By Brenda Nguyen Costar

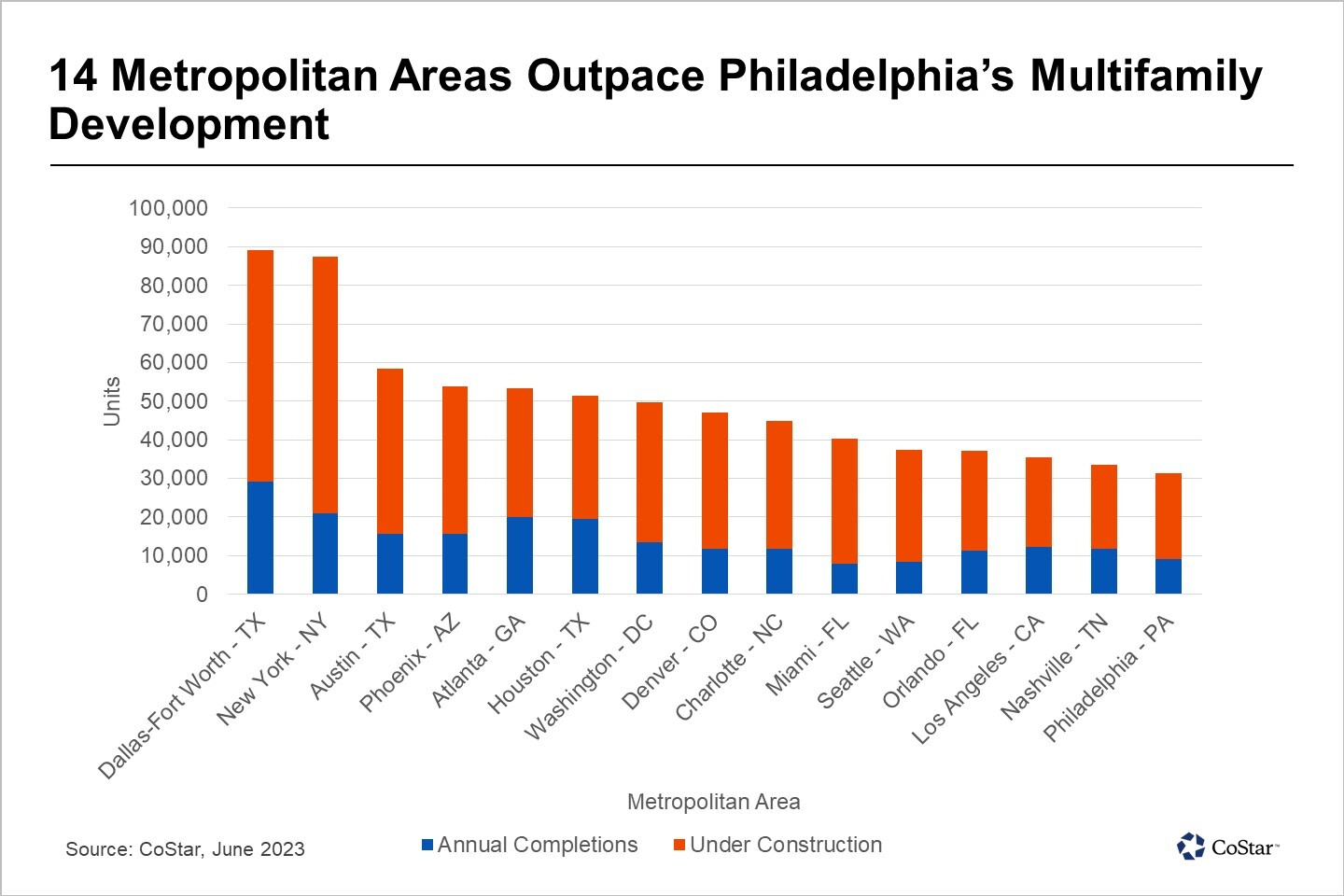

Despite the unprecedented level of apartment construction underway locally, Philadelphia's multifamily development seems downright modest compared with several other top markets nationwide. As the seventh-largest metropolitan area in the U.S. by population, Philadelphia ranks 15th in total units completed in the past 12 months and units under construction.

The City of Philadelphia's rich history has shaped its core housing stock, largely comprised of row houses, townhouses and converted older buildings. The city’s density has limited the amount of land available for significant multifamily development. As a result, Philadelphia’s multifamily developments have mostly been limited to in-fill projects or warehouse-to-apartment conversions over the years.

Most cities leading in multifamily development nationally, including Dallas, Houston and Phoenix, also have a large inventory of available, developable land. Surging population growth has further fueled these Sun Belt metropolitan areas in recent years.

In the Philadelphia suburbs, it's not so much the availability of land that is impeding significant multifamily development so much as the prioritization of low-density residential development by many municipalities. These residential areas tend to focus on single-family homes on larger lot sizes, resulting in more restrictive zoning regulations. These regulations can be more confining compared to those in the city, making it challenging for developers to obtain permits and variances for large-scale multifamily projects.

The region’s slower pace of rental housing development is a decade-long trend that has led to a highly compressed multifamily market with a 5.7% vacancy rate – the fourth tightest of these 15 metropolitan areas. Only New York, Los Angeles and Miami have vacancy rates under 6% as of mid-2023.

Despite Philadelphia’s comparatively slow housing production, the record 22,000 units scheduled to be completed over the next 24 months should help to ease supply pressures stemming from decades of underdevelopment. Even with various efforts to increase construction levels and address the housing shortage, the market needs to work together to keep pace with other major markets. Moreover, balancing the need for affordable housing and the demand for higher-end units will be crucial in shaping the future of multifamily development in Philadelphia.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.