Thursday, November 30, 2023

Endurance sells 5-building industrial portfolio; NoLibs project secures $55.7M construction loan

By Paul Schwedelson – Reporter, Philadelphia Business Journal

A roundup of recent real estate news and transactions across the Philadelphia region:

$17 million

Camden-based logistics company NFI Industries paid $17 million for a 330,000-square-foot industrial building at 1515 Burnt Mill Road in Cherry Hill, according to Camden County property records.

NFI bought the property from Burnt Mill Group LLC, which acquired the property in 2009 for $2.3 million from Vineland Construction Co.

The property is near I-295 off Haddonfield-Berlin Road.

The Class B industrial property was built in 1960. In 2020, Devereux Advanced Behavioral Health New Jersey leased 26,500 square feet in the building.

$55.7 million

Summit, New Jersey-based Saxum Real Estate closed on a construction loan for $55.7 million for the second phase of its 466-unit development in the Northern Liberties section of Philadelphia. Phase 2, which will include 187 luxury apartments, is expected to cost $96 million with funding from a combination of equity and the construction loan.

The project site is located at 700-30 N. Delaware Ave., near the Delaware River waterfront in a part of Northern Liberties booming with new development.

Corebridge Financial, previously known as AIG Life & Retirement, provided the construction financing. Corebridge also provided a $77.5 million construction loan for the project’s first phase, which features a seven-story, 279-unit building at 711-35 N. Front St.

339,136 SF

Boston-based Taurus Investment Holdings bought a portfolio of five Class B industrial buildings in South Jersey from Wayne-based Endurance Real Estate Group. The portfolio totals 339,136 square feet and the five buildings are fully leased to 22 tenants.

Taurus declined to disclose the purchase price.

The properties are:

600 Delran Parkway, Delran (87,827 square feet)

601 Delran Parkway, Delran (57,930)

603 Heron Drive, Swedesboro (43,250)

614 Heron Drive, Swedesboro (46,888)

1 Killdeer Court, Swedesboro (103,241)

Taurus plans to build a 64,500-square-foot industrial building on a parking lot adjacent to the property at 600 Delran Parkway. The firm also plans to install rooftop solar panels on the new building and four of the existing buildings, reducing the portfolio’s annual carbon emissions by more than 300%.

Taurus’ nationwide industrial footprint includes more than 18 million square feet across 12 states.

