Thursday, December 28, 2023

Thursday, December 21, 2023

Wednesday, December 20, 2023

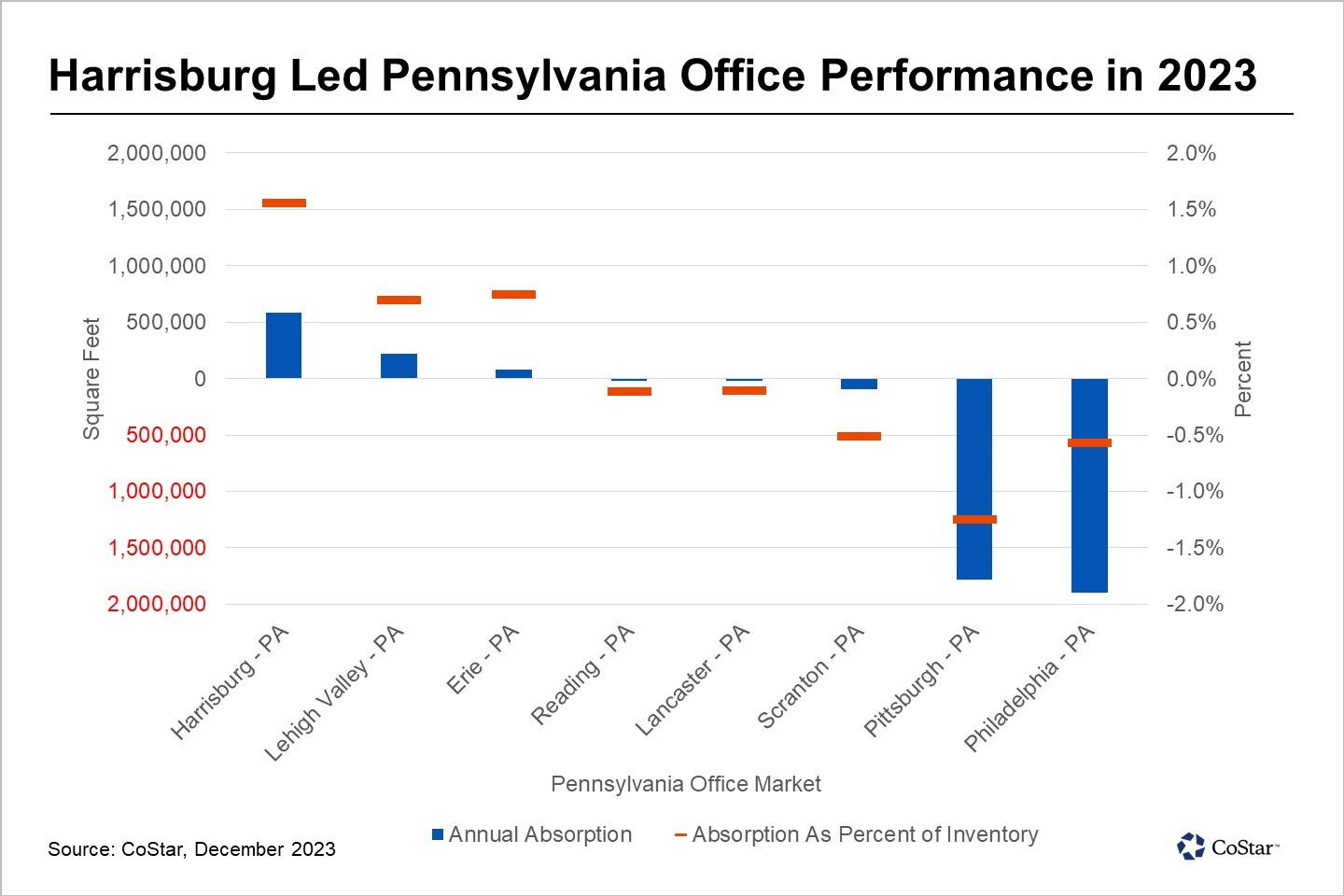

Harrisburg Leads Pennsylvania in Office Performance, Bucks National Trend

By Brenda Nguyen Costar

Tuesday, December 19, 2023

Commercial real estate volume may pick up in 2024 as Federal Reserve signals interest-rate cuts

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

Commercial real estate transactions slowed considerably in 2023, amid high interest rates, declining values and pricing uncertainty.

Investment volume declined by 42% in 2023 from the prior year, according to CBRE Group Inc. (NYSE: CBRE). The Dallas-based commercial real estate firm is expecting deal volume to be down again in 2024, but by a more modest 5% year over year.

Richard Barkham, global chief economist and global head of research at CBRE, said there's been "enormous excitement" since the 10-year Treasury yield recently dropped, to about 4%. Combined with the Federal Reserve's signaling of some interest-rate cuts next year, that should propel more commercial real estate transactions in 2024.

"There are still some issues we will need to contend with," Barkham said, adding the Fed still wants to see a lower rate of inflation, and economies in the rest of the world are also slowing. "We’ve found it very difficult to forecast and be accurate on inflation. It’s not impossible we’ll get another inflation upside surprise," he added.

CBRE is forecasting an average 10-year Treasury yield of 3.3% between 2025 and 2028. That will likely result in more deal volume in the medium term rather than in 2024, though transactions are likely to start picking up in the second half of 2024, Barkham said.

CBRE isn't predicting a recession in 2024 but expects the economy to slow, with a projected unemployment rate of 4.5% — up modestly from the rate of 3.7% last month — and the inflation rate to cool to about 2.7% by the end of 2024.

Next year will also have a closely watched U.S. presidential election. Barkham said he wasn't sure what impact that will have on commercial real estate activity but, he added, during very contested elections, the market tends to slow about three months before Election Day.

Interest rate impact on commercial real estate

Rebecca Rockey, deputy chief economist and global head of forecasting at Cushman & Wakefield plc (NYSE: CWK), in an email said last week's Fed announcement was largely expected and doesn't meaningfully shift the Chicago-based commercial real estate firm's perspective for 2024. There's also still uncertainty about inflation and no guaranteed path for the federal funds rate, she added.

"So, as the Fed stated, it is too soon to declare victory," Rockey continued. "I think there is a temptation to place too much emphasis on the Fed pause and pivot. Certainly, it will add much needed clarity, but the fact remains that we are in the midst of a broader adjustment process to higher costs of capital, and that will persist well after the Fed’s pivot and throughout their cutting cycle."

Still, she said, Cushman is predicting commercial real estate transaction momentum to gain steam through next year and into 2025 as the economy and interest-rate picture becomes clearer. That'll allow for greater conviction in underwriting income and exit assumptions, Rockey said.

Tim Bodner, real estate deals leader at PricewaterhouseCoopers LLP, said there's new optimism among real estate investors since the Fed's announcement last week. The economy is also holding up fairly well, with inflation coming down and the consumer and labor market overall resilient, he added.

"All of these things provide a really nice backdrop for ... the commercial real estate market," Bodner said.

But it's inevitable a looming wave of debt maturities will need to be addressed, and most who track the commercial real estate industry closely expect an uptick in distress and foreclosures in 2024. Moody's Analytics Inc. estimates there will be $182 billion in commercial real estate debt maturing next year.

Full story: https://tinyurl.com/yc2v77sp

High interest rates tame region's industrial market, but rents and new development remain strong

By Paul Schwedelson – Reporter, Philadelphia Business Journal

Philadelphia's industrial real estate market in 2023 was marked by moderating prices and less intense demand after two years of peak activity.

“From a broad standpoint, everything starts really with the interest rate environment. Sales and leasing, no one has been untouched by it. Starting off the year, fundamentals were incredibly strong. They still are, but the headwinds of the interest rate environment has definitely cooled down everything.”

During the Covid-19 pandemic, as companies rushed to improve their e-commerce operations, tenant demand for warehouse and distribution space reached historic highs. While demand for industrial properties is still elevated, the urgent rush is no longer in play. Meanwhile, pricing had to be adjusted to accommodate what tenants and buyers can now afford in a more challenging economic environment.

