermarket.

“The pride of ownership on a generational asset, the success of the lease-up, fine aesthetics of first-class construction, and internet-proof tenancy created strong demand from national investors to own Centre Square Commons."

Centre Square Commons’ tenant roster includes a 10,816-square-foot Pennsylvania Fine Wine & Spirits Signature Premium Store, Starbucks, Zoe’s Kitchen, Anthony’s Coal Fired Pizza, Turning Point, Hand & Stone Massage, Lash Lounge, Jersey Mike’s, Barre 3 Yoga, Verizon and Vist Bank.

www.omegare.com

Monday, January 13, 2020

Giant Food Stores to Spend $114M to Expand PA Operations

by John Jordan Globest.com

Giant Foods Stores, LLC reports it intends to spend $114 million over the next 18 months to expand its operations in Pennsylvania. The initiative will include a new fulfillment center in Philadelphia and new store locations in Pocono Summit and Swatara Township.

The grocer states that the capital program builds on the success of its recently launched Giant Direct and Giant Heirloom Market formats.

The company unveiled plans to remodel 35 existing stores in 2020 and 2021. With this investment, Giant will grow its commitment to the city of Philadelphia, its home market in Central Pennsylvania, and Monroe County. Giant announced the capital investment program at last week’s 104th Pennsylvania Farm Show.

Nicholas Bertram, president, Giant Food Stores, says, “The accelerated growth of Giant Direct has set the stage for additional investment opportunities that extend our e-commerce geographic reach. At the same time, our Giant Heirloom Market format has enabled us to reach an entirely new demographic in Philadelphia.”

Giants states it will construct its largest omni-channel fulfillment center in support of its e-commerce brand, Giant Direct at 3501 Island Ave. in Philadelphia. The 124,000 square foot facility will be completely renovated and will provide the firm with more capacity, better distribution and room to grow home delivery and in-store pick-up serving. Giant will partner with Peapod Digital Labs, an Ahold Delhaize USA company, on the development of the project.

The first Giant Direct facility to open in Philadelphia is expected to bring more than 200 new jobs to the Eastwick neighborhood of Philadelphia.

Giant also announced it will open a new 52,000-square-foot store in the Harrisburg market. Located at 6301 Grayson Road in Swatara Township, construction on the existing structure will begin in early 2020 and the new store will create approximately 150 new jobs. The company plans to open the Swatara Township store later this year. GIANT currently operates eight stores in Dauphin County, employing approximately 1,550 team members.

Also planned is a new, ground-up 66,000-square-foot Giant location that will be built in Pocono Summit at the southwest corner of Interstate 380 and state Route 940. The new store will expand the Giant brand along the Interstate 380 corridor and within Monroe County. Currently, a 2021 opening is being planned and the company anticipates hiring 200 team members for the new location.

The company plans to remodel 35 stores in various locations across its operating footprint that, in some cases, may include a new Beer & Wine Eatery. Future remodels in the Commonwealth include the communities of Camp Hill and St. Davids.

Giant, which is the second largest private employer in Pennsylvania, currently employs more than 27,000 people statewide.

www.omegare.com

Giant Foods Stores, LLC reports it intends to spend $114 million over the next 18 months to expand its operations in Pennsylvania. The initiative will include a new fulfillment center in Philadelphia and new store locations in Pocono Summit and Swatara Township.

The grocer states that the capital program builds on the success of its recently launched Giant Direct and Giant Heirloom Market formats.

The company unveiled plans to remodel 35 existing stores in 2020 and 2021. With this investment, Giant will grow its commitment to the city of Philadelphia, its home market in Central Pennsylvania, and Monroe County. Giant announced the capital investment program at last week’s 104th Pennsylvania Farm Show.

Nicholas Bertram, president, Giant Food Stores, says, “The accelerated growth of Giant Direct has set the stage for additional investment opportunities that extend our e-commerce geographic reach. At the same time, our Giant Heirloom Market format has enabled us to reach an entirely new demographic in Philadelphia.”

Giants states it will construct its largest omni-channel fulfillment center in support of its e-commerce brand, Giant Direct at 3501 Island Ave. in Philadelphia. The 124,000 square foot facility will be completely renovated and will provide the firm with more capacity, better distribution and room to grow home delivery and in-store pick-up serving. Giant will partner with Peapod Digital Labs, an Ahold Delhaize USA company, on the development of the project.

The first Giant Direct facility to open in Philadelphia is expected to bring more than 200 new jobs to the Eastwick neighborhood of Philadelphia.

Giant also announced it will open a new 52,000-square-foot store in the Harrisburg market. Located at 6301 Grayson Road in Swatara Township, construction on the existing structure will begin in early 2020 and the new store will create approximately 150 new jobs. The company plans to open the Swatara Township store later this year. GIANT currently operates eight stores in Dauphin County, employing approximately 1,550 team members.