Over the past five years, more than $1.5 billion has been spent acquiring shipping and warehouse assets, and much of that was from out-of-state or international buyers.

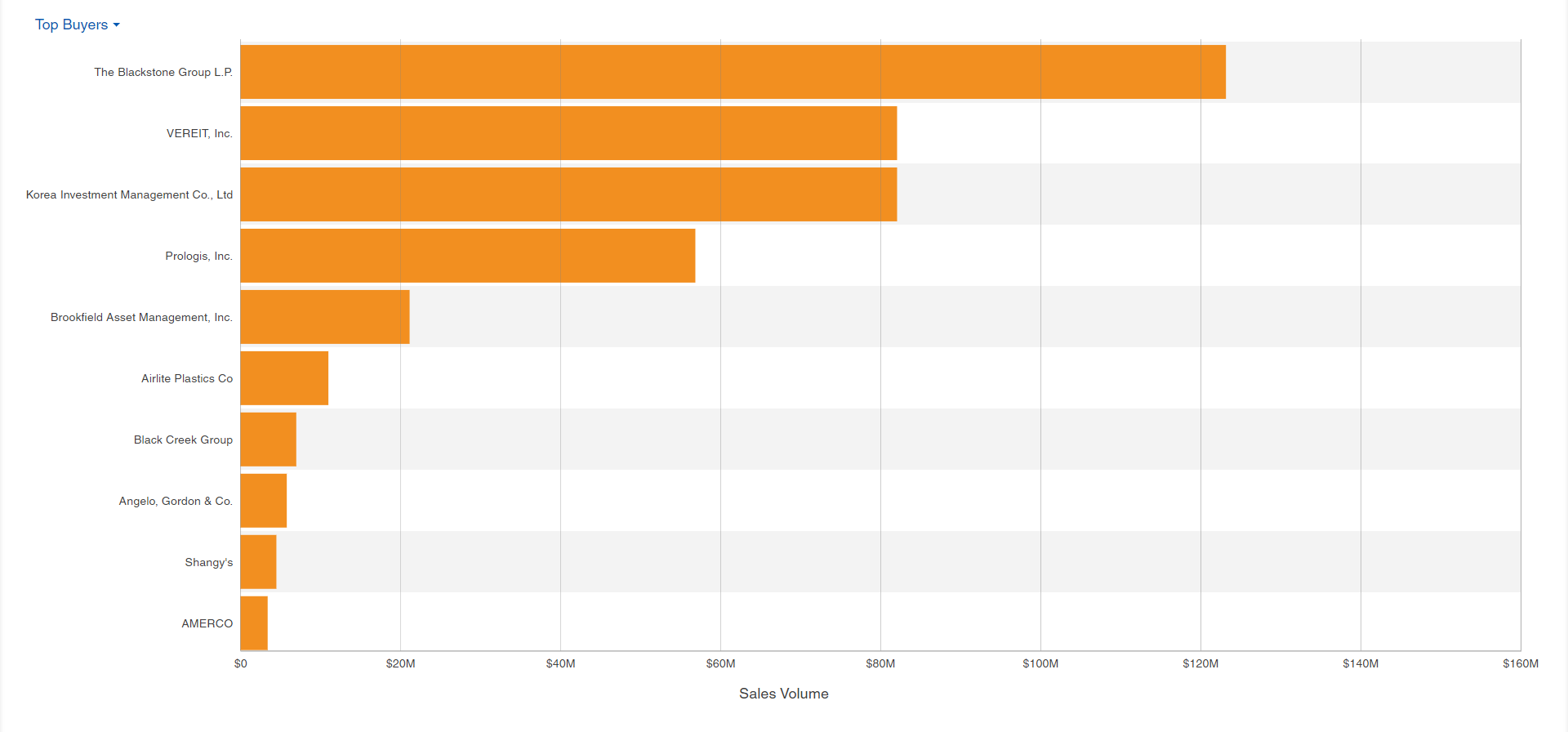

Outside interest in commercial real estate is fairly uncommon in Pennsylvania, but private equity and REIT’s account for two-thirds of the market’s sales volume. Blackstone, VEREIT and the Korean Investment Management Company were some of the largest buyers of the past 12 months; spending about $300 million combined on Lehigh assets.

These were largely portfolio purchases of large modern assets, but even aging properties fetched a decent price, pre-pandemic. Investors like Prologis made moves on properties like 6390 Hedgewood Drive, which is over 30 years old and contains only 70,000 square feet.

The market’s prime location for shipping means tenant interest is high, and new properties filled quickly. Even with an average of 5 million square feet arriving every year over the past five years, vacancies rarely fluctuated for long.

That stability is what drew in the big money, and some of those within the logistics industry believe the trend will continue post-pandemic.

"Shipping will be impacted the least of all the property types."

The shipping and logistics sector will be mostly insulated from the shutdown, largely because e-commerce will grow rapidly in the near future.

"Everyone in the world is being forced to adapt to online shipping now," he said. "Our parents didn’t use e-commerce before the shutdown; now they have to."

Most of the leases he is closing now involve food companies, which he believes is one of the strongest opportunities for growth.

CoStar’s latest severe downturn forecast shows Lehigh Valley’s vacancies spiking in the near future, from 4% to 8% by the end of the year. Should these properties quickly refill, investment activity could pick up sooner for markets like Lehigh than elsewhere.

www.omegare.com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.