Asking rent for industrial space in the Philadelphia region is around $11 per square foot. That’s up 8% from a year ago, which is strong growth but slower than the double-digit rent increases in previous years. He expects rent growth to be more incremental moving forward, with the market unlikely to see the big surges it experienced during the pandemic.

As a result of the shifting landscape, sellers may not be able to command as much for their properties since buyers need to factor in higher financing costs.

“The challenge this year has been bridging the gap between expectations of the year in the past vs. what’s really affordable today. Doesn’t mean that deals still haven’t gotten done.”

The effects on the region's industrial market have varied depending on geography and property size. In South Jersey, for example, enough new supply has hit the market that vacancy rates in the third quarter reached around 9.5%, according to Colliers. That’s a big increase from a low of 2% a year or two ago. In five southeast Pennsylvania counties, the vacancy rate was between 4% and 4.5% in the third quarter.

Full story: https://tinyurl.com/mskjye6c

Monday, December 18, 2023

Thursday, December 14, 2023

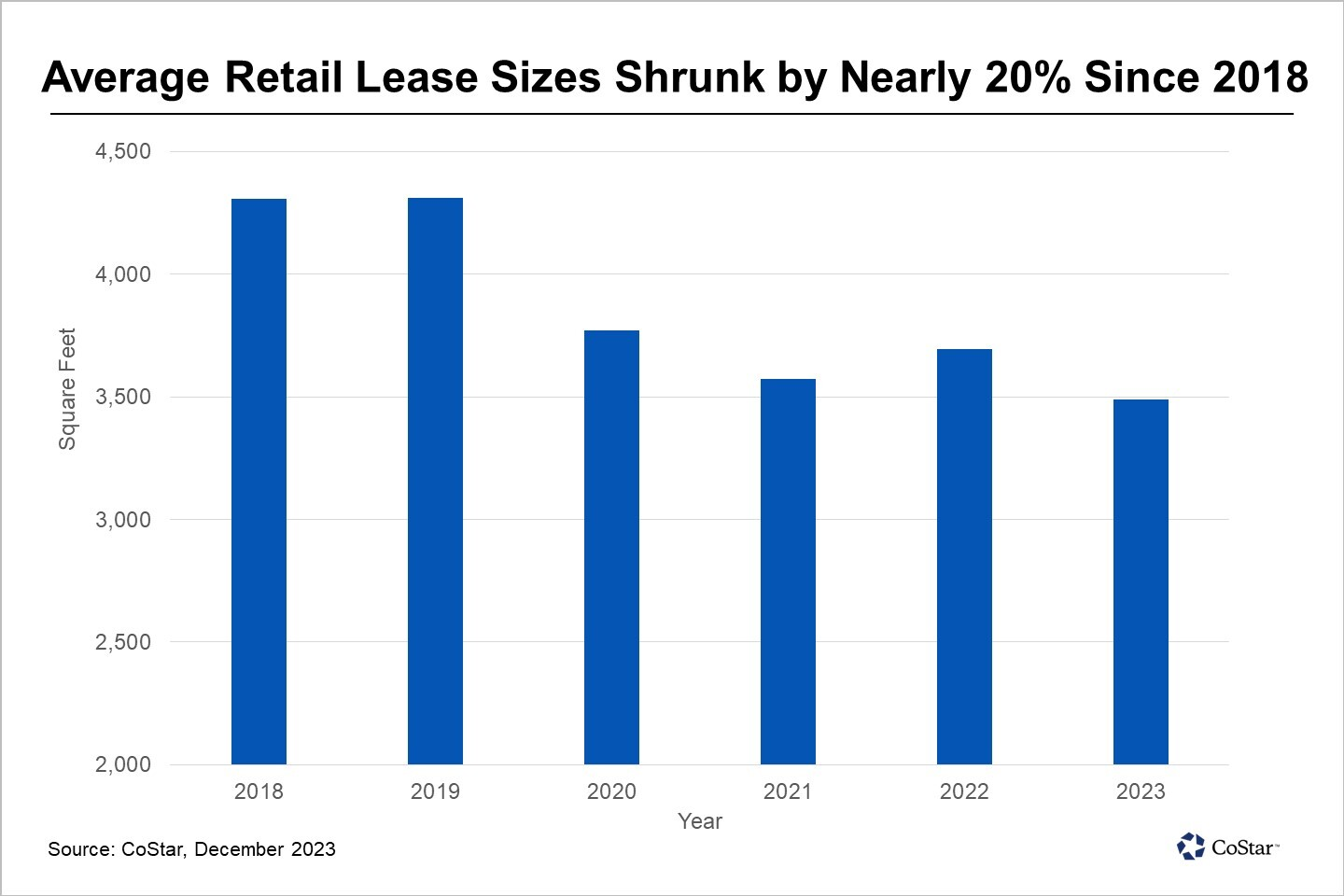

Average Retail Lease Size Gets Smaller as Philadelphia Retailers Reduce Store Size Requirements

By Brenda Nguyen Costar

Tuesday, December 12, 2023

Thursday, December 7, 2023

Companies will have to ask tough questions in office-space negotiations in 2024

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

The calculus for companies in the market for office space has become significantly more complicated in the wake of the Covid-19 pandemic.

For one, it's been tough to get workers to return to the office, although 2023 has seen a more robust comeback, as a greater number of employers mandate in-office time at least a few days a week. Still, to lure a reticent workforce and "earn the commute," company leaders have had make their workspaces more compelling and amenity-laden.

For another, companies are facing higher costs of everything, especially borrowing, and the economy is widely expected to slow in 2024. This year saw more layoffs and hiring slow in certain sectors as companies reassessed their expenditures, although the labor market remains tight.

Heading into 2024, business owners and managers making decisions about their office space — whether out of necessity, such as a lease expiring, or driven by factors such as recruitment — will have a few notable things to consider.

High-stakes environment

One of the biggest changes in office-space negotiations, experts say, is an expectation of more landlord transparency — especially their financials.

There's an estimated $47 billion in office loan debt coming due in 2024, according to Moody's Analytics Inc. Among commercial mortgage-backed securities loans backing office properties, Moody's estimates three-quarters of that will struggle to refinance next year.

"We’re seeing the same themes over and over again for tenants, corporate users and even small businesses: They want to reduce risk. What is the risk of doing a deal with a landlord that’s maybe on shaky ground?" said Michael Lirtzman, head of U.S. office agency leasing at Colliers International Group Inc.

There's a lot potentially at stake if a company signs a medium- or long-term deal at a building that'll face issues when its loan matures. Distressed buildings could be taken back by their lender, throwing tenants into chaos and uncertainty. Some landlords are even giving the keys back on buildings they no longer see as financially viable to retain.

Tenant brokers today frequently are advocating for subordination, non-disturbance and attornment (SNDA) clauses when their clients are signing an office deal, said Giles Wrench, vice chairman of financial services at Jones Lang LaSalle Inc. Those agreements spell out the rights of the tenant, landlord and any interested third parties — a lender or other investors, for example. Such clauses could prevent a tenant from being evicted if the building goes into foreclosure.

"There's a tremendous focus on that in the moment," said Wrench, who works with large financial-services companies and banks on their leasing strategy. He added office-space decisions and lease negotiations have gotten down to the micro level with tenants because of the current state of the office market.

In fact, the CEO is almost always on the ground floor of real estate decisions today.

Companies both public and private are under immense pressure to exercise financial scrutiny, Redmond said, and building the business case for a real estate decision is "under a big spotlight."

"There’s a need now more than ever before to really do due diligence around real estate decisions — understanding where your business is going, aligning with expectations and being really sharp on how you’re coming to the negotiation table, even at the individual-deal level," Redmond said.

Asking questions earlier in the process

Before a deal is even close to being signed, brokers say they're having to exercise more scrutiny on behalf of their tenants, and they're doing so earlier in the process.

Redmond said with companies her team works with, there are questions in requests for proposals to landlords about a building's capital stack, to try and gain a clearer picture of things such as a property's financial condition and whether there's an upcoming loan maturity.

