Thursday, December 28, 2023

Thursday, December 21, 2023

Wednesday, December 20, 2023

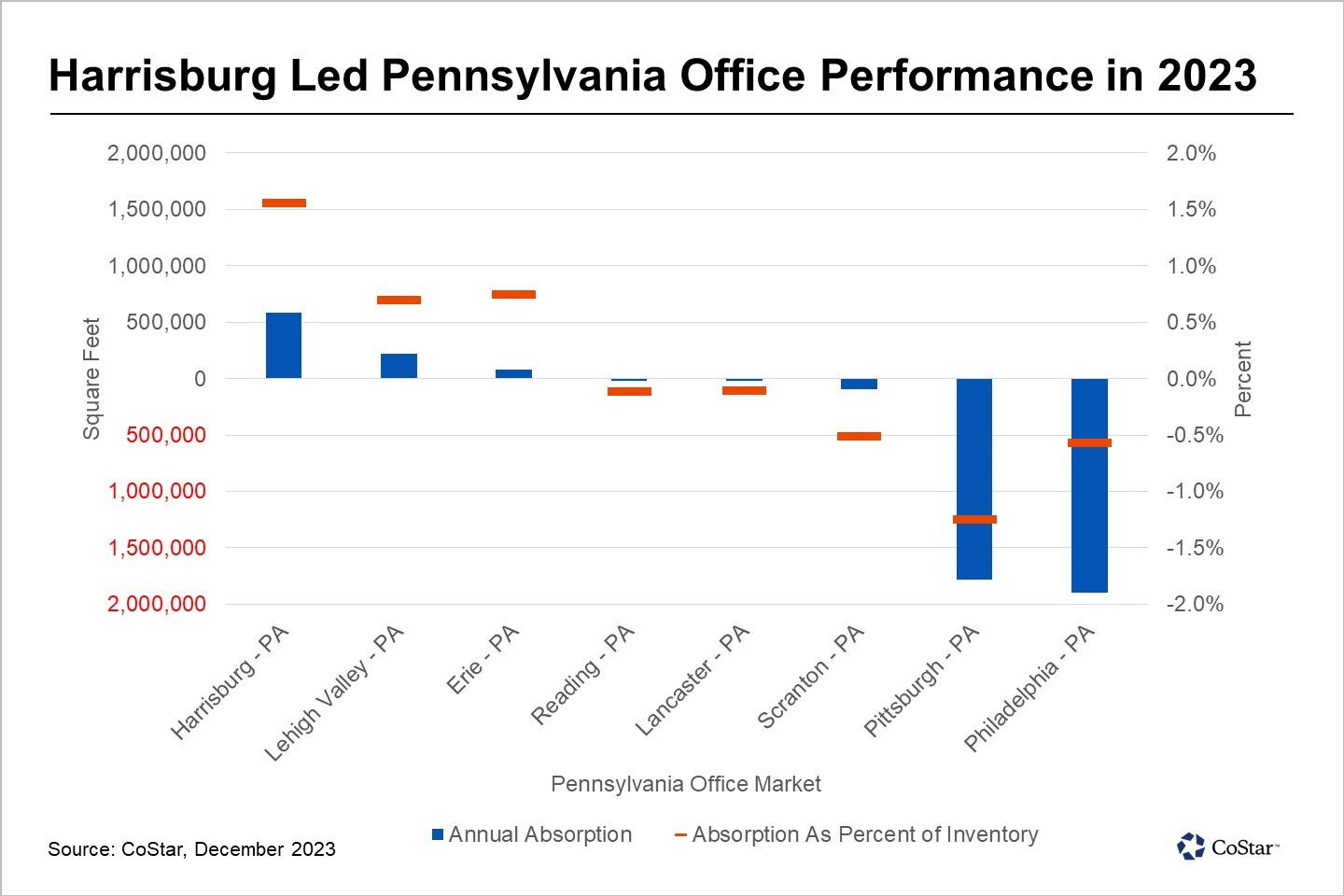

Harrisburg Leads Pennsylvania in Office Performance, Bucks National Trend

By Brenda Nguyen Costar

Tuesday, December 19, 2023

Commercial real estate volume may pick up in 2024 as Federal Reserve signals interest-rate cuts

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

Commercial real estate transactions slowed considerably in 2023, amid high interest rates, declining values and pricing uncertainty.

