By Brenda Nguyen Costar

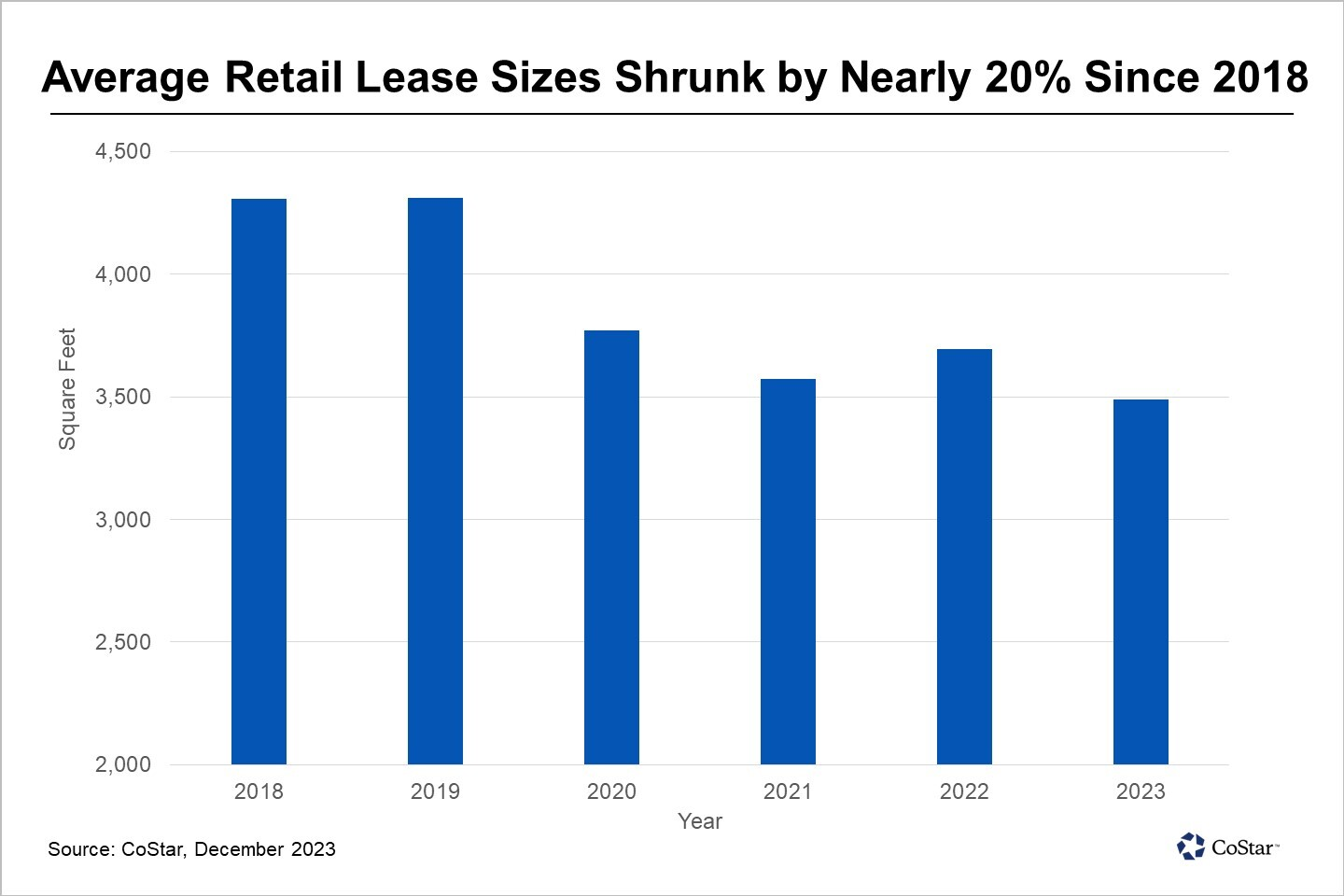

The trend of shrinking retail lease sizes in the Philadelphia metropolitan area, catalyzed by the COVID-19 pandemic, persists. In 2023, the size of the average retail lease contracted by nearly 20% compared to 2018. In parallel, major big-box retailers are recalibrating their site criteria. In 2018, a dozen retail leases were signed for spaces exceeding 50,000 square feet, but that number plummeted to only five annually in 2022 and 2023.

This shift towards smaller retail spaces is primarily motivated by the prospect of lower operational costs. Smaller stores generally entail reduced rent, utilities and staffing expenses, supporting increased cost efficiency. This is especially advantageous for retailers navigating a fiercely competitive market and striving to sustain profitability.

A case in point is Burlington, a locally based national department store chain, which has recently made significant changes to its site criteria. With stores previously averaging over 50,000 square feet, the company now prefers store sizes ranging from 20,000 to 30,000 square feet, as indicated on its website. Despite this reduction in store size, Burlington remains in an aggressive national expansion mode, with plans to double its fleet to 2,000 stores.

Even retail giant Macy's is part of this shift across the local region. Macy's full-line department stores usually measure between 180,000 to 200,000 square feet, but Macy's is reducing its typical footprint by over 80% in opening a small-format, 30,2000-square-foot at Mount Laurel's Centerton Square in 2024. This trend underscores a broader industry move towards more compact and efficient retail spaces.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.