On the whole, landlords that are in a relatively stable position financially are willing to share those details, brokers say. For landlords that aren't as transparent, those buildings might be eliminated in a space decision.

"It’s a massive red flag if you run into a landlord that’s being opaque," Wrench said, adding many companies, especially highly regulated ones like banks, can't afford to take on that risk.

David Lipson, president of Savills North America, said in an interview last month that companies and brokers should not only look into the capital stack of a building or the limited-liability company that owns it, but they should examine the parent company's financials as well. And a loan doesn't need to be coming due tomorrow to be a potential problem, he said.

"You can have a landlord sitting on a billion dollars of cash, [but] it doesn't mean they're going to put any of it into a given asset," he said.

Colliers' Lirtzman, who primarily works with landlords, said the smarter tenants and brokers are asking questions much earlier in the process. For landlords with a strong capital stack, those questions are welcome, he said.

Redmond said it's also imperative that companies in the market for space understand the capital markets, which will help them make more-informed decisions.

Full story: https://tinyurl.com/49hn9hfp

Wednesday, December 6, 2023

Velocity Venture Partners acquires Montgomery County industrial property for $31M

By Paul Schwedelson – Reporter, Philadelphia Business Journal

Velocity Venture Partners acquired a single-tenant, 340,000-square-foot industrial building in Montgomery County for $30.7 million with visions to improve and expand the site.

The 28-acre property is at 3400 E. Walnut St. in Colmar, in between Route 309 and County Line Road and less than a mile from SEPTA’s Regional Rail Colmar station. Velocity Founding Partner Zach Moore hailed the site for being one of the only industrial buildings in Montgomery County near a train station.

Auto body parts supplier Dorman Products (NASDAQ: DORM) occupies the entire building. Velocity acquired the property from BREP I LP, a partnership owned by the Berman family, including Dorman Executive Chairman Steven Berman, according to Dorman’s 2022 annual report.

The property has 15 loading docks and Moore said Bala Cynwyd-based Velocity could add another 50. There’s also enough room on the property to expand the building or construct another industrial building around 100,000 square feet.

“We love the property, the tenant is the cherry on top,” Moore said. “But the sundae for us is the property. We think we’ll do extremely well with it just because of our basis, the location, the land value, the train station. We think we can redevelop it very inexpensively to a modern Class A industrial facility with tremendous loading.”

Dorman engineers and designs automotive aftermarket parts. The company’s lease expires at the end of 2027, according to a U.S. Securities and Exchange Commission filing. Dorman paid $2.5 million in rent in 2022. The Colmar property serves as the company's headquarters.

“We think they’re a phenomenal tenant for the property,” Moore said, “but we’re not dependent on that for our business plan to be executed.”

The existing building was built in the 1950s with 32- to 42-foot clear heights. Since it was built as a manufacturing facility, Moore said it has “more power than any user could know what to do with.”

Velocity secured a $21 million loan from Canadian Imperial Bank of Commerce to buy the property, he said. Considering the challenging financing environment, co-founder Tony Grelli said securing loans is differentiating Velocity from its competitors. He credited existing relationships with lenders as the key to striking a deal.

“This falls into the traditional bread and butter Velocity deal,” Moore said. “Traditionally an industrial facility, family owned, great location, great functionality with a value-add component. When you look at the genesis of Velocity and the original business plan and blueprint, this couldn’t fall any closer to that.”

Velocity, founded in 2017, has expanded its business model in recent years by redeveloping office and industrial properties into modern industrial buildings.

With the two different types of properties in its portfolio, Velocity now owns approximately 9 million square feet across 100 buildings. Three months ago, the firm said its goal was to reach 10 million square feet by the end of the year.

Velocity has a handful of acquisitions in the pipeline that may close in the next few weeks, Grelli said.

Full story: https://tinyurl.com/3s7sh6a5

Monday, December 4, 2023

Friday, December 1, 2023

Thursday, November 30, 2023

Endurance sells 5-building industrial portfolio; NoLibs project secures $55.7M construction loan

By Paul Schwedelson – Reporter, Philadelphia Business Journal

A roundup of recent real estate news and transactions across the Philadelphia region:

$17 million

Camden-based logistics company NFI Industries paid $17 million for a 330,000-square-foot industrial building at 1515 Burnt Mill Road in Cherry Hill, according to Camden County property records.

NFI bought the property from Burnt Mill Group LLC, which acquired the property in 2009 for $2.3 million from Vineland Construction Co.

The property is near I-295 off Haddonfield-Berlin Road.

The Class B industrial property was built in 1960. In 2020, Devereux Advanced Behavioral Health New Jersey leased 26,500 square feet in the building.

$55.7 million

Summit, New Jersey-based Saxum Real Estate closed on a construction loan for $55.7 million for the second phase of its 466-unit development in the Northern Liberties section of Philadelphia. Phase 2, which will include 187 luxury apartments, is expected to cost $96 million with funding from a combination of equity and the construction loan.

The project site is located at 700-30 N. Delaware Ave., near the Delaware River waterfront in a part of Northern Liberties booming with new development.

Corebridge Financial, previously known as AIG Life & Retirement, provided the construction financing. Corebridge also provided a $77.5 million construction loan for the project’s first phase, which features a seven-story, 279-unit building at 711-35 N. Front St.

339,136 SF

Boston-based Taurus Investment Holdings bought a portfolio of five Class B industrial buildings in South Jersey from Wayne-based Endurance Real Estate Group. The portfolio totals 339,136 square feet and the five buildings are fully leased to 22 tenants.

Taurus declined to disclose the purchase price.

The properties are:

600 Delran Parkway, Delran (87,827 square feet)

601 Delran Parkway, Delran (57,930)

603 Heron Drive, Swedesboro (43,250)

614 Heron Drive, Swedesboro (46,888)

1 Killdeer Court, Swedesboro (103,241)

Taurus plans to build a 64,500-square-foot industrial building on a parking lot adjacent to the property at 600 Delran Parkway. The firm also plans to install rooftop solar panels on the new building and four of the existing buildings, reducing the portfolio’s annual carbon emissions by more than 300%.

Taurus’ nationwide industrial footprint includes more than 18 million square feet across 12 states.

