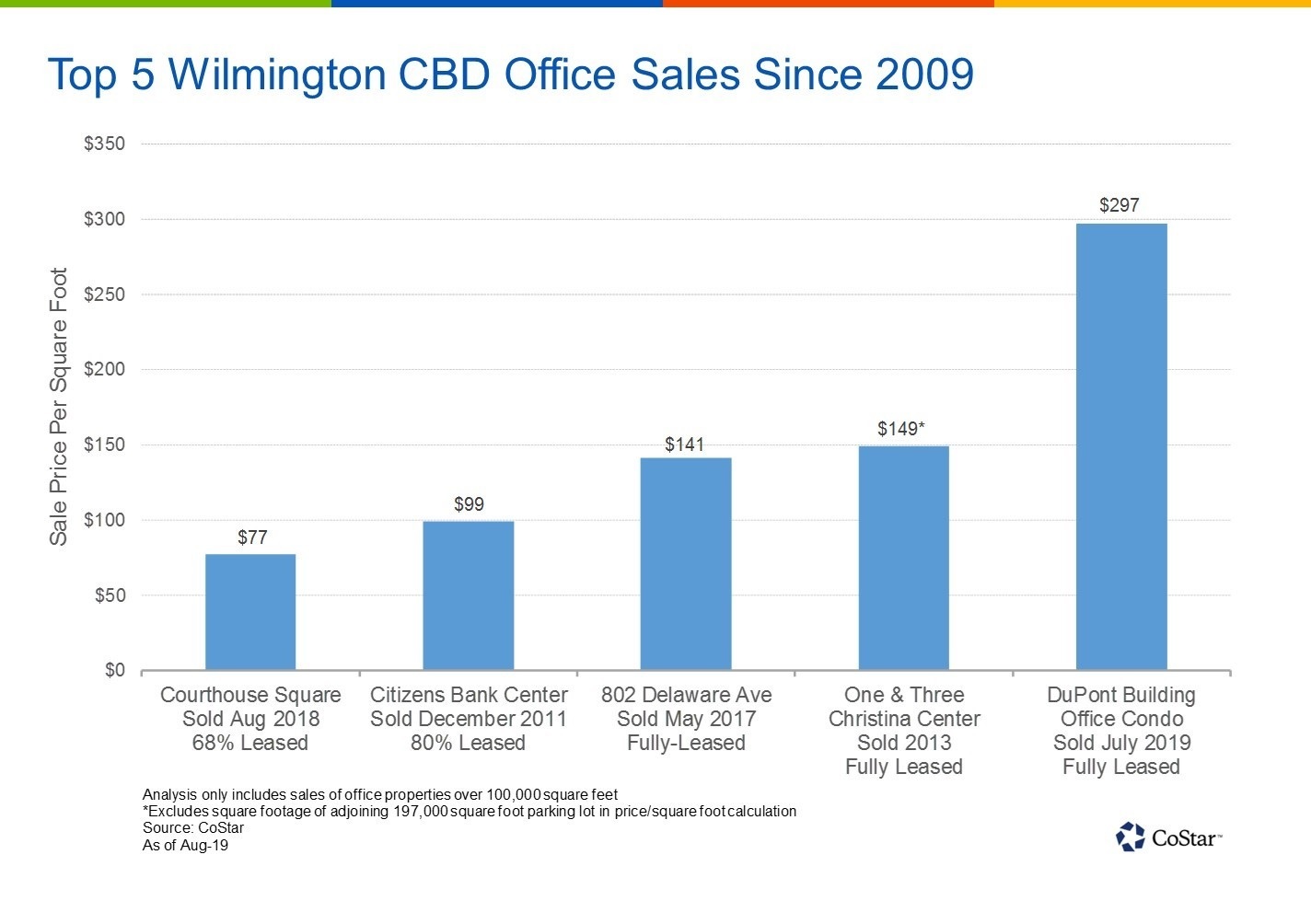

Thanks in part to Chemours’ 15-year lease in place, this was by far the highest price per square foot on a major office sale that has ever closed in Wilmington’s Central Business District, a submarket that has been riddled with tenant move-outs and sales of high-vacancy properties over the past few years.

The office condo was jointly purchased by Connecticut’s Arch Street Capital Advisors and Kuwait-based private equity firm Soor Capital. The pair also jointly purchased a portfolio of Malvern office properties from Liberty Property Trust in 2018.

The Buccini/Pollin Group, the most active local developer revitalizing the submarket’s office and residential properties of late, first acquired the entire 950,000-square-foot DuPont Building at 1007 N Market St. in 2017, for a lean $32 million, or about $34 per square foot.

At the time of the 2017 sale, the 1908-built property straddled a number of uses. The luxury Hotel du Pont occupied more than 200,000 square feet, which it still does today. Meanwhile, the seller, chemical company Chemours, announced plans to downsize its office within the property to 283,000 square feet that would be renovated by the incoming owner.

After a 20-month long renovation, Chemours’ new office opened in the fall of 2018 and last month, Buccini/Pollin group capitalized on the award-winning project, selling Chemours’ office as a separate condo within the property for nearly $297 per square foot.

Other investors including Austin, Texas-based Capital Commercial Investments, and Louisville, Kentucky-based Real Capital Solutions, have acquired high-vacancy office properties in Downtown Wilmington in recent years.

Although the DuPont Building is unique for its historical and architectural attributes, the willingness of an international private equity fund to pay almost $300 per square foot for Chemours’ headquarters sends an encouraging signal to other recent value-add buyers, in terms of the level of investor interest their Downtown Wilmington properties could garnish if they are successfully released to long-term tenants.

The sale gives Buccini/Pollin Group a large cash infusion to continue with its plan to renovate a large portion of the property’s remaining empty office space into 180 luxury multifamily units that would share some amenities and services with Hotel du Pont.

Buccini/Pollin Group also opened a new foodhall on the ground floor of the property last spring, and the property’s reinvigoration is a sign of hope in a submarket that has proven challenging for plenty of other local office owners in recent years.

www.omegare.com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.