Investment volume declined by 42% in 2023 from the prior year, according to CBRE Group Inc. (NYSE: CBRE). The Dallas-based commercial real estate firm is expecting deal volume to be down again in 2024, but by a more modest 5% year over year.

Richard Barkham, global chief economist and global head of research at CBRE, said there's been "enormous excitement" since the 10-year Treasury yield recently dropped, to about 4%. Combined with the Federal Reserve's signaling of some interest-rate cuts next year, that should propel more commercial real estate transactions in 2024.

"There are still some issues we will need to contend with," Barkham said, adding the Fed still wants to see a lower rate of inflation, and economies in the rest of the world are also slowing. "We’ve found it very difficult to forecast and be accurate on inflation. It’s not impossible we’ll get another inflation upside surprise," he added.

CBRE is forecasting an average 10-year Treasury yield of 3.3% between 2025 and 2028. That will likely result in more deal volume in the medium term rather than in 2024, though transactions are likely to start picking up in the second half of 2024, Barkham said.

CBRE isn't predicting a recession in 2024 but expects the economy to slow, with a projected unemployment rate of 4.5% — up modestly from the rate of 3.7% last month — and the inflation rate to cool to about 2.7% by the end of 2024.

Next year will also have a closely watched U.S. presidential election. Barkham said he wasn't sure what impact that will have on commercial real estate activity but, he added, during very contested elections, the market tends to slow about three months before Election Day.

Interest rate impact on commercial real estate

Rebecca Rockey, deputy chief economist and global head of forecasting at Cushman & Wakefield plc (NYSE: CWK), in an email said last week's Fed announcement was largely expected and doesn't meaningfully shift the Chicago-based commercial real estate firm's perspective for 2024. There's also still uncertainty about inflation and no guaranteed path for the federal funds rate, she added.

"So, as the Fed stated, it is too soon to declare victory," Rockey continued. "I think there is a temptation to place too much emphasis on the Fed pause and pivot. Certainly, it will add much needed clarity, but the fact remains that we are in the midst of a broader adjustment process to higher costs of capital, and that will persist well after the Fed’s pivot and throughout their cutting cycle."

Still, she said, Cushman is predicting commercial real estate transaction momentum to gain steam through next year and into 2025 as the economy and interest-rate picture becomes clearer. That'll allow for greater conviction in underwriting income and exit assumptions, Rockey said.

Tim Bodner, real estate deals leader at PricewaterhouseCoopers LLP, said there's new optimism among real estate investors since the Fed's announcement last week. The economy is also holding up fairly well, with inflation coming down and the consumer and labor market overall resilient, he added.

"All of these things provide a really nice backdrop for ... the commercial real estate market," Bodner said.

But it's inevitable a looming wave of debt maturities will need to be addressed, and most who track the commercial real estate industry closely expect an uptick in distress and foreclosures in 2024. Moody's Analytics Inc. estimates there will be $182 billion in commercial real estate debt maturing next year.

Full story: https://tinyurl.com/yc2v77sp

High interest rates tame region's industrial market, but rents and new development remain strong

By Paul Schwedelson – Reporter, Philadelphia Business Journal

Philadelphia's industrial real estate market in 2023 was marked by moderating prices and less intense demand after two years of peak activity.

“From a broad standpoint, everything starts really with the interest rate environment. Sales and leasing, no one has been untouched by it. Starting off the year, fundamentals were incredibly strong. They still are, but the headwinds of the interest rate environment has definitely cooled down everything.”

During the Covid-19 pandemic, as companies rushed to improve their e-commerce operations, tenant demand for warehouse and distribution space reached historic highs. While demand for industrial properties is still elevated, the urgent rush is no longer in play. Meanwhile, pricing had to be adjusted to accommodate what tenants and buyers can now afford in a more challenging economic environment.

