By Brenda Nguyen Costar

Amid headlines driven by the mega-leasing sprees of Amazon, Target, Walmart and other high-profile companies in recent years, industrial developers have increasingly catered to the massive bulk-warehouse segment so much in demand by these types of users.

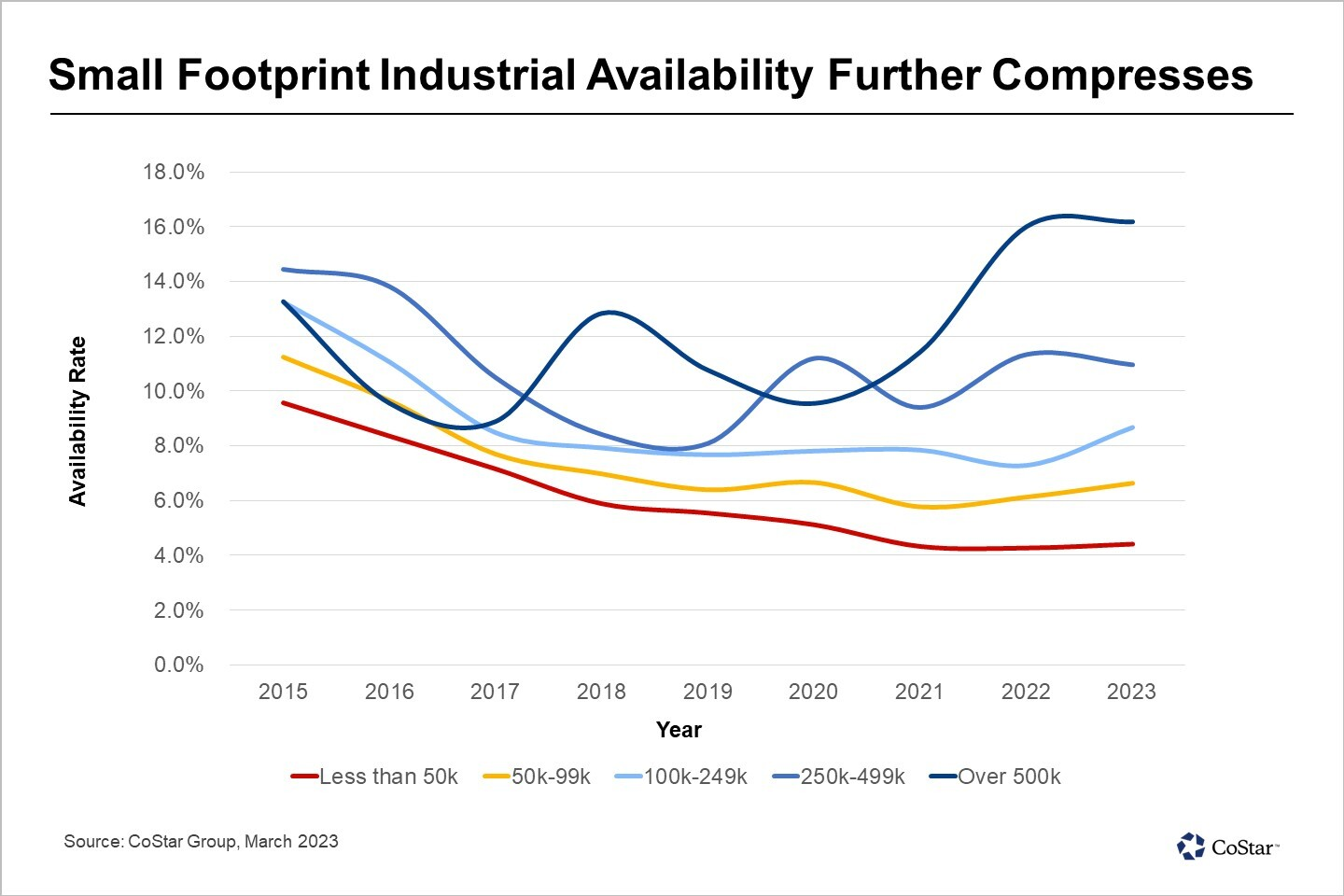

However, one industrial property segment that has flown under the radar is those measuring 50,000 square feet or less, or small-bay industrial facilities. Small-bay spaces are the only industrial segment where vacancy and availability continue to shrink despite record levels of new construction underway.

Across Philadelphia’s small-bay industrial buildings, availability fell from an already-compressed 5.5% at the end of 2019 to where it sits at 4.5% entering the second quarter. Meanwhile, industrial properties exceeding 500,000 square feet have already hit a 16% availability rate across the Philadelphia region, fueled by the disproportionate levels of new construction underway.

Small-bay properties have also recorded the fastest pace of leasing, with 600 available spaces leasing within six months on average in the past year – down from eight months in 2019. Meanwhile, larger industrial spaces of over 100,000 square feet averaged 13 months across 40 listings during the same period. The volume and pace at which the market absorbs small-footprint industrial spaces are notable, suggesting this industrial segment is in high demand and is becoming sparser over time. Locally oriented distributors, suppliers and retailers have significantly driven this demand in the Philadelphia region.

Despite these impressive metrics, very little new construction is underway to cater to this corner of the market. Of the 26.8 million square feet of new industrial inventory in the pipeline, only 1.4 %, or under 400,000 square feet, is being developed for properties below 50,000 square feet and 2.7% for properties below 100,000 square feet. While this will alleviate supply-side pressures for existing landlords, the constrained levels of new construction for this segment continue to make it highly competitive for occupiers to find suitable industrial supply.

Several recent transactions have highlighted the demand for small-bay industrial spaces.

In January, Glick Fire Equipment Company leased a 10-year, 30,000-square-foot property in Harleysville, Pennsylvania within three months of the listing hitting the market. A month earlier, Smart Prep Center, a transportation and warehousing company, inked a 10-year, 19,000-square-foot lease in Harleysville within two months.

In November 2022, Bliss New Jersey, a cannabis company, leased a five-year, 12,000-square-foot industrial site in Lumberton, New Jersey, within only one month of the property hitting the market. That same month, Parallel Productions, a local full-service production company, leased a five-year, 7,500-square-foot warehouse, also within one month in Philadelphia.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.