Full story: https://tinyurl.com/32pmbc8y

Wednesday, November 29, 2023

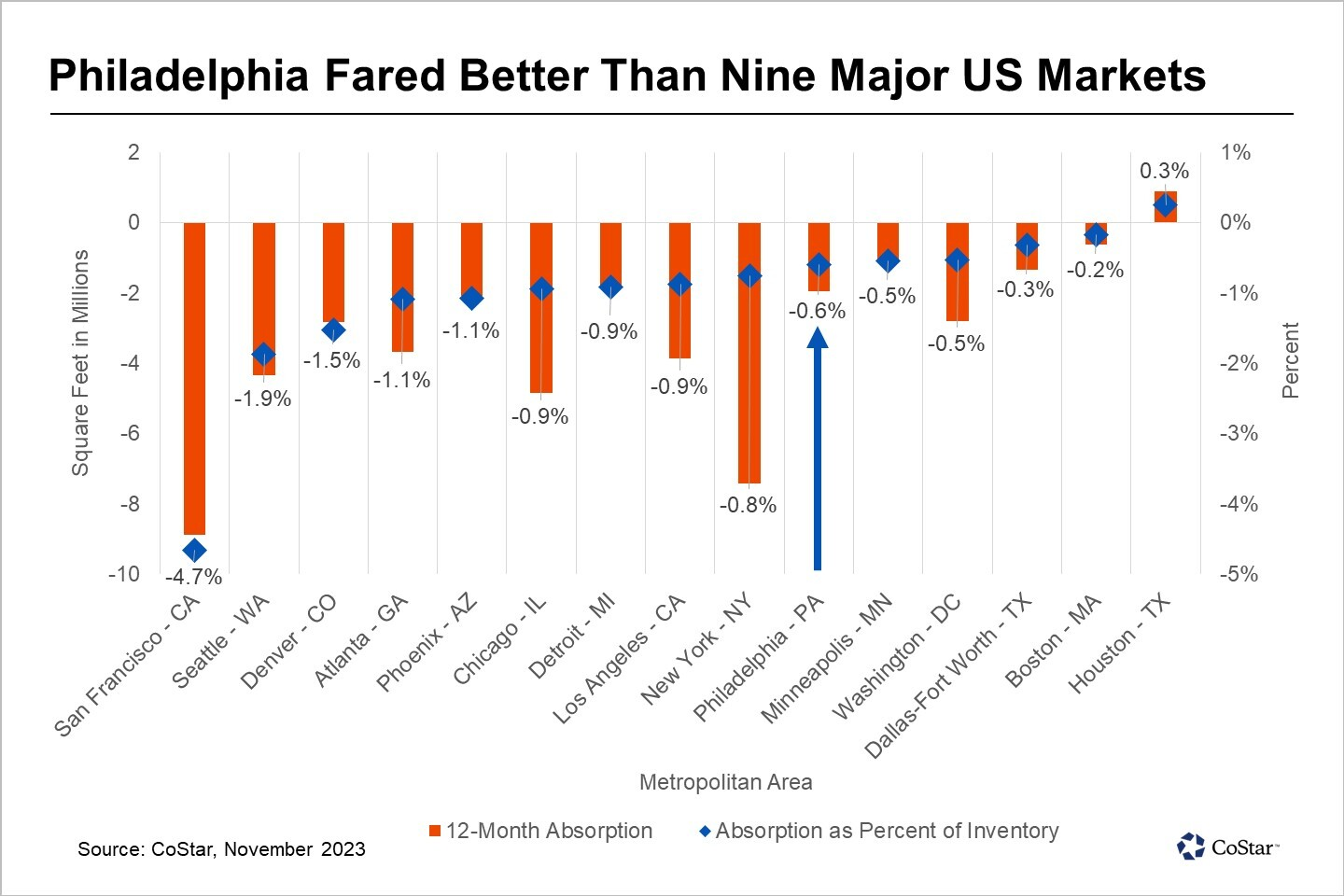

Comparing Philadelphia’s Office Performance with Other Major US Markets

In the face of a nationwide, three-year trend of companies reducing the overall size of their offices, the Philadelphia metropolitan area has been weathering the storm better than several other major U.S. office markets. While Philadelphia saw nearly 2 million square feet of space returned to the office leasing market in the past year, nine of the 15 largest office metropolitan areas experienced even higher levels of unwanted office space as a percent of the total inventory returned by office occupiers.

This snapshot analysis looks at absorption rates, which is the pace at which occupied space changes over time. The annual absorption rate, calculated by dividing a market’s 12-month net absorption by its total office space, provides another perspective on leasing performance while accounting for market size differences. For instance, an absorption loss of 1 million square feet has very different implications for an office market the size of New York City, which has 980 million square feet, compared to Philadelphia's 330 million square feet of office space.

As of the fourth quarter, the U.S. recorded nearly 62 million square feet in negative absorption, resulting in an annual absorption rate of negative 0.7%. Philadelphia's absorption rate of negative 0.6% aligns closely with the national average. This reflects a broader trend where Philadelphia closely follows national office performance. The U.S. and Philadelphia each experienced a 430-basis-point increase in office availability since early 2020, even though Philadelphia's availability rate has historically held lower than the national average.

Meanwhile, nine of the 15 largest U.S. metropolitan areas logged even larger negative annual absorption rates than the national annual average.

San Francisco led the nation with a negative absorption of 9.3 million square feet, reflecting a negative 4.7% absorption rate, followed by Seattle which posted a negative 1.9% absorption rate and Denver at negative 1.5%. In contrast, Houston was the only metropolitan area to experience positive absorption at 900,000 square feet, equating to a 0.3% absorption rate. Minneapolis and Washington D.C., both logged a negative 0.5% rate, on par with Philadelphia's.

These figures only provide a snapshot of the past 12 months, so it's essential to recognize that conditions affecting the office market will continue to evolve over the next year. With more office leases set to expire throughout the country, rankings based on recent absorption rates may shift considerably across these metropolitan areas.

Each region’s ability to adapt to these changes will continue to be influenced by its distinctive economic composition, regional dynamics and local public-private leadership.

Monday, November 27, 2023

Monday, November 20, 2023

5-building Bala Plaza complex sells for $185M; buyer to move forward with redevelopment plan

By Paul Schwedelson – Reporter, Philadelphia Business Journal

FLD Group and the Adjmi family have acquired the Bala Plaza office complex from Tishman Speyer for $185 million and will move forward with an already approved redevelopment plan for the Bala Cynwyd property.

The transaction is one of the largest multi-tenant suburban office sales in the country this year, according to the buyers.

Bala Plaza’s 1.1 million leasable square feet of space is spread across four towers — One Bala Plaza, Two Bala Plaza, Three Bala Plaza East and Three Bala Plaza West — as well as a freestanding Saks Fifth Avenue department store off City Avenue near Monument Road, less than a mile from I-76.

New York-based Tishman Speyer acquired the property in 2004 from GIC Real Estate as part of a $1.85 billion deal for a larger 7.3 million-square-foot portfolio that included 12 office buildings in eight cities.

The buyers plan to follow through on redevelopment plans for the 61.4-acre Bala Plaza site previously put forth by Tishman Speyer. The master plan, which was recently approved by Lower Merion Township, features 2.1 million square feet of new development with multiple retail sites, a 168-room hotel, approximately 750,000 square feet of office space, and 750 residential units.

“The ownership group is committed to being thoughtful stewards of one of the region’s most prestigious assets and sees tremendous value in the future of Bala Plaza and of Bala Cynwyd as a whole,” FLD Group and the Adjmi family said in a statement to the Philadelphia Business Journal. “They are confident in their ability to execute the vision to create an experiential live work play campus.”

Eatontown, New Jersey-based FLD Group also owns an office building at 150 Monument Road, just north of the Bala Plaza property, and has increased its Philadelphia market presence in recent years. It bought 45 Liberty Blvd., a 136,977-square-foot office property in Malvern's Great Valley Corporate Center, for $36.3 million in 2021. Two years prior, FLD Group paid $15.5 million for 100 Deerfield Lane, a 91,190-square-foot office building also located in the Great Valley Corporate Center.

Full story: https://tinyurl.com/2s44csj3

CHOP continues King of Prussia expansion with $24.5M office building purchase

By John George and Paul Schwedelson – Philadelphia Business Journal

Children’s Hospital of Philadelphia is expanding its King of Prussia footprint, paying $24.5 million for a 97,290-square-foot office building at 460 N. Gulph Road.

The building is across the street from CHOP’s nearly two-year-old Middleman Family Pavilion and its adjacent specialty care center.

CHOP bought the property from UGI Corp., which acquired the 39-year-old building in 1993 for $9.1 million. In May the Business Journal reported UGI Corp. (NYSE: UGI), an oil and natural gas company, was moving its headquarters a half-mile west from 460 N. Gulph Road to 500 N. Gulph Road. The move represented the flight-to-quality trend as the Brandywine Realty Trust-owned 500 N. Gulph Road building underwent a $29.7 million renovation in 2019.

CHOP's plans for the five-story building at 460 N. Gulph Road are unclear.

“We acquired the property as part of our facilities roadmap to ensure access to high-quality, convenient care for our patients when and where they need it,” a CHOP spokesperson said in a statement. "While we do not have specific use plans to share at this time, our focus has been on operationalizing and maintaining the property as an important part of our footprint.”

CHOP has had a presence in King Prussia since the 1990s, initially with two care sites near the King of Prussia Mall.

In 2015, CHOP opened a 135,000-square-foot specialty care and ambulatory surgical center on Goddard Boulevard, at a cost of $65 million, as a replacement facility for its two pediatric care sites a few miles away.