Asking rent for industrial space in the Philadelphia region is around $11 per square foot. That’s up 8% from a year ago, which is strong growth but slower than the double-digit rent increases in previous years. He expects rent growth to be more incremental moving forward, with the market unlikely to see the big surges it experienced during the pandemic.

As a result of the shifting landscape, sellers may not be able to command as much for their properties since buyers need to factor in higher financing costs.

“The challenge this year has been bridging the gap between expectations of the year in the past vs. what’s really affordable today. Doesn’t mean that deals still haven’t gotten done.”

The effects on the region's industrial market have varied depending on geography and property size. In South Jersey, for example, enough new supply has hit the market that vacancy rates in the third quarter reached around 9.5%, according to Colliers. That’s a big increase from a low of 2% a year or two ago. In five southeast Pennsylvania counties, the vacancy rate was between 4% and 4.5% in the third quarter.

Full story: https://tinyurl.com/mskjye6c

Monday, December 18, 2023

Thursday, December 14, 2023

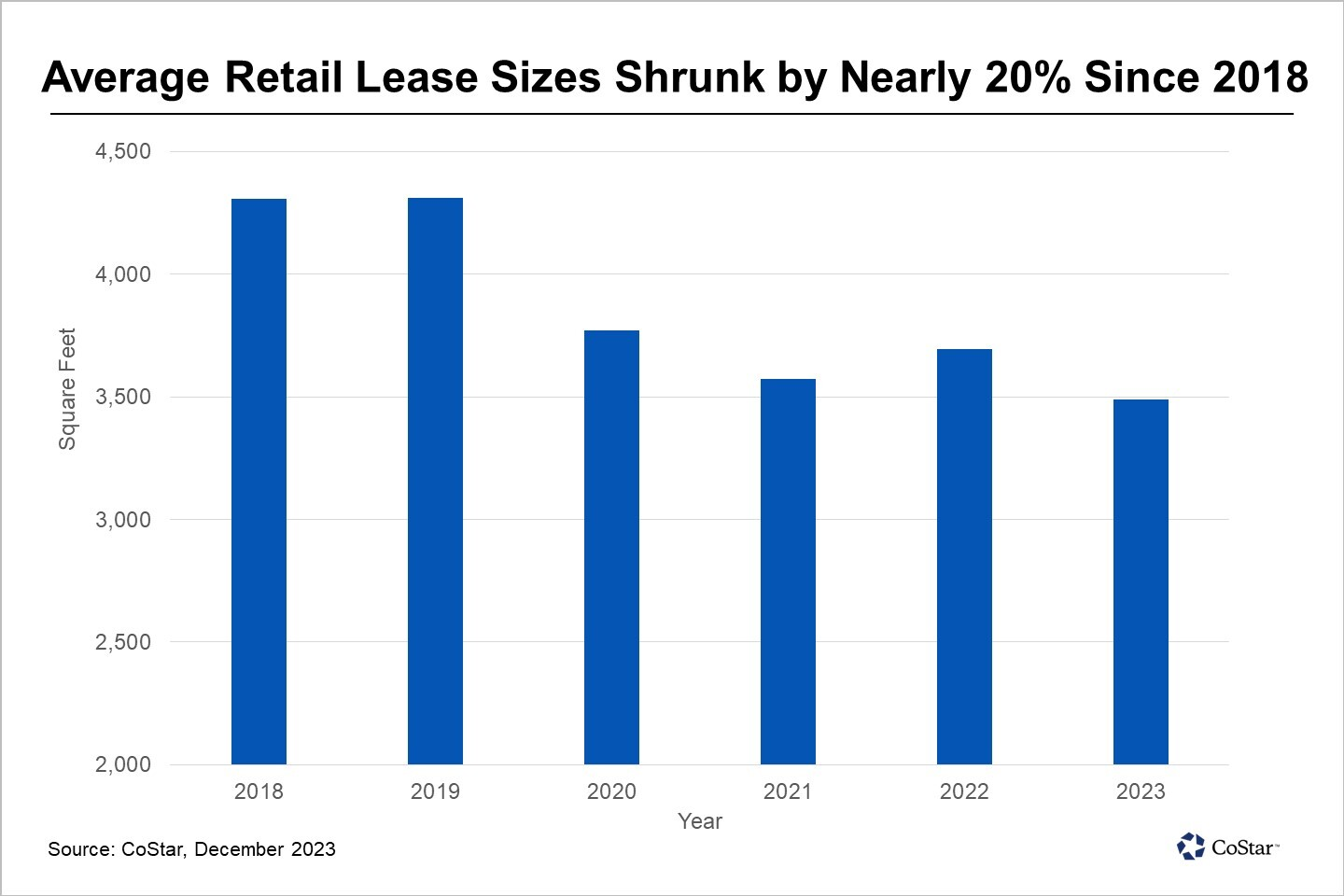

Average Retail Lease Size Gets Smaller as Philadelphia Retailers Reduce Store Size Requirements

By Brenda Nguyen Costar

Tuesday, December 12, 2023

Thursday, December 7, 2023

Companies will have to ask tough questions in office-space negotiations in 2024

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

The calculus for companies in the market for office space has become significantly more complicated in the wake of the Covid-19 pandemic.

For one, it's been tough to get workers to return to the office, although 2023 has seen a more robust comeback, as a greater number of employers mandate in-office time at least a few days a week. Still, to lure a reticent workforce and "earn the commute," company leaders have had make their workspaces more compelling and amenity-laden.

For another, companies are facing higher costs of everything, especially borrowing, and the economy is widely expected to slow in 2024. This year saw more layoffs and hiring slow in certain sectors as companies reassessed their expenditures, although the labor market remains tight.

Heading into 2024, business owners and managers making decisions about their office space — whether out of necessity, such as a lease expiring, or driven by factors such as recruitment — will have a few notable things to consider.

High-stakes environment

