At the end of the first quarter of this year, warehouse construction in the United States reached an unprecedented 255 million square feet, driven in large part by e-commerce demand.

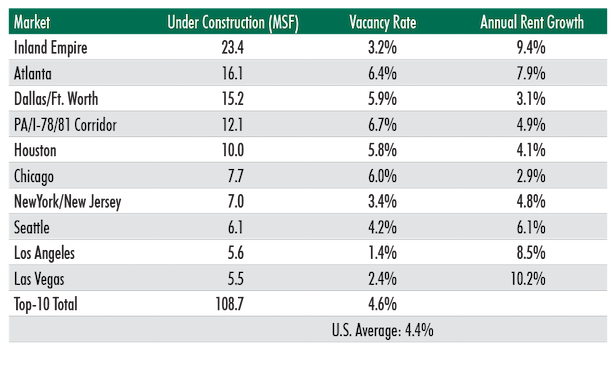

The top 10 warehouse markets were ranked with the Inland Empire, CA leading the way with 23.4 million square feet in the ground and a 3.2% vacancy rate and 9.4% annual rent growth, followed by Atlanta at 16.1 million square feet under construction, a 6.4% vacancy rate and 7.9% annual rent growth and Dallas /Fort Worth, TX at number three at 15.2 million square feet being built, a 5.9% vacancy rate and 3.1%% annual growth.

The New York/NJ and Pennsylvania markets have very active warehouse markets with a combined more than 19 million square feet under construction.

The PA/78/81 Corridor came in at number four in the US with 12.1 million square feet in the ground, a 6.7% vacancy rate and 4.9% annual rent growth.

Ranked at number seven, New York/New Jersey market has 7 million square feet under construction, a 3.4% vacancy rate and 4.8% annual rent growth.

Coming in at number five in the US was Houston at 10 million square feet under construction, a 5.8% vacancy rate and 4.1% annual rent growth.

The City of Chicago came in at number six with 7.7 million square feet being built at the moment, with a 6.0% vacancy rate and 2.9% annual rent growth.

Rounding at the top 10 were: Seattle at 6.1 million square feet in the ground, a 4.2% vacancy rate and 6.1% annual rent growth; Los Angeles with 5.6 million square feet in the ground, a 1.4% vacancy rate and 8.5% rent growth and Las Vegas, which has 5.5 million square feet being built, a 2.4% vacancy rate and 10.2% annual rent growth.

The US average vacancy rate is 4.4%.

Of the 255 million square feet of warehouse space under construction, 70.2% of it is on spec. Since 2015, however, warehouse demand has outpaced new warehouse completions by 169 million square feet and rents have increased by 19.2%.

Five of the top-10 markets for speculative development have market conditions that justify adding more big-box warehouses: vacancy rates below or slightly above the national average (4.4%) and aggregate net asking rent growth of 7.8% annually.

The remaining five markets were well above the national vacancy average and their aggregate rent growth averaged 4.6% due to more available supply.

With demand not likely to diminish, speculative big-box developments in those five markets are expected to lease up shortly after completion. E-commerce, food & beverage, wholesaler and third-party logistics users, which have dominated pre-leasing activity, are the best candidates to occupy these new modern warehouse facilities, they add.

Commenting on the New York/New Jersey industrial markets, “In Northern New Jersey, e-commerce continues to create a huge demand for new distribution space. As online grocery sales continue to grow and given the state’s prime location to major consumer markets and local ports, we anticipate the warehouse vacancy rate to remain low, while rents steadily increase.”

www.omegare.com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.