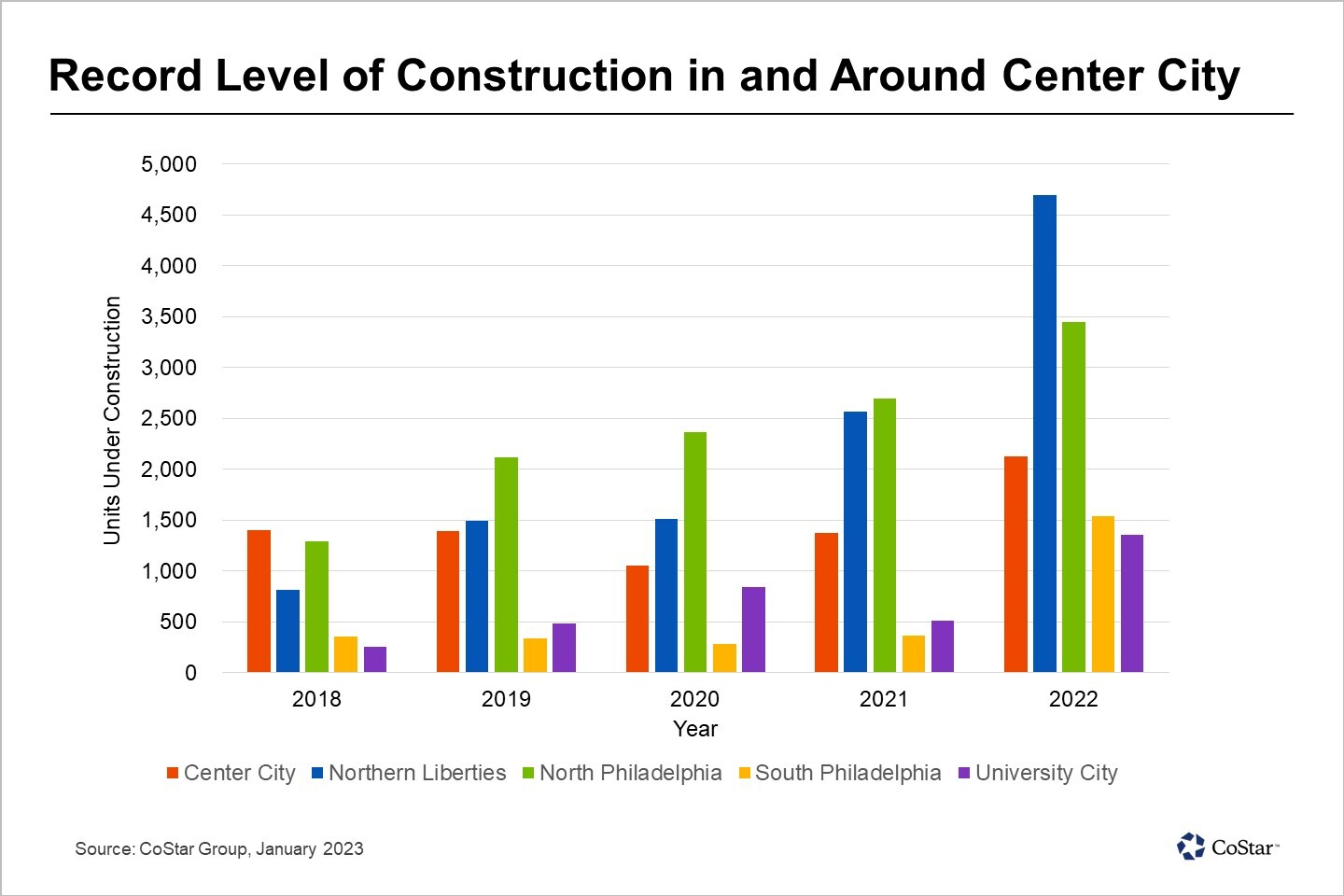

The record-breaking supply surge will temporarily outpace renter demand during this cycle. Subsequently, marketing efforts aimed at a more constrained renter pool have already ramped up in these neighborhoods, and lease-up competition will likely continue through mid-2024. If overall macro environment confidence improves near-term, the springtime may unlock pent-up renter demand. However, this supply wave will still moderately exceed even the highest demand levels seen throughout the golden period between late 2020 and early 2022. As vacancy trends upward alongside the wave of new additions, daily asking rent growth is expected to moderate, while concessions will become more widespread throughout 2023.

A review of Apartments.com listings indicates that concessions have returned in early 2023. Nearly half of the top properties in each area offer some form of concession, from a $500 move-in credit to a generous two months of free rent plus a $1,000 move-in credit for city, education and health professionals. Several stabilized properties with occupancy above 90% are even offering concessions.

As renters digest recent rent surges, landlords will need to re-evaluate what 2023 rental rates are competitive to lease up individual developments in a sea of high-end options for renters. Across three-star properties in these five areas, vacancy is 6.5%. Meanwhile, across four- and five-star properties, vacancy is already at 10% and is expected to increase in the near term with the large number of new deliveries. While rent differentials may fluctuate drastically across individual properties, the average market rent differential between three-star and four- and five-star properties is $445 per month for studio units, $540 per month for one-bedroom, and $860 per month for two-bedroom units in these five areas.

In 2023, four- and five-star multifamily owners will need to prepare for the heavy competition ahead, but there should be a reprieve by late 2024 from a significant slowdown in new large-scale supply entering the market. Until then, property owners should focus on renter retention as much as renter attraction to maintain a well-occupied, competitive development.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.