One of the biggest changes in office-space negotiations, experts say, is an expectation of more landlord transparency — especially their financials.

There's an estimated $47 billion in office loan debt coming due in 2024, according to Moody's Analytics Inc. Among commercial mortgage-backed securities loans backing office properties, Moody's estimates three-quarters of that will struggle to refinance next year.

"We’re seeing the same themes over and over again for tenants, corporate users and even small businesses: They want to reduce risk. What is the risk of doing a deal with a landlord that’s maybe on shaky ground?" said Michael Lirtzman, head of U.S. office agency leasing at Colliers International Group Inc.

There's a lot potentially at stake if a company signs a medium- or long-term deal at a building that'll face issues when its loan matures. Distressed buildings could be taken back by their lender, throwing tenants into chaos and uncertainty. Some landlords are even giving the keys back on buildings they no longer see as financially viable to retain.

Tenant brokers today frequently are advocating for subordination, non-disturbance and attornment (SNDA) clauses when their clients are signing an office deal, said Giles Wrench, vice chairman of financial services at Jones Lang LaSalle Inc. Those agreements spell out the rights of the tenant, landlord and any interested third parties — a lender or other investors, for example. Such clauses could prevent a tenant from being evicted if the building goes into foreclosure.

"There's a tremendous focus on that in the moment," said Wrench, who works with large financial-services companies and banks on their leasing strategy. He added office-space decisions and lease negotiations have gotten down to the micro level with tenants because of the current state of the office market.

In fact, the CEO is almost always on the ground floor of real estate decisions today.

Companies both public and private are under immense pressure to exercise financial scrutiny, Redmond said, and building the business case for a real estate decision is "under a big spotlight."

"There’s a need now more than ever before to really do due diligence around real estate decisions — understanding where your business is going, aligning with expectations and being really sharp on how you’re coming to the negotiation table, even at the individual-deal level," Redmond said.

Asking questions earlier in the process

Before a deal is even close to being signed, brokers say they're having to exercise more scrutiny on behalf of their tenants, and they're doing so earlier in the process.