The center features 68 exam rooms, two operating rooms, three therapy gyms and an urgent care center. It is home to physicians in more than 30 medical and surgical subspecialties including cardiology, audiology, gastroenterology, hematology, oncology, otolaryngology, and neurology.

The expanded space in the new center was designed to allow CHOP to provide care to 400 patients a day, up from 300 a day at the sites it replaced.

Full story: https://tinyurl.com/2p9957d5

Friday, November 10, 2023

Thursday, November 9, 2023

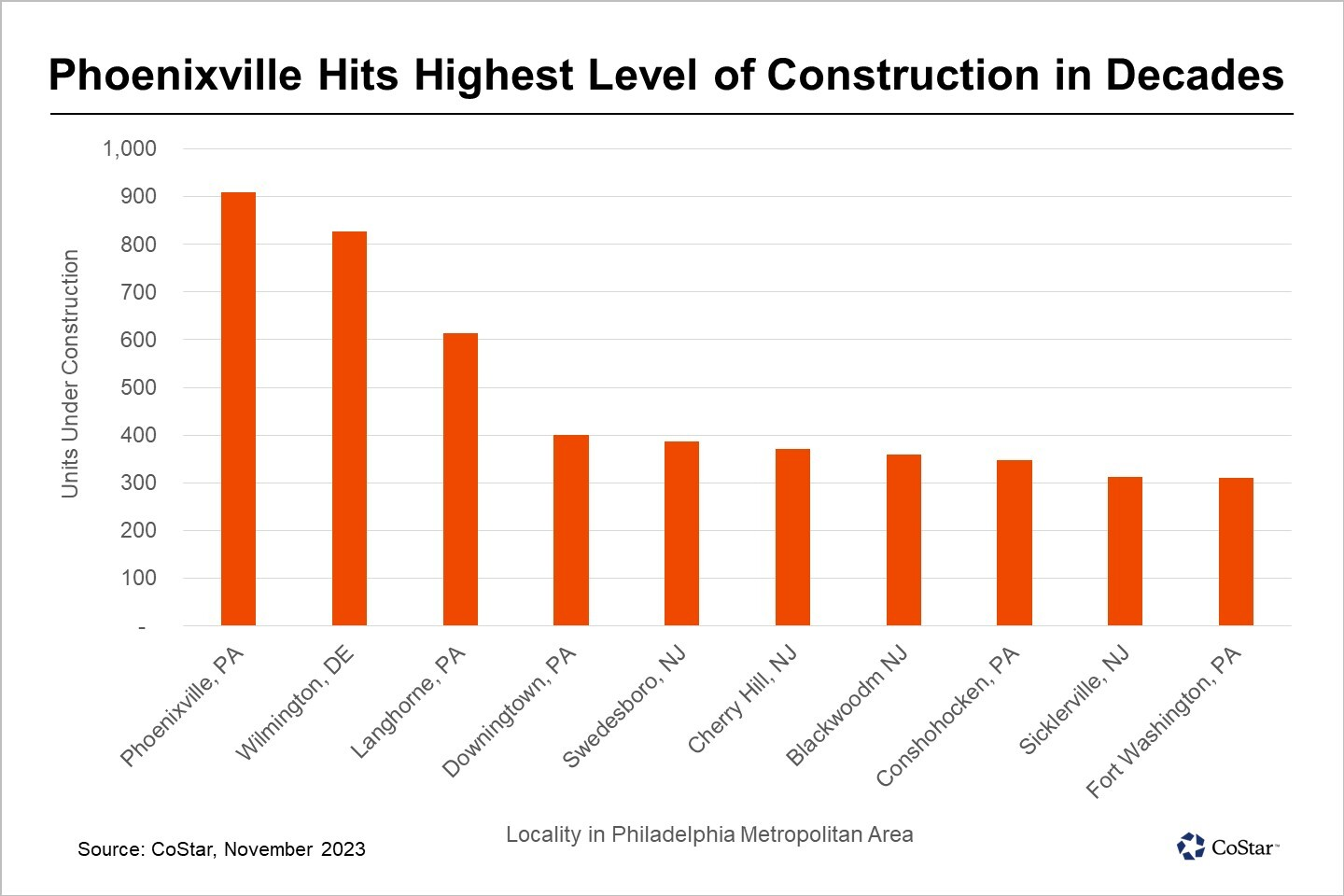

Phoenixville Emerges as a Rising Star for Apartment Development in Philadelphia Suburbs

By Brenda Nguyen Costar

Phoenixville, a quaint borough in Chester County, Pennsylvania, is making waves in the Philadelphia region's apartment construction scene. As of late 2023, this locality boasts the highest concentration of new apartment units under construction for any borough, township or city in the region, except the City of Philadelphia. Phoenixville has four ongoing multifamily projects totaling 908 units under construction.

Originally settled as Manavon, the borough took its name from the local Phoenix Iron Works to become Phoenixville when it was incorporated in 1849.

Over the past 12 months, the borough has added 313 units to strengthen its reputation as a fast-growing suburban community. Development has closely followed Phoenixville's recent burgeoning population, which has grown by an impressive 12% between 2019 and 2022, according to the U.S. Census Bureau.

The most significant development underway in Phoenixville is Steelworks, a mixed-use development that is adding 336 high-end apartments, 40,000 square feet of retail space and a 22,000-square-foot piazza. Developed by The DeMutis Group, Steelworks will replace a formerly abandoned slaughterhouse site on the western side of Bridge Street, extending the downtown area when it is completed in 2024.

Delaware-based developer Capano Management also has two significant projects in the pipeline: The Phoenix and The Reserve at Steelpointe. Once completed, each development will add 240 new apartments to the area for a total of 480. The developer also recently completed the 108-unit Reserve on Forge, which opened to its first tenants in June of this year and is still in lease-up.

Several factors have contributed to Phoenixville's recent surge in investment and real estate development. The suburban area has become a hotspot for young professionals who work in nearby employment centers such as King of Prussia and Malvern, both about a 20-minute drive away.

Moreover, its picturesque setting along the Schuylkill River, coupled with a vibrant and revitalized downtown area, has made it increasingly attractive for renters and investors. A walkable downtown, a full calendar of cultural events, and a burgeoning dining and brewery scene have further contributed to its growing popularity over the years.

While Phoenixville has led the Philadelphia region's suburban apartment growth, other localities have also experienced an apartment construction surge. Wilmington, Delaware, trails closely with the second-highest apartment construction in the region, with 830 units under construction. Langhorne and Downingtown, both Philadelphia suburbs on the Pennsylvania side, also have a notable number of new units under construction.

Wednesday, November 8, 2023

Tuesday, November 7, 2023

Greek Real Estate makes $80M bet on redevelopment of Northeast Philadelphia industrial property

By Paul Schwedelson – Reporter, Philadelphia Business Journal

Two years after buying a 305,706-square-foot industrial building in Northeast Philadelphia for $31.5 million, Greek Real Estate Partners knocked it down and is replacing it with a new warehouse.

The 287,000-square-foot building at 2121 Wheatsheaf Lane is expected to cost about $50 million to build, Greek Real Estate Partners Managing Partner David Greek said. The East Brunswick, New Jersey, developer secured a $44 million construction loan from First Citizens Bank.

The cost of land and construction adds up to an $80 million bet that a modern industrial building in a dense part of Northeast Philadelphia will yield a high return.

“I have to have a pretty strong belief in the overall market to make this sizable investment at this time,” Greek said. “We remain really confident that there is a significant amount of demand for this space.”

Demolishing the building was part of the plan all along, Greek said. It was knocked down over the summer and the new one is planned to be ready for tenants in about a year. The industrial building had been leased to cocoa bean distributor Dependable Distribution Services, and a neighboring 25,000-square-foot office building was leased to Amazon, which used the site for parking.

Having those tenants in place bought time for Greek Real Estate Partners to gain approvals to redevelop the site. The initial purchase came with a short due diligence period, Greek said, so the approvals weren’t in place at the time.

