By Brenda Nguyen Costar Analytics

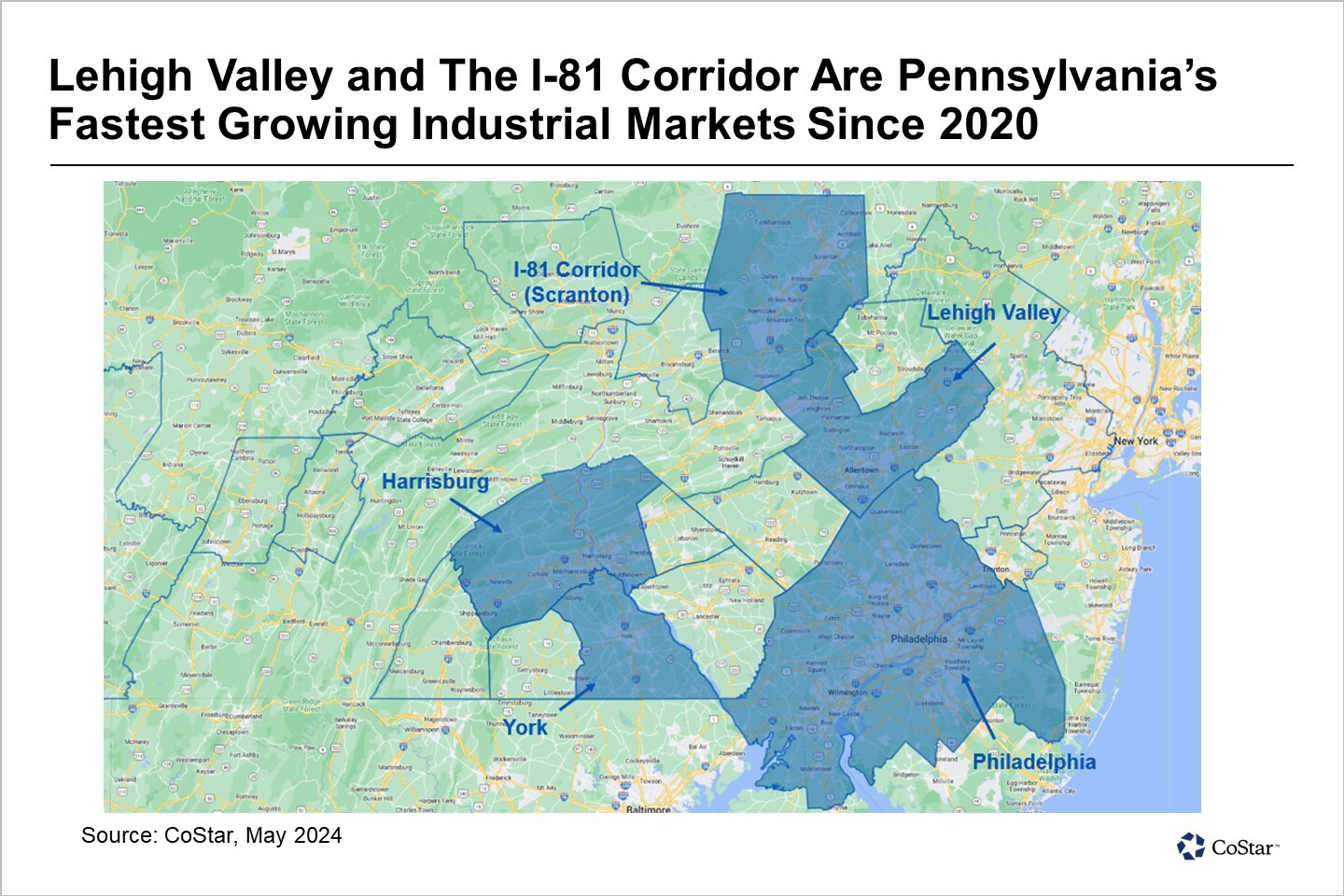

Demand has flooded Pennsylvania's top industrial markets in recent years, prompting a wave of new development. Last year's record number of completions capped more than 110 million square feet of new industrial space added over the past four years in Philadelphia and the nearby areas of Lehigh Valley, the I-81 Corridor, Harrisburg and York.

As the ninth largest U.S. industrial market, the Philadelphia region experienced the most significant addition of industrial inventory, gaining more than 250 new buildings measuring 63 million square feet.

Taking the 14.2 million square feet of industrial demolitions into account and Philadelphia's net gain in inventory since the first quarter of 2020 totals 48.8 million square feet, an 8.5% increase. Half of this new industrial space is concentrated in the southern New Jersey counties of Burlington, Gloucester, Camden and Salem, where supply-driven vacancy has been increasing.

The Philadelphia metropolitan area has attracted the heaviest regional demand for industrial space from retailers, manufacturers and third-party logistics companies seeking to locate near major ports, airports and dense population centers along the Northeast U.S. corridor. Additionally, average rents for industrial space are about 30% lower than in Northern New Jersey, making Philadelphia a cost-effective alternative for occupiers.

Further north, the industrial hub of Lehigh Valley has followed a similar development trend, adding a net gain of 26 million square feet of industrial space across 74 buildings with very little space demolitions. This resulted in an impressive 18.6% increase in the region's industrial inventory, making it the fastest-growing industrial market in Pennsylvania.

Lehigh Valley's proximity to New York and Philadelphia has positioned it to capture spillover industrial demand from these costlier port markets. In recent years, the region attracted some of the country's largest industrial leases, which exceeded one million square feet at times. These headline leases have grabbed the attention of developers hoping to capitalize on the high demand.

As the availability of suitable land grows more limited in the mountainous region of Lehigh Valley, industrial development has shifted to the neighboring I-81 Corridor or Scranton. This inland region offers even deeper rent discounts to its port neighbors.

Over the past four years, the I-81 Corridor gained 17.2 million square feet across 47 buildings, a 17% increase in inventory, to become the second fastest-growing industrial market in Pennsylvania.

Meanwhile, Harrisburg gained 9.9 million square feet across 21 buildings, and York gained 9 million square feet across 30 buildings. Modest construction and continued demand have resulted in a very tight industrial market in Harrisburg and York, which have among the lowest industrial vacancy rates in the country.

Industrial development activity is expected to decelerate due to elevated interest rates and an accumulation of unleased inventory in some markets. Construction starts in these five Pennsylvania industrial areas have already decreased by 50% compared to the previous year, setting the stage for a quieter yet still active period of industrial completions through 2025.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.