Redmond said with companies her team works with, there are questions in requests for proposals to landlords about a building's capital stack, to try and gain a clearer picture of things such as a property's financial condition and whether there's an upcoming loan maturity.

On the whole, landlords that are in a relatively stable position financially are willing to share those details, brokers say. For landlords that aren't as transparent, those buildings might be eliminated in a space decision.

"It’s a massive red flag if you run into a landlord that’s being opaque," Wrench said, adding many companies, especially highly regulated ones like banks, can't afford to take on that risk.

David Lipson, president of Savills North America, said in an interview last month that companies and brokers should not only look into the capital stack of a building or the limited-liability company that owns it, but they should examine the parent company's financials as well. And a loan doesn't need to be coming due tomorrow to be a potential problem, he said.

"You can have a landlord sitting on a billion dollars of cash, [but] it doesn't mean they're going to put any of it into a given asset," he said.

Colliers' Lirtzman, who primarily works with landlords, said the smarter tenants and brokers are asking questions much earlier in the process. For landlords with a strong capital stack, those questions are welcome, he said.

Redmond said it's also imperative that companies in the market for space understand the capital markets, which will help them make more-informed decisions.

Full story: https://tinyurl.com/49hn9hfp

Wednesday, December 6, 2023

Velocity Venture Partners acquires Montgomery County industrial property for $31M

By Paul Schwedelson – Reporter, Philadelphia Business Journal

Velocity Venture Partners acquired a single-tenant, 340,000-square-foot industrial building in Montgomery County for $30.7 million with visions to improve and expand the site.

The 28-acre property is at 3400 E. Walnut St. in Colmar, in between Route 309 and County Line Road and less than a mile from SEPTA’s Regional Rail Colmar station. Velocity Founding Partner Zach Moore hailed the site for being one of the only industrial buildings in Montgomery County near a train station.

Auto body parts supplier Dorman Products (NASDAQ: DORM) occupies the entire building. Velocity acquired the property from BREP I LP, a partnership owned by the Berman family, including Dorman Executive Chairman Steven Berman, according to Dorman’s 2022 annual report.

The property has 15 loading docks and Moore said Bala Cynwyd-based Velocity could add another 50. There’s also enough room on the property to expand the building or construct another industrial building around 100,000 square feet.

“We love the property, the tenant is the cherry on top,” Moore said. “But the sundae for us is the property. We think we’ll do extremely well with it just because of our basis, the location, the land value, the train station. We think we can redevelop it very inexpensively to a modern Class A industrial facility with tremendous loading.”

Dorman engineers and designs automotive aftermarket parts. The company’s lease expires at the end of 2027, according to a U.S. Securities and Exchange Commission filing. Dorman paid $2.5 million in rent in 2022. The Colmar property serves as the company's headquarters.

“We think they’re a phenomenal tenant for the property,” Moore said, “but we’re not dependent on that for our business plan to be executed.”

The existing building was built in the 1950s with 32- to 42-foot clear heights. Since it was built as a manufacturing facility, Moore said it has “more power than any user could know what to do with.”

Velocity secured a $21 million loan from Canadian Imperial Bank of Commerce to buy the property, he said. Considering the challenging financing environment, co-founder Tony Grelli said securing loans is differentiating Velocity from its competitors. He credited existing relationships with lenders as the key to striking a deal.

“This falls into the traditional bread and butter Velocity deal,” Moore said. “Traditionally an industrial facility, family owned, great location, great functionality with a value-add component. When you look at the genesis of Velocity and the original business plan and blueprint, this couldn’t fall any closer to that.”

Velocity, founded in 2017, has expanded its business model in recent years by redeveloping office and industrial properties into modern industrial buildings.

With the two different types of properties in its portfolio, Velocity now owns approximately 9 million square feet across 100 buildings. Three months ago, the firm said its goal was to reach 10 million square feet by the end of the year.

Velocity has a handful of acquisitions in the pipeline that may close in the next few weeks, Grelli said.

Full story: https://tinyurl.com/3s7sh6a5