“With that open-ended risk, the fact that we had two leases in place and that the asset was producing cash flow actively from the day we bought it, allowed us to say we can spend this $30 million and if we are not successful, the worst that can happen is we continue to collect rent checks,” Greek said.

What happened, though, was the best case for Greek Real Estate Partners. The firm gained the necessary approvals and both leases had termination clauses so the leases could end as long as the tenants were given 18 months notice.

“If the property was just land and didn’t have any leases in place, we would not have been able to afford the purchase price we paid,” Greek said.

While the existing buildings offered short-term cash flow, Greek said a new building can command “significantly higher” rent. Since the developer plans to be a long-term owner and hold the property for 15 to 20 years, Greek can further justify the construction costs.

The previous industrial building was built in the 1950s and added onto in the 1970s. While leasable when the property was purchased, Greek didn’t think that value would last over the next 15 to 20 years.

The previous building had 22-foot heights and 10 dock doors. The new building is planned to have 40-foot heights, 36 dock doors and two drive-in doors. It’ll also have 65 trailer parking spaces and 258 car parking spaces, another sizable upgrade.

The building is being built without tenants in place and could be specialized for specific uses like cold storage, data centers and e-commerce distribution. It could also accommodate multiple tenants, although Greek said it’s likely it’ll be leased to one. He anticipates leasing activity picking up next year once the walls and roof are built and a lease signed potentially around next summer.

“One of the things that holds up my confidence is the lack of other options in this market,” Greek said.

Greek touted the site as one that could be popular with e-commerce distributors who want to be close to population centers. The density of Philadelphia and challenge of replicating a site like this help Greek believe in the project.

Full story: https://tinyurl.com/3st345ta

Monday, November 6, 2023

Thursday, November 2, 2023

Wednesday, November 1, 2023

Top Property Sales & Leasing Deals for Philadelphia Area

As big-ticket items involving sizable investments, commercial property transactions often have a wider impact within the local community. CoStar recognized the largest deals completed during the third quarter in their respective markets.

Here are the Philadelphia property sales selected as the third-quarter 2023 winners of the CoStar Power Broker Quarterly Deal Awards:

TOP SALE DEALS:

400 and 500 Arcola Road, Collegeville, PA

Sale Price: $180,000,000

Sale Date: August 9, 2023

Size: 1,890,685 SF

Buyer: David Werner Real Estate, New York, NY

Seller: Pfizer, New York, NY

Deal Commentary: A sprawling 340-acre life science and office campus sold in a top third-quarter deal for approximately $180 million. New York-based David Werner Real Estate Investments purchased the two-building complex in Collegeville, Pennsylvania, in a sale-leaseback deal with Pfizer, the pharmaceutical giant which had owned the property since acquiring Wyeth Pharmaceuticals in 2009. Dow Chemicals occupies 400 Arcola Road and Pfizer is in 500 Arcola Road. The portfolio features a mix of office, lab, and research space with the two buildings sharing approximately 70,000 square feet of common space.

1130 N. Pottstown Pike, Exton, PA

Sale Price: $103,500,000

Sale Date: July 11, 2023

Size: 169.41 Acres

Buyer: Portman Holdings, Atlanta, GA

Seller: Audubon Land Development, Norristown, PA

Deal Commentary: In another top deal during the third quarter, Audubon Land Development sold four industrial-zoned parcels totaling nearly 170 acres to Atlanta-based developer Portman, which executed a development agreement to construct the I-76 Trade Center, a new industrial campus spanning 1.9 million square feet. Site work on the first phase is underway, with construction beginning on the first building this fall. The three-building logistics campus will be developed in two phases. Phase I will be a 636,120-square-foot building with an expected delivery of August 2024. Phase II includes a 1.1 million-square-foot facility and a 154,440-square-foot building. Portman is planning to substantially complete construction by early 2025.

101 Commerce Drive, Hazleton, PA

Sale Price: $51,000,000

Sale Date: August 22, 2023

Size: 470,000 SF

Buyer: Transwestern Investment Group, Dallas, TX

Seller: Bluewater Property Group, Conshohocken, PA and PCCP, Los Angeles, CA

Deal Commentary: After securing Ingram Micro as a full-building tenant last year, the development partnership of Bluewater Property Group, LLC and PCCP flipped this fully leased speculative warehouse in Hazelton, Pennsylvania, to an investment fund managed by Transwestern Investment Group in a top third-quarter deal. “The acquisition complements our strategy to acquire highly functional assets below replacement cost in core major logistics markets across the country,” said Chris Sterling, director of Acquisitions at TIG, in a statement announcing the acquisition.

Bristol Gardens Apartments, 1321 Veterans Highway, Bristol, PA

Sale Price: $40,750,000

Sale Date: July 11, 2023

Size: 320,000 SF

Buyer: Goldcrest Properties, Lakewood, NJ

Seller: Joshua Klein, Villanova, PA

Deal Commentary: Lakewood, New Jersey-based Goldcrest Properties completed its acquisition of the 392-unit Bristol Gardens Apartments in Philadelphia in a third-quarter transaction. The garden-style complex serving low- to moderate-income individuals and families sold for $40.75 million or about $103,954 per unit. Located at 1321 Veterans Hwy. in Bristol, Pennsylvania, the 55-year-old apartments consist of 36 two-story buildings on 31 acres of land.

Hartford Corners, 1310-1330 Fairview Blvd., Delran, NJ

Tuesday, October 31, 2023

More Flight to Quality: LevLane relocates and downsizes Center City offices

By Paul Schwedelson – Reporter, Philadelphia Business Journal

LevLane has relocated its Center City headquarters to One Logan Square, departing its longtime home in the Wanamaker building as the troubled office property continues to lose tenants.

After almost two decades at the historic Wanamaker, LevLane joins the growing number of businesses downsizing their space and moving to more attractive office properties following the shift to hybrid and remote work arrangements.

The advertising agency moved into its new offices at One Logan this month after departing the Wanamaker over the summer, reducing its space from 13,914 square feet to 7,373 square feet on a nine-year lease. The firm had been at the Wanamaker since 2004.

The departure is yet another blow to the more than half-vacant Wanamaker, which was placed in receivership in September as debtholders pursue foreclosure on the 1300 Market St. property.

While the price per square foot is higher at Brandywine Realty Trust-owned One Logan, LevLane Chief Creative Officer Bruce Lev said the company's total cost for its new offices is about the same as it was at the Wanamaker. He believes the move into higher-quality space will help entice workers to return to the office.

The firm requires senior leaders to be in the office two to three days a week. LevLane President Josh Lev said the company will likely determine staff-wide office attendance policies in the coming months, but it won’t require in-office work five days a week.

“The need for that much space just wasn’t as severe as it was when we were five days a week,” Josh Lev said. “Being hybrid and being financially cautious in the current situation of the economy, we felt the perfect fit would be to take half the space. … We didn’t really need the old-school office space.”

With less space, LevLane designed its new office in One Logan, which sits along the Benjamin Franklin Parkway at 130 N. 18th St., to focus on collaboration with a coffee bar and barstools, conference rooms for video calls and seating areas that resemble living rooms.

Full story: https://tinyurl.com/3s78kz3f

Monday, October 30, 2023

Friday, October 27, 2023

Thursday, October 26, 2023

Tuesday, October 24, 2023

$270B in CRE capital is on the sidelines. How much of that sum could go into distressed real estate?

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

It's still mostly a waiting game for commercial loans and properties showing signs of distress — so what'll it take for more of those deals to trade?

At the end of the third quarter, an estimated $270.6 billion targeting North American real estate was sitting on the sidelines, according to Preqin Ltd. Of that, more than $100 billion was opportunistic capital, which typically targets properties requiring an aggressive repositioning and lease-up strategy, and also includes new development.

It comes at a time when the broader commercial real estate industry is watching what'll happen to an estimated $1.9 trillion in commercial real estate loans set to mature in the next four years. In particular, the office market is being closely observed as companies depart big blocks of space in older buildings in favor of consolidating into smaller offices in higher-quality buildings.

