The development arm of WinnCos. has acquired a portfolio of affordable housing properties for $17.3 million in Atlantic City, New Jersey, under the federal Opportunity Zone program.

The Boston-based real estate firm bought Sencit Liberty, a scattered-site complex featuring 153 units of income-restricted housing located in three historic properties previously adapted for residential use.

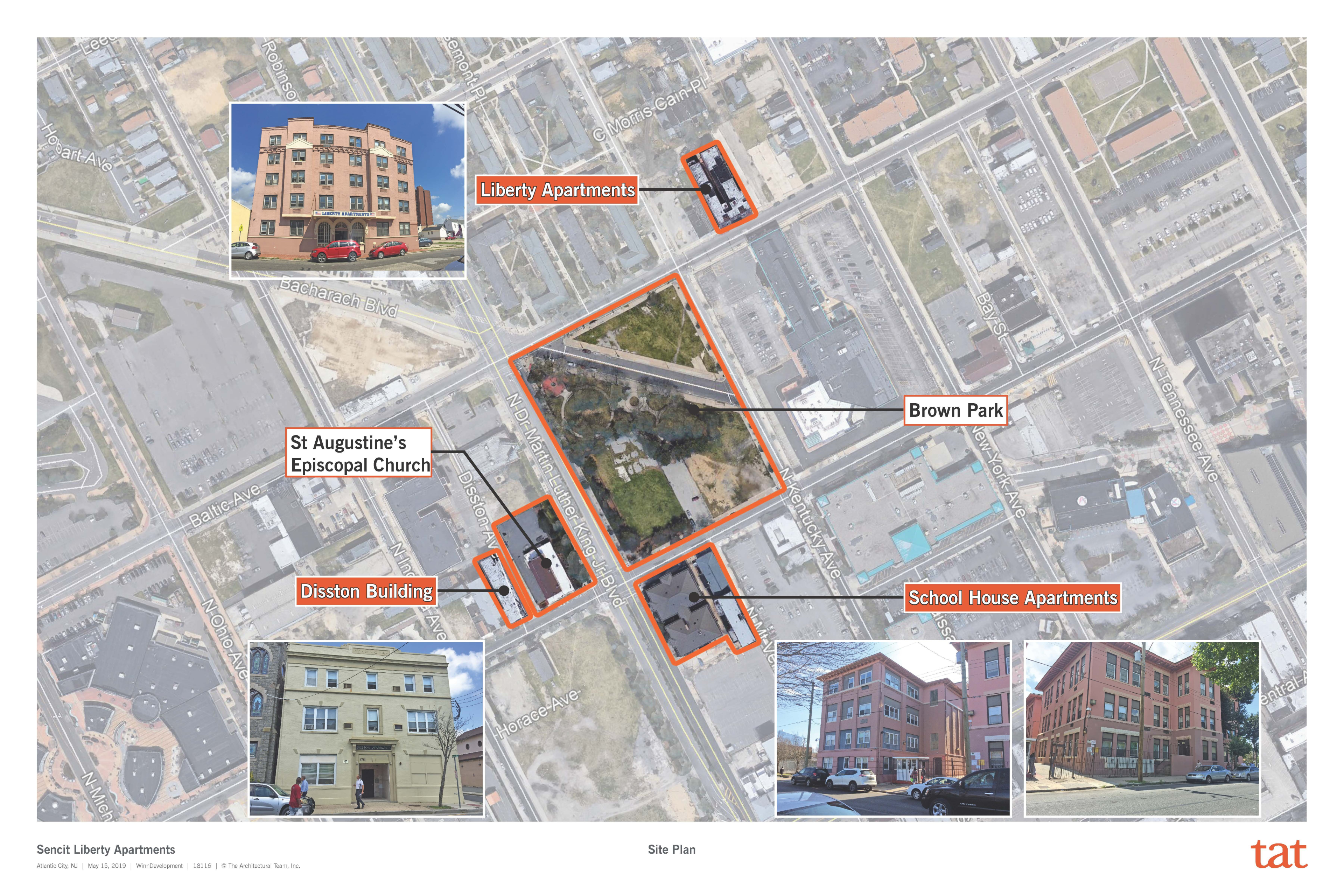

The sites include Liberty, 67 apartment units at 1519 Baltic Ave., formerly the Liberty Hotel originally built in 1924; Schoolhouse, 66 units at 61 N. Martin Luther King Blvd., formerly the Illinois Avenue School originally built in 1906; and Disston, 20 units at 1711 Arctic Ave., formerly the Northside YMCA originally built in 1927.

“In the spirit of the local and state policy objective to drive more investment in qualified opportunity zones, we were fortunate to be able to structure our equity investment through our own qualified opportunity fund and take advantage of the benefits that this new program offers,” Brett Meringoff, the WinnDevelopment senior vice president who led the acquisition team, said in a statement.

The federal Opportunity Zone program was established as part of the Tax Cuts and Jobs Act of 2017. It was created to drive long-term private capital investment in low-income urban and rural communities by providing investors tax breaks on capital gains. New Jersey has 169 opportunity zones located across 75 municipalities.

WinnDevelopment said it's committed to keeping Sencit Liberty affordable for the next 30 years, while at the same time upgrading the complex as part of an occupied rehabilitation. The company plans to pay for the renovation through a number of funding sources, including developer loans, private equity investment, private lender sources, and local and state resources.

The purchase was financed by BlueHub Capital, formerly known as Boston Community Capital, using Capital Magnet funds from the U.S. Department of Treasury, and by Citi Community Capital, using a combination of Affordable Housing Catalyst funds and acquisition bridge debt financing. The broker for the transaction was Dane PCG.

“We believe the successful rehabilitation of these three properties would not only improve the quality of life for the residents, but also positively impact the entire community and signal major investment in this area of Atlantic City,” Meringoff said.

Atlantic City, including its City Council and Planning & Development Department, the New Jersey Housing and Mortgage Finance Agency, the U.S. Department of Housing and Urban Development, and the Casino Reinvestment Development Authority provided planning and financial support for the acquisition.

WinnDevelopment hopes to have assembled all the financing needed for the rehabilitation project by later this summer.

WinnCos. owns more than 100 multifamily housing properties in 11 states and Washington, D.C., totaling more than 13,000 apartments. In New Jersey it has City Crossing, a 131-unit scattered site property in Jersey City, and Bridgeton Villas, a 156-unit property in Bridgeton. Both sites have undergone extensive rehabilitations in the past three years, according to the developer.

Since July 2014, WinnCos. has overseen the completion of more than 17 occupied rehabilitation projects, totaling about 3,000 units, at its owned properties in six states and Washington, with total development costs of $335 million. The company currently has more than 500 units under rehabilitation in five states, with an additional 1,000 units set to undergo upgrades through 2020.

The Sencit Liberty properties will be managed by WinnResidential, the nation’s largest operator of affordable housing. The company manages 2,310 apartments and 19,500 square feet of commercial space at 17 multifamily properties in New Jersey.

www.omegare.com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.