Full story: https://tinyurl.com/32pmbc8y

Wednesday, November 29, 2023

Comparing Philadelphia’s Office Performance with Other Major US Markets

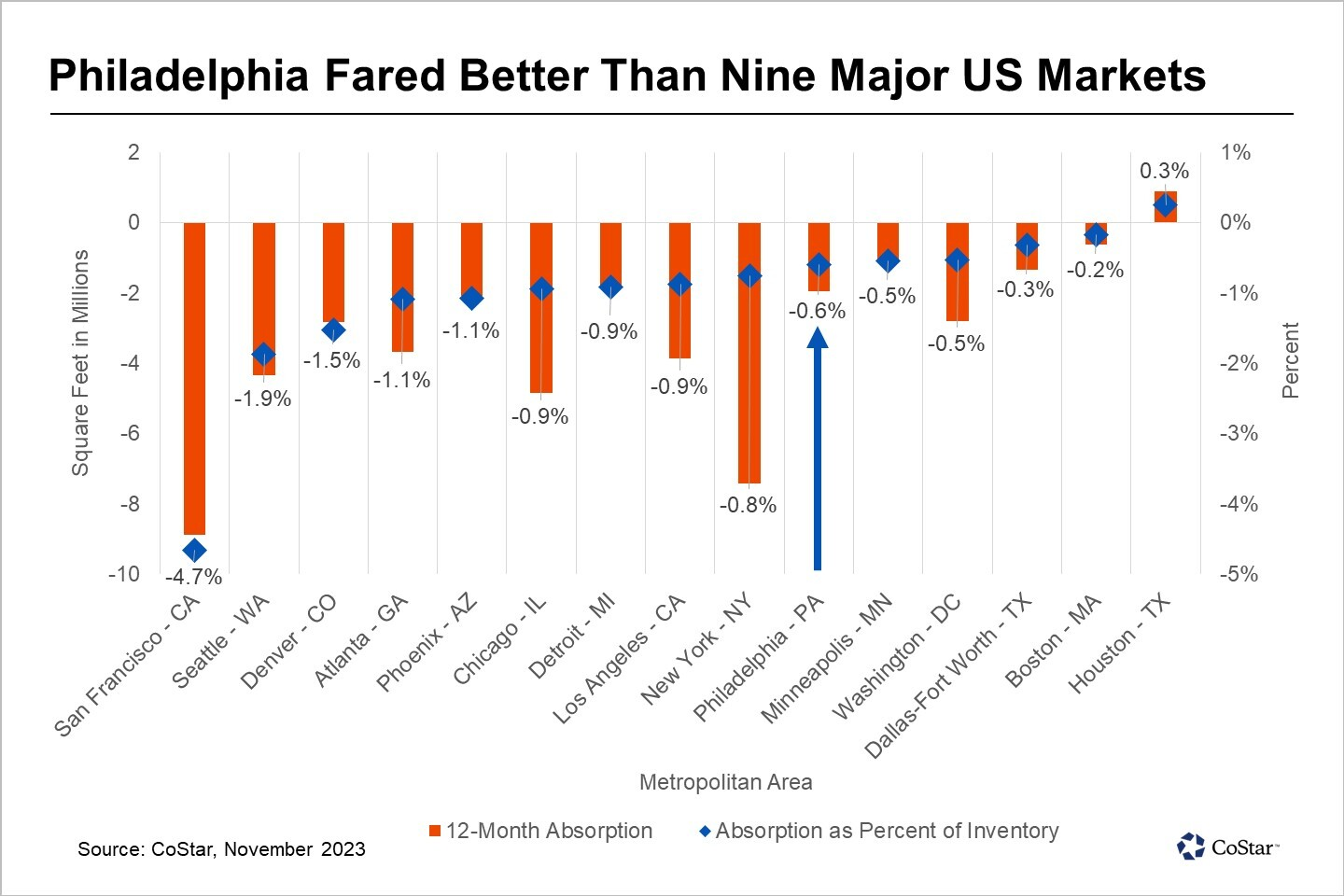

In the face of a nationwide, three-year trend of companies reducing the overall size of their offices, the Philadelphia metropolitan area has been weathering the storm better than several other major U.S. office markets. While Philadelphia saw nearly 2 million square feet of space returned to the office leasing market in the past year, nine of the 15 largest office metropolitan areas experienced even higher levels of unwanted office space as a percent of the total inventory returned by office occupiers.

This snapshot analysis looks at absorption rates, which is the pace at which occupied space changes over time. The annual absorption rate, calculated by dividing a market’s 12-month net absorption by its total office space, provides another perspective on leasing performance while accounting for market size differences. For instance, an absorption loss of 1 million square feet has very different implications for an office market the size of New York City, which has 980 million square feet, compared to Philadelphia's 330 million square feet of office space.

As of the fourth quarter, the U.S. recorded nearly 62 million square feet in negative absorption, resulting in an annual absorption rate of negative 0.7%. Philadelphia's absorption rate of negative 0.6% aligns closely with the national average. This reflects a broader trend where Philadelphia closely follows national office performance. The U.S. and Philadelphia each experienced a 430-basis-point increase in office availability since early 2020, even though Philadelphia's availability rate has historically held lower than the national average.

Meanwhile, nine of the 15 largest U.S. metropolitan areas logged even larger negative annual absorption rates than the national annual average.

San Francisco led the nation with a negative absorption of 9.3 million square feet, reflecting a negative 4.7% absorption rate, followed by Seattle which posted a negative 1.9% absorption rate and Denver at negative 1.5%. In contrast, Houston was the only metropolitan area to experience positive absorption at 900,000 square feet, equating to a 0.3% absorption rate. Minneapolis and Washington D.C., both logged a negative 0.5% rate, on par with Philadelphia's.

These figures only provide a snapshot of the past 12 months, so it's essential to recognize that conditions affecting the office market will continue to evolve over the next year. With more office leases set to expire throughout the country, rankings based on recent absorption rates may shift considerably across these metropolitan areas.

Each region’s ability to adapt to these changes will continue to be influenced by its distinctive economic composition, regional dynamics and local public-private leadership.

Monday, November 27, 2023

Monday, November 20, 2023

5-building Bala Plaza complex sells for $185M; buyer to move forward with redevelopment plan

By Paul Schwedelson – Reporter, Philadelphia Business Journal

FLD Group and the Adjmi family have acquired the Bala Plaza office complex from Tishman Speyer for $185 million and will move forward with an already approved redevelopment plan for the Bala Cynwyd property.

The transaction is one of the largest multi-tenant suburban office sales in the country this year, according to the buyers.

Bala Plaza’s 1.1 million leasable square feet of space is spread across four towers — One Bala Plaza, Two Bala Plaza, Three Bala Plaza East and Three Bala Plaza West — as well as a freestanding Saks Fifth Avenue department store off City Avenue near Monument Road, less than a mile from I-76.

New York-based Tishman Speyer acquired the property in 2004 from GIC Real Estate as part of a $1.85 billion deal for a larger 7.3 million-square-foot portfolio that included 12 office buildings in eight cities.

The buyers plan to follow through on redevelopment plans for the 61.4-acre Bala Plaza site previously put forth by Tishman Speyer. The master plan, which was recently approved by Lower Merion Township, features 2.1 million square feet of new development with multiple retail sites, a 168-room hotel, approximately 750,000 square feet of office space, and 750 residential units.

“The ownership group is committed to being thoughtful stewards of one of the region’s most prestigious assets and sees tremendous value in the future of Bala Plaza and of Bala Cynwyd as a whole,” FLD Group and the Adjmi family said in a statement to the Philadelphia Business Journal. “They are confident in their ability to execute the vision to create an experiential live work play campus.”

Eatontown, New Jersey-based FLD Group also owns an office building at 150 Monument Road, just north of the Bala Plaza property, and has increased its Philadelphia market presence in recent years. It bought 45 Liberty Blvd., a 136,977-square-foot office property in Malvern's Great Valley Corporate Center, for $36.3 million in 2021. Two years prior, FLD Group paid $15.5 million for 100 Deerfield Lane, a 91,190-square-foot office building also located in the Great Valley Corporate Center.

Full story: https://tinyurl.com/2s44csj3

CHOP continues King of Prussia expansion with $24.5M office building purchase

By John George and Paul Schwedelson – Philadelphia Business Journal

Children’s Hospital of Philadelphia is expanding its King of Prussia footprint, paying $24.5 million for a 97,290-square-foot office building at 460 N. Gulph Road.

The building is across the street from CHOP’s nearly two-year-old Middleman Family Pavilion and its adjacent specialty care center.

CHOP bought the property from UGI Corp., which acquired the 39-year-old building in 1993 for $9.1 million. In May the Business Journal reported UGI Corp. (NYSE: UGI), an oil and natural gas company, was moving its headquarters a half-mile west from 460 N. Gulph Road to 500 N. Gulph Road. The move represented the flight-to-quality trend as the Brandywine Realty Trust-owned 500 N. Gulph Road building underwent a $29.7 million renovation in 2019.

CHOP's plans for the five-story building at 460 N. Gulph Road are unclear.

“We acquired the property as part of our facilities roadmap to ensure access to high-quality, convenient care for our patients when and where they need it,” a CHOP spokesperson said in a statement. "While we do not have specific use plans to share at this time, our focus has been on operationalizing and maintaining the property as an important part of our footprint.”

CHOP has had a presence in King Prussia since the 1990s, initially with two care sites near the King of Prussia Mall.

In 2015, CHOP opened a 135,000-square-foot specialty care and ambulatory surgical center on Goddard Boulevard, at a cost of $65 million, as a replacement facility for its two pediatric care sites a few miles away.

The center features 68 exam rooms, two operating rooms, three therapy gyms and an urgent care center. It is home to physicians in more than 30 medical and surgical subspecialties including cardiology, audiology, gastroenterology, hematology, oncology, otolaryngology, and neurology.

The expanded space in the new center was designed to allow CHOP to provide care to 400 patients a day, up from 300 a day at the sites it replaced.

Full story: https://tinyurl.com/2p9957d5

Friday, November 10, 2023

Thursday, November 9, 2023

Phoenixville Emerges as a Rising Star for Apartment Development in Philadelphia Suburbs

By Brenda Nguyen Costar

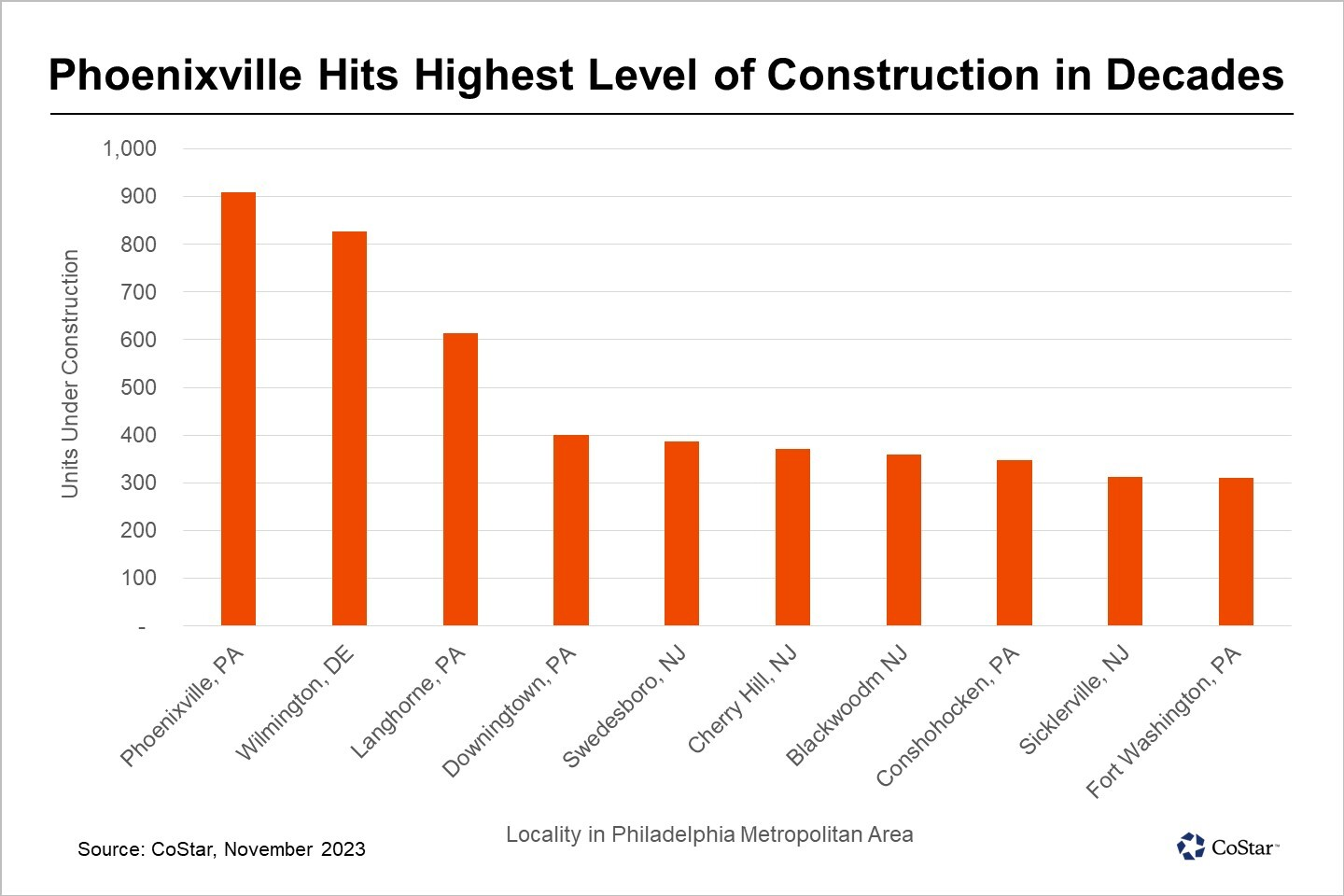

Phoenixville, a quaint borough in Chester County, Pennsylvania, is making waves in the Philadelphia region's apartment construction scene. As of late 2023, this locality boasts the highest concentration of new apartment units under construction for any borough, township or city in the region, except the City of Philadelphia. Phoenixville has four ongoing multifamily projects totaling 908 units under construction.

Originally settled as Manavon, the borough took its name from the local Phoenix Iron Works to become Phoenixville when it was incorporated in 1849.

Over the past 12 months, the borough has added 313 units to strengthen its reputation as a fast-growing suburban community. Development has closely followed Phoenixville's recent burgeoning population, which has grown by an impressive 12% between 2019 and 2022, according to the U.S. Census Bureau.

The most significant development underway in Phoenixville is Steelworks, a mixed-use development that is adding 336 high-end apartments, 40,000 square feet of retail space and a 22,000-square-foot piazza. Developed by The DeMutis Group, Steelworks will replace a formerly abandoned slaughterhouse site on the western side of Bridge Street, extending the downtown area when it is completed in 2024.

Delaware-based developer Capano Management also has two significant projects in the pipeline: The Phoenix and The Reserve at Steelpointe. Once completed, each development will add 240 new apartments to the area for a total of 480. The developer also recently completed the 108-unit Reserve on Forge, which opened to its first tenants in June of this year and is still in lease-up.

Several factors have contributed to Phoenixville's recent surge in investment and real estate development. The suburban area has become a hotspot for young professionals who work in nearby employment centers such as King of Prussia and Malvern, both about a 20-minute drive away.

Moreover, its picturesque setting along the Schuylkill River, coupled with a vibrant and revitalized downtown area, has made it increasingly attractive for renters and investors. A walkable downtown, a full calendar of cultural events, and a burgeoning dining and brewery scene have further contributed to its growing popularity over the years.

While Phoenixville has led the Philadelphia region's suburban apartment growth, other localities have also experienced an apartment construction surge. Wilmington, Delaware, trails closely with the second-highest apartment construction in the region, with 830 units under construction. Langhorne and Downingtown, both Philadelphia suburbs on the Pennsylvania side, also have a notable number of new units under construction.

Wednesday, November 8, 2023

Tuesday, November 7, 2023

Greek Real Estate makes $80M bet on redevelopment of Northeast Philadelphia industrial property

By Paul Schwedelson – Reporter, Philadelphia Business Journal

Two years after buying a 305,706-square-foot industrial building in Northeast Philadelphia for $31.5 million, Greek Real Estate Partners knocked it down and is replacing it with a new warehouse.

The 287,000-square-foot building at 2121 Wheatsheaf Lane is expected to cost about $50 million to build, Greek Real Estate Partners Managing Partner David Greek said. The East Brunswick, New Jersey, developer secured a $44 million construction loan from First Citizens Bank.

The cost of land and construction adds up to an $80 million bet that a modern industrial building in a dense part of Northeast Philadelphia will yield a high return.

“I have to have a pretty strong belief in the overall market to make this sizable investment at this time,” Greek said. “We remain really confident that there is a significant amount of demand for this space.”

Demolishing the building was part of the plan all along, Greek said. It was knocked down over the summer and the new one is planned to be ready for tenants in about a year. The industrial building had been leased to cocoa bean distributor Dependable Distribution Services, and a neighboring 25,000-square-foot office building was leased to Amazon, which used the site for parking.

Having those tenants in place bought time for Greek Real Estate Partners to gain approvals to redevelop the site. The initial purchase came with a short due diligence period, Greek said, so the approvals weren’t in place at the time.

“With that open-ended risk, the fact that we had two leases in place and that the asset was producing cash flow actively from the day we bought it, allowed us to say we can spend this $30 million and if we are not successful, the worst that can happen is we continue to collect rent checks,” Greek said.

What happened, though, was the best case for Greek Real Estate Partners. The firm gained the necessary approvals and both leases had termination clauses so the leases could end as long as the tenants were given 18 months notice.

“If the property was just land and didn’t have any leases in place, we would not have been able to afford the purchase price we paid,” Greek said.

While the existing buildings offered short-term cash flow, Greek said a new building can command “significantly higher” rent. Since the developer plans to be a long-term owner and hold the property for 15 to 20 years, Greek can further justify the construction costs.

The previous industrial building was built in the 1950s and added onto in the 1970s. While leasable when the property was purchased, Greek didn’t think that value would last over the next 15 to 20 years.

The previous building had 22-foot heights and 10 dock doors. The new building is planned to have 40-foot heights, 36 dock doors and two drive-in doors. It’ll also have 65 trailer parking spaces and 258 car parking spaces, another sizable upgrade.

The building is being built without tenants in place and could be specialized for specific uses like cold storage, data centers and e-commerce distribution. It could also accommodate multiple tenants, although Greek said it’s likely it’ll be leased to one. He anticipates leasing activity picking up next year once the walls and roof are built and a lease signed potentially around next summer.

“One of the things that holds up my confidence is the lack of other options in this market,” Greek said.

Greek touted the site as one that could be popular with e-commerce distributors who want to be close to population centers. The density of Philadelphia and challenge of replicating a site like this help Greek believe in the project.

Full story: https://tinyurl.com/3st345ta

Monday, November 6, 2023

Thursday, November 2, 2023

Wednesday, November 1, 2023

Top Property Sales & Leasing Deals for Philadelphia Area

As big-ticket items involving sizable investments, commercial property transactions often have a wider impact within the local community. CoStar recognized the largest deals completed during the third quarter in their respective markets.

Here are the Philadelphia property sales selected as the third-quarter 2023 winners of the CoStar Power Broker Quarterly Deal Awards:

TOP SALE DEALS:

400 and 500 Arcola Road, Collegeville, PA

Sale Price: $180,000,000

Sale Date: August 9, 2023

Size: 1,890,685 SF

Buyer: David Werner Real Estate, New York, NY

Seller: Pfizer, New York, NY

Deal Commentary: A sprawling 340-acre life science and office campus sold in a top third-quarter deal for approximately $180 million. New York-based David Werner Real Estate Investments purchased the two-building complex in Collegeville, Pennsylvania, in a sale-leaseback deal with Pfizer, the pharmaceutical giant which had owned the property since acquiring Wyeth Pharmaceuticals in 2009. Dow Chemicals occupies 400 Arcola Road and Pfizer is in 500 Arcola Road. The portfolio features a mix of office, lab, and research space with the two buildings sharing approximately 70,000 square feet of common space.

1130 N. Pottstown Pike, Exton, PA

Sale Price: $103,500,000

Sale Date: July 11, 2023

Size: 169.41 Acres

Buyer: Portman Holdings, Atlanta, GA

Seller: Audubon Land Development, Norristown, PA

Deal Commentary: In another top deal during the third quarter, Audubon Land Development sold four industrial-zoned parcels totaling nearly 170 acres to Atlanta-based developer Portman, which executed a development agreement to construct the I-76 Trade Center, a new industrial campus spanning 1.9 million square feet. Site work on the first phase is underway, with construction beginning on the first building this fall. The three-building logistics campus will be developed in two phases. Phase I will be a 636,120-square-foot building with an expected delivery of August 2024. Phase II includes a 1.1 million-square-foot facility and a 154,440-square-foot building. Portman is planning to substantially complete construction by early 2025.

101 Commerce Drive, Hazleton, PA

Sale Price: $51,000,000

Sale Date: August 22, 2023

Size: 470,000 SF

Buyer: Transwestern Investment Group, Dallas, TX

Seller: Bluewater Property Group, Conshohocken, PA and PCCP, Los Angeles, CA

Deal Commentary: After securing Ingram Micro as a full-building tenant last year, the development partnership of Bluewater Property Group, LLC and PCCP flipped this fully leased speculative warehouse in Hazelton, Pennsylvania, to an investment fund managed by Transwestern Investment Group in a top third-quarter deal. “The acquisition complements our strategy to acquire highly functional assets below replacement cost in core major logistics markets across the country,” said Chris Sterling, director of Acquisitions at TIG, in a statement announcing the acquisition.

Bristol Gardens Apartments, 1321 Veterans Highway, Bristol, PA

Sale Price: $40,750,000

Sale Date: July 11, 2023

Size: 320,000 SF

Buyer: Goldcrest Properties, Lakewood, NJ

Seller: Joshua Klein, Villanova, PA

Deal Commentary: Lakewood, New Jersey-based Goldcrest Properties completed its acquisition of the 392-unit Bristol Gardens Apartments in Philadelphia in a third-quarter transaction. The garden-style complex serving low- to moderate-income individuals and families sold for $40.75 million or about $103,954 per unit. Located at 1321 Veterans Hwy. in Bristol, Pennsylvania, the 55-year-old apartments consist of 36 two-story buildings on 31 acres of land.

Hartford Corners, 1310-1330 Fairview Blvd., Delran, NJ