In September, the overall commercial-mortgage backed securities delinquency rate was 4.39%, an increase from 4.25% the month prior, according to Trepp LLC. The office delinquency rate also continued a monthly ascent (it has grown every month since December 2022), hitting 5.58% in September.

What will it take for distressed properties to trade?

While more distress is expected, it hasn't fully emerged yet, as lenders work with borrowers on short-term extensions and modify and restructure loans when possible.

The $100 billion or so earmarked for opportunistic real estate appears to be waiting to capitalize on emerging distressed situations across asset classes, said Aaron Jodka, director of U.S. capital markets research at Colliers International Inc. (Nasdaq: CIGI).

"We have to wait for some of these properties' debt to mature and a decision to be made," Jodka said. "A lot of investors are waiting for their hands to be forced: If they can wait out their existing financing, they’re going to do that. At the point that they need to refinance or they have an occupancy loss that doesn’t allow them to cover their debt service, that’s when those events will take place."

Pricing also has been cited as a major barrier for distressed and non-distressed buildings alike to trade. Commercial real estate investment volume was down by 60% year-over-year in the second quarter, according to CBRE Group Inc. (NYSE: CBRE).

Aaron Jackson, the loan enforcement team leader of law firm Polsinelli PC's financial services litigation practice group, said there are buyers in the market with the ability now to purchase buildings, even ones facing financial issues, low vacancy and that need a significant capital infusion.

But, he added, a lot of buyers don't feel prices have bottomed out. There also are a lot of commercial real estate loans that, by today's standards, have low interest rates, meaning more buyers are interested in assuming existing debt.

Jodka said there's evidence of bridge capital being deployed, even for things like construction loans that will come due during the time of development, to help offset the rapid rise of interest rates since they were underwritten.

Still, there's been an increase in fund redemption requests this year, particularly in the private REIT space, said Chad Littell, national director of capital market analytics at CoStar Group Inc. (Nasdaq: CSGP). It's also taking twice as long to raise money in a commercial real estate fund as it did 18 months ago, he said, prompting questions about how much so-called dry powder will be available as loan distress and delinquencies rise.

While office real estate is expected to see the most potential distress and opportunistic buying, the hospitality sector is another one to watch closely, both Jodka and Jackson said.

Hotel real estate is usually financed with floating-rate debt, Jodka said, so there's naturally more refinancing risk there. Plus, the hospitality sector was hit hard during the Covid-19 pandemic, and any Paycheck Protection Program money owners received during that time went to keeping the lights on. In many cases, that further deferred maintenance that will soon need to be addressed, he said.

The lodging CMBS delinquency rate was 5.27% in September, according to Trepp LLC. That's actually a slight decline from recent months, and lower than both retail and office delinquency rates last month.

Full story: https://tinyurl.com/2p8ckmy3

Monday, October 23, 2023

Industrial Construction Starts in Philadelphia Stage Precipitous Drop-Off

By Brenda Nguyen Costar

Reacting to a combination of higher borrowing and construction costs, as well as cooling demand for warehouse space, Philadelphia’s industrial landscape is showing the first signs of slowing development after three years of heightened construction levels.

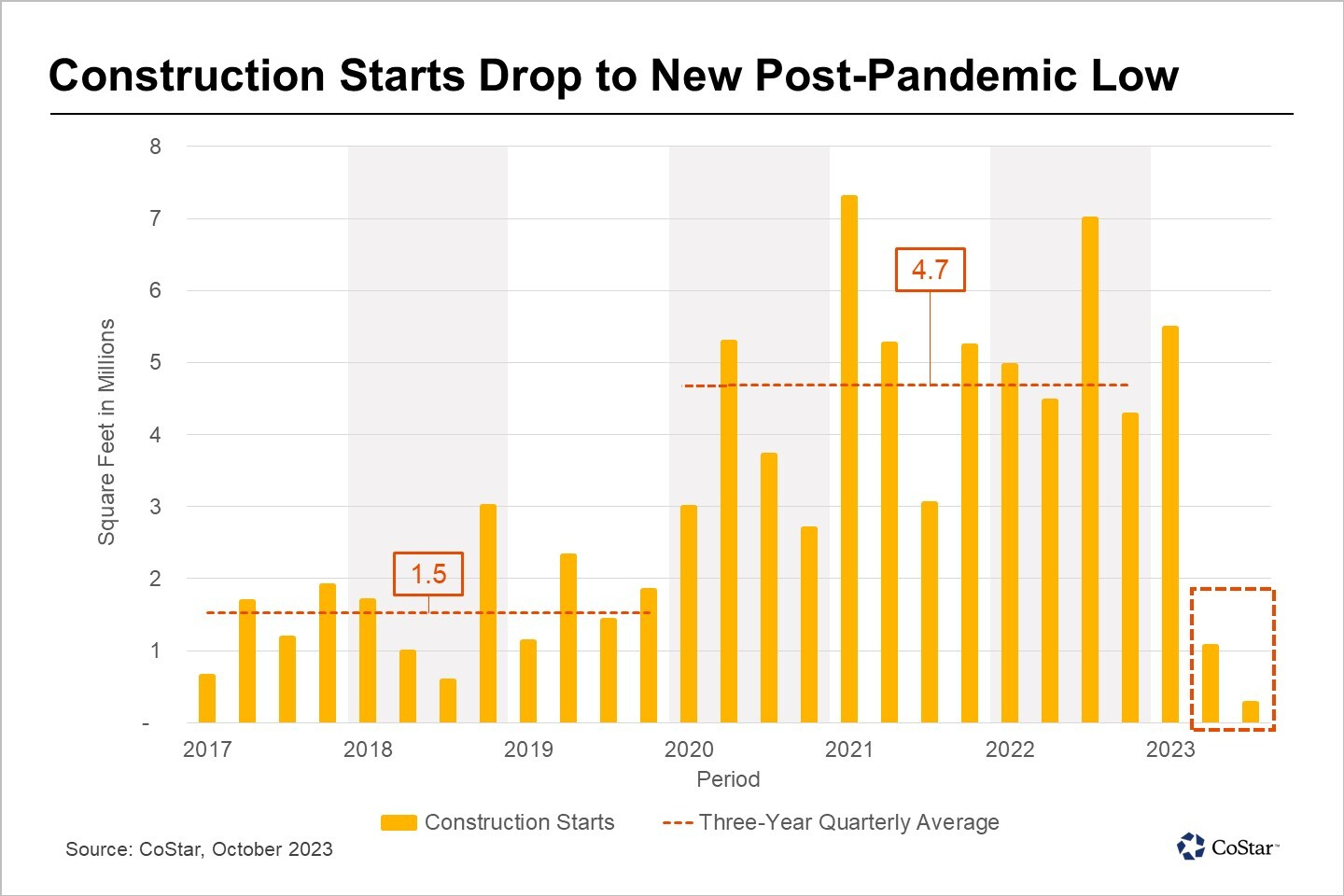

During the past two quarters, the Philadelphia industrial sector averaged only 665,000 square feet in construction starts, a small fraction of the 4.7 million square feet of quarterly construction starts seen between 2020 and 2022. For context, quarterly construction starts between 2017 and 2019 averaged a modest 1.5 million square feet.

While the industrial sector has been a standout performer, demonstrating resilience even amid concerns over elevated interest rates and recessionary pressures, the recent near halt in construction starts and a pullback in leasing demand confirms developers are finally easing on their bullishness.

The effects of the area's recent construction surge are clearly visible in the region's availability rate, which jumped to 9.5% in late 2023, from 6.6% in mid-2022. Some sections of the region, including Burlington County in New Jersey, saw the average industrial availability rate surge as high as 16.5%. Recently completed projects have faced heightened competition in securing tenants, leading to a buildup of industrial inventory that has lingered on the market longer than originally anticipated.

These factors, coupled with a slowdown in leasing momentum, have prompted developers to reevaluate their strategies. Subsequently, construction completions are now outpacing deliveries, with projects under construction shrinking from 27 million square feet in the first quarter to 17 million square feet in the fourth quarter, a 35% decline.

The pullback in construction starts is expected to offer developers and owners some breathing room as they seek to lease still-vacant buildings, but another ramp-up of construction is likely should interest rates begin to decline and the economy remains resilient in 2024.

There are more than 220 industrial development projects encompassing some 65 million square feet that are already in the proposal stage across the Philadelphia region. And while not all of them will be approved, nearly 40% of the proposed industrial development is concentrated in Southern New Jersey.

Given the already elevated availability levels, developers are encouraged to exercise caution when considering new projects, as competition in the market remains fierce.

Friday, October 20, 2023

Wednesday, October 18, 2023

Why some cities are likely to see taller warehouse projects — and the role Amazon is playing

By Ashley Fahey – Editor, The National Observer: Real Estate Edition, The Business Journals

After proliferating largely in other parts of the world, multistory warehouses are beginning to rise in the United States.

Nationally, there were 62.8 million square feet of warehouses with three or more stories in the U.S., as of August, with another 11.9 million square feet underway and 23 million in planning stages.

Notably, 74% of that pipeline and existing inventory is occupied by Amazon.com Inc. (Nasdaq: AMZN), the dominant player in industrial real estate, despite its pullback since the height of the Covid-19 pandemic.

But the cost to develop multistory warehouses continues to be higher than a more traditional industrial box, one reason why taller warehouses are likely to remain a fairly niche part of the market and concentrate in the nation's densest cities.

"We do think it’s going to continue to be a trend, and something we're going to see, and more are planned in many of these (denser) markets because there continues to be a need for occupier clients."

They recently examined multistory warehouses in the U.S., as the nation is in its fifth year of building multilevel logistics facilities. The first U.S. multistory warehouse opened in 2018 in Seattle.

Today, notable multistory warehouse projects include several in New York, where urban-logistics projects under construction and in planning would add 9.4 million square feet of additional last-mile logistics space.

Those include the 385,510-square-foot Red Hook Logistics Center in Brooklyn and the Borden Complex, which totals 680,000 square feet, in Long Island City.

The multistory warehouses being built in the U.S. today are past the point of "version 1.0" of five years ago, which tended to be larger projects, including some 1 million square feet or larger.

"People are looking at smaller parcels and then designing there, which is cool, because it gives occupier clients a little bit more variety," she continued.

At the Red Hook project, for example, there's an ability to subdivide the space by floor, so tenants that need 40,000 square feet or 80,000 square feet of industrial space in a dense urban market could lease space there, Lanne said.

Most of the urban multistory warehouse tenant demand is coming from groups needing last-mile delivery space, although, she said, there's also a lot of interest from food-and-beverage groups in occupying that kind of space.

Still, while the multistory warehouse trend has gained traction in the five years it's been in the United States, it's not likely to become a mainstream part of the industrial market.

For one, these facilities are more expensive to build — and may require specific, costlier infrastructure like underground parking, Lanne said. There are also zoning constraints to getting a multistory warehouse project approved, not unlike more traditional single-story industrial facilities.

Full story: https://tinyurl.com/yv5wxtrr

How talent, funding and flexible workspace options are turning Philadelphia into one of America’s fastest-rising life sciences cities

By Jeff DeVuono – executive vice president and regional managing director, Brandywine Realty Trust, The Business Journals

With a growing number of startups and established companies wanting a presence in Philly, the city has buzz. Here’s what’s behind it.

Over the last several years, no life sciences market in America has had greater momentum than Philadelphia. As the birthplace of cell and gene therapy, the city is not only producing breakout companies — including Spark Therapeutics (owned by Roche) and Tmunity Therapeutics (recently acquired by Kite) — it’s also become a place where both new and established cell and gene therapy companies are eager to have a presence. What’s more, Philadelphia has been at the forefront of other recent life sciences breakthroughs, including Nobel Prize-winning advances in mRNA technology that led directly to the development of Pfizer’s and Moderna’s COVID-19 vaccines.

With such success stories, it’s little wonder that the city has been rising rapidly in rankings of life sciences clusters. In recent reports, Philadelphia finished ahead of markets such as New York and the Research Triangle in the Raleigh-Durham area in North Carolina while closing the gap on longtime leader Boston in several key categories. For new and established life sciences companies, Philadelphia is now an essential part of the conversation.

Depth of talent in Philadelphia

What’s driving all this vitality? At the top of the list is talent. The work done by cell and gene therapy pioneers Carl June, co-founder of Tmunity, and Katherine High, co-founder of Spark and former president of therapeutics at AskBio, is attracting other highly regarded researchers and spurring even greater innovation. As of 2022, Philadelphia-based cell and gene therapy scientists had been granted more than 300 patents, and they were leading more than 130 clinical trials for new cell and gene therapies, according to research from the economics firm Econsult Solutions Inc. Overall, Philadelphia has one of the highest concentrations of life sciences researchers in the country, with its numbers rising nearly 20% between 2017 and 2022.

That injection of talent is bolstered by several other factors that are important to growing life sciences companies. The pharmaceutical industry — including such titans as Merck, Johnson & Johnson, and GSK — has long had a major presence in the Greater Philadelphia region, providing a deep talent pool of experienced leaders for startups and existing companies. The region is also strong at the other end of the career spectrum: new graduates. Greater Philadelphia is home to four R1 research universities, and its 93 colleges and universities have been producing an increasing number of people ready for careers in science. According to Colliers, the region now ranks ahead of San Francisco, San Diego and Raleigh-Durham when it comes to producing next-generation talent.

Philadelphia’s arrow is also pointing up when it comes to biomanufacturing capacity. At the forefront of the phenomenon is Spark, whose headquarters is located within Schuylkill Yards, the development created by Brandywine Realty Trust and Drexel University in University City. Spark’s groundbreaking gene therapy treatment, Luxturna — used for a rare form of genetic blindness — was approved by the FDA in 2017, and the company (which is developing gene therapy treatments for other diseases, including hemophilia A and B and several central nervous system disorders) is now building a 500,000-square-foot manufacturing facility in University City, adjacent to its headquarters. The decision by Spark’s owner, Roche, to place the new facility there, just a short walk from the University of Pennsylvania, Drexel, Children’s Hospital of Philadelphia and other leading research institutions, is further enriching the life sciences ecosystem in University City and cementing the neighborhood as one of the world’s leading gene and cell therapy hubs. Meanwhile, manufacturing capacity is expanding quickly throughout the entire Greater Philadelphia region, with additional facilities opening everywhere from the Philadelphia Navy Yard to King Prussia.

An influx of funding for life sciences

Not surprisingly, all the recent advances and activity in Philadelphia have caught the attention of funders. The most significant statistic: Since 2018, Philadelphia is the number-one market in the country when it comes to NIH funding for cell and gene therapy, outpacing Boston, New York, Seattle and Los Angeles. When it comes to NIH grants more broadly, Philadelphia pulled in more than a billion dollars in support from the NIH in 2022 for thousands of projects, including work from Penn researchers on the design of universal vaccines against highly mutating viruses, bacteria and cancer, as well as work at the Wistar Institute that explores immunotherapy approaches to early-stage melanoma. And the awards are going to a mix of institutions: the region’s 10 most awarded organizations have seen annual funding grow by 4.2% on average, while smaller, emerging institutions are seeing 12.3% annual growth.*

Thanks to that kind of validation, as well as the continuing breakthroughs being produced in the lab, private investors are also seeing the city’s extraordinary potential. In 2022, venture capitalists poured $1.7 billion into Philadelphia life sciences firms, a nearly 400% increase over 2020. And despite the cooling of the overall venture capital market in the second half of 2022 and first quarter of 2023, opportunities for young companies remain robust.

The inflow of money reflects the confidence both public and private funders feel in work originating in Philadelphia, and with good reason: Penn, whose groundbreaking research led to the development of mRNA technology, now receives more than $1 billion annually from mRNA licensing agreements.

Full story: https://tinyurl.